US Treasuries

- Monday’s range for UST 10y: 3.99% – 4.04%, closing at 3.995%

- Monday’s range for UST 30y: 4.565% – 4.63%, closing at 4.57%

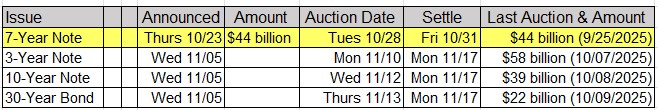

- Tomorrow, Tuesday, October 28th: $44 billion 7y Note Auction

- Wednesday, October 29th: FOMC Rate Decision

Intraday Commentary From Jim Bianco

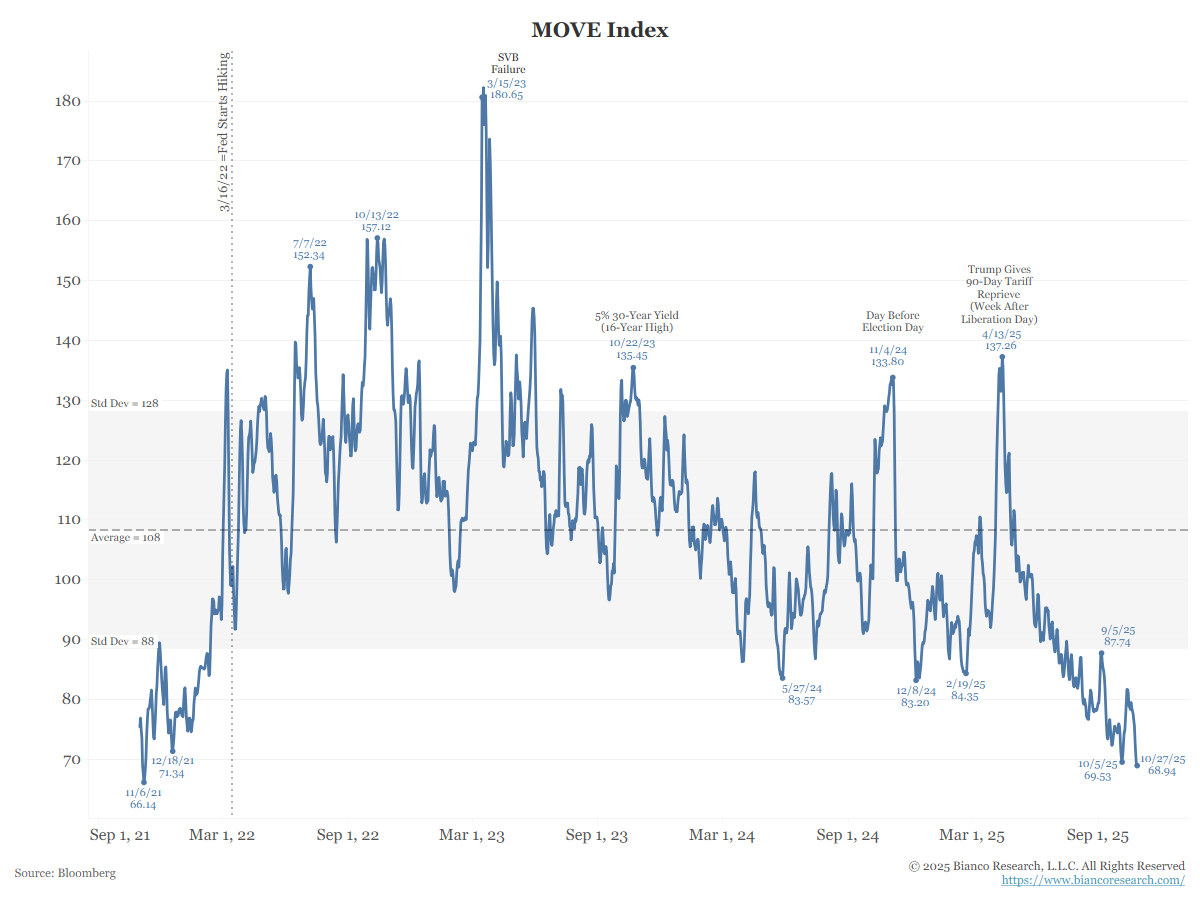

Bonds Volatility continues to slump.

In my opinion, volatility, and especially bond volatility, is among the most mean-reverting of all things in finance. What this means is the natural instinct SHOULD be to sell high volatility and buy low volatility.

In my opinion, volatility, and especially bond volatility, is among the most mean-reverting of all things in finance. What this means is the natural instinct SHOULD be to sell high volatility and buy low volatility.

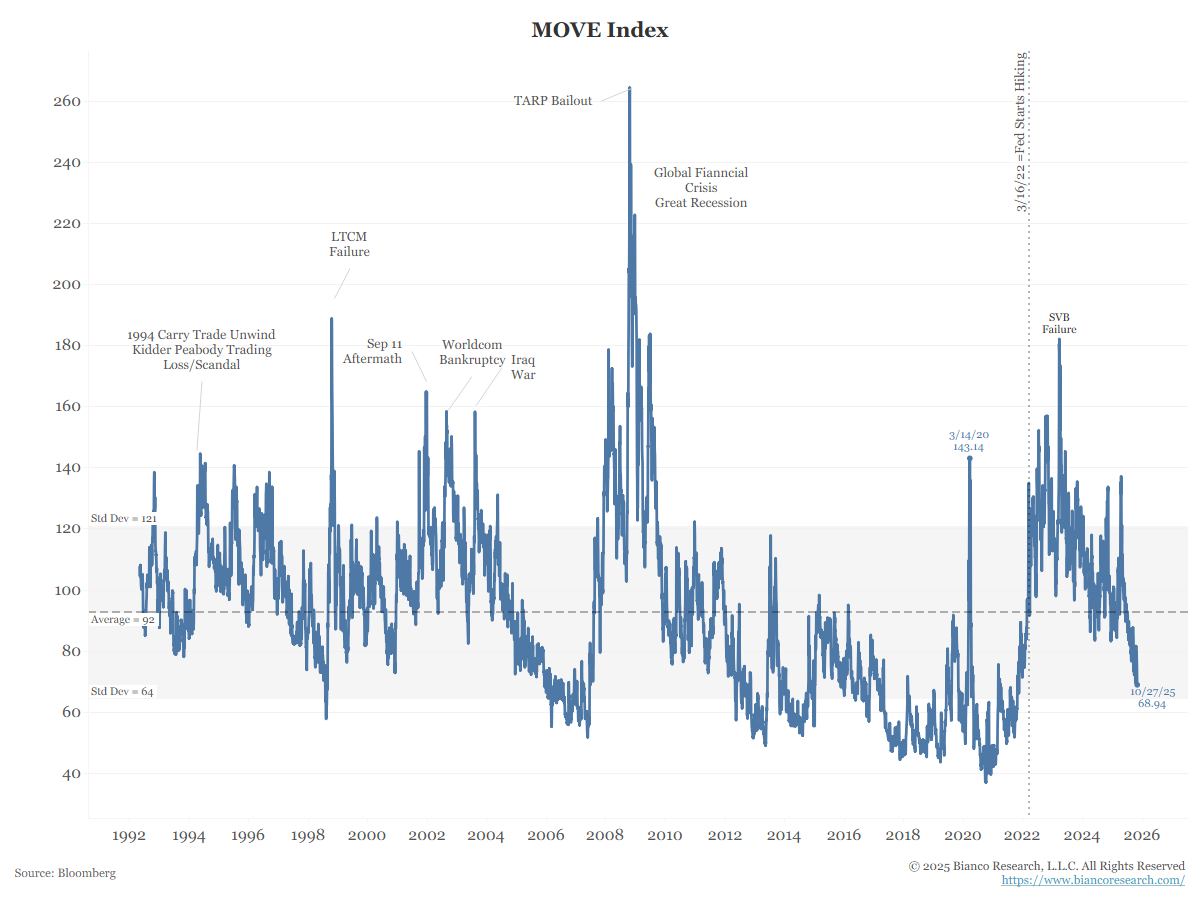

The period from 2012 to 2021, when the MOVE Index spent much of the time below 60, was also the period of zero interest rates and QE. Rates are now 4% (and about to be cut again this week) and QT is ongoing (which may be nearing an end).The point is this is NOT 2012 to 2021. The period from 2012 to 2021, when the MOVE Index spent much of the time below 60, was also the period of zero interest rates and QE. Rates are now 4% (and about to be cut again this week) and QT is ongoing (which may be nearing an end). The point is this is NOT 2012 to 2021.

The period from 2012 to 2021, when the MOVE Index spent much of the time below 60, was also the period of zero interest rates and QE. Rates are now 4% (and about to be cut again this week) and QT is ongoing (which may be nearing an end). The point is this is NOT 2012 to 2021.

We had a story about it in “What We’re Reading” today (in the middle) with this chart.

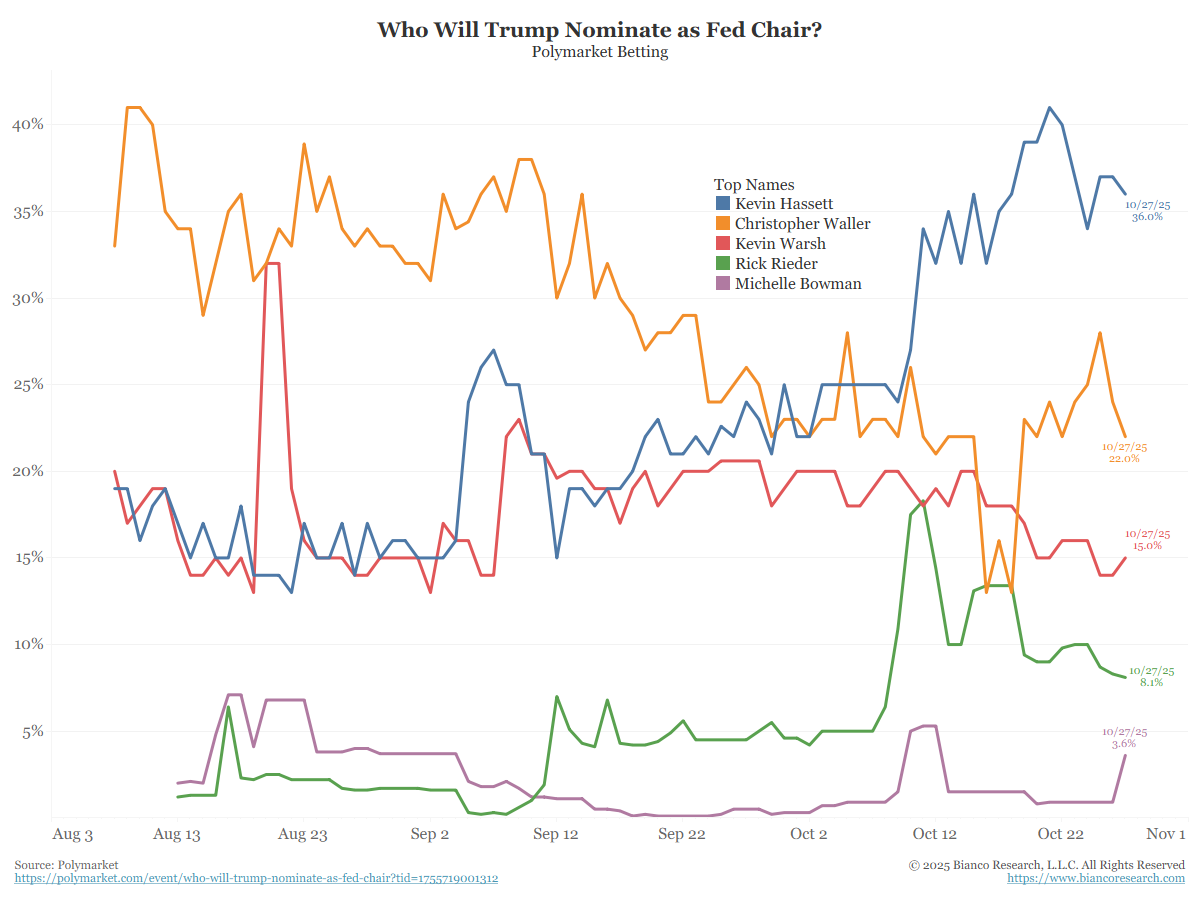

Note that Hassett is leading, but at only 36% (so well below 50%), and all the top five. Bessent suggested this morning only add up to ~82%. This suggests a low conviction in all these names.

Restated, no one is a real leader at this point. This is consistent with what was said on “2Way.”

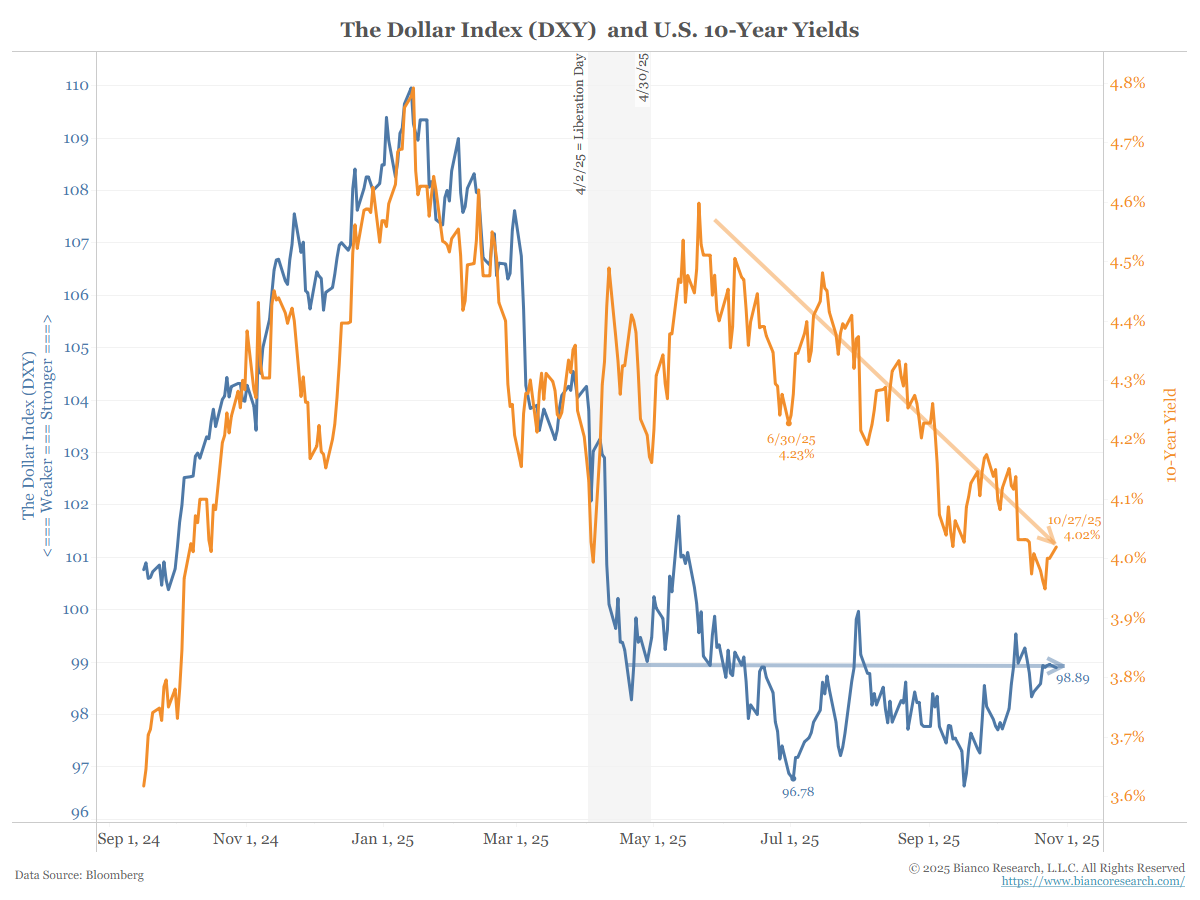

The dollar is decoupling from interest rates in a bullish way. It should be going lower as rates fall, but it is not. There never was a debasement trade, just like their never was a loss of American Exceptionalism trade.

In the News

Reuters: Exclusive: Amazon targets as many as 30,000 corporate job cuts, sources say

Meatingplace: Brazil-US Trade Truce Could Restore Beef Trade

FarmProgress: China agrees to make ‘substantial purchases of U.S. soybeans, treasury secretary says

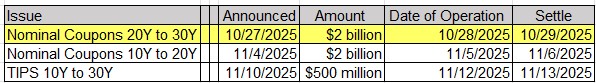

Upcoming US Treasury Supply