Arbor Quantitative Analytics

Today’s Range for UST 10y: 3.44 – 3.51 (highlighted zones are in play today)

Today’s Range for UST 30y: 3.47 – 3.56 (highlighted zones are in play today)

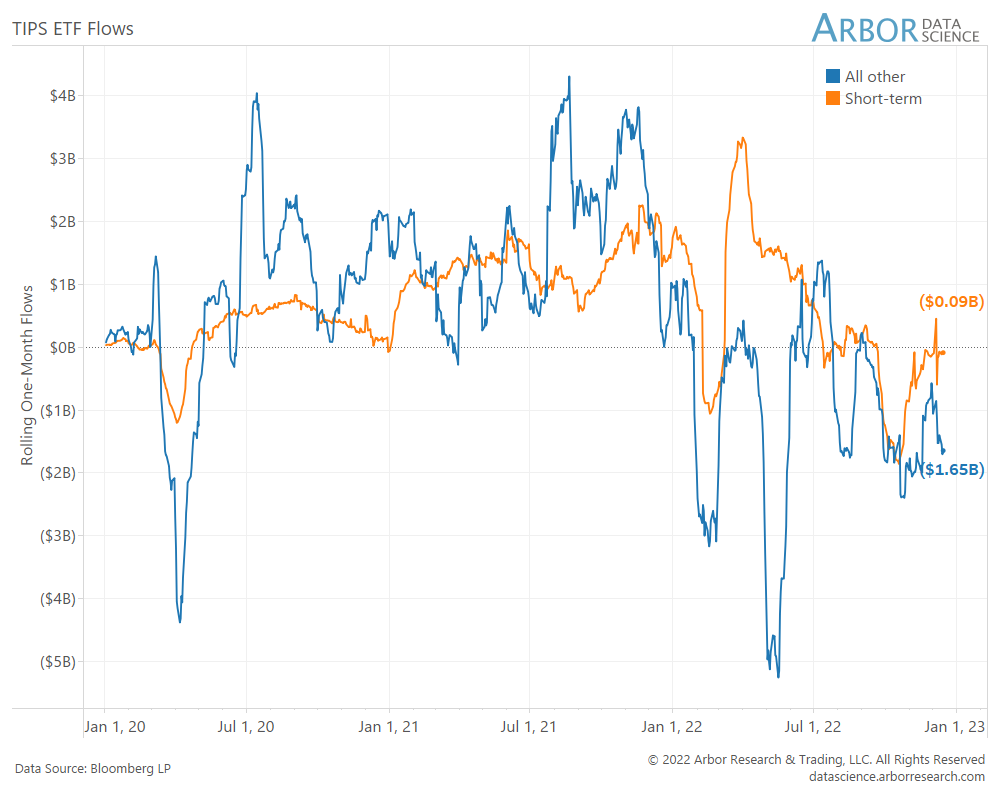

TIPS ETF Flows

Chart of the Day from Bianco Research

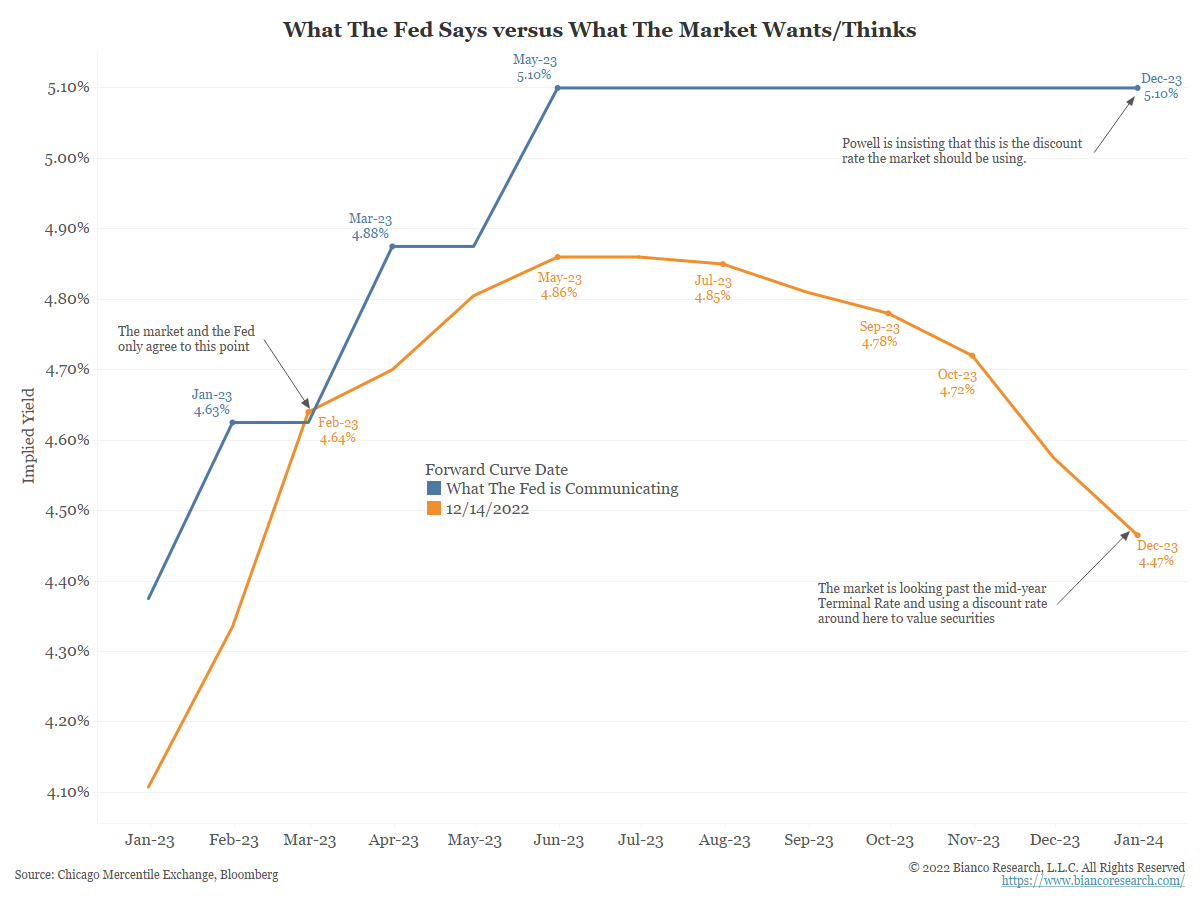

The market thinks Powell is sincere in saying rates will be higher for longer, but is also convinced the incoming economic data will be far weaker than he expects. Ultimately, the market thinks he will be forced to “pivot” much sooner than he thinks.

Restated, the market is not buying the policy Powell laid out. The chart above illustrates the difference between the Fed’s and the market’s views.

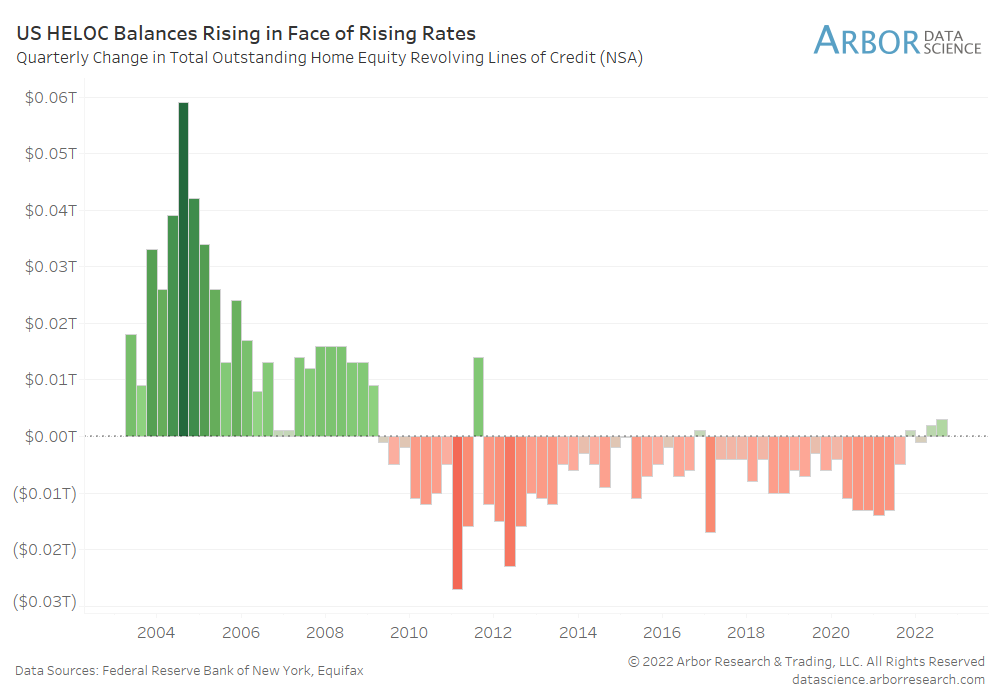

Chart of the Day from Arbor Data Science

For more evidence that Americans are struggling, consider home equity lines of credit. As rates rise, one might expect to see fewer homeowners taking HELOCs. On the contrary, balances have increased for the past two quarters suggesting that the higher rates are not doing much to deter borrowers. Perhaps some see a HELOC as the lesser evil when the other option is credit card debt, which typically is lent at a much higher interest rate if not paid off monthly.

Topics Our Clients Are Talking About

Companies that announced Major Layoffs and Hiring Freezes

Europe Stocks Up On Diesel Ahead Of Ban On Russian Product Imports

UK interest rates raised to highest level for 14 years

TC Energy Restarts Keystone Pipeline Section

Supply chain problems prompt some shortages of holiday essentials

A new study of high US food prices says culprit is consumer behavior, not inflation

Builders Helping Buyers Reduce Mortgage Rates

What’s On Tap For the Week

T – denotes TIPS R – denotes reopening