US Treasuries

- Tuesday’s range for UST 10y: 3.945% – 3.99%, closing at 3.96%

- Tuesday’s range for UST 30y: 4.53% – 4.57%, closing at 4.545%

- Fed’s Waller: Welcomes ‘New Era’ for Federal Reserve in Payments

Join Us Thursday (10/23/25) for our Next Conference Call Featuring Jim Bianco

Jim Bianco Joins Fox Business to explain what Bond Yields are telling us about Federal Reserve Rate Cut Expectations

Intraday Commentary From Jim Bianco

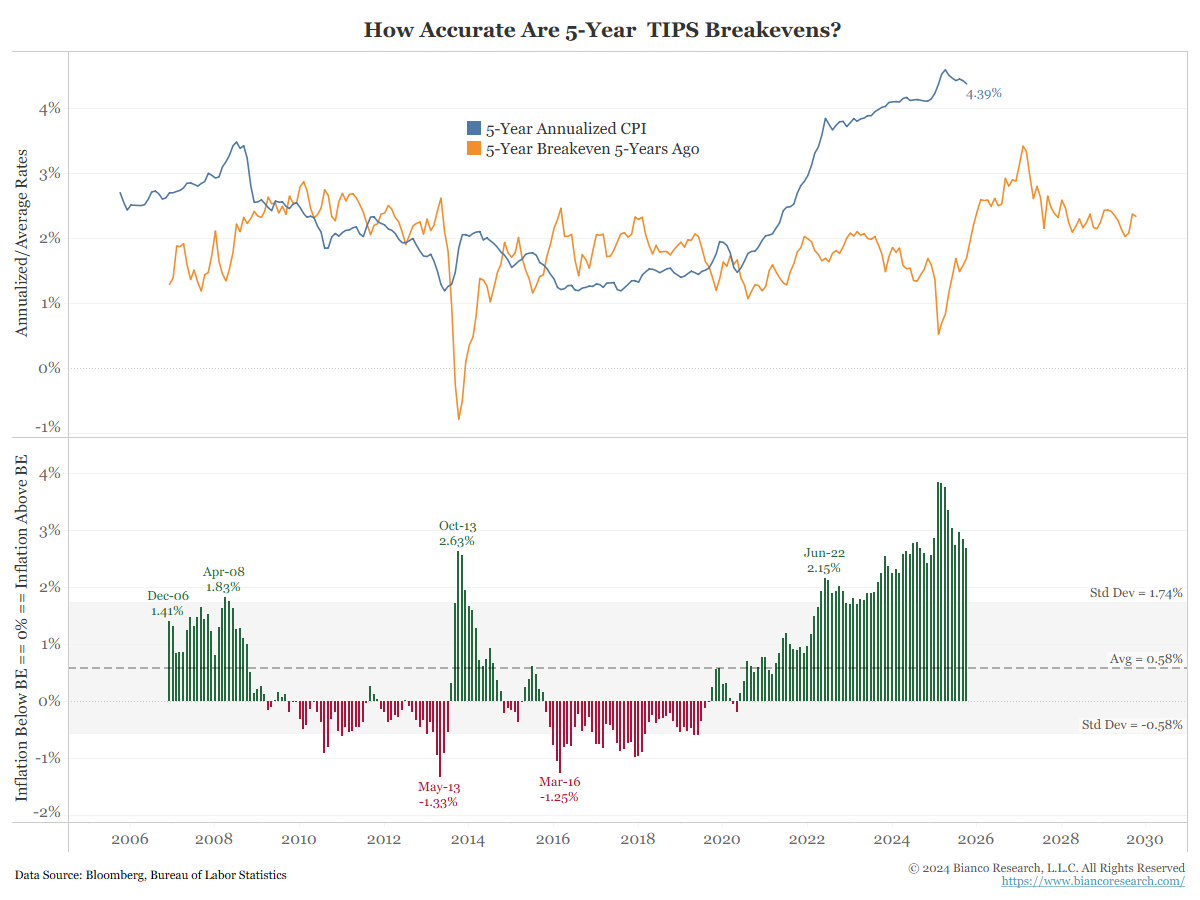

This chart shows the track record of the 5-year TIPS in predicting actual inflation.

The orange line is the 5-year TIPS inflation break-even rate FIVE YEARS AGO. The blue line is the 5-year average inflation rate (because the 5-year TIPS is predicting the 5-year average inflation rate). The bottom panel is the difference, or the error rate, of the TIPS market.

TIPS break-evens are a terrible predictor of the actual inflation rate. Tossing a coin might be better.

That said, it is a good measure of what market players think will happen, but knowing market expectations says nothing about what will happen.

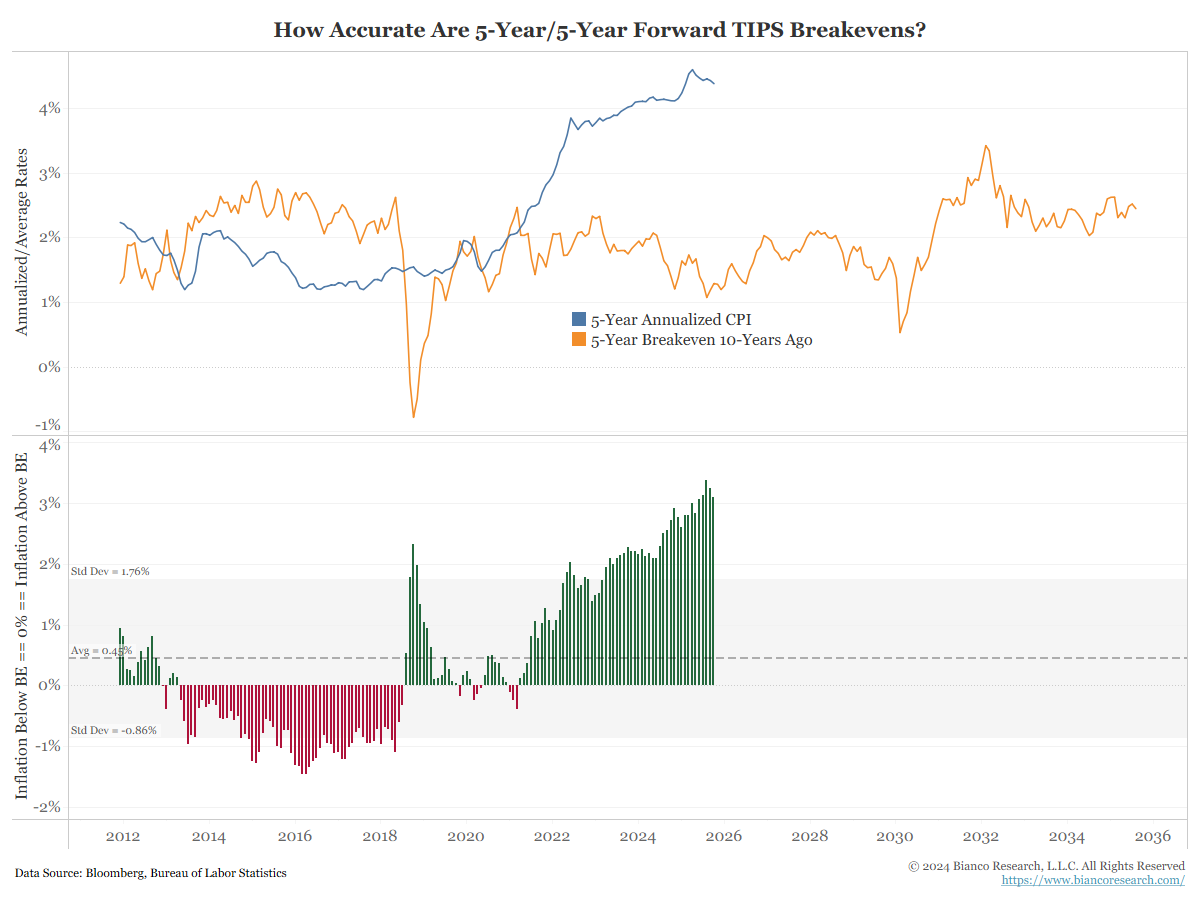

The Fed’s favor measure, the 5yr/5yr forward inflation rate, is even worse.

The Fed knows this, so they subtly started calling TIPS break-even rates “Inflation compensation” and not “inflation expectations.” Meaning the TIPS market is what the market is charging you to buy protection against inflation, but it is NOT a predictor of what the inflation rate will be.

In the News

Bloomberg: Catastrophe Bonds’ Huge Market Gains Put Reinsurers on Backfoot

ZeroHedge: Rare Earths Stocks Soar After Mega US-Australia Minerals Deal To Slash Dependence on China

SucessfulFarming: Brazil Begins Planting with Expected Record Acreage Driven by High Demand but Low Margins

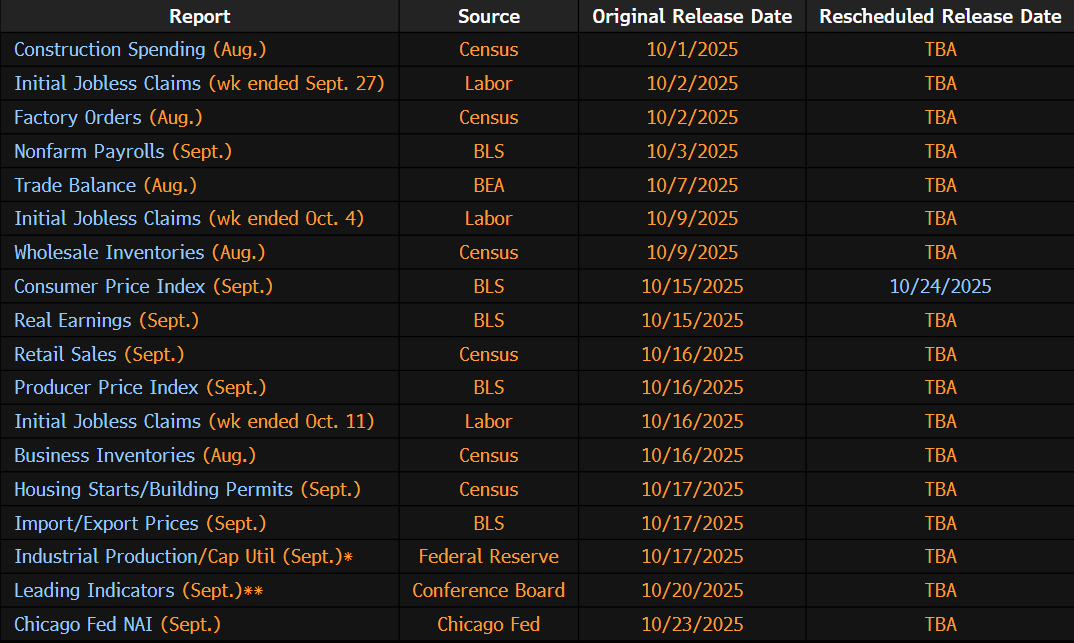

US Economic Data Releases Delayed by Government Shutdown:

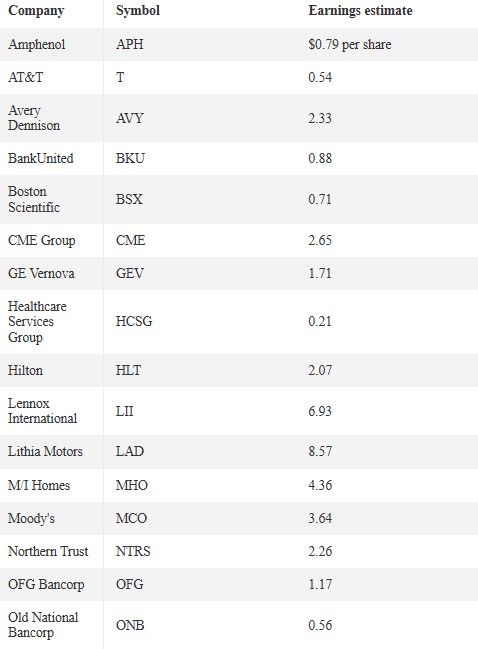

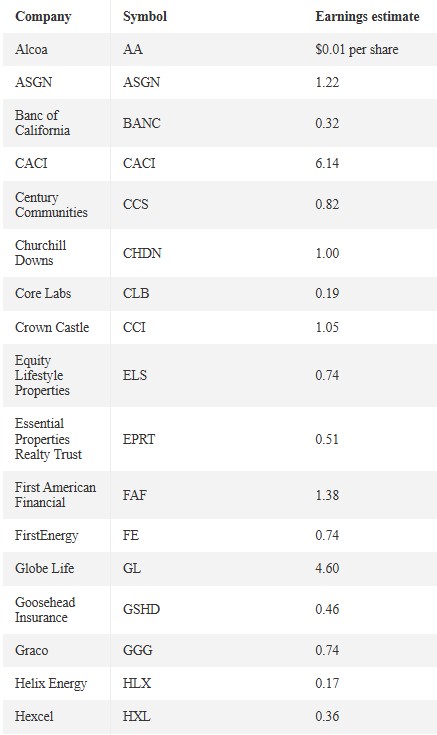

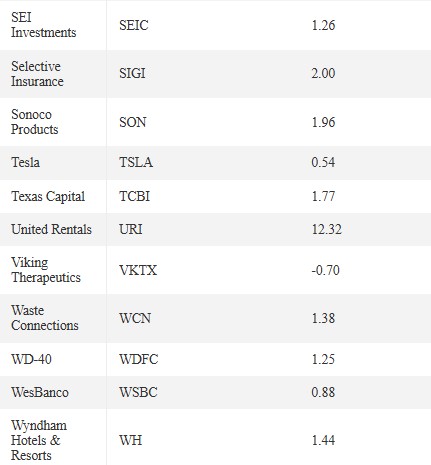

After the Close