US Treasuries

- Friday’s UST 10y range: 4.565% – 4.62%, closing at 4.61%

Financial Times: ETF Flows obliterate previous full-year record to hit $1.5 trillion

Global exchange traded fund flows hit a record $1.5tn last year with the buying frenzy accelerating after Donald Trump’s presidential victory in November.

Upcoming US Treasury Supply

Tentative Schedule of Treasury Buyback Operations

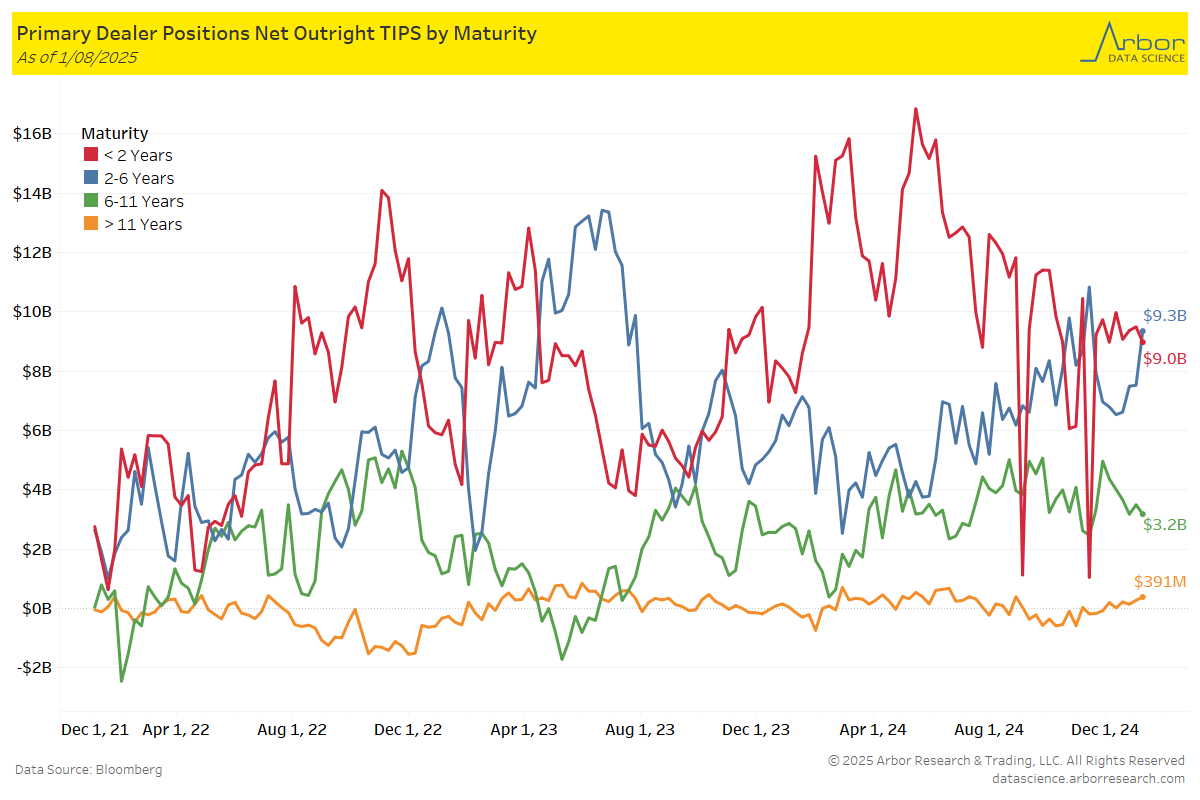

TIPS: Primary Dealer Positions by Maturity

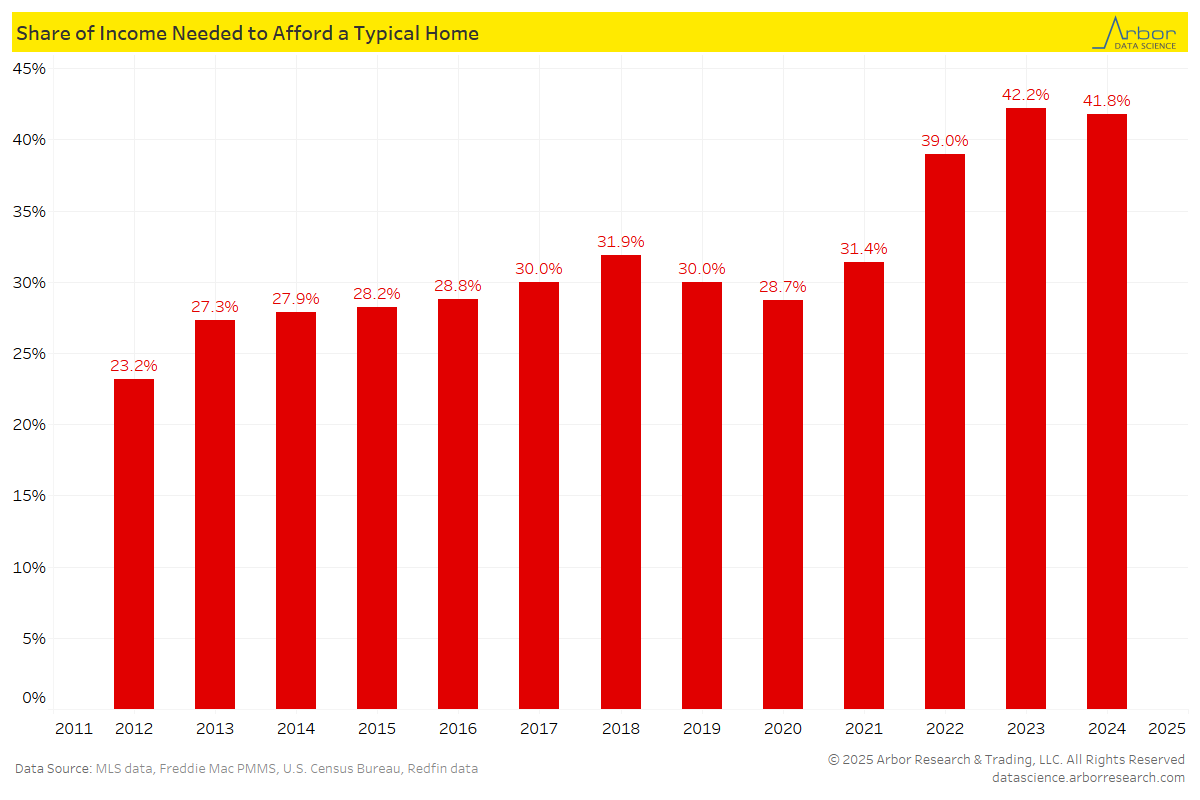

From our Arbor Data Science Desk: Checking in on Housing Affordability

Redfin: The Income Needed in Each State to Afford a Starter Home at a 7% Mortgage Rate

Mortgage rates are quickly approaching 7% again, after rising each of the first two weeks in January. Nationally, it means the household income now required to afford the typical starter home is $70,164, up more than 100% from just $32,357 in 2019.

In Other News:

NPR: Fed cuts were supposed to lower mortgage rates, but they’re back above 7%. Here’s why

Mortgage rates hit 7% for the first time since May 2024 on Thursday, providing another drag in an already tough housing market.

Vox: It’s a make-or-break moment for housing in California

As fires continue to rage in and around Los Angeles, burning more than 40,000 acres since last week, destroying more than 12,000 homes and other buildings, and killing at least 25 people, two things are becoming clear: California must rebuild quickly, and it must rebuild differently.

OilPrice: U.S. Oil and Gas Jobs Plummet Despite Record Production

U.S. oil and gas companies are using automation and outsourcing to reduce their workforce, despite record production levels.

PaymentsDive: Buy Now, Pay Later users pile on debt, CFPB finds

Most people who use BNPL as a payment method also carry disproportionately large amounts of other types of debt such as credit card and personal debt. Nearly two-thirds of consumers in the U.S. who lean on buy now, pay later transactions to pay for goods and services take out multiple BNPL loans at once.

Upcoming Economic Releases & Fed Speak

- 1/21/2025 at 08:30am EST: Philadelphia Fed Non-Manufacturing Activity

- 1/22/2025 at 07:00am EST: MBA Mortgage Applications

- 1/22/2025 at 10:00am EST: Leading Index

- 1/23/2025 at 08:30am EST: Initial Jobless Claims

- 1/23/2025 at 08:30am EST: Continuing Claims

- 1/23/2025 at 11:00am EST: Kansas City Fed Manf. Activity

- 1/24/2025 at 9:00am EST: Bloomberg Jan. United States Economic Survey

- 1/24/2025 at 9:45am EST: S&P Global US Manufacturing PMI & S&P Global US Services PMI & S&P Global US Composite PMI

- 1/24/2025 at 10:00am EST: U. of Mich. Sentiment & U. of Mich. Current Conditions & U. of Mich. Expectations

- 1/24/2025 at 10:00am EST: U. of Mich. 1 Yr Inflation & U. of Mich. 5-10 Yr Inflation

- 1/24/2025 at 10:00am EST: Existing Home Sales & Existing Home Sales MoM

- 1/24/2025 at 11:00am EST: Kansas City Fed Services Activity