US Treasuries

- Friday’s UST 10y range: 4.53% – 4.595%, closing at 4.595%

Bloomberg: Spike in Failed Trades Shows Persistent 20-Year US Bond Shortage

The 20-year US bond is again tripping up traders in the repo market, where participants lend and borrow Treasuries.

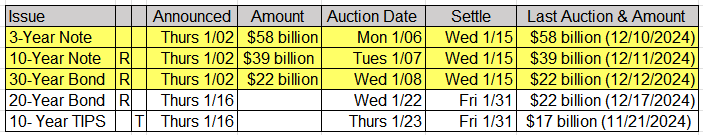

Upcoming US Treasury Supply*

*Note that next week’s auction dates moved up by 1 day, respectively, due to the early market close on 1/9/25 in honor of the National Day of Mourning for former U.S. President Jimmy Carter.

Tentative Schedule of Treasury Buyback Operations

Join us for our Next Conference Call on Tuesday, 1/07/25, featuring Jim Bianco

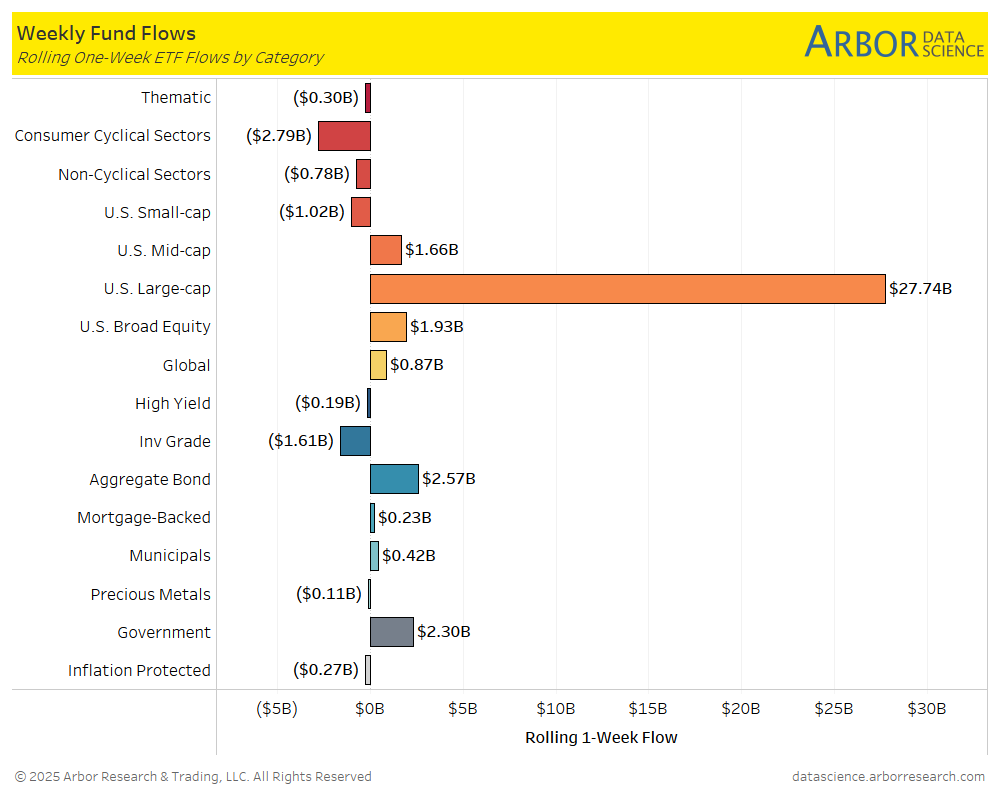

From our Arbor Data Science Desk:

Special Edition: Investor Flows – U.S. Large Cap ETF Inflows Make a Comeback (updated for the week ended 1/02/25)

Jim Bianco joins Fox Business to discuss the K-Shaped Economy, Stubborn Sticky Inflation & Tariffs

Intraday Commentary from Jim Bianco

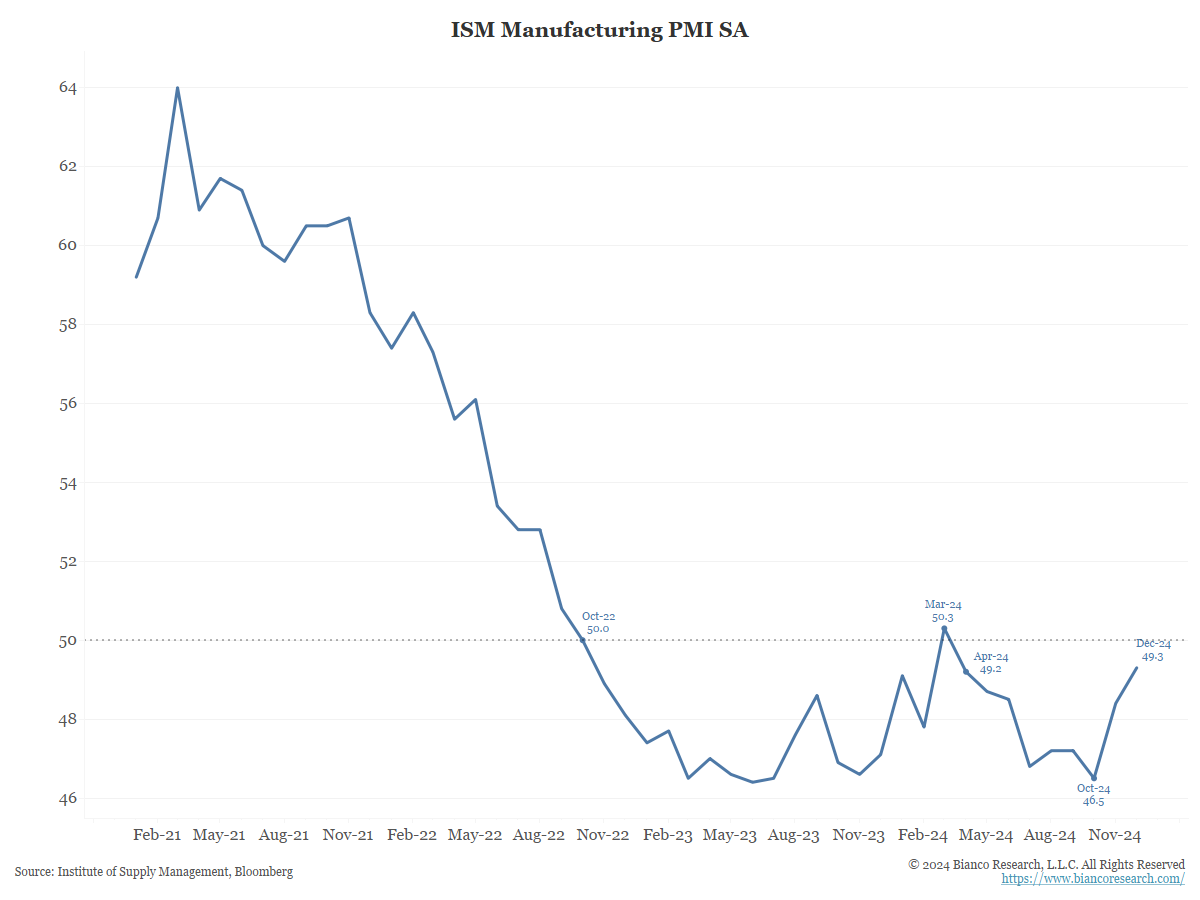

*US DEC. ISM MANUFACTURING INDEX RISES TO 49.3; EST. 48.2

ISM beat and as the chart shows, this is the second highest reading since October 2022 (26 months).

Prices Paid 52.5 versus Estimate of 51.8

It is staying “sticky” above 50…… Remind me again … why is the Fed cutting rates?

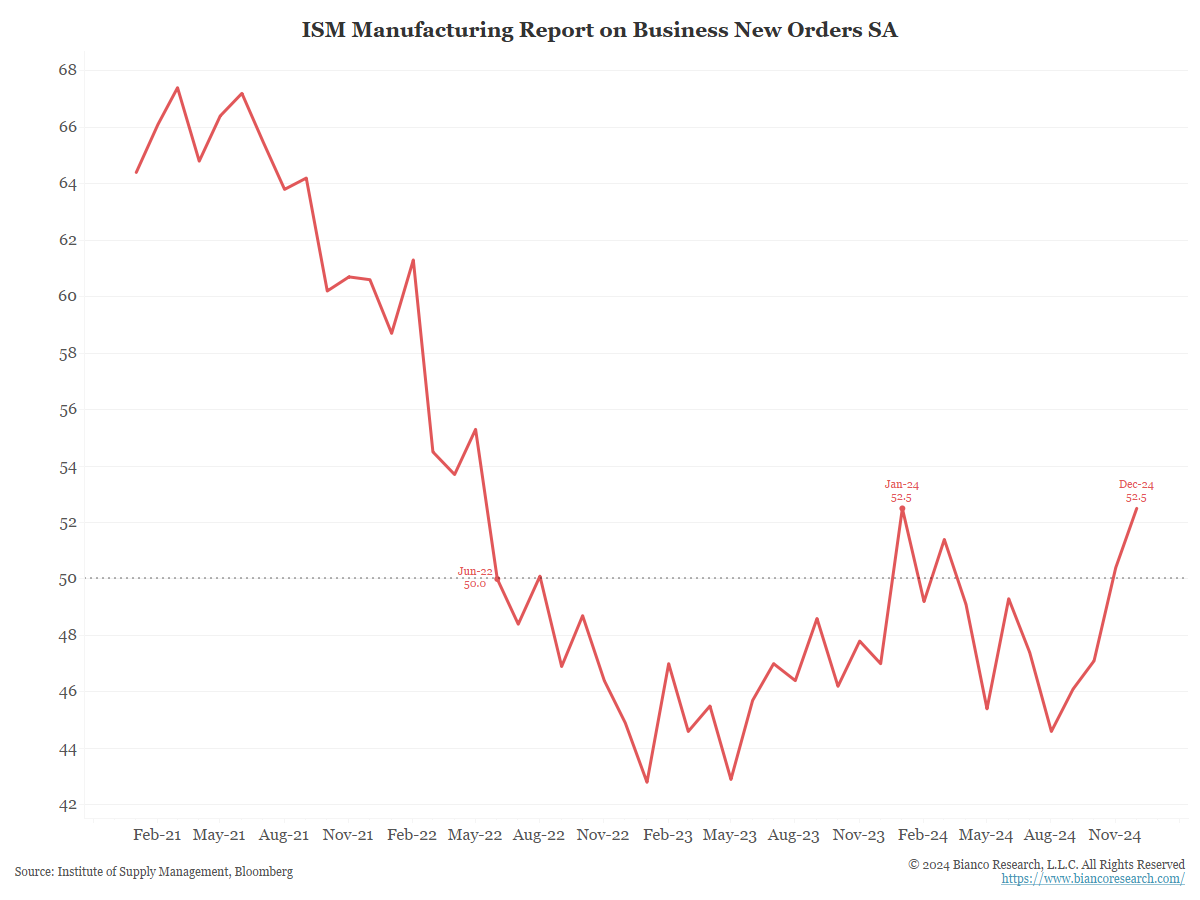

New Orders is actually in the Index of Leading Economic Indicators. This means economists think this is the most important “sub-component” of this report.

It jumped to 52.5, equaling its highest reading since June 2022 (the month YoY CPI hit 9%).

Remind me again, why is the Fed cutting rates?

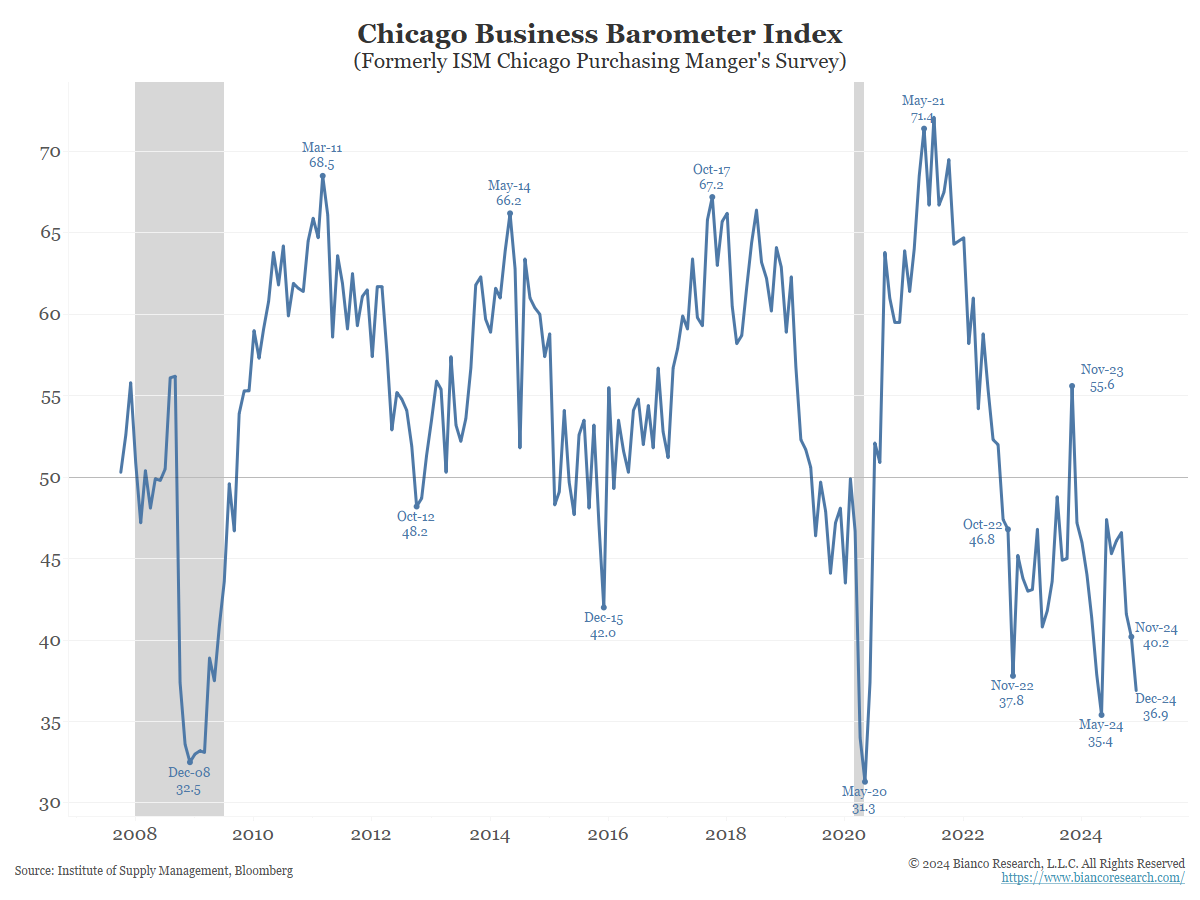

The Chicago ISM report came out on Tuesday, and it was shockingly weak. 36.9 is the second lowest reading since COVID-19.

Many pointed to the saying it was a harbinger of the national report. Instead, the national report was the opposite, a beat and very strong.

Remember, ISM is a survey of purchasing managers’ opinions, not a measure of actual production.

Given the state of Illinois’s economy, the dreadful state of Chicago’s economy, maybe the Chicago survey was more of a plea for help from Chicago area Purchasing Managers than an indication about the state of the national economy.

In Other News:

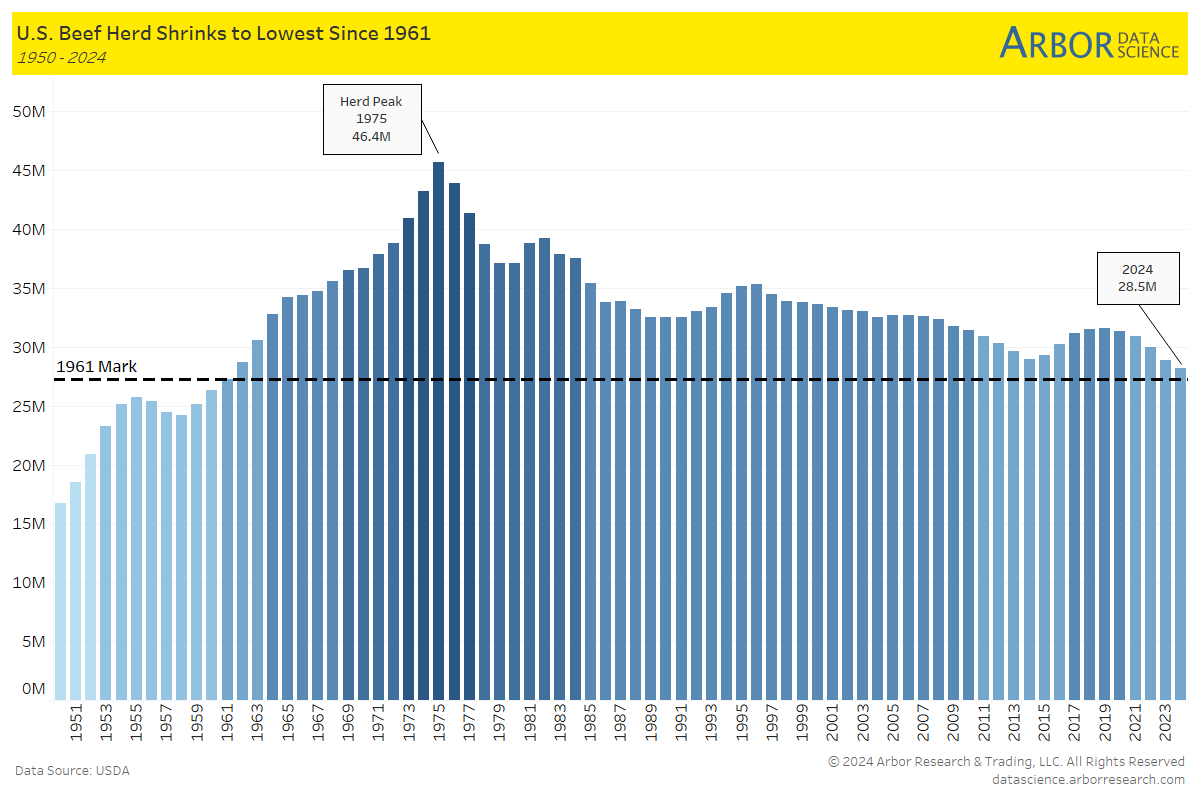

ZeroHedge: Cattle Futures Hit New Record High As Polar Blast Set To Hit Nation’s Beef Supply

Cattle futures in Chicago surged to fresh record highs on Friday, driven by severe winter weather forecasts for the Central Plains and Midwest, two key regions home to the nation’s cattle belt. Analysts warn that the harsh conditions could reduce herd sizes and impact carcass weights, further tightening the nation’s cattle supply.

Read more on the topic from Arbor Data Science: Where’s the Beef? by Sam Rines (published on 12/10/24)

Newsweek: China Raises Retirement Age Amid Population Crisis

China is raising its statutory retirement ages for the first time since establishing them seven decades ago as an ever-rising proportion of seniors pressures the country’s pension systems.

Upcoming Economic Releases & Fed Speak

- 1/04/2025 at 5:30pm EST: Daly Speaks at AEA Monetary Policy Session

- 1/05/2025 at 1:15pm EST: Daly Gives Remarks on Panel Honoring Bernanke

- 1/06/2025 at 8:00am EST: Cook Gives Speech at University of Michigan Event

- 1/06/2025 at 9:45am EST: S&P Global US Services PMI and S&P Global US Composite PMI

- 1/06/2025 at 10:00am EST: Factory Orders and Factory Orders Ex Trans

- 1/06/2025 at 10:00am EST: Durable Goods Orders and Durables Ex Transportation

- 1/06/2025 at 10:00am EST: Cap Goods Orders Nondef Ex Air and Cap Goods Ship Nondef Ex Air

- 1/07/2025 at 8:00am EST: Barkin Speaks to Raleigh Chamber

- 1/07/2025 at 8:30am EST: Trade Balance

- 1/07/2025 at 10:00am EST: JOLTS Job Openings & ISM Services Index/Employment/New Orders

- 1/08/2025 at 7:00am EST: MBA Mortgage Applications

- 1/08/2025 at 8:15am EST: ADP Employment Change

- 1/08/2025 at 8:35am EST: Waller Gives Speech on Economic Outlook

- 1/08/2024 at 2:00pm EST: FOMC Meeting Minutes

- 1/08/2024 at 3:00pm EST: Consumer Credit

- 1/09/2024 at 7:30am EST: Challenger Job Cuts YoY

- 1/09/2024 at 7:30am EST: Initial Jobless Claims & Continuing Claims

- 1/09/2024 at 9:00am EST: Harker Speaks on Economic Outlook

- 1/09/2024 at 10:00am EST: Wholesale Trade Sales MoM & Wholesale Inventories MoM

- 1/09/2024 at 12:40pm EST: Barkin Speaks to Virginia Bankers Association

- 1/09/2024 at 1:30pm EST: Schmid Speaks to Economic Club of Kansas City

- 1/09/2024 at 1:35pm EST: Bowman Reflects on 2024 in Speech

- 1/10/2024 at 8:30am EST: Average Hourly Earnings YoY & Average Hourly Earnings MoM

- 1/10/2024 at 8:30am EST: Underemployment Rate & Labor Force Participation Rate

- 1/10/2024 at 8:30am EST: Change in Manufact. Payroll & Change in Nonfarm Payrolls

- 1/10/2024 at 8:30am EST: Two-Month Payroll Net Revision & Unemployment Rate

- 1/10/2024 at 8:30am EST: Change in Private Payrolls & Average Weekly Hours All Employees

- 1/10/2024 at 10:00am EST: U. of Mich. Sentiment & U. of Mich. Current Conditions & U. of Mich. Expectations

- 1/10/2024 at 10:00am EST: U. of Mich. 1 Yr Inflation & U. of Mich. 5-10 Yr Inflation