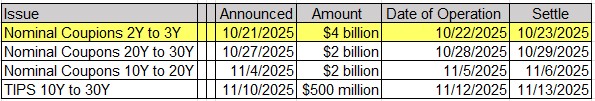

US Treasuries

- Friday’s range for UST 10y: 3.93% – 4.01%, closing at 4.005%

- Weekly range for UST 10y: 3.93% – 4.065%

- Friday’s range for UST 30y: 4.545% – 4.61%, closing at 4.60%

- Weekly range for UST 30y: 4.545% – 4.655%

- Fed’s Musalem: Could Support Another Cut, Policy Not Preset

Intraday Commentary From Jim Bianco

Wall Street is really good at (over)analyzing symptoms, while not recognizing the causes. The banking system “cause” is a liquidity squeeze. The symptom is credit announcements that bother the markets.

I try to explain this in today’s lead post.

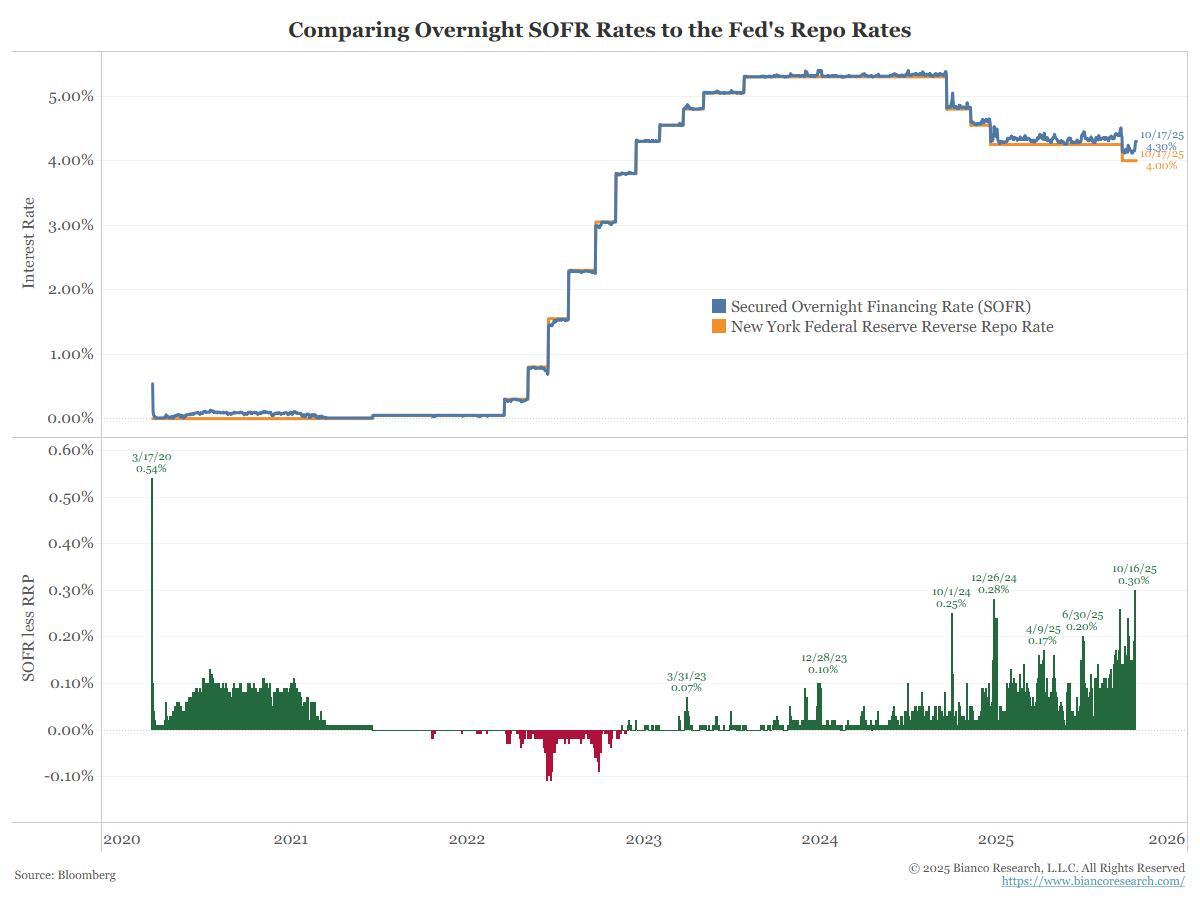

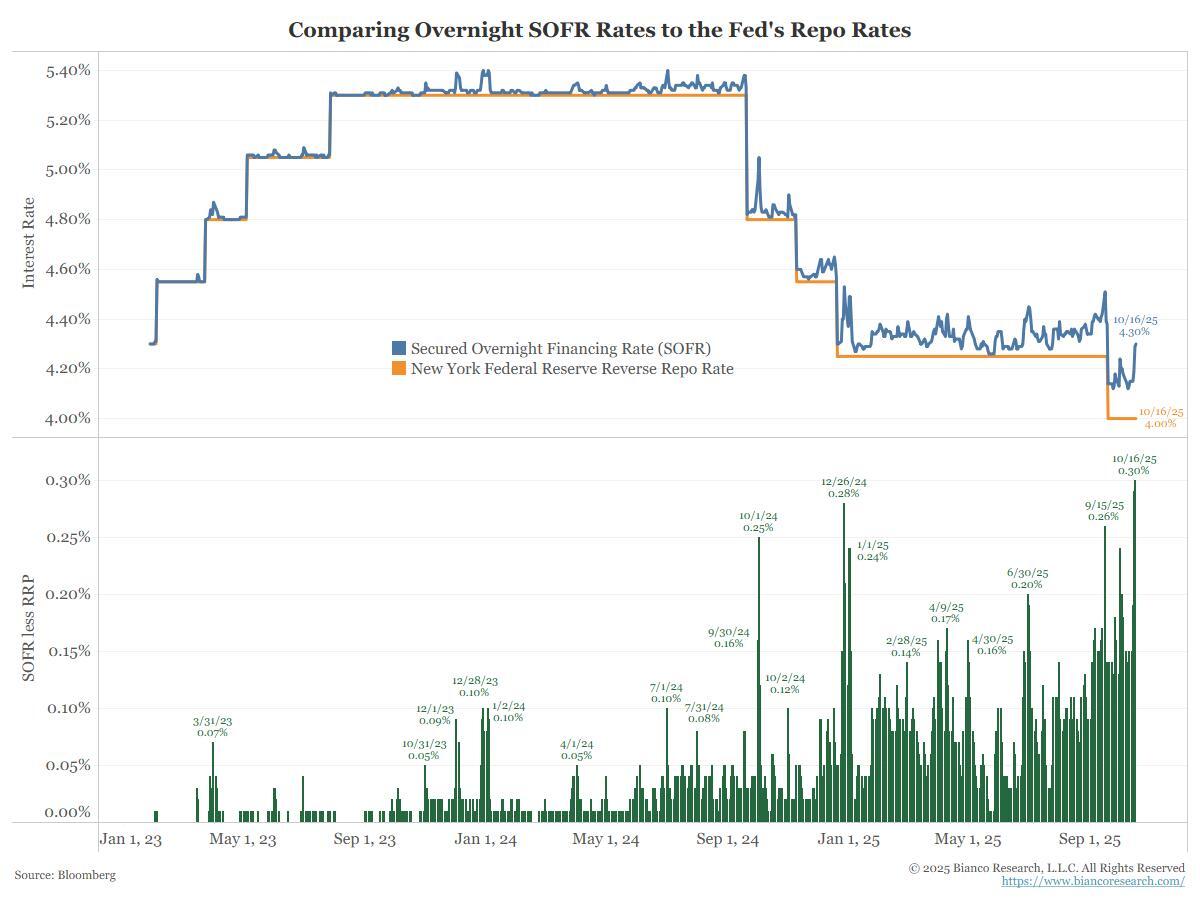

While there was no borrowing for the standing Repo Facility this morning, SOFR did make a new 5-year high yesterday. The last time SOFR traded 30 bps above RRP was March 17, 2020. (Exceptions are month and year-end, when it regularly spikes for window-dressing purposes.) We are not at a month or year-end now.

Here is a short-term look.

Bad news … Funding markets are still stressed.

Good news … The stress did not worsen today.

In the News

Bloomberg: Fed’s Policy Benchmark Rate Rises for Third Time in a Month

Reuters: ADM seeks to lure soy sales from US farmers as prices languish, sources say

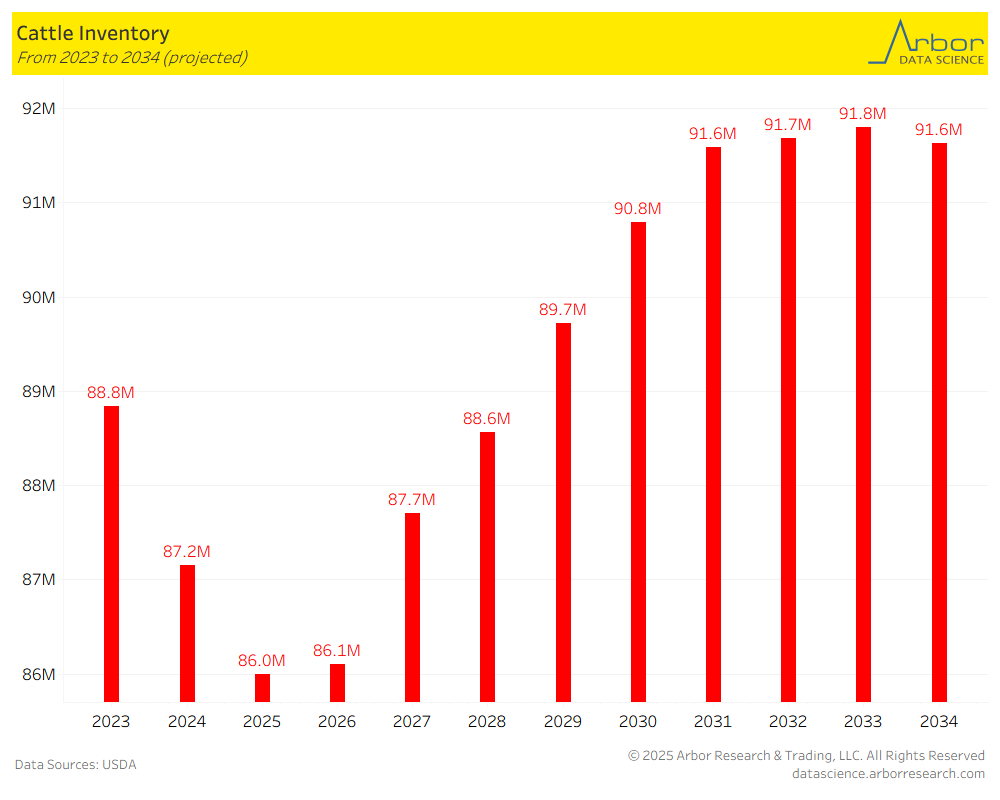

ZeroHedge: Trump “Worked Magic” on Beef Deal – Likely With Argentina – As Cattle Futures Surge Most since 1978

Arbor Data Science: A Bump in Beef Prices

The Guardian: ‘Finances are getting tighter’: US car repossessions surge as more Americans default on auto loans

The Guardian: ‘Finances are getting tighter’: US car repossessions surge as more Americans default on auto loans

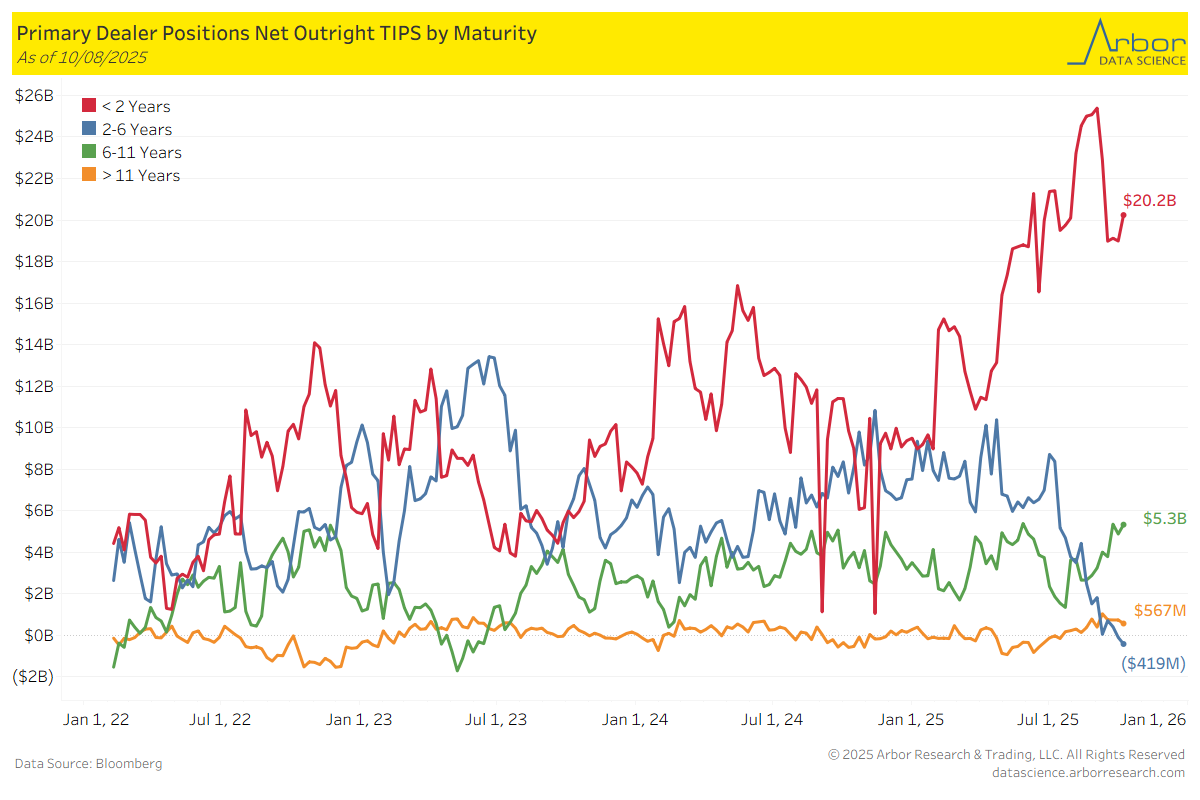

TIPS by Maturity (data through 10/08/25)

Week over Week Changes by Maturity

- < 2 years: $19.0 Bn on 10/01/25 to $20.2 Bn on 10/08/25 = $1.2 Bn

- 2 – 6 years: ($104 Mn) on 10/01/25 to ($419 Mn) on 10/08/25 = ($315 Mn)

- 6 – 11 years: $4.9 Bn on 10/01/25 to $5.3 Bn on 10/08/25 = ($0.4 Bn)

- > 11 years: $738 Mn on 10/01/25 to $567 Mn on 10/08/25 = ($171 Mn)

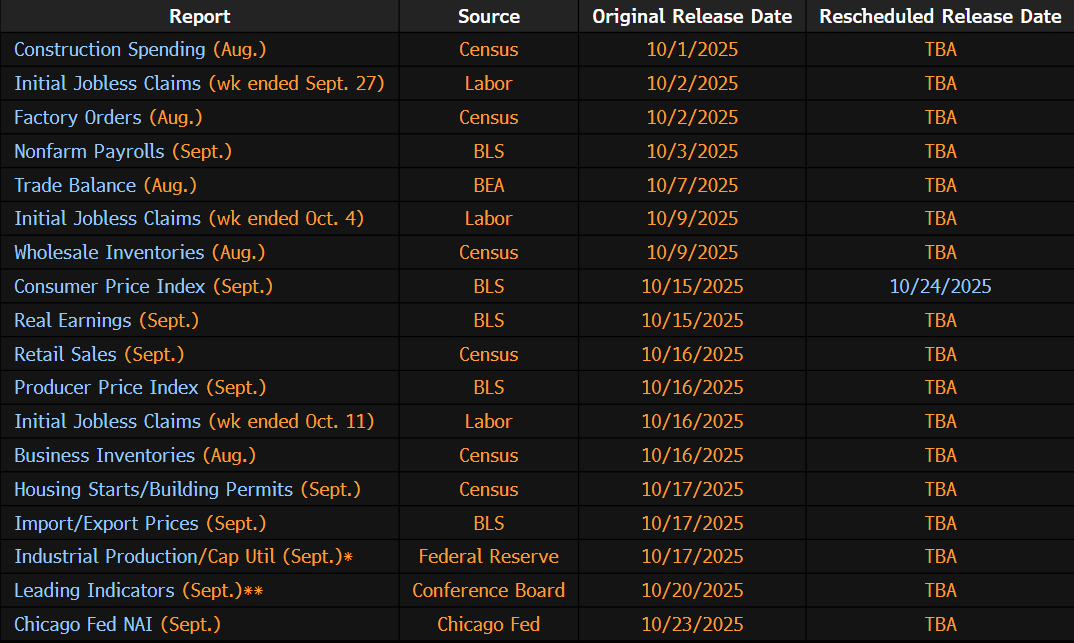

US Economic Data Releases Delayed by Government Shutdown:

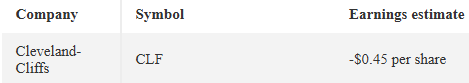

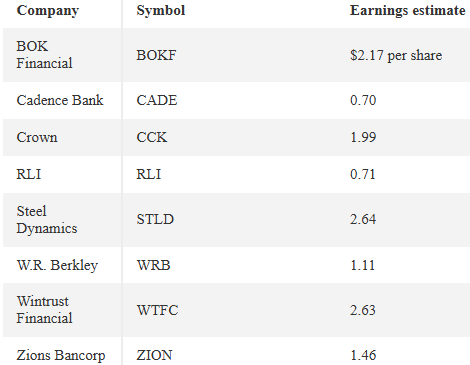

After the Close