Download this Report to Print

US Treasuries

UST 10s closed today at 4.18%. Our 1st weekly support zone is 4.22% – 4.23% (57% shot to hold). Our 2nd weekly support zone is 4.27% – 4.28% . Our 1st monthly support zone is 4.245% – 4.27% (66% shot to hold). Our 1st weekly resistance zone is 4.12% – 4.13% (90% shot to hold).

CNBC Treasury Secretary Bessent says more Fed rate cuts are ‘only ingredient missing’ for stronger economy

Intraday Commentary From Jim Bianco

Stephen Miran is calling for 150 bps of cuts in 2026 to support the labor market.

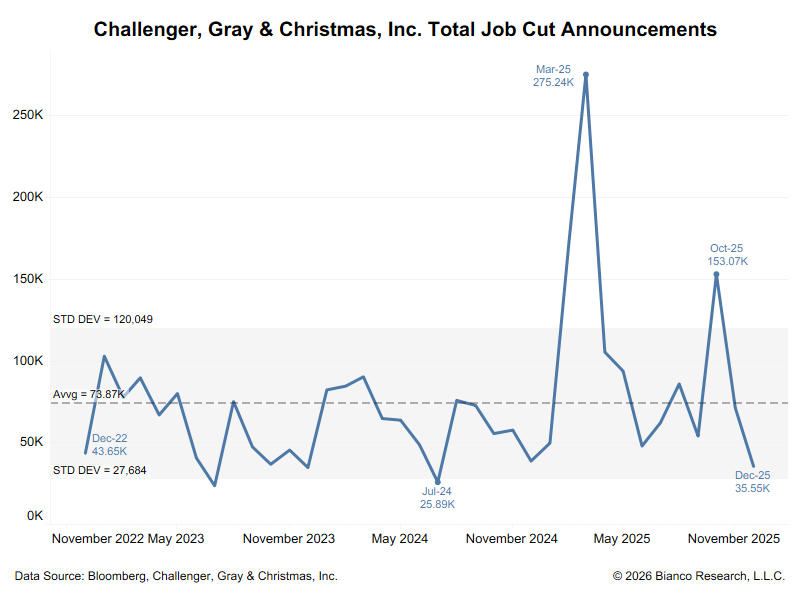

*US CHALLENGER: DEC. TOTAL JOB CUTS AT 35,553, 17-MONTH LOW

Note the two spikes were DOGE layoffs earlier this year and Amazon warehouse announced not

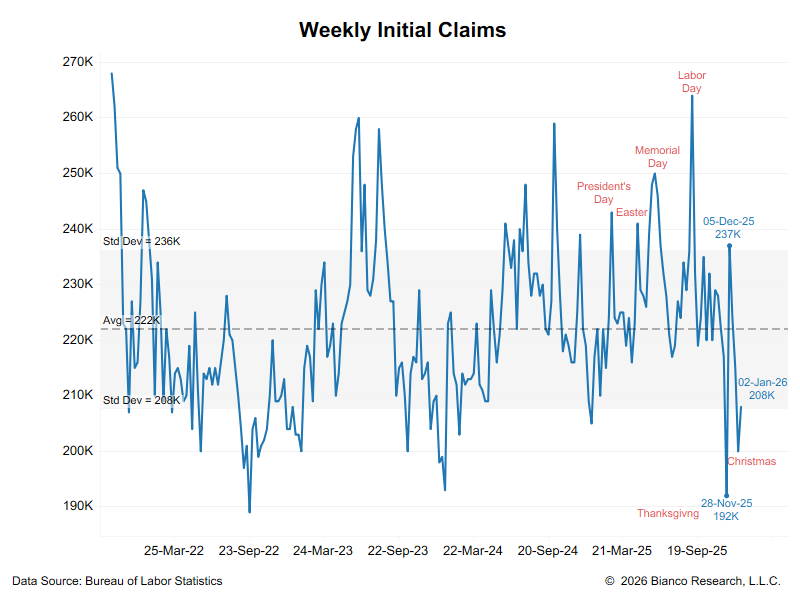

*US JOBLESS CLAIMS 208,000 IN JAN. 3 WEEK; EST. 212K

Above shows initial claims, they are falling again and support the idea that no one is getting fired. Continuing claims are also falling, suggesting that the previously fired are getting jobs again (and getting off of unemployment insurance).

Payrolls tomorrow …So, what about the Labor market needs aggressive rates cuts, and how will this “support it?”

In the News

ARTEMIS : Catastrophe bond market records that were broken in 2025

OilPrice : AI Set to Drive 50% Rise in Copper Demand by 2040

SupplyChainBrain : Brazil Shakes Off Trump Tariffs With Record Exports in 2025

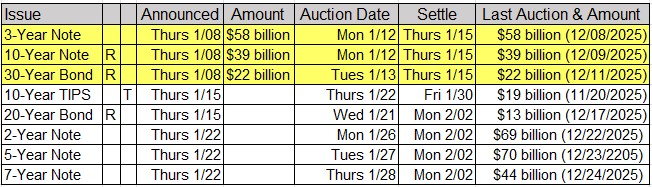

Upcoming US Treasury Supply

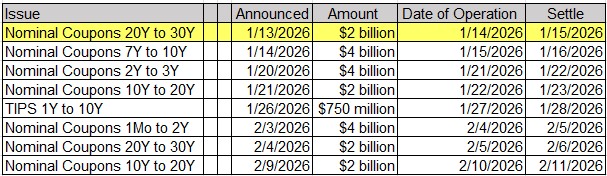

Tentative Schedule of Treasury Buyback Operations

Upcoming Economic Releases & Fed Speak

1/09/2026 at 08:30am EST: Two-Month Payroll Net Revisions 1/09/2026 at 08:30am EST: Change in Nonfarm Payrolls / Private Payrolls / Manufacturing Payrolls 1/09/2026 at 08:30am EST: Nonfarm Payrolls 3-Mo Avg Chg 1/09/2026 at 08:30am EST: Average Hourly Earnings MoM / YoY / All Employees 1/09/2026 at 08:30am EST: Unemployment Rate / Labor Force Participation Rate / Underemployment Rate 1/09/2026 at 08:30am EST: Census Releases Sept – Oct Housing Starts 1/09/2026 at 08:30am EST: Housing Starts / Building Permits / Housing Starts MoM / Building Permits MoM 1/09/2026 at 10:00am EST: Fed’s Kashkari Gives Opening Remarks 1/09/2026 at 10:00am EST: U. of Mich. Sentiment / Current Conditions / Expectations 1/09/2026 at 10:00am EST: U. of Mich. 1 Yr Inflation / 5-10 Yr Inflation 1/09/2026 at 12:00pm EST: Household Change in Net Worth 1/09/2026 at 01:35pm EST: Fed’s Barkin Repeats Outlook Speech 1/12/2026 at 12:30pm EST: Fed’s Bostic Moderates Discussion with CEO of Intercontinental 1/12/2026 at 12:45pm EST: Fed’s Barkin Participates in a Fireside Chat 1/12/2026 at 06:00pm EST: Fed’s Williams Delivers Keynote Remarks 1/13/2026 at 06:00am EST: NFIB Small Business Optimism 1/13/2026 at 08:15am EST: ADP Weekly Employment Change 1/13/2026 at 08:30am EST: CPI MoM / YoY 1/13/2026 at 08:30am EST: Core CPI MoM / YoY / Core CPI Index SA 1/13/2026 at 08:30am EST: Real Avg Weekly Earnings YoY / Real Avg Hourly Earnings YoY 1/13/2026 at 10:00am EST: Census Releases Sept – Oct New Home Sales Reports 1/13/2026 at 10:00am EST: New Home Sales / MoM 1/13/2026 at 10:00am EST: Fed’s Musalem Speaks on MNI Webcast 1/13/2026 at 02:00pm EST: Federal Budget Balance 1/13/2026 at 04:00pm EST: Fed’s Barkin in Moderated Conversation 1/14/2026 at 07:00am EST: MBA Mortgage Applications 1/14/2026 at 08:30am EST: BLS to Release Oct. and Nov. PPI on Jan. 14 1/14/2026 at 08:30am EST: PPI Final Demand MoM / PPM Ex Food and Energy MoM 1/14/2026 at 08:30am EST: PPI Ex Food, Energy, Trade MoM / PPI Final Demand YoY 1/14/2026 at 08:30am EST: PPI Ex Food and Energy YoY / PPI Ex Food, Energy, Trade YoY 1/14/2026 at 08:30am EST: Retail Sales Advance MoM / Retail Sales Ex Auto MoM 1/14/2026 at 08:30am EST: Retail Sales Ex Auto and Gas / Retail Sales Control Group 1/14/2026 at 08:30am EST: Current Account Balance 1/14/2026 at 09:50am EST: Fed’s Paulson Speaks on Economic Outlook 1/14/2026 at 10:00am EST: Fed’s Miran Speaks in Athens 1/14/2026 at 10:00am EST: Existing Home Sales / MoM 1/14/2026 at 10:00am EST: Business Inventories 1/14/2026 at 12:00pm EST: Fed’s Kashkari Speaks in Virtual Town Hall 1/14/2026 at 02:10pm EST: Fed’s Williams Delivers Opening Remarks 1/15/2026 at 08:30am EST: Initial Jobless Claims / Initial Claims 4-Wk Moving Avg / Continuing Claims 1/15/2026 at 08:30am EST: BLS Releases Limited Oct. Import-Export Series with Nov. Data 1/15/2026 at 08:30am EST: Import Price Index MoM and YoY / Import Price Index ex Petroleum MoM 1/15/2026 at 08:30am EST: Export Price Index MoM and YoY 1/15/2026 at 08:30am EST: Empire Manufacturing 1/15/2026 at 08:30am EST: Philadelphia Fed Business Outlook 1/15/2026 at 12:40am EST: Fed’s Tom Barkin Speaks on Virginia Economic Outlook 1/15/2026 at 04:00pm EST: Total Net TIC Flows / Net Long-term TIC Flows