US Treasuries

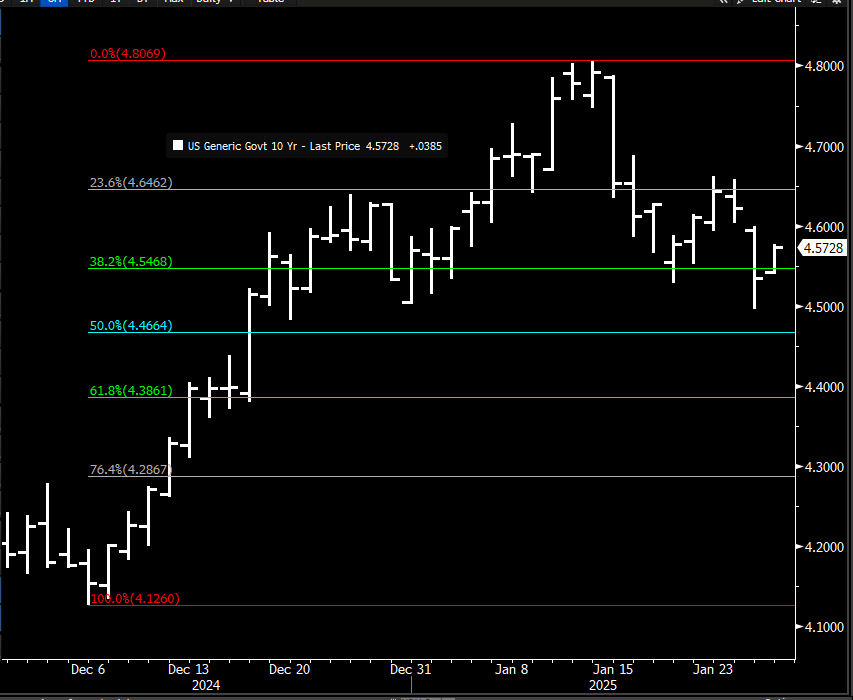

- Tuesday’s UST 10y range: 4.54% to 4.575%, closing at 4.545%

Bloomberg: Fed’s Balance-Sheet Plans Mystify Wall Street as Officials Meet

Buried in a rote US Treasury survey released on the eve of the latest holiday weekend was a question that all of Wall Street wants the answer to: What’s the Federal Reserve’s plan once it’s done drawing down its crisis-era bond holdings?

Upcoming US Treasury Supply

Tentative Schedule of Treasury Buyback Operations

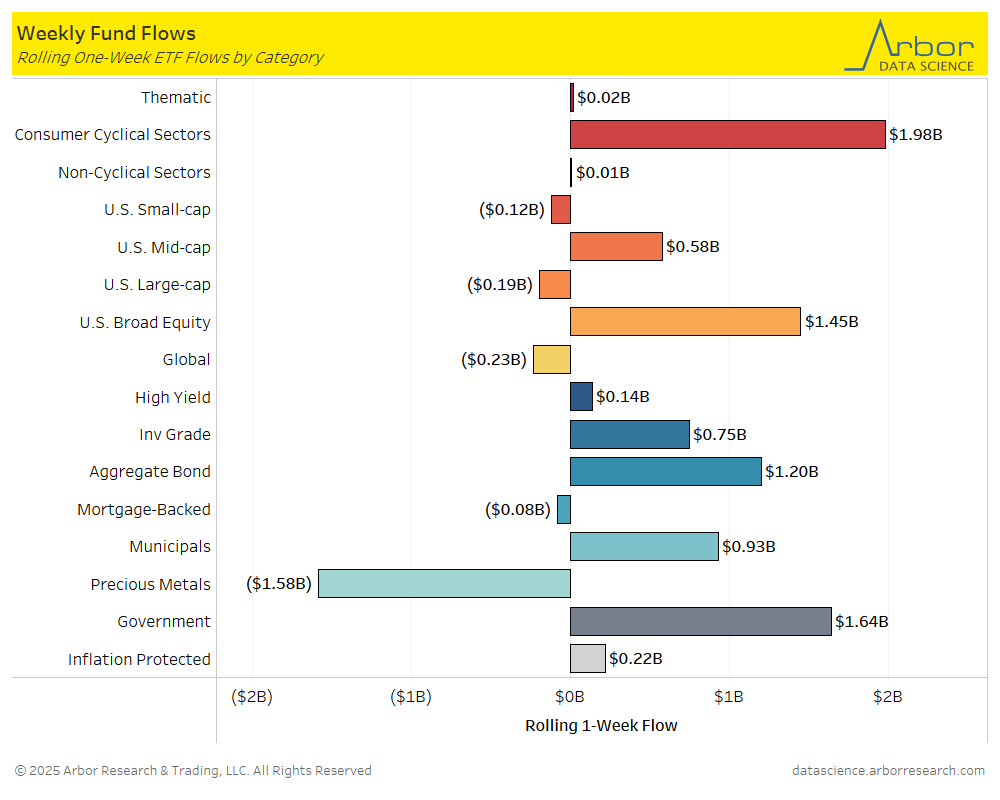

From our Arbor Data Science Desk: Investor Flows – Consumer Cyclical Sector ETFs on Top

Conference Call Replay featuring Jim Bianco

Intraday Commentary From Jim Bianco

Retracement update. Closed below the .382 yesterday (upper green line) but back above it today.

In other words, having a hard time in breaking this resistance (price) point.

If the market cannot break below .382, then the trend in yields remains higher.

In Other News…

OilPrice: U.S. Fracking Services Sector Braces Itself for Lower Demand

Efficiency gains, flat capital budgets, and consolidation among U.S. oil and gas producers have started to affect oilfield services companies which expect weaker demand for their fleets and products and increasing pricing pressure this year.

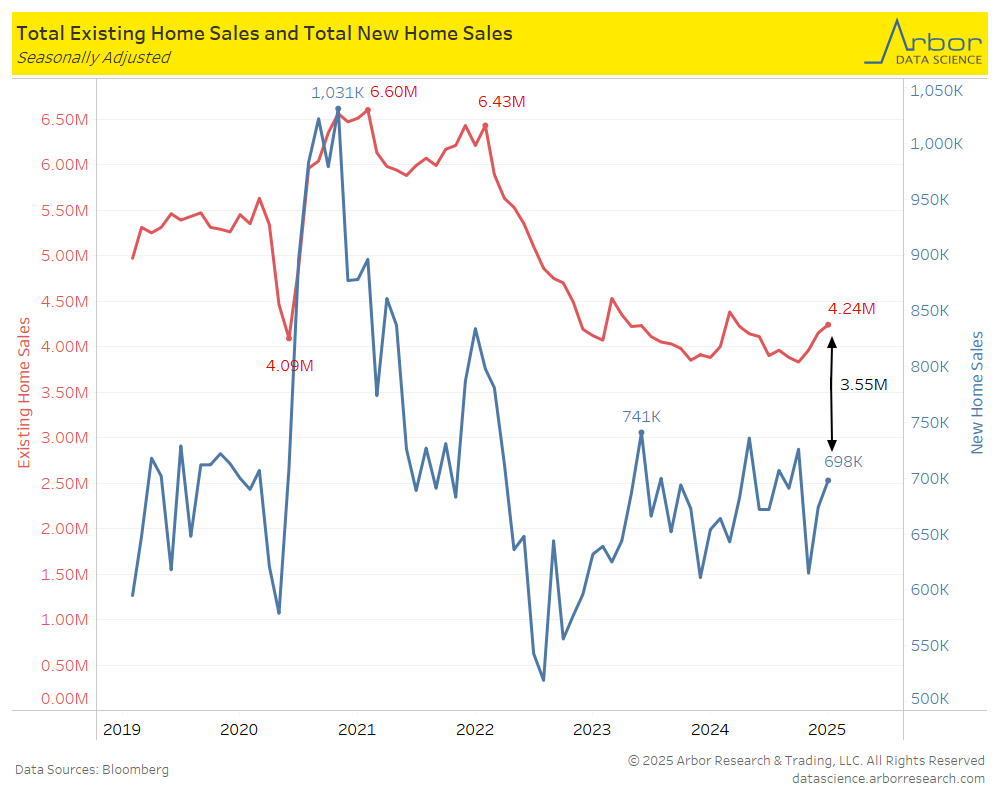

Newsweek: Florida and Texas Housing Market ‘Dominoes’ Have Fallen – Real Estate Analyst

A surge in inventory in Florida and Texas is likely to cause significant price declines in the two states’ housing markets, according to real estate analyst Nick Gerli, while home prices in the Northeast are still appreciating.

Arbor Data Science:

Axios: Pay raises are shrinking in 2025, CFOs say

Axios: Pay raises are shrinking in 2025, CFOs say

The vast majority of employers, 94%, are still planning raises this year, per Gartner, which surveyed 300 CFOs and finance executives. The amounts are just smaller now.

Upcoming Economic Releases & Fed Speak

- 1/29/2025 at 07:00am EST: MBA Mortgage Applications

- 1/29/2025 at 08:30am EST: Advance Goods Trade Balance

- 1/29/2025 at 08:30am EST: Wholesale Inventories MoM

- 1/29/2025 at 08:30am EST: Retail Inventories MoM

- 1/29/2025 at 02:00pm EST: FOMC Rate Decision

- 1/29/2025 at 02:00pm EST: Fed Interest on Reserve Balances Rate

- 1/30/2025 at 08:30am EST: GDP Annualized QoQ

- 1/30/2025 at 08:30am EST: Personal Consumption

- 1/30/2025 at 08:30am EST: Core PCE Price Index QoQ

- 1/30/2025 at 08:30am EST: Initial Jobless Claims

- 1/30/2025 at 08:30am EST: Continuing Claims

- 1/30/2025 at 10:00am EST: Pending Home Sales MoM and YoY

- 1/31/2025 at 08:30am EST: Bowman Speaks on Economy, Banks

- 1/31/2025 at 08:30am EST: Employment Cost Index & Personal Income

- 1/31/2025 at 08:30am EST: Personal Spending & Real Personal Spending

- 1/31/2025 at 08:30am EST: PCE Price Index MoM & PCE Price Index YoY

- 1/31/2025 at 08:30am EST: Core PCE Price Index MoM & Core PCE Price Index YoY

- 1/31/2025 at 09:45am EST: MNI Chicago PMI

- 2/03/2025 at 09:45am EST: S&P Global US Manufacturing PMI

- 2/03/2025 at 10:00am EST: Construction Spending MoM & ISM Manufacturing

- 2/03/2025 at 10:00am EST: ISM Prices Paid & ISM Prices Orders & ISM Employment

- 2/03/2025 at 12:30pm EST: Bostic Speaks on Economic Outlook

- 2/03/2025 at Wards Total Vehicle Sales

- 2/04/2025 at 10:00am EST: JOLTS Job Opening & Factory Orders

- 2/04/2025 at 10:00am EST: Factory Orders Ex Trans & Durable Goods Orders

- 2/04/2025 at 10:00am EST: Durables Ex Transportation & Cap Goods Orders Nondef Ex Air & Cap Goods Ship Nondef Ex Air

- 2/04/2025 at 11:00am EST: Bostic Speaks in Moderated Conversation on Housing

- 2/04/2025 at 02:00pm EST: Daly Speaks in Moderated Panel