Download this Report to Print

US Treasuries

Tuesday’s range for UST 10y: Tuesday’s range for UST 30y:

Intraday Commentary From Bianco Research

*POWELL: FED MAY END BALANCE-SHEET RUNOFF IN COMING MONTHS

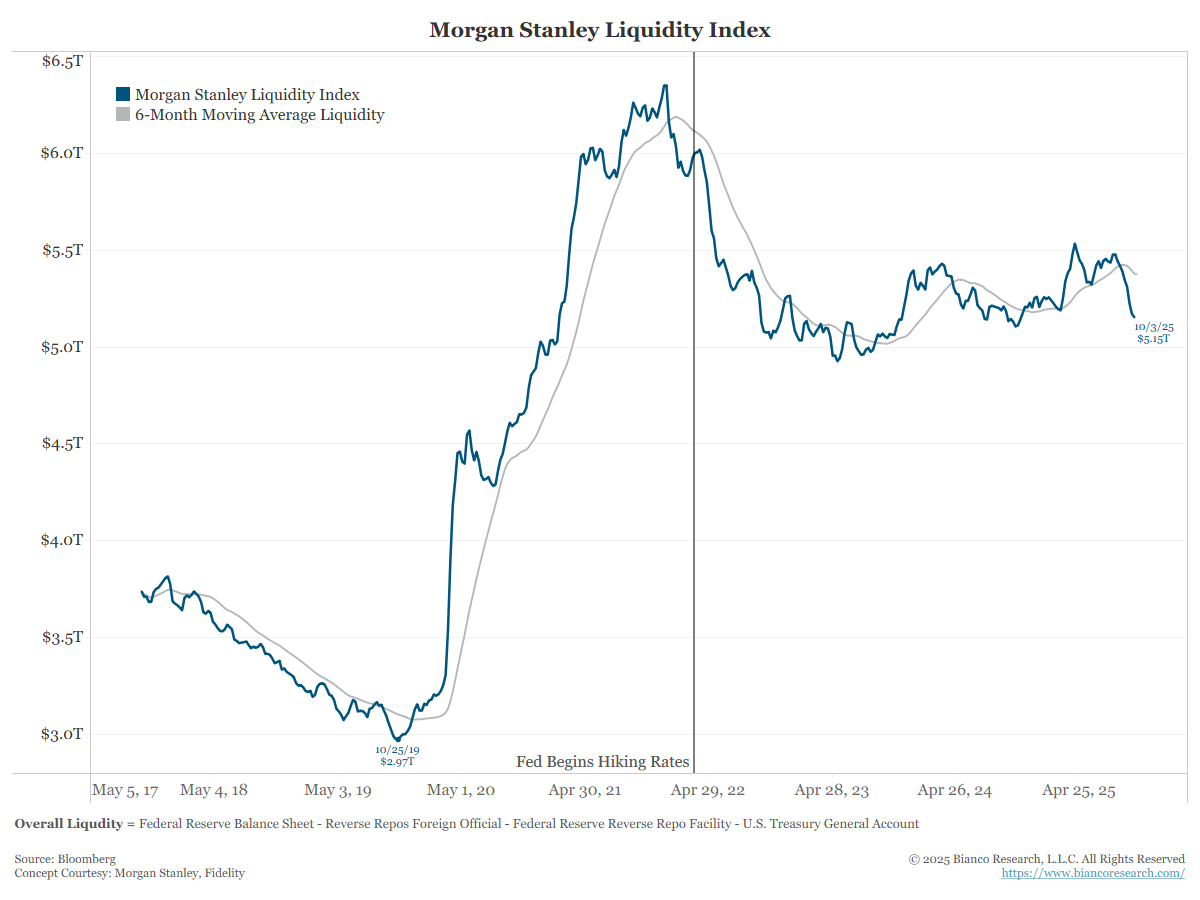

While liquidity has meandered sideways for the past 3 years, RRP is no longer a cushion for liquidity and QT is ACTUALLY drawing liquidity out now. We will see if this becomes a meaningful decline in overall liquidity or just another blip.

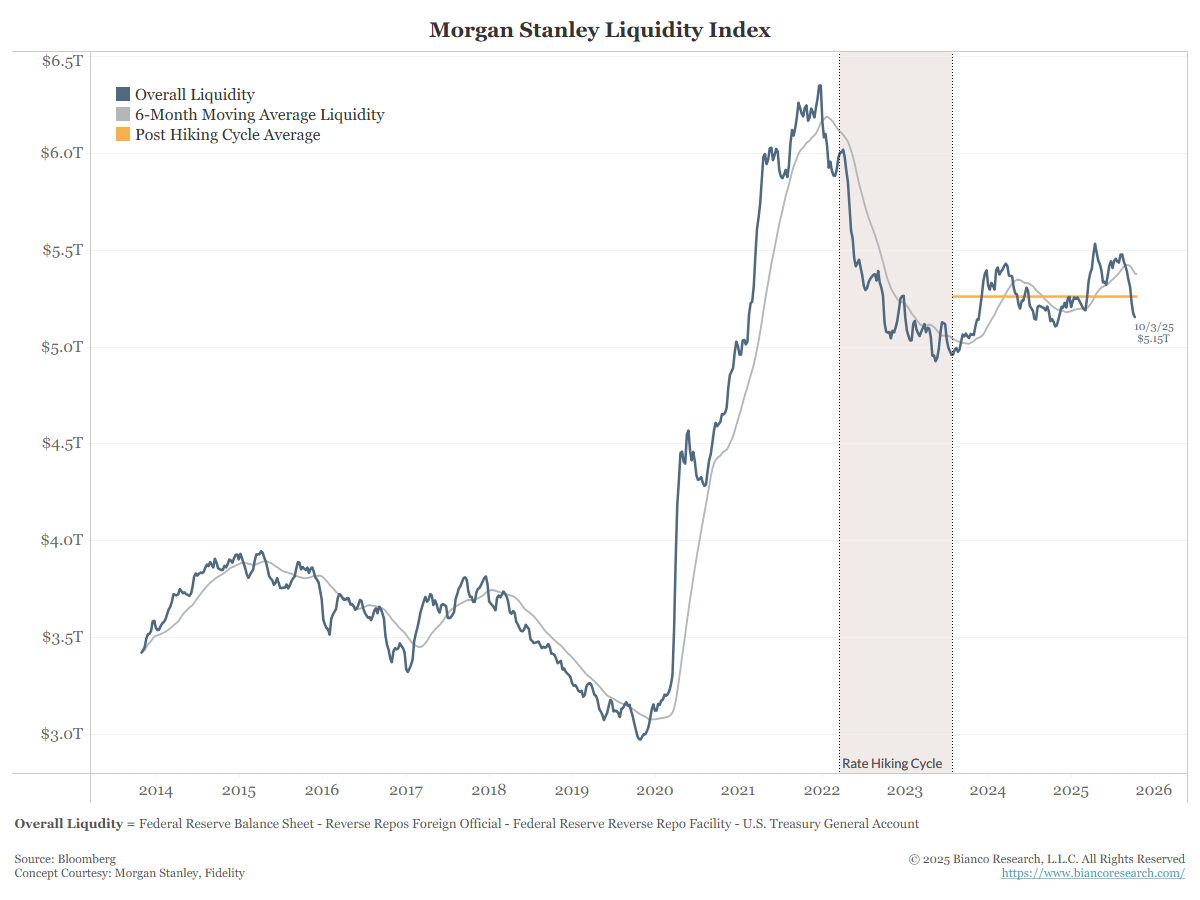

Here is maybe a more interesting view of the chart above.

The hiking cycle drew lots of liquidity out, but notice that since then, we have not seen much movement. The orange line represents the post hiking cycle average.

In the News

Reuters : Auto sector bankruptcies spark fresh scrutiny of Wall Street credit risks

CNBC : K-shaped cars: New vehicle pries top $50,000 while auto loan delinquencies keep rising

Bloomberg : First Rise in US Tractor Sales in Year Lifts Farm Sector Hopes

OilPrice : The $400 Billion Bottleneck: Why AI’s Power Grab Is Stalling at the Turbine

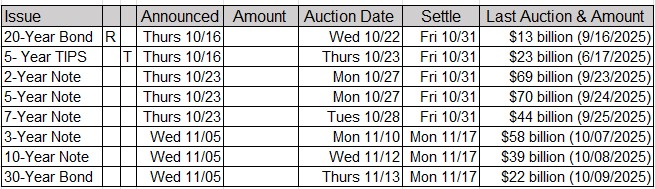

Upcoming US Treasury Supply

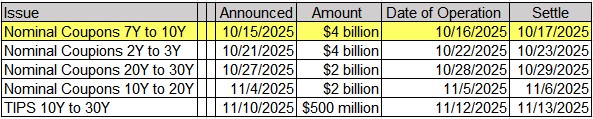

Tentative Schedule of Treasury Buyback Operations

Upcoming Economic Releases & Fed Speak

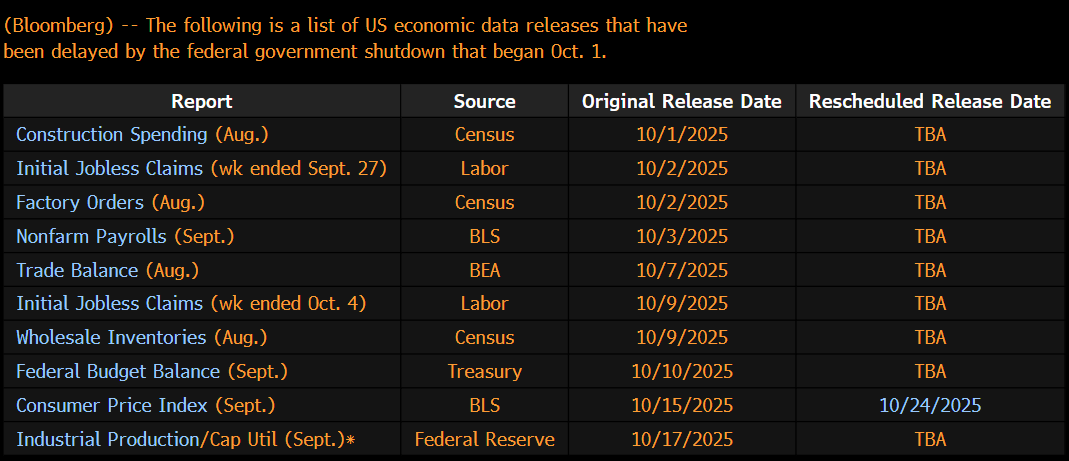

10/15/2025 at 07:00am EST: MBA Mortgage Applications 10/15/2025 at 08:30am EST: Empire Manufacturing 10/15/2025 at 08:30am EST: Real Avg Hourly Earnings YoY / Real Avg Weekly Earnings YoY 10/15/2025 at 09:30am EST: Fed’s Miran Speaks at Invest in America Forum 10/15/2025 at 12:30pm EST: Fed’s Miran at Nomura Research Forum 10/15/2025 at 01:00pm EST: Fed’s Waller Speaks on Artificial Intelligence 10/15/2025 at 02:00pm EST: Fed Releases Beige Book 10/15/2025 at 02:30pm EST: Fed’s Schmid Holds Townhall Event 10/16/2025 at 08:30am EST: Retail Sales Advance MoM / Retail Sales Ex Auto MoM 10/16/2025 at 08:30am EST: Retail Sales Ex auto and Gas / Retail Sales Control Group 10/16/2025 at 08:30am EST: PPI Final Demand MoM and YoY / PPI Ex Food and Energy MoM and YoY 10/16/2025 at 08:30am EST: PPI Ex Food, Energy, Trade MoM and YoY 10/16/2025 at 08:30am EST: New York Fed Services Business Activity 10/16/2025 at 08:30am EST: Philadelphia Fed Business Outlook 10/16/2025 at 08:30am EST: Initial Jobless Claims / 4-Wk Moving Ag / Continuing Claims 10/16/2025 at 09:00am EST: Fed’s Waller Speaks at Council on Foreign Relations 10/16/2025 at 09:00am EST: Fed’s Barr Speaks on Stablecoins 10/16/2025 at 09:00am EST: Fed’s Miran in Moderated Conversation 10/16/2025 at 10:00am EST: Fed’s Bowman Speaks at Stress Testing Research Conference 10/16/2025 at 10:00am EST: Business Inventories 10/16/2025 at 10:00am EST: NAHB Housing Market Index 10/16/2025 at 04:15pm EST: Fed’s Governor Stephen Miran in Moderated Discussion 10/16/2025 at 06:00pm EST: Fed’s Kashkari Speaks in Town Hall in South Dakota 10/17/2025 at 08:30am EST: Housing Starts & Building Permits 10/17/2025 at 08:30am EST: Housing Starts MoM & Building Permits MoM 10/17/2025 at 08:30am EST: Import Price Index MoM & Import Price Index ex Petroleum 10/17/2025 at 08:30am EST: Import Price Index YoY 10/17/2025 at 08:30am EST: Export Price Index MoM & Export Price Index YoY 10/17/2025 at 09:15am EST: Industrial Production Report Delayed by Government Shutdown 10/17/2025 at 12:15pm EST: Fed’s Musalem in Fireside Chat at IIF 10/17/2025 at 04:00pm EST: Net Long-term TIC Flows & Total Net TIC Flows 10/18/2025 – 10/30/2025: Fed’s External Communications Blackout 10/20/2025 at 10:00am EST: Leading Index 10/21/2025 at 08:30am EST: Philadelphia Fed Non-Manufacturing Activity 10/24/2025 at 08:30am EST: CPI MoM / Core CPI MoM / CPI YoY / Core CPI YoY / Core CPI Index SA

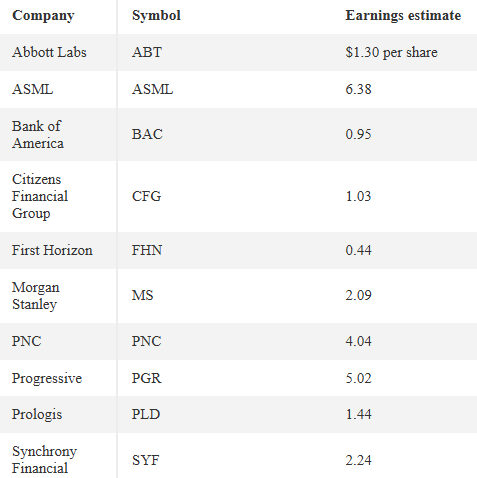

Upcoming Earnings Releases for Wednesday, October 15, 2025

Before the Open

After the Close