US Treasuries

- Friday’s UST 10y range: 4.69% – 4.785%, closing at 4.77%

Upcoming US Treasury Supply

Tentative Schedule of Treasury Buyback Operations

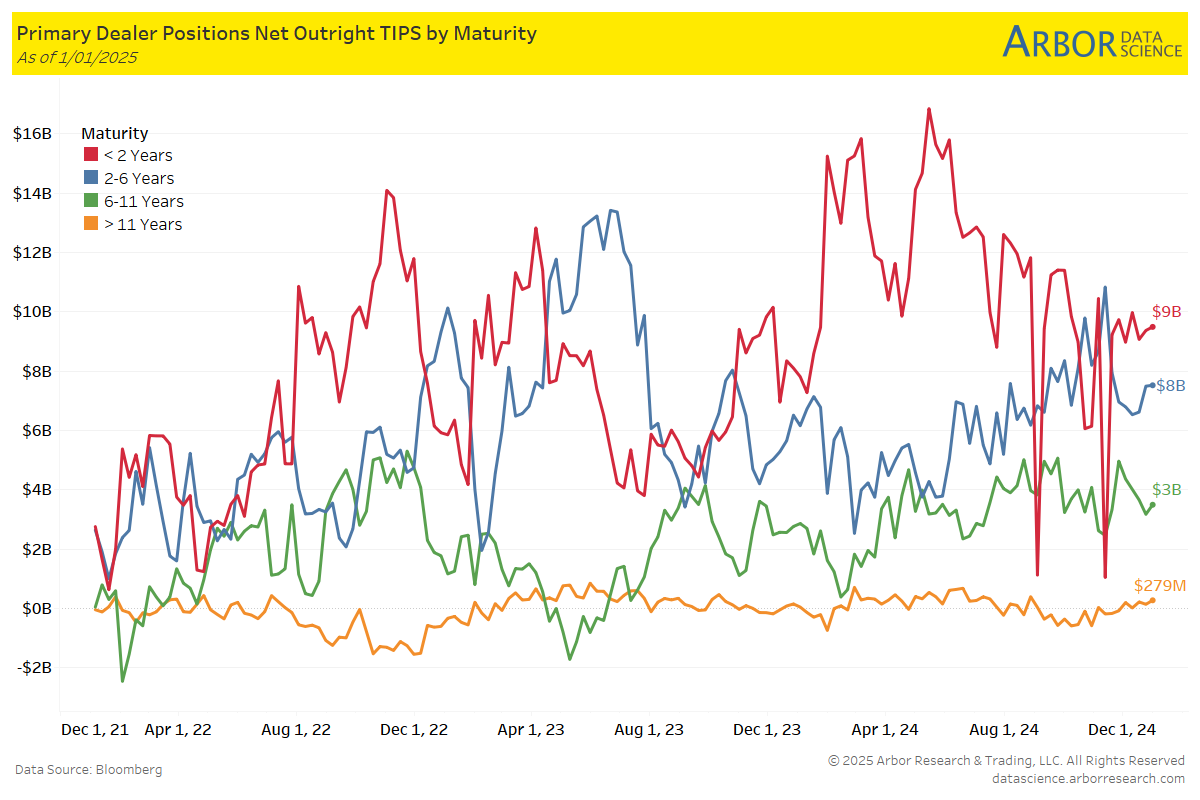

TIPS: Primary Dealer Positions by Maturity

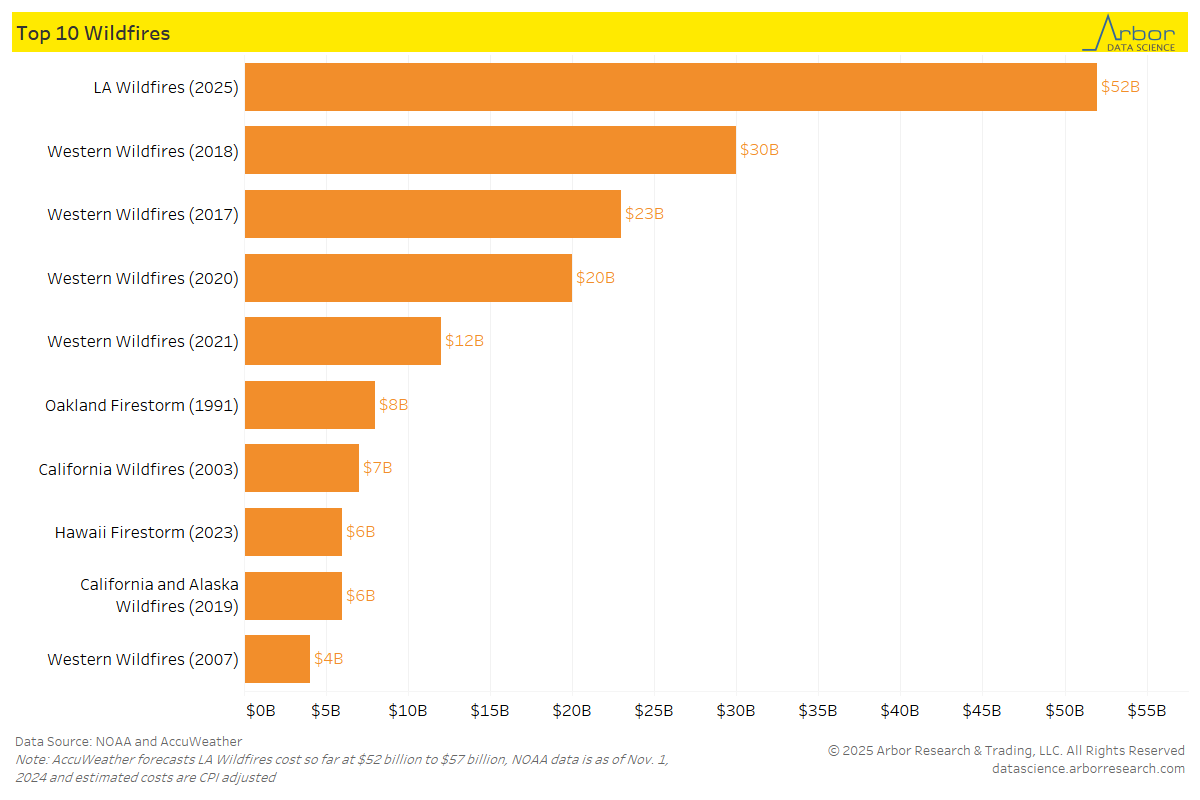

From our Arbor Data Science Desk: The Financial Impact of the LA Wildfires

Bloomberg: California Fires Expose a $1 Trillion Hole in US Home Insurance

Homeowners in increasingly risky areas can’t obtain adequate coverage as insurers flee the state to avoid losses.

In Other News:

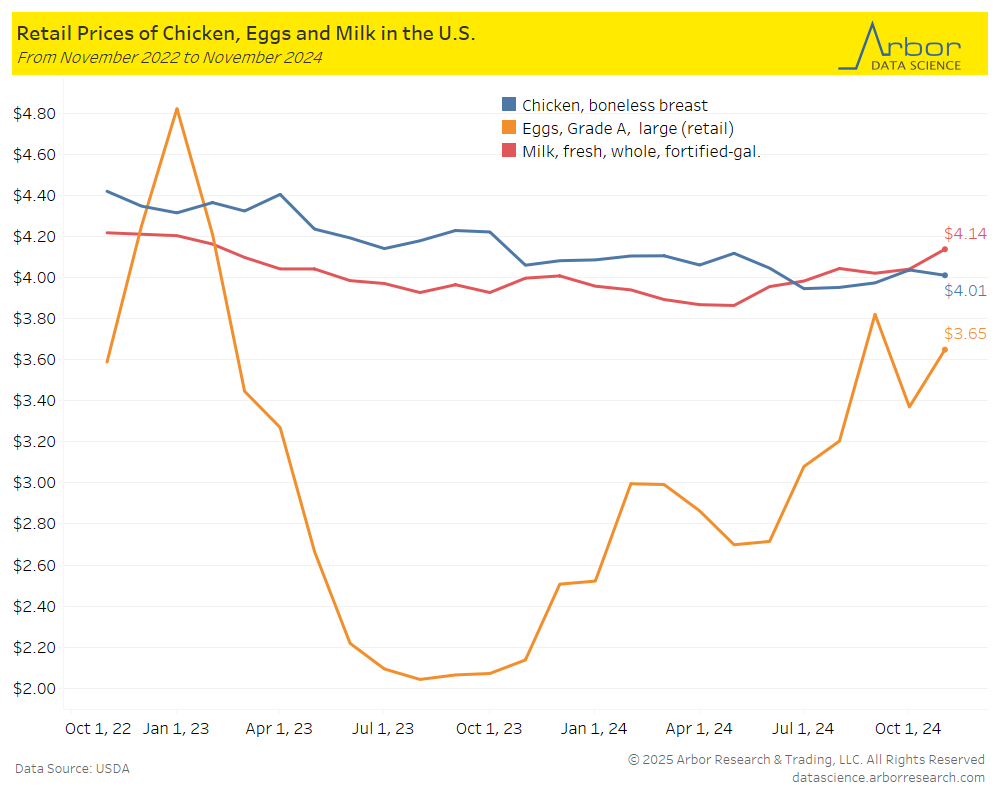

USA Today: Where are the eggs? And why are they expensive? Here’s what to know about prices and supply

In fact, egg prices have increased nationwide by around 38% in the last year, bringing the average cost of one dozen up to $3.65 in November versus $3.37 in October and $2.14 in November 2023, according to the U.S.Bureau of Labor Statistics Consumer Price Index.

Arbor Data Science: Bird Flu on the Rise

Oil Price: Oil Prices Skyrocket 4.5% as U.S. Targets Russian Tankers

New US sanctions targeting Russian oil tankers and maritime insurance providers have caused oil prices to surge to a three-month high.

CoStar: Amazon picks Georgia for $11 billion investment in data centers

AWS, a subsidiary of Amazon, plans to spend $11 billion over an undisclosed period to expand its infrastructure in Georgia to support cloud computing and artificial intelligence technologies, according to a company statement.

Bloomberg: UPenn, Clemson Show College Bond Sales-Boom Isn’t Over

The borrowing boom that America’s colleges and universities went on last year is likely to continue in 2025 as they upgrade campuses to compete for a shrinking pool of potential students and race against threats to their tax breaks.

RFDTV: More farmers are buying farmland than selling, and pressure over costs remain

Demand for farmland is good, but supply levels are concerning economists.

Across the industry, leaders say listings are down around 25 percent from active times between 2020 and 2023.

Upcoming Economic Releases & Fed Speak

- 1/13/2025 at 11:00am EST: NY Fed 1-Yr Inflation Expectations

- 1/13/2025 at 02:00pm EST: Federal Budget Balance

- 1/14/2025 at 06:00am EST: NFIB Small Business Optimism

- 1/14/2025 at 08:30am EST: PPI Final Demand MoM/Ex Food and Energy MoM/PPI Final Demand YoY

- 1/14/2025 at 10:00am EST: Schmid Gives Remarks in Kansas City

- 1/14/2025 at 03:05pm EST: Williams Gives Opening Remarks

- 1/15/2025 at 07:00am EST: MBA Mortgage Applications

- 1/15/2025 at 08:30am EST: Empire Manufacturing

- 1/15/2025 at 08:30am EST: CPI MoM/ Ex Food and Energy MoM/ YoY/ Ex Food and Energy YoY/ Index / Core

- 1/15/2025 at 08:30am EST: Real Average Hourly Earnings YoY/Real Average Weekly Earnings YoY

- 1/15/2025 at 09:00am EST: Barkin Speaks in Annapolis

- 1/15/2025 at 10:00am EST: Kashkari Participates in Q&A

- 1/15/2025 at 11:00am EST: Williams Gives Keynote Remarks

- 1/15/2025 at 12:00pm EST: Goolsbee Speaks at Midwest Economic Forecast Forum

- 1/15/2025 at 2:00pm EST: Federal Reserve Releases Beige Book

- 1/16/2025 at 8:30am EST: Philadelphia Fed Business Outlook & Retail Sales Advance MoM & Retail Sales Ex Auto MoM

- 1/16/2025 at 8:30am EST: Retail Sales Ex Auto and Gas

- 1/16/2025 at 8:30am EST: Import Price Index MoM & Import Price Index YoY

- 1/16/2025 at 8:30am EST: Export Price Index MoM & Export Price Index YoY

- 1/16/2025 at 8:30am EST: New York Fed Services Business Activity & Initial Jobless Claims & Continuing Claims

- 1/16/2025 at 10:00am EST: Business Inventories & NAHB Housing Market Index

- 1/17/2025 at 8:30am EST: Housing Starts & Housing Starts MoM

- 1/17/2025 at 8:30am EST: Building Permits & Building Permits MoM

- 1/17/2025 at 9:15am EST: Industrial Production MoM & Capacity Utilization & Manufacturing (SIC) Production

- 1/17/2025 at 4:00pm EST: Net Long-term TIC Flows & Total Net TIC Flows