US Treasuries

- Monday’s range for UST 10y: 3.98% – 4.02%, closing at 3.98%

- Monday’s range for UST 30y: 4.57% – 4.615%, closing at 4.575%

Join Us Thursday (10/23/25) for our Next Conference Call Featuring Jim Bianco

Intraday Commentary From Jim Bianco

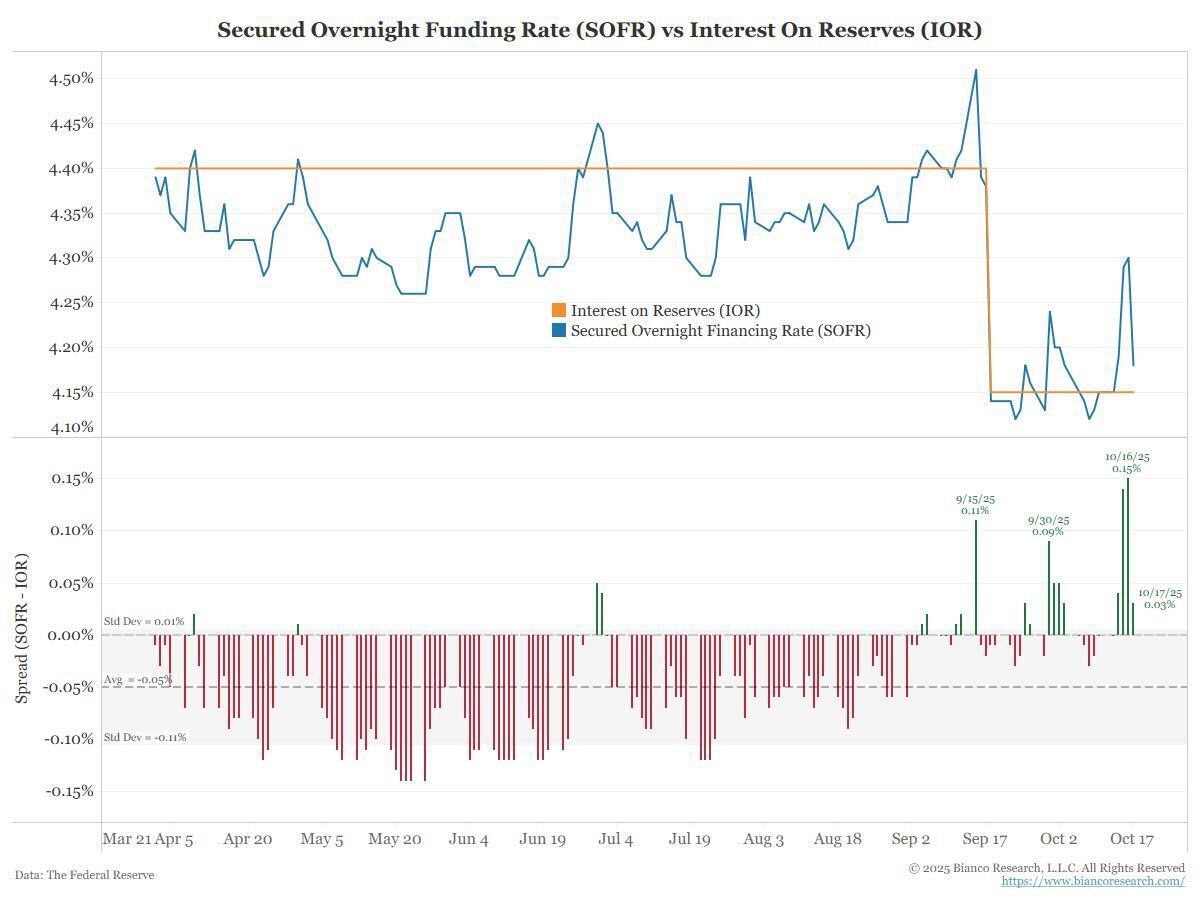

Over the weekend I posted a chart noting that liquidity was getting worrisome. On Thursday, SOFR was 4.30%, for a spread of 12 bps (the widest such spread since March 2020). This morning Friday’s SOFR was reported at 4.18%, down 12 bps. So, is the liquidity problem now over? Not exactly.

Here is a version that only shows the last 6 months, and the spread in the bottom panel is daily (not moving average).

The average back to 2022 was -8 bps. See the chart immediately above, -5 bps. A “normal” liquidity environment is one where the SOFR/IOR spread is around -8 to -5. See the last 5 or six weeks, lots of green bars with some red bars interspersed in between.

What this shows is this measure of liquidity it still “worrisome.” Not a crisis, but worrisome. And note that over the last few months it is moving toward larger green bars.

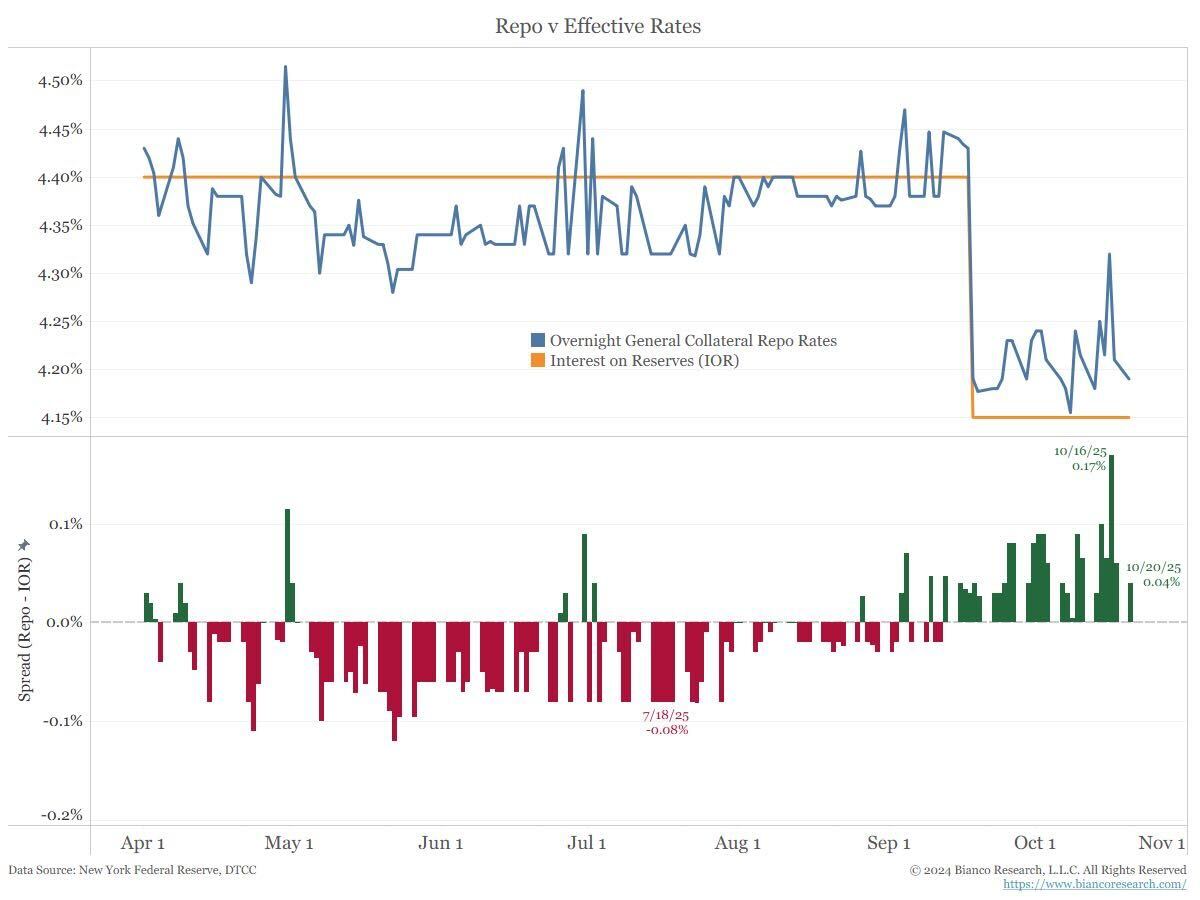

SOFR is reported every morning for the previous day. Overnight general collateral Repo is a big part of the SOFR average reported every morning. It is real-time. See the last bar, it is green again today.

Again, not a crisis, but slowly moving toward larger premiums (bigger green bars) that suggest we still have a liquidity “worry.”

It does not take much to go from “worry” to “crisis.” So the longer we continue to print green bars above, the more I get concerned that we are moving closer to “crisis.”

In the News

OilPrice: China’s Rare Earth Magnets Exports Slump as Market Fears Crunch

ZeroHedge: Shell’s Fuel Shortage In Indonesia Proves The Next Era Is Electric

PR Newswire: Century Lithium Produces Lithium Hydroxide At Demonstration Plant in Nevada

Fox Business: Merck breaks ground on $3B manufacturing plant in Virginia

Freightwaves: The chemicals industry hates the UP – NS merger

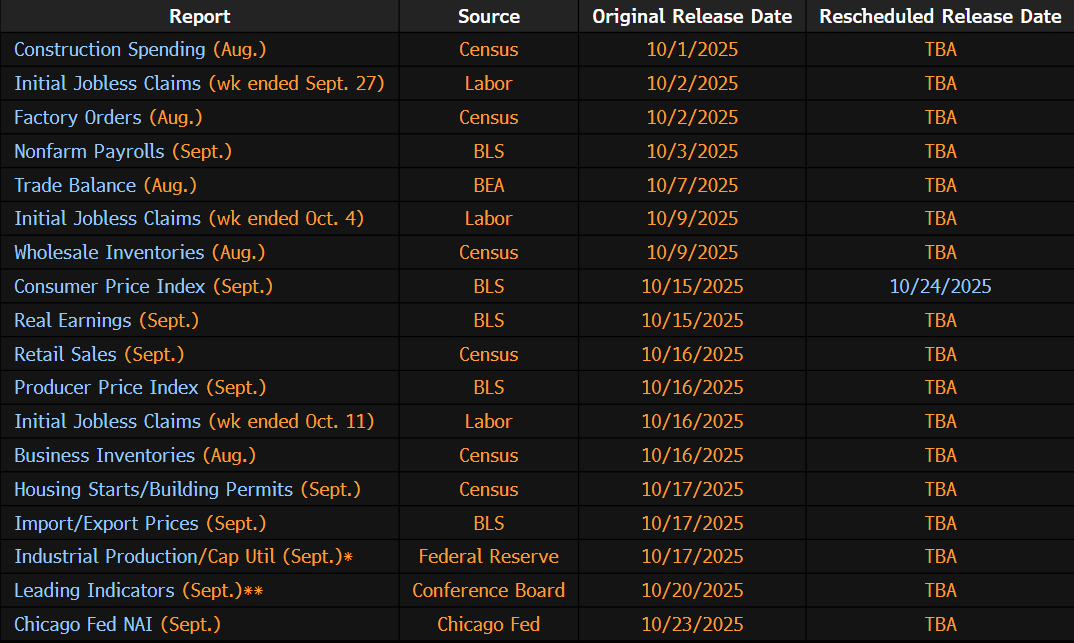

US Economic Data Releases Delayed by Government Shutdown:

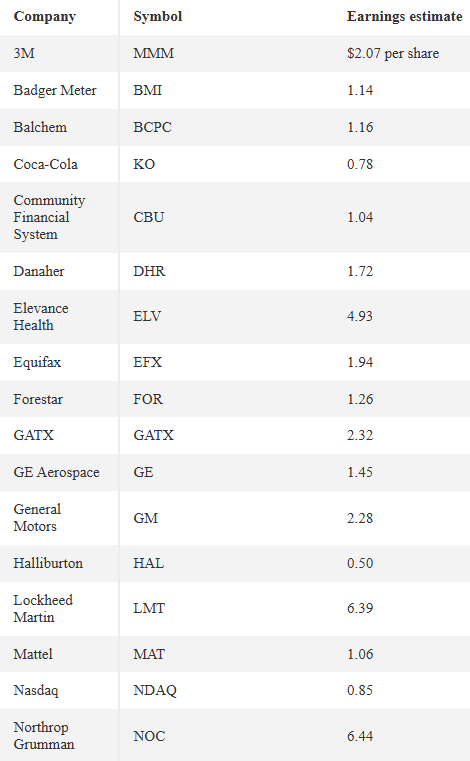

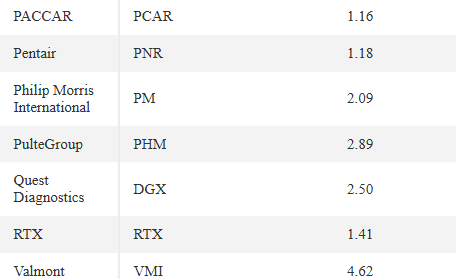

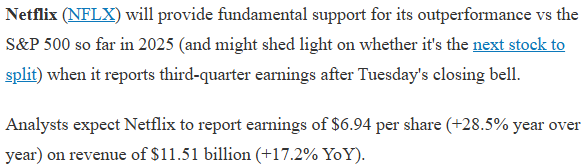

After the Close