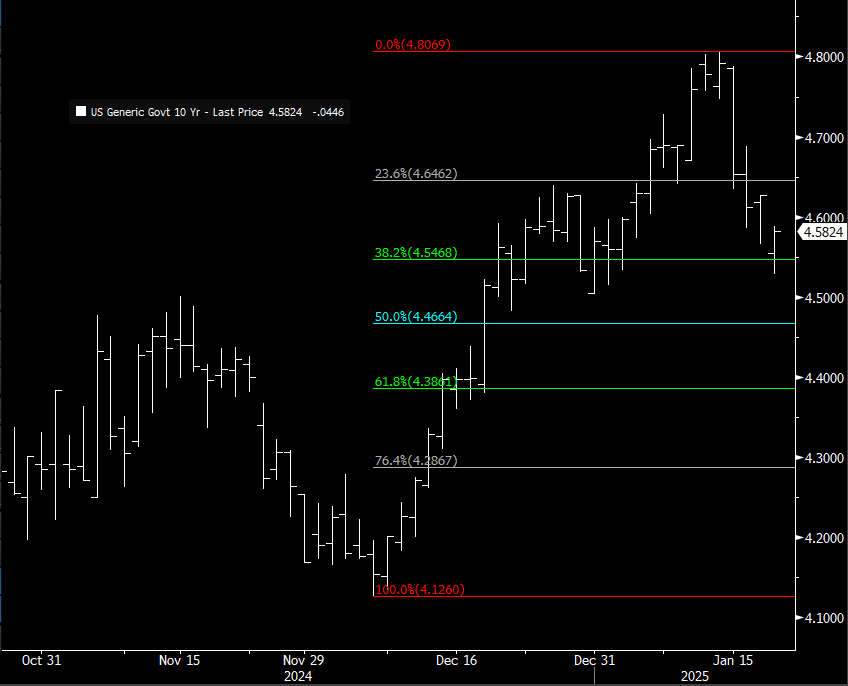

US Treasuries

- Monday’s UST 10y range: 4.53% – 4.59%, closing at 4.57%

Upcoming US Treasury Supply

Tentative Schedule of Treasury Buyback Operations

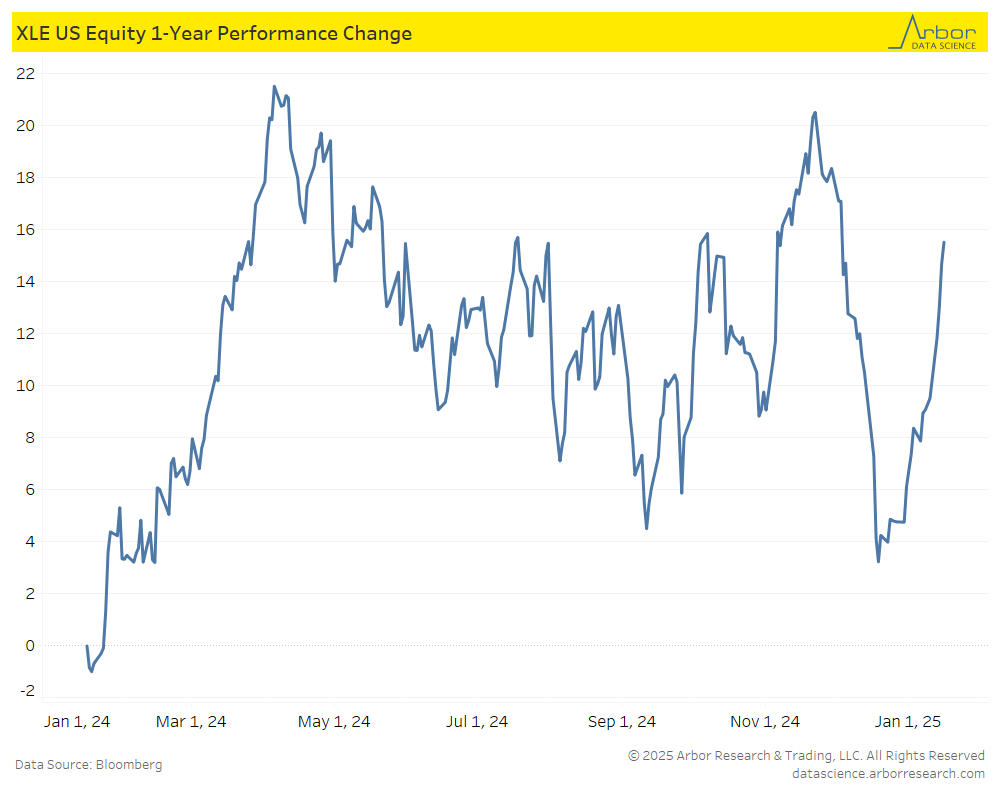

From our Arbor Data Science Desk: Energy by Petr Pinkhasov

EIA: EIA forecasts lower oil price in 2025 amid significant market uncertainties

We forecast benchmark Brent crude oil prices will fall from an average of $81 per barrel (b) in 2024 to $74/b in 2025 and $66/b in 2026, as strong global growth in production of petroleum and other liquids and slower demand growth put downward pressure on prices and help offset heightened geopolitical risks and voluntary production restraint from OPEC+ members.

Intraday Commentary from Jim Bianco

Bar chart of the 10-year yield with Fibonacci retracements.

A market can always pull .302 and keep its primary trend.

The 10-year tested 4.55% (green line, .382) and is holding. If it does, this means rates are still going north.

Break it, and it STARTS to get murky.

The dollar’s uptrend since September can now be questioned as it broke below the red line.

Finally, the S&P 500 since the election (lower red line) has been trading sideways (upper red line).

The S&P 500 has gone from the bottom of the range to the top in the last week.

Will it break out this time?

In Other News…

Earnings Releases this Week:

MPA: Regional banks face growing CRE losses

As US Treasury yields continue to climb, regional banks are facing mounting pressure from the distressed commercial real estate sector.

Since November, smaller bank stocks have dropped by 8.2%, reflecting the impact of higher borrowing rates as the 10-year Treasury yield surged.

CoStar: As wave of commercial loans come due, concerns rise over tougher payment options

This month alone, $8.6 billion of commercial mortgage-backed security loans are scheduled to come due. That’s putting pressure on the property lending system after years of leniency on holders of maturing debt — and leading some industry professionals to expect an increase in foreclosures.

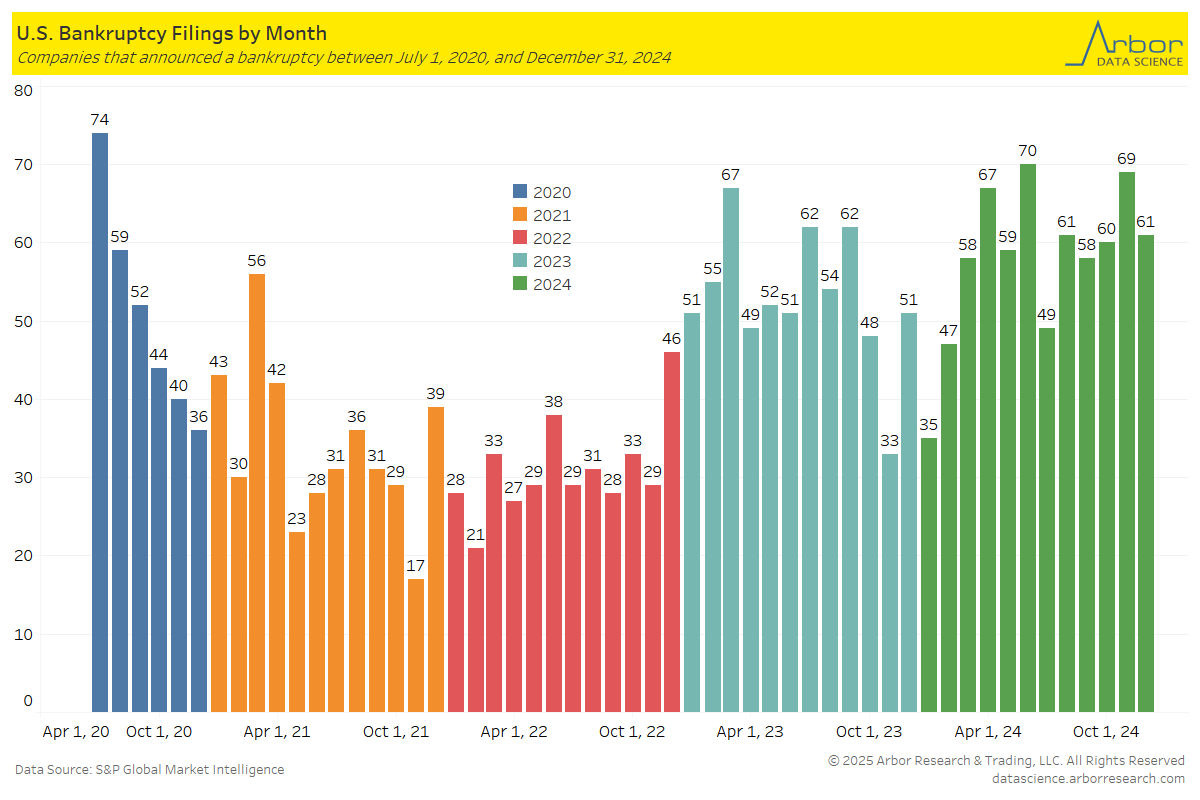

autoevolution: Canoo Is the Latest EV Startup To File for Bankruptcy, but It Will Not Be the Last

The last two years have been rough on EV startups as the cash resources have dried out, and the opportunities to raise more capital have narrowed. Many were bolstered by Tesla’s success and tried to replicate it, but the pandemic and economic difficulties that followed proved to be a tough nut to crack for most of them.

Arbor Data Science: U.S. Bankruptcies Hit a 14-Year High

Freightwaves: Ocean rates could fall as Houthis say they will end Red Sea attacks

But a confluence of factors could moderate prices with negotiations on 2025 ocean rates well underway: a return to less costly sailings on the Suez route; a slack shipping season ahead of Lunar New Year; and the deployment of new ships expected to begin in February, when reorganized carrier alliances and vessel-sharing agreements go into effect.

Medicalxpress: Georgia halts poultry sales in state after bird flu

Georgia officials suspended the sale of poultry in the state after confirming a positive case of bird flu in a commercial operation, threatening one of the state’s prime industries.

Arbor Data Science: Bird Flu on the Rise

Upcoming Economic Releases & Fed Speak

- 1/22/2025 at 07:00am EST: MBA Mortgage Applications

- 1/22/2025 at 10:00am EST: Leading Index

- 1/23/2025 at 08:30am EST: Initial Jobless Claims

- 1/23/2025 at 08:30am EST: Continuing Claims

- 1/23/2025 at 11:00am EST: Kansas City Fed Manf. Activity

- 1/24/2025 at 09:00am EST: Bloomberg Jan. United States Economic Survey

- 1/24/2025 at 09:45am EST: S&P Global US Manufacturing PMI/US Services PMI/US Composite PMI

- 1/24/2025 at 10:00am EST: U. of Mich. Sentiment & U. of Mich. Current Conditions & U. of Mich. Expectations

- 1/24/2025 at 10:00am EST: U. of Mich. 1 Yr Inflation & U. of Mich. 5-10 Yr Inflation

- 1/24/2025 at 10:00am EST: Existing Home Sales & Existing Home Sales MoM

- 1/24/2025 at 11:00am EST: Kansas City Fed Services Activity

- 1/27/2025 at 08:30am EST: Chicago Fed Nat Activity Index

- 1/27/2025 at 10:00am EST: New Home Sales & New Home Sales MoM

- 1/27/2025 at 10:30am EST: Dallas Fed Manf. Activity

- 1/27/2025: Building Permits & Building Permits MoM

- 1/28/2025 at 08:30am EST: Durable Goods Orders & Durable Ex Transportation

- 1/28/2025 at 08:30am EST: Cap Goods Orders Nondef Ex Air & Cap Goods Ship Nondef Ex Air

- 1/28/2025 at 09:00am EST: FHFA House Price Index MoM

- 1/28/2025 at 09:00am EST: S&P CoreLogic CS 20-City MoM and YoY

- 1/28/2025 at 09:00am EST: S&P CoreLogic CS US HPI YoY

- 1/28/2025 at 09:30am EST: Dallas Fed Services Activity

- 1/28/2025 at 09:30am EST: Conf. Board Consumer Confidence/Present Situation/Expectation

- 1/28/2025 at 10:00am EST: Richmond Fed Manufact. Index/Business Conditions