US Treasuries

Friday’s range for UST 10y: 3.96% – 4.01%, closing at 3.995%Weekly range for UST 10y: 3.935% – 4.02% Friday’s range for UST 30y: 4.55% – 4.60%, closing at 4.58% Weekly range for UST 10y: 4.52% – 4.615%

Bloomberg : The Bond Market’s Favorite Recession Signal Is on the Fritz

Intraday Commentary From Jim Bianco

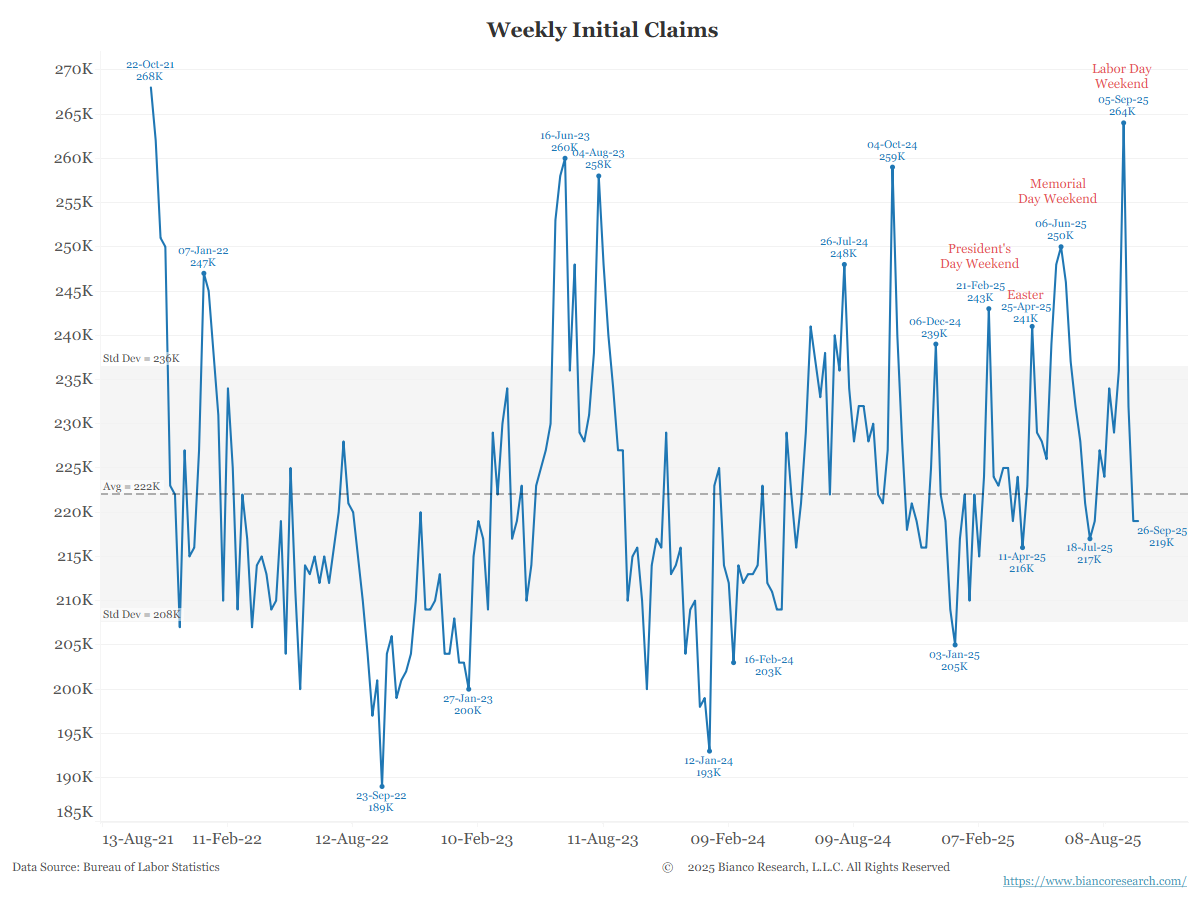

Bloomberg and Goldman are both collecting state unemployment claims data and applying seasonal adjustment. They both got the same numbers. Seasonally adjusted

227k the week ending October 18 220k the week ending October 11

The last data point released by the BLS was the week of September 26 at 219k (chart). So, very little change in this series … suggesting this measure is not showing weakening in the last month.

Bloomberg : Inflation Bond Market Faces ‘Debt-Limit Equivalent’ in CPI Delay

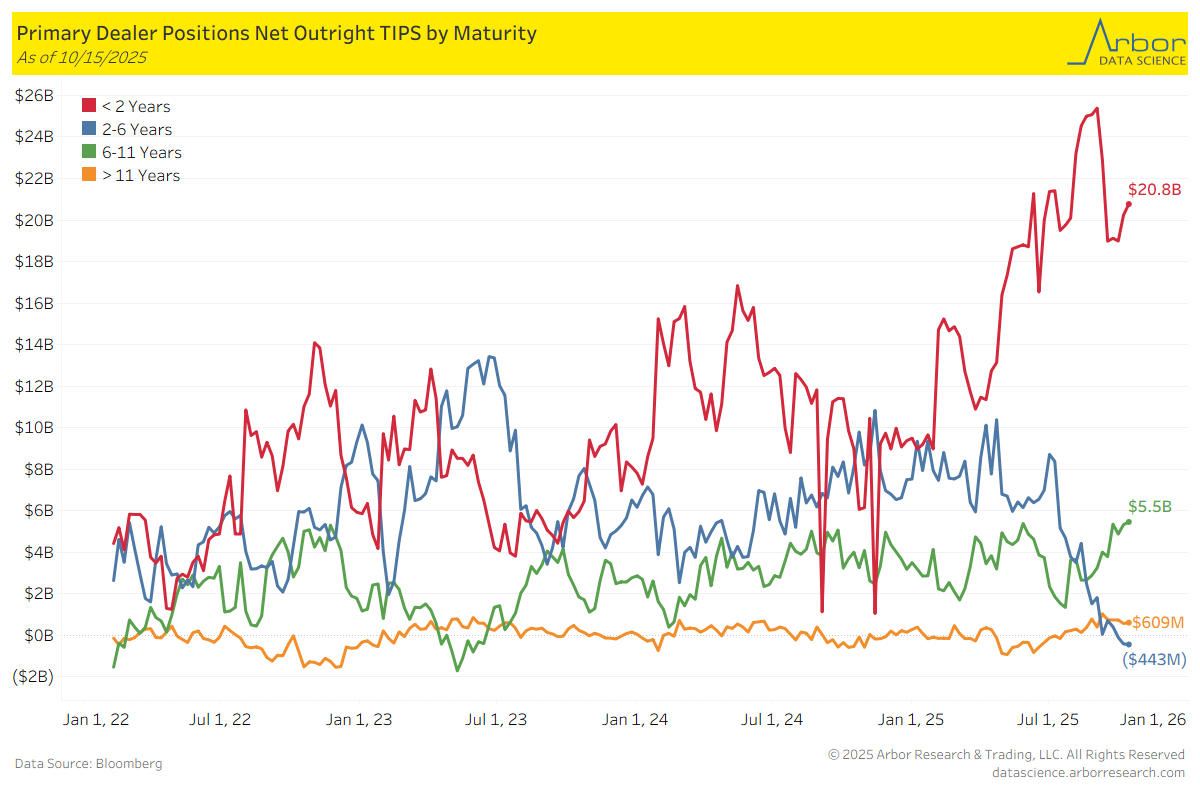

TIPS by Maturity (data through 10/15/25)

Week over Week Changes by Maturity

< 2 years: $20.2 Bn on 10/08/25 to $20.8 Bn on 10/15/25 = $0.6 Bn2 – 6 years: ($419 Mn) on 10/08/25 to ($443 Mn) on 10/15/25 = ($24 Mn)6 – 11 years: $5.3 Bn on 10/08/25 to $5.5 Bn on 10/15/25 = $0.2 Bn> 11 years: $567 Mn on 10/08/25 to $609 Mn on 10/15/25 = $42 Mn

In the News

OilPrice : Ukraine Strikes Russia’s Fourth-Largest Refinery, Disrupting 80,000 bpd

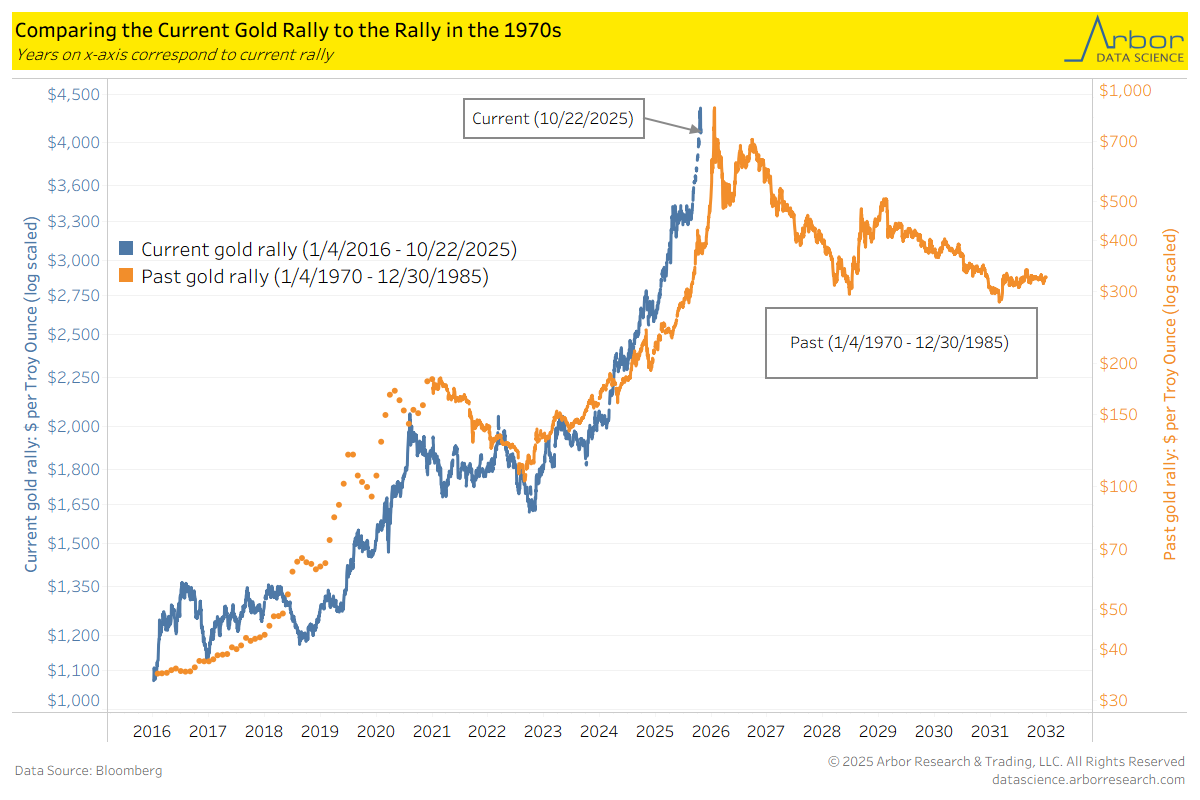

Bloomberg : Gold and Bonds Are Heading for Record-Breaking Inflows This Year

Arbor Data Science : Gold Will History Repeat Itself?

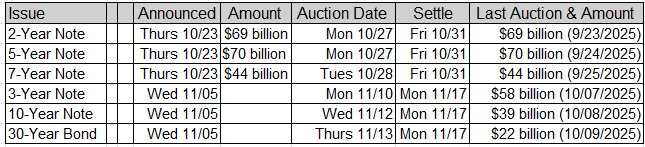

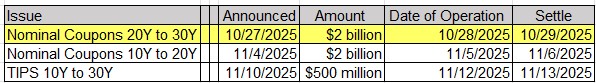

Upcoming US Treasury Supply

Tentative Schedule of Treasury Buyback Operations

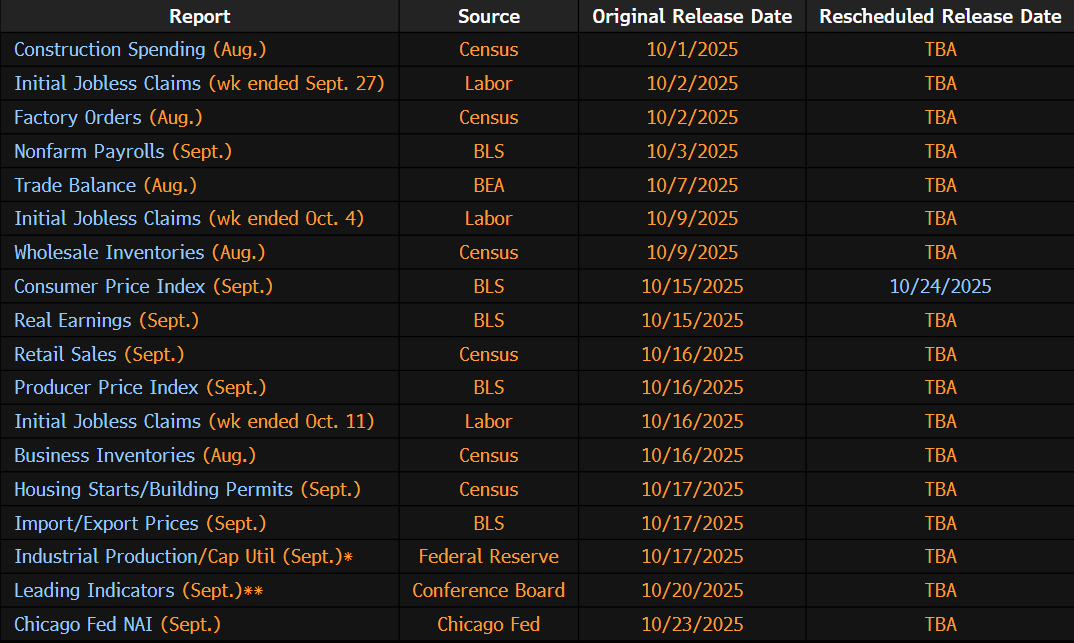

Upcoming Economic Releases & Fed Speak

US Economic Data Releases Delayed by Government Shutdown:

10/18/2025 – 10/30/2025: Fed’s External Communications Blackout 10/27/2025 at 08:30am EST: Durable Goods Orders / Durables Ex Transportation 10/27/2025 at 08:30am EST: Cap Good Orders Nondef ex Air / Cap Goods Ship Nondef Ex Air 10/27/2025 at 10:30am EST: Dallas Fed Manf. Activity 10/28/2025 at 09:00am EST: FHFA House Price Index MoM 10/28/2025 at 09:00am EST: S&P Cotality CS 20-City MoM SA; YoY NSA 10/28/2025 at 09:00am EST: S&P Cotality CS US HPI YoY NSA 10/28/2025 at 10:00am EST: Richmond Fed Manufact. Index / Business Conditions 10/28/2025 at 10:00am EST: Conf. Board Consumer Confidence / Present Situation / Expectations 10/28/2025 at 10:30am EST: Dallas Fed Services Activity 10/29/2025 at 07:00am EST: MBA Mortgage Applications 10/29/2025 at 08:30am EST: Wholesale Inventories MoM 10/29/2025 at 08:30am EST: Advance Goods Trade Balance / Exports MoM SA / Imports MoM SA 10/29/2025 at 08:30am EST: Retail Inventories MoM 10/29/2025 at 08:30am EST: Pending Home Sales MoM / NSA YoY 10/29/2025 at 02:00pm EST: FOMC Rate Decision (Upper Bound) (Lower Bound) 10/29/2025 at 02:00pm EST: Fed Interest on Reserve Balances Rate 10/29/2025 at 02:00pm EST: Fed Reverse Repo Rate 10/30/2025 at 08:30am EST: Initial Jobless Claims & GDP Annualized QoQ 10/30/2025 at 08:30am EST: Initial Claims 4-Wk Moving Avg & Personal Consumption 10/30/2025 at 08:30am EST: Continuing Claims & GDP Price Index & Core PCE Price index QoQ 10/30/2025 at 01:15pm EST: Fed’s Logan Speaks at Bank Funding Conference 10/31/2025 at 08:30am EST: Personal Income & Personal Spending & Real Personal Spending 10/31/2025 at 08:30am EST: PCE Price Index MoM & PCE Price Index YoY 10/31/2025 at 08:30am EST: Core PCE Price Index MoM & Core PCE Price Index YoY & Employment Cost Index 10/31/2025 at 08:30am EST: MNI Chicago PMI 10/31/2025 at 09:30am EST: Fed’s Logan Speaks at Bank Funding Conference, Day 2 10/31/2025 at 12:00pm EST: Fed’s Hammack ad Bostic Speak at Bank Funding Conference

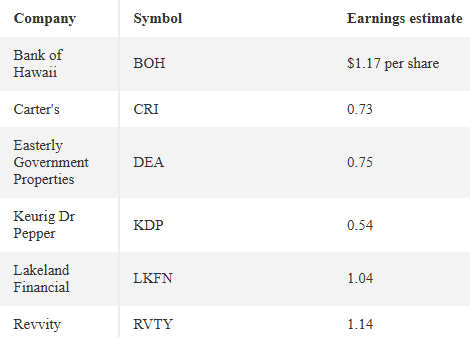

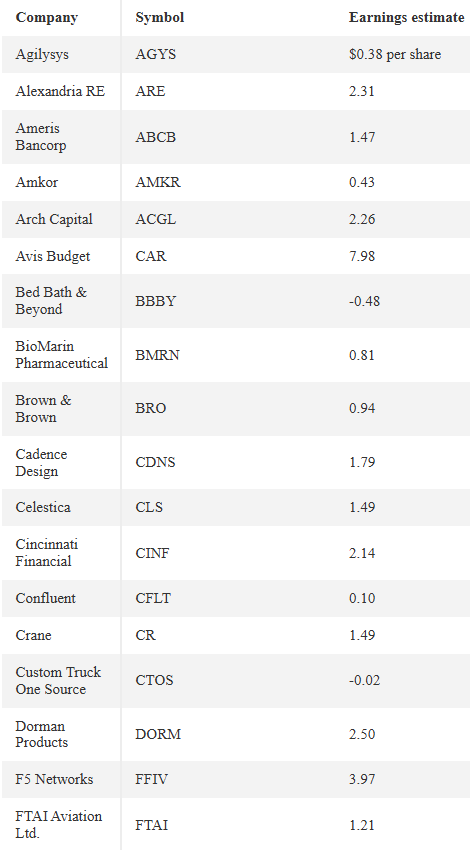

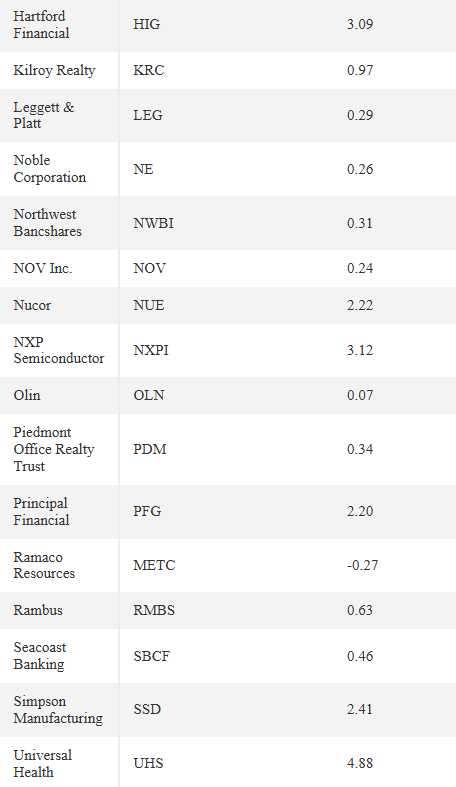

Upcoming Earnings Releases on Monday, October 27, 2025

Before the Open

After the Close