US Treasuries

- Thursday’s range for UST 10y: 3.97% – 4.05%, closing at 3.975%

- Thursday’s range for UST 30y: 4.58% – 4.64%, closing at 4.58%

- Fed’s Miran: Says He Would Favor Half-Point Interest Rate Cut

- Fed’s Waller: Calls for Careful Cuts, Miran Wants Bigger Move

- Fed’s Barr: Calls For More Regulation to Boost Stablecoin Trust

Intraday Commentary From Jim Bianco

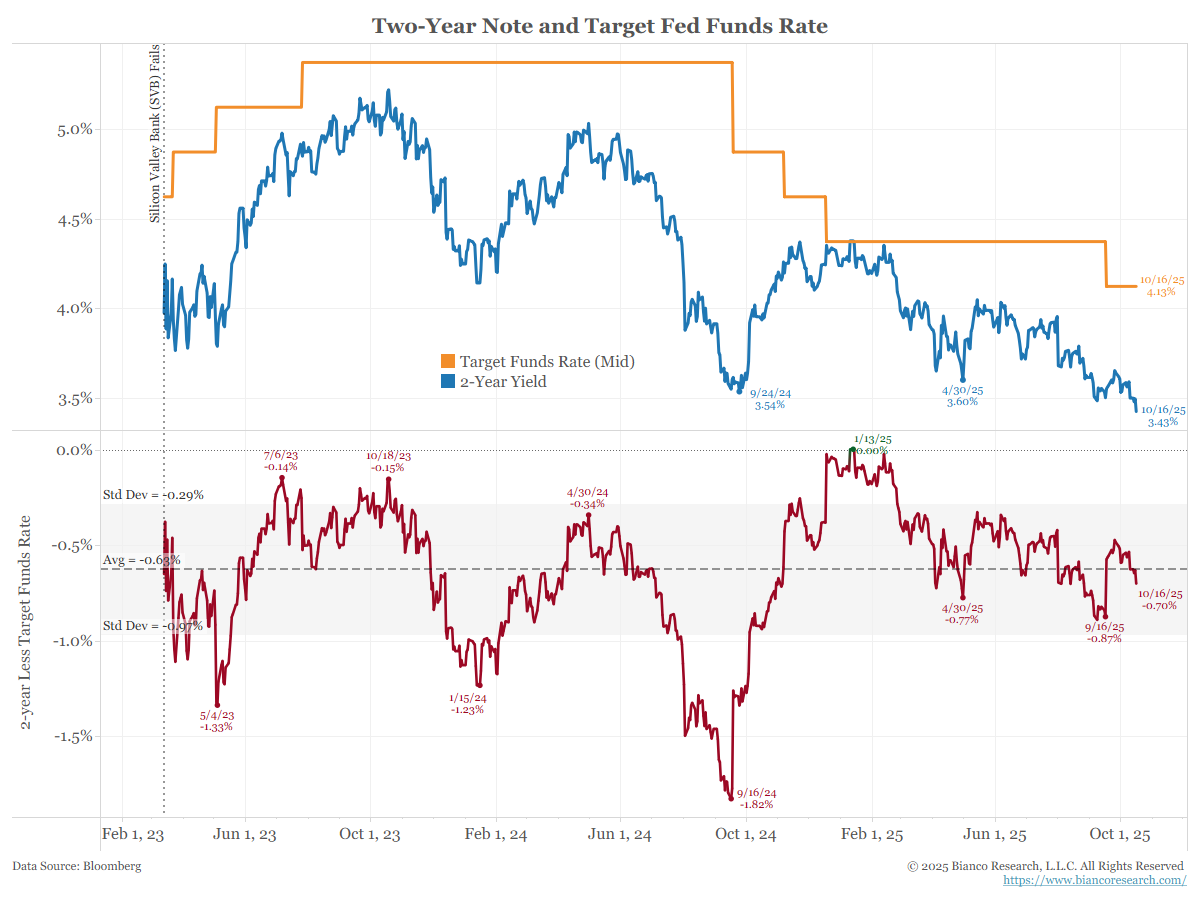

*US 2-YEAR YIELD FALLS TO 3.42%, LOWEST SINCE SEPTEMBER 2022

While it is headline-grabbing to note that the two-year yield (blue) is making a new 3+ year low, see the bottom panel: the two-year fund yield spread (red). This chart starts on the day Silicon Valley Bank failed in March of 2023.

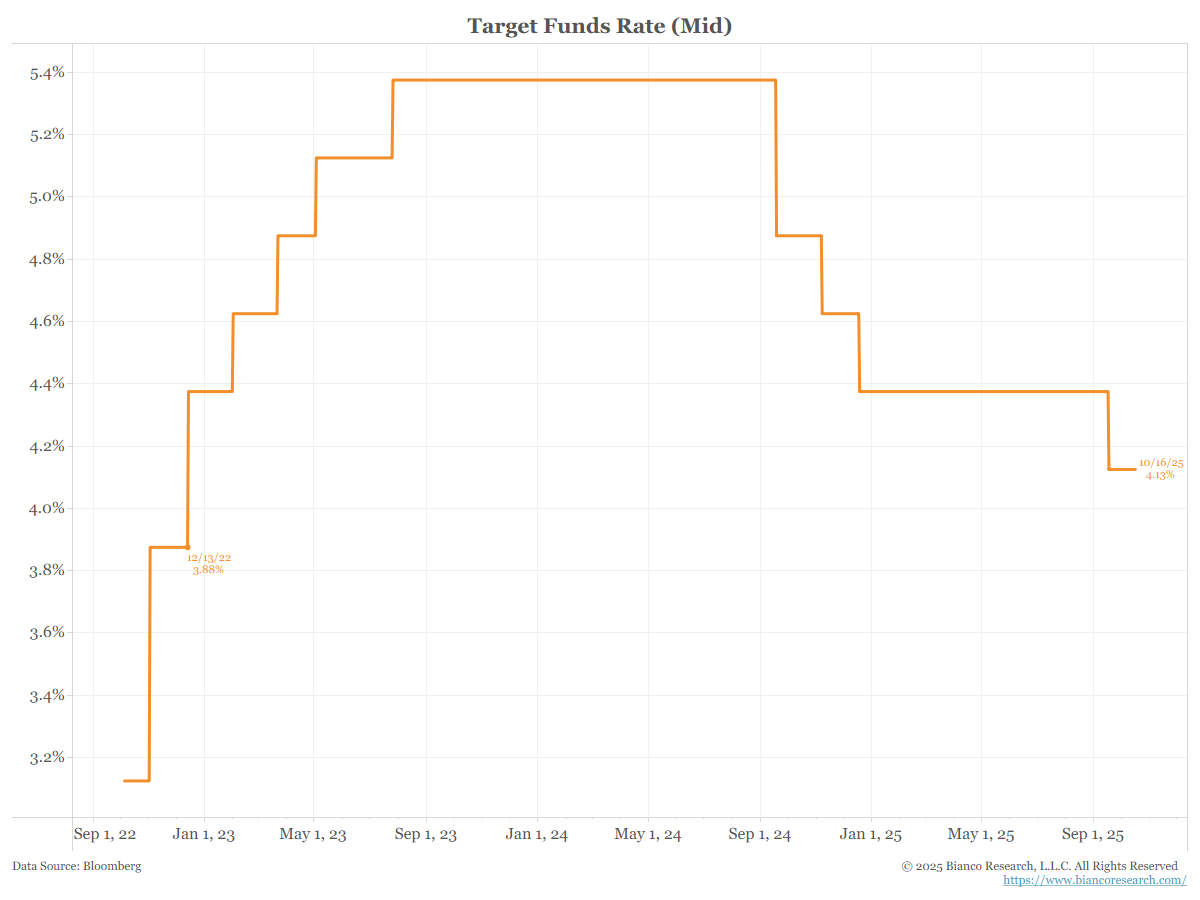

It shows that the 2-year-to-funds spread, now at 70 bps, is near its average of the last 2 1/2 years (63 bps). The Fed has cut rates 125 bps (five 25 bps cuts) since September of 2024, and has a 97% chance it’s going to cut another 25 bps at the end of this month (orange). The two-year yield should be at a 3+ year low because that’s what it would take to keep the 2-year/funds spread at its 2 1/2 year average.

To restate what I wrote above, the two-year note is now at the lowest level since September 2022.The Fed is expected to cut rates at the end of this month and again in December.

At the end of the month, the funds rate will be at its lowest level since December 2022.

In other words, the two-year is just discounting where we all know the funds rate is going.

In the News

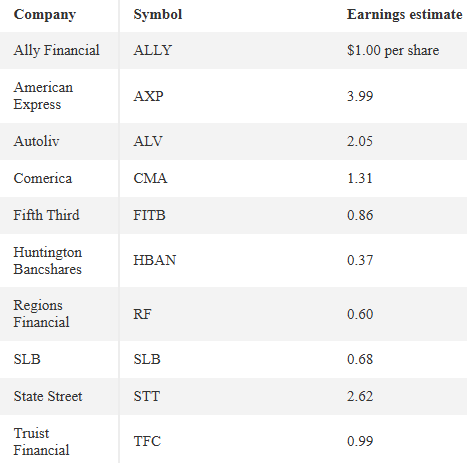

CNBC: Regional banks, Jefferies shares tank as concerns about sour loans grow on Wall Street

Reuters: Health insurance premiums are going up next year – unless you work at these companies

FarmPolicyNews: Immigration Crackdown Hurting Ag, Labor Dept. Concedes

RedfinNews: New Listings Creep Up As Would-Be Homebuyers Back Off, Haunted by High Prices and Economic Unease

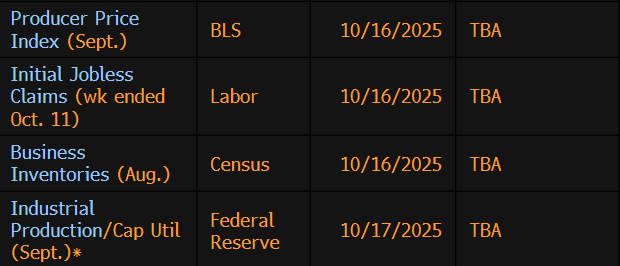

US Economic Data Releases Delayed by Government Shutdown: