US Treasuries

- UST 10s closed on Thursday (1/15/26) at 4.16%.

- Our 1st weekly resistance zone through tomorrow (Friday, 1/16/26) is 4.12% – 4.14% (89% shot to hold). Our second weekly resistance zone through Friday is 4.05% – 4.06% (75% shot to hold).

- Our 1st monthly resistance zone is 4.035% – 4.065% (73% shot to hold) which has held for 10 months.

- Our 1st weekly support zone through tomorrow (Friday) is 4.20% – 4.22% (90% shot to hold).

- Fed’s Goolsbee: says inflation could come ‘roaring back’ if central bank independence goes away and says taming inflation ‘most’ important thing

- Fed’s Daly: says growth projections solid, job market stabilizing

- Fed’s Barr: sees DOJ Probe as an “Assault” on Fed, Yahoo Finance Says

- Fed’s Barkin: says stretched consumers limit retail pricing power

- Fed’s Paulson: says rate cuts can wait, shows support for Powell

- Fed’s Schmid: says policy should be restrictive to curb inflation

Bloomberg: MUFG Named Primary Dealer for Treasury Auctions by New York Fed

Intraday Commentary From Bianco Research

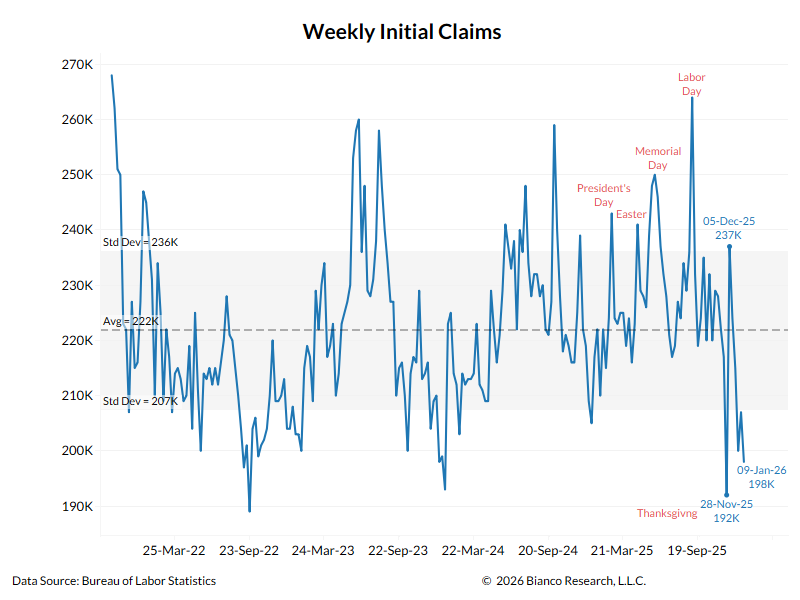

Remind me again why the Fed rate 75 basis points this fall, and including in December?

Oh yeah, they are worried that the labor market is falling apart. This stat says it’s doing the opposite.

In the News

OilPrice: U.S. Sells First Venezuela Oil Cargo for $500 Million

CNBC: Underwater car trade-ins are on the rise – and drivers owe a record amount, Edmund finds

The Economist: The race for copper has brought a wave of mining mega-mergers

Insurance Journal: Two Big California Home Insurers to Raise Rates by 6.9%

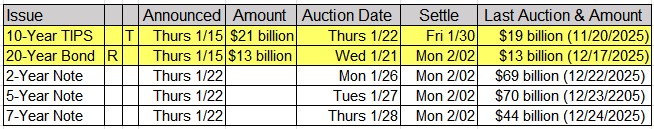

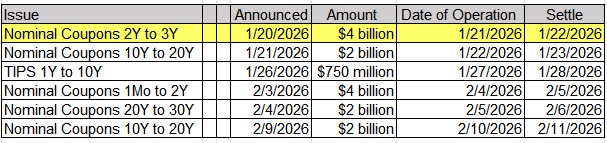

Upcoming US Treasury Supply