US Treasuries

- Thursday’s UST 10y range: 4.585% – 4.685%, closing at 4.60%

Upcoming US Treasury Supply

Tentative Schedule of Treasury Buyback Operations

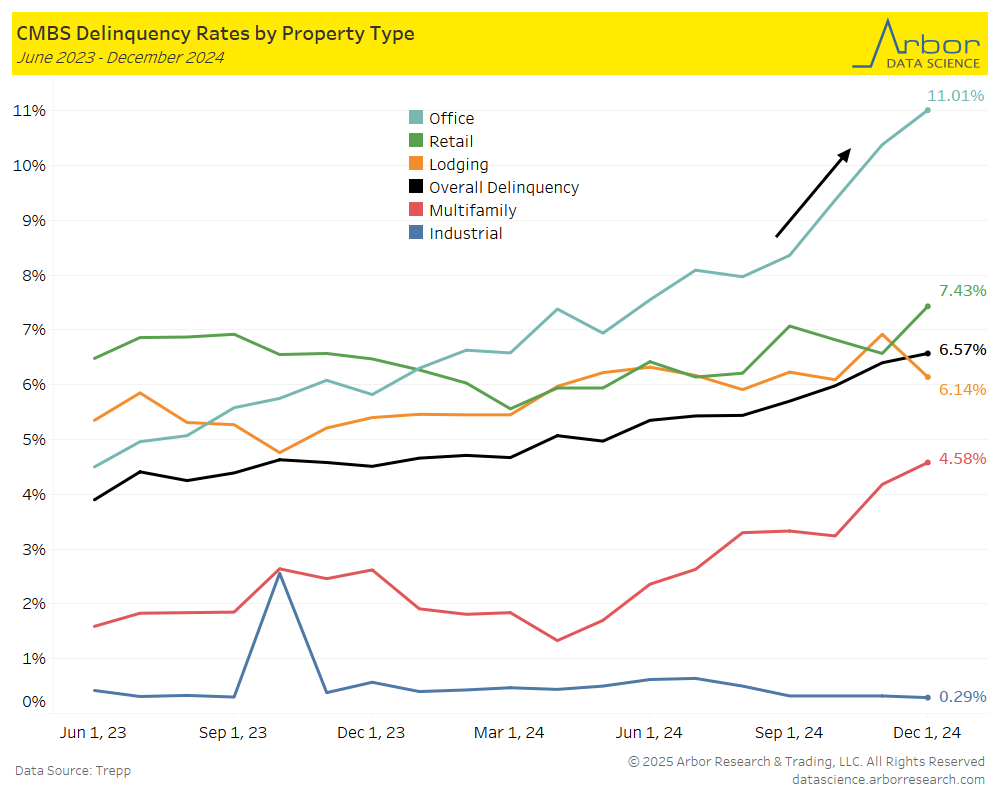

From our Arbor Data Science Desk: Commercial Real Estate Delinquency Rates Climb Higher

CoStar: LA fires put 12 million square feet of commercial real estate at risk

Office, apartments and retail property make up bulk of buildings in evacuation zones

In Other News:

AI-CIO: Public Pension Funds Remain in ‘Fragile State,’ per Equable Report

For the 17th straight year, public pensions remain below 90% funded.

NBC News: Here’s where insurance companies see the most risk for disasters

Last month, the Senate Budget Committee released a report showing the states and counties that have seen the greatest changes to their insurance profiles, as measured by number of canceled policies and extent of premium increases.

CNBC: Boeing delivered 30 airplanes in December, but gap with Airbus widened in 2024

Boeing handed over 348 airplanes in 2024, about a third fewer than it did a year earlier as the aerospace giant struggled with a crisis after a midair door panel blowout a year ago and a machinist strike in the fall that halted production.

GoBankingRates: How Far $1 Million in Retirement Savings Plus Social Security Goes in Every State

A retirement nest egg of $1 million would be completely drained in less than 20 years in three states: Massachusetts (19 years), California (16 years) and Hawaii (12 years).

Upcoming Economic Releases & Fed Speak

- 1/17/2025 at 08:30am EST: Housing Starts & Housing Starts MoM

- 1/17/2025 at 08:30am EST: Building Permits & Building Permits MoM

- 1/17/2025 at 09:15am EST: Industrial Production MoM & Capacity Utilization & Manufacturing (SIC) Production

- 1/17/2025 at 04:00pm EST: Net Long-term TIC Flows & Total Net TIC Flows

- 1/21/2025 at 08:30am EST: Philadelphia Fed Non-Manufacturing Activity

- 1/22/2025 at 07:00am EST: MBA Mortgage Applications

- 1/22/2025 at 10:00am EST: Leading Index

- 1/23/2025 at 08:30am EST: Initial Jobless Claims

- 1/23/2025 at 08:30am EST: Continuing Claims

- 1/23/2025 at 11:00am EST: Kansas City Fed Manf. Activity

Dealer Positions ($’s in millions of dollars)

- Dealer positions in T-Bills (as of 1/01) were down 25.82bln @75.87bln

- Dealer positions <2yrs TIPS (as of 1/01) were up 121mln @9.49bln.

- Dealer positions in 2-6yrs TIPS (as of 1/01) were up 29mln @7.52bln.

- Dealer positions in 6-11yrs TIPS (as of 1/01) were up 322mln @3.49mln.

- Dealer positions > 11yrs TIPS (as of 1/01) were up 135mln @279mln.

- Dealer positions in < 2yrs Coupons (as of 1/01) were up 11.53bln @38.33bln.

- Dealer positions > 2yrs and < 3yrs Coupons (as of 1/01) were down 7.45bln @7.25bln.

- Dealer positions in > 3 years and< 6yrs Coupons (as of 1/01) were up 195mln @89.31bln.

- Dealer positions > 6yrs and < 7yrs Coupons (as of 1/01) were up 404mln @26.52bln.

- Dealer positions in > 7 years and< 11yrs Coupons (as of 1/01) were down 2.30bln @35.07bln.

- Dealer positions > 11yrs and < 21yrs Coupons (as of 1/01) were up 722mln @29.36bln.

- Dealer positions in > 21 years Coupons (as of 1/01) were down 1.53bln @42.47bln.