US Treasuries

- Thursday’s UST 10y range: 4.48% to 4.54%, closing at 4.51%

Upcoming US Treasury Supply

Tentative Schedule of Treasury Buyback Operations

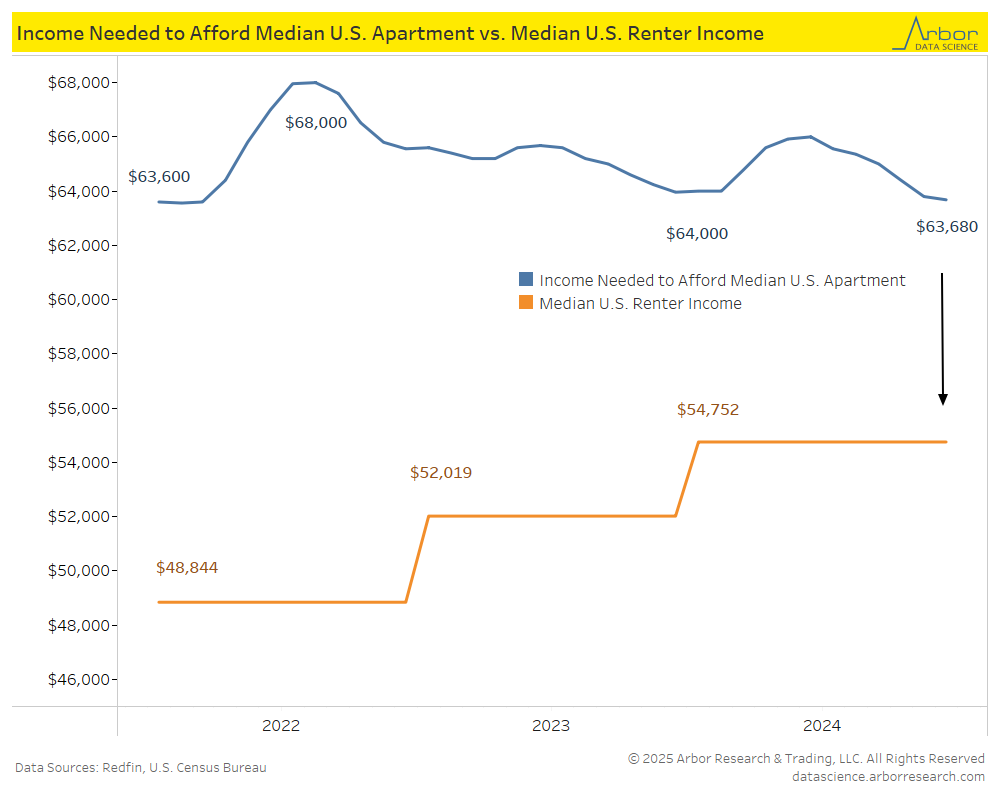

From our Arbor Data Science Desk: The Rent is Too High by Sam Rines

CoStar: Midwestern markets top national rent growth

National rent growth has slowed significantly since the first quarter of 2022, from 9.9% to just 1.0% for 2024’s fourth quarter.

TheStreet: Skyrocketing housing costs put huge strain on homeowners and renters

A 2024 Credit Karma study found that almost half (49%) of Americans note that inflation and mortgage rates have made it ‘impossible’ to buy a home, but many also find it difficult to afford rent.

Intraday Commentary from Jim Bianco

WSJ: Why ‘Distillation’ Has Become the Scariest Word for AI Companies

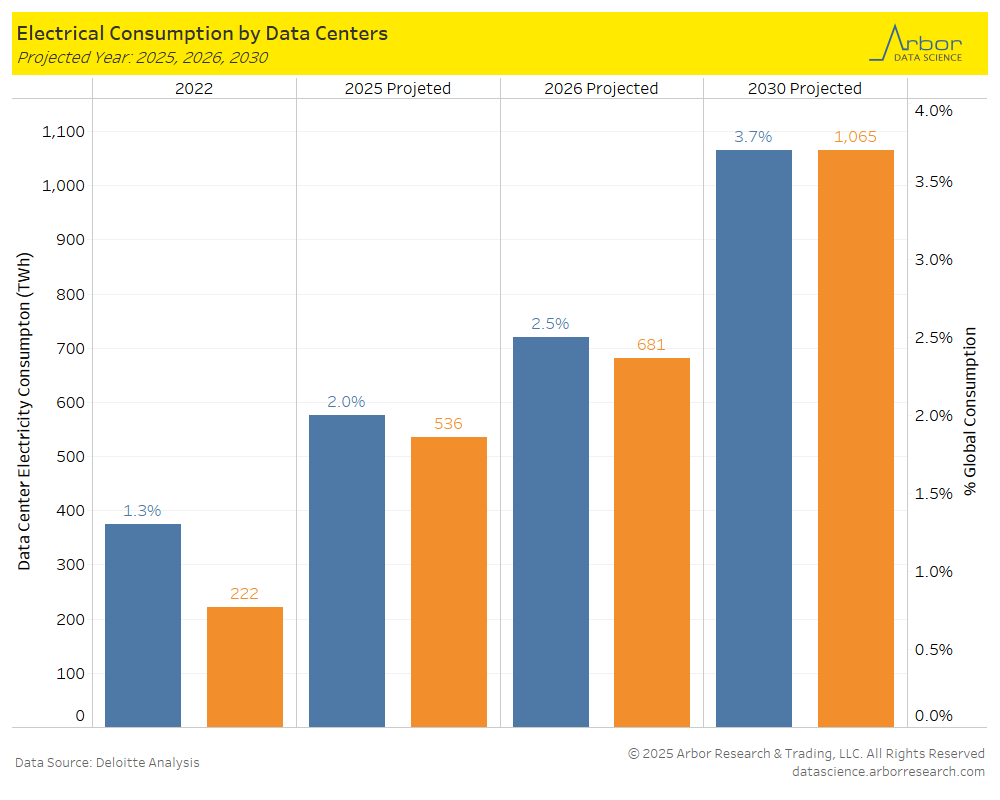

Jim Bianco: Keep in mind the takeaway from Deepseek is cost.

AI is incredibly expensive and requires such massive power needs that Microsoft contracted with the nuclear power plant on Three-Mile Island to restart it so they could build their massive data centers next to it and have enough power.

Deepseek did it at much lower costs (maybe as low as 1/30th the price) and with far far less power needs.

This will open the door to many competitors who lack the capital to compete at the current scale required, which will mean lower costs and margins for the big AI players (the MAG 7).

September 20, 2024

BBC: Three Mile Island nuclear site to reopen in Microsoft deal

The 1979 accident at Three Mile Island had cast a shadow on nuclear power in the US for decades.

In Other News…

ConstructionDive: Multibillion-dollar data center projects to watch

In addition to Oracle and OpenAI’s Stargate initiative, Amazon, Meta, Google and other tech giants are building facilities across the country this year.

Arbor Data Science:

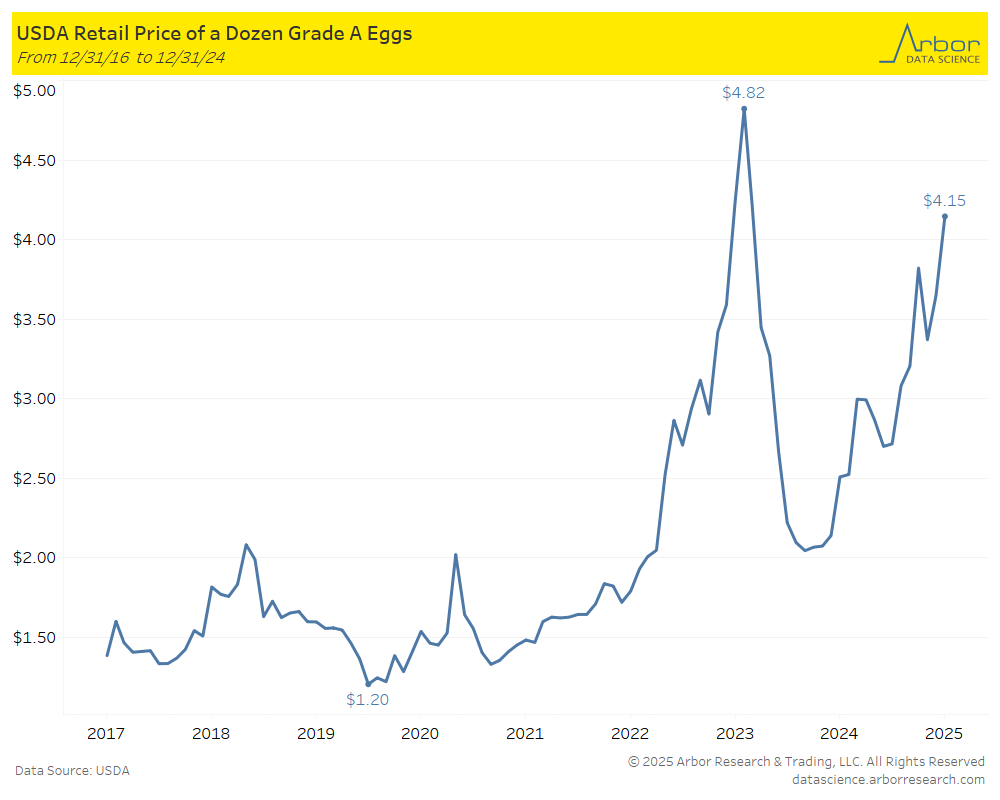

SupplyChainBrain: A Lesson in Egg-Onomics: Tracing the Trouble with U.S. Egg Prices

The U.S. avian flu epidemic has affected more than 130 million total birds since it began, making it the largest outbreak of the disease in the country’s history.

Arbor Data Science:

Upcoming Economic Releases & Fed Speak

- 1/31/2025 at 08:30am EST: Bowman Speaks on Economy, Banks

- 1/31/2025 at 08:30am EST: Employment Cost Index & Personal Income

- 1/31/2025 at 08:30am EST: Personal Spending & Real Personal Spending

- 1/31/2025 at 08:30am EST: PCE Price Index MoM & PCE Price Index YoY

- 1/31/2025 at 08:30am EST: Core PCE Price Index MoM & Core PCE Price Index YoY

- 1/31/2025 at 09:45am EST: MNI Chicago PMI

- 2/03/2025 at 09:45am EST: S&P Global US Manufacturing PMI

- 2/03/2025 at 10:00am EST: Construction Spending MoM & ISM Manufacturing

- 2/03/2025 at 10:00am EST: ISM Prices Paid & ISM Prices Orders & ISM Employment

- 2/03/2025 at 12:30pm EST: Bostic Speaks on Economic Outlook

- 2/03/2025 at 06:30pm EST: Musalem Gives Welcoming Remarks

- 2/03/2025 at Wards Total Vehicle Sales

- 2/04/2025 at 10:00am EST: JOLTS Job Opening & Factory Orders

- 2/04/2025 at 10:00am EST: Factory Orders Ex Trans & Durable Goods Orders

- 2/04/2025 at 10:00am EST: Durables Ex Transportation & Cap Goods Orders Nondef Ex Air & Cap Goods Ship Nondef Ex Air

- 2/04/2025 at 11:00am EST: Bostic Speaks in Moderated Conversation on Housing

- 2/04/2025 at 02:00pm EST: Daly Speaks in Moderated Panel

- 2/05/2025 at 07:00am EST: MBA Mortgage Applications

- 2/05/2025 at 08:15am EST: ADP Employment Change

- 2/05/2025 at 08:30am EST: Trade Balance

- 2/05/2025 at 09:00am EST: Barkin Speaks at Fireside Chat

- 2/05/2025 at 09:45am EST: S&P Global US Services PMI & S&P Global US Composite PMI

- 2/05/2025 at 10:00am EST: ISM Services Index & ISM Services New Orders

- 2/05/2025 at 10:00am EST: ISM Services Employment & ISM Services Prices Paid

- 2/05/2025 at 01:00pm EST: Goolsbee Gives Remarks at Auto Conference

- 2/06/2025 at 07:30am EST: Challenger Job Cuts YoY

- 2/06/2025 at 08:30am EST: Nonfarm Productivity & Unit Labor Costs

- 2/06/2025 at 08:30am EST: Initial Jobless Claims & Continuing Claims

- 2/06/2025 at 02:30pm EST: Waller Gives Remarks on the Future of Payments

Dealer Positions ($’s in millions of dollars)

- Dealer positions in T-Bills (as of 1/15) were down 10.11bln @53.47bln

- Dealer positions <2yrs TIPS (as of 1/15) were up 210mln @9.18bln.

- Dealer positions in 2-6yrs TIPS (as of 1/15) were down 1.41bln @7.93bln.

- Dealer positions in 6-11yrs TIPS (as of 1/15) were down 1.89mln @2.84mln.

- Dealer positions > 11yrs TIPS (as of 1/15) were up 299mln @292mln.

- Dealer positions in < 2yrs Coupons (as of 1/15) were up 6.85bln @56.78bln.

- Dealer positions > 2yrs and < 3yrs Coupons (as of 1/15) were up 10mln @716.56bln.

- Dealer positions in > 3 years and< 6yrs Coupons (as of 1/15) were up 4.66bln @91.93bln.

- Dealer positions > 6yrs and < 7yrs Coupons (as of 1/15) were up 6.71bln @16.63bln.

- Dealer positions in > 7 years and< 11yrs Coupons (as of 1/15) were down 1.53bln @29.90bln.

- Dealer positions > 11yrs and < 21yrs Coupons (as of 1/15) were up 1.35bln @25.33bln.

- Dealer positions in > 21 years Coupons (as of 1/15) were down 2.63bln @40.17bln.