US Treasuries

- Tuesday’s range for UST 10y: 3.97% – 4.00%, closing at 3.98%

- Tuesday’s range for UST 30y: 4.535% – 4.565%, closing at 4.555%

- Wednesday, October 29th: FOMC Rate Decision

Intraday Commentary From Jim Bianco

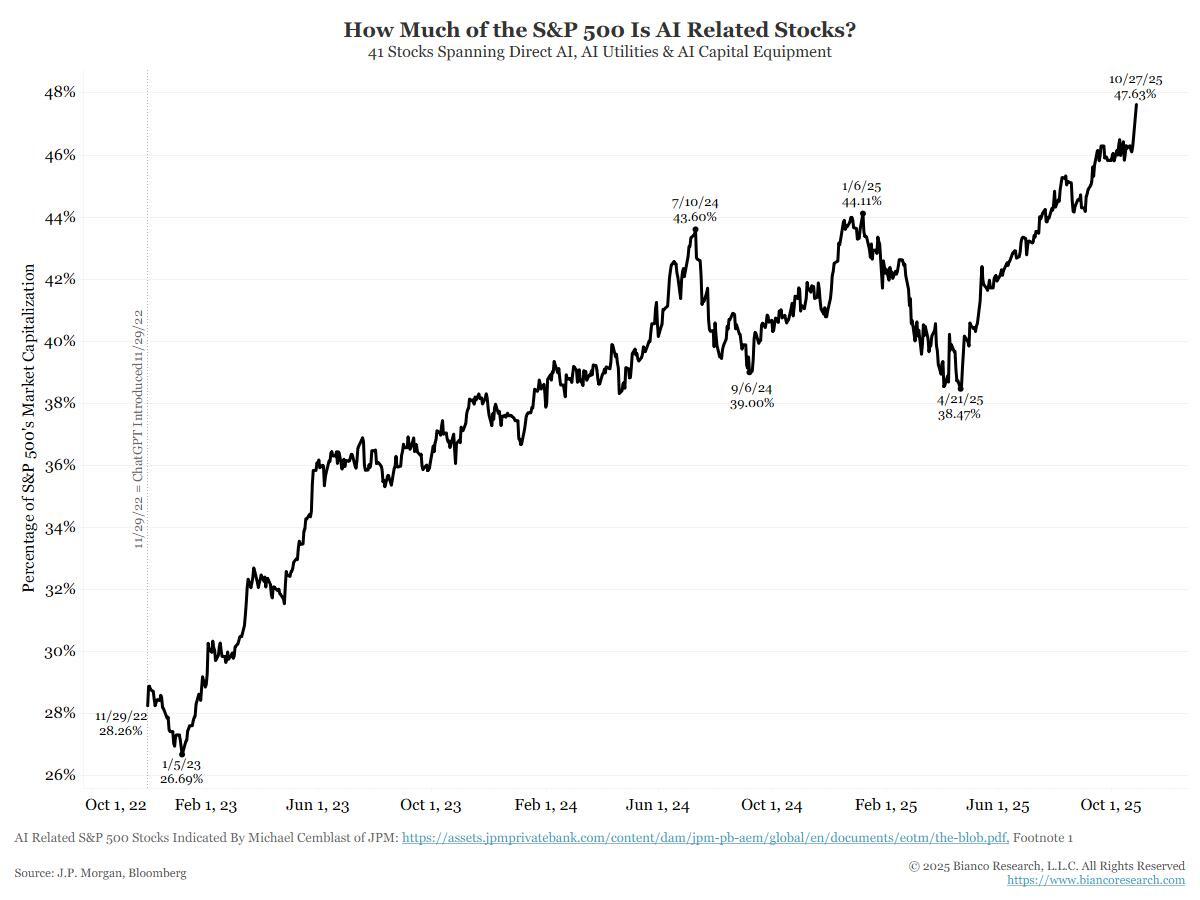

JP Morgan has identified 41 AI-related stocks, 8% of the S&P 500. These stocks now account for 47% of the Index’s market capitalization, a new record. The other 459 stocks, 92% of the S&P 500, are 53% of the Index’s market capitalization.

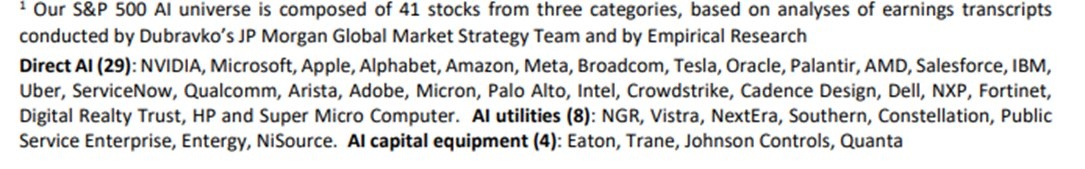

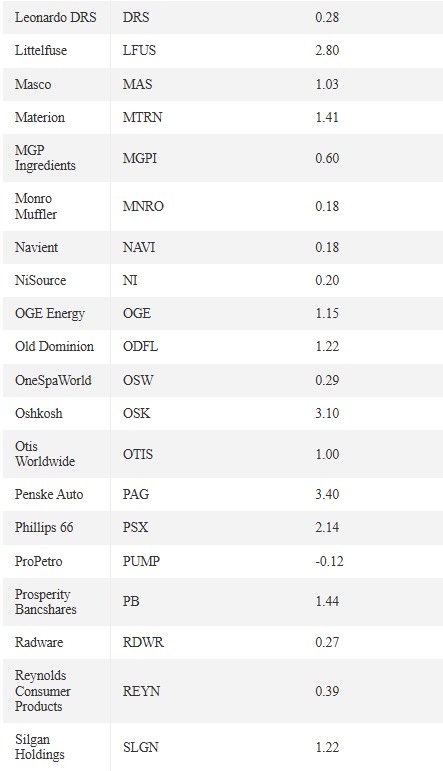

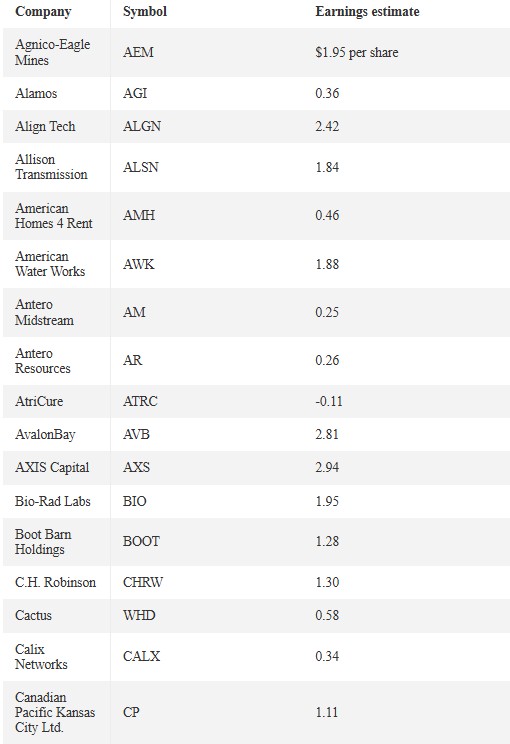

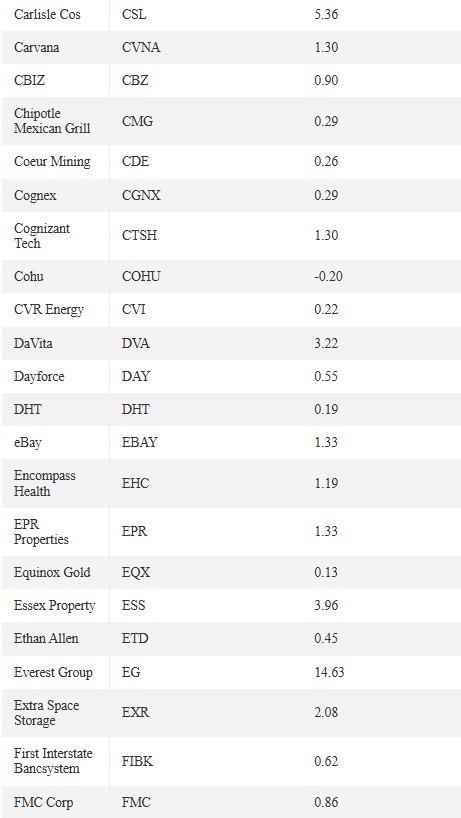

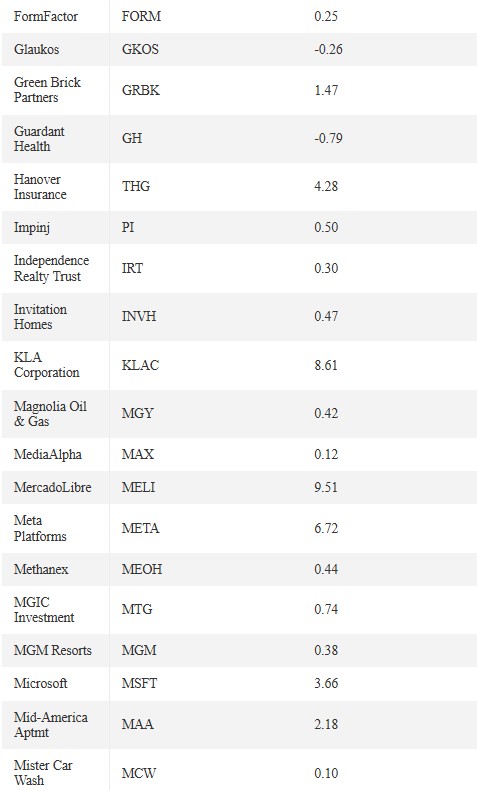

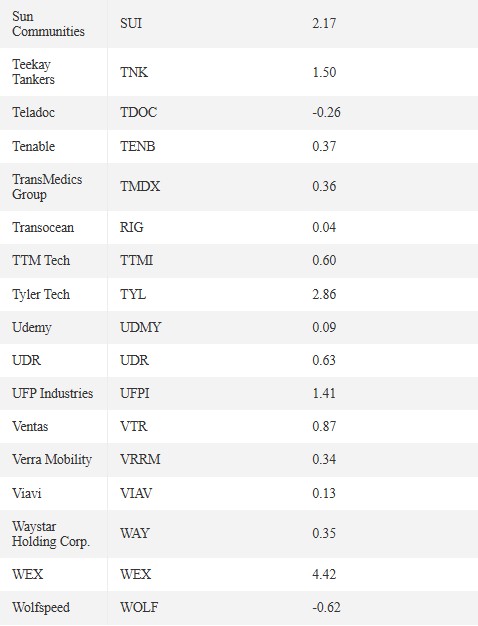

The list of the AI-related stocks.

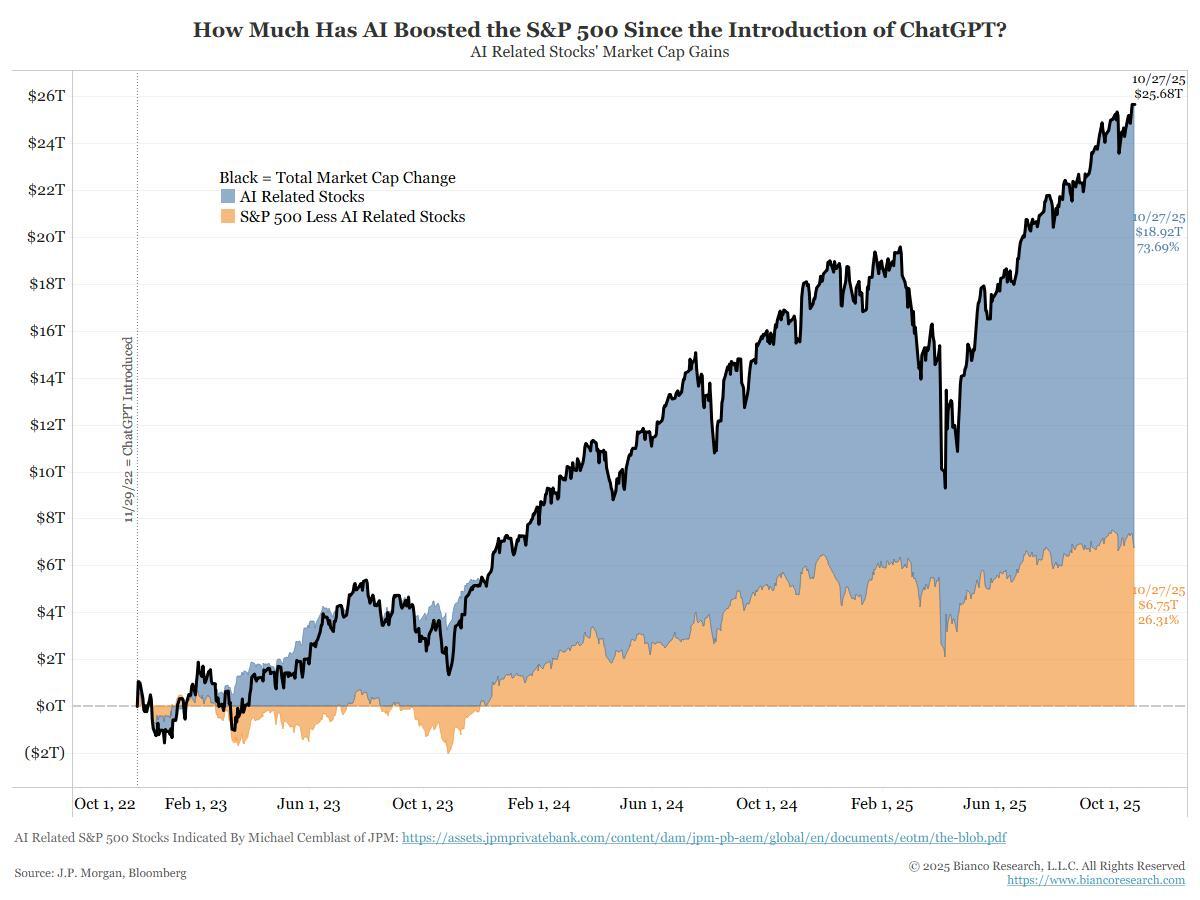

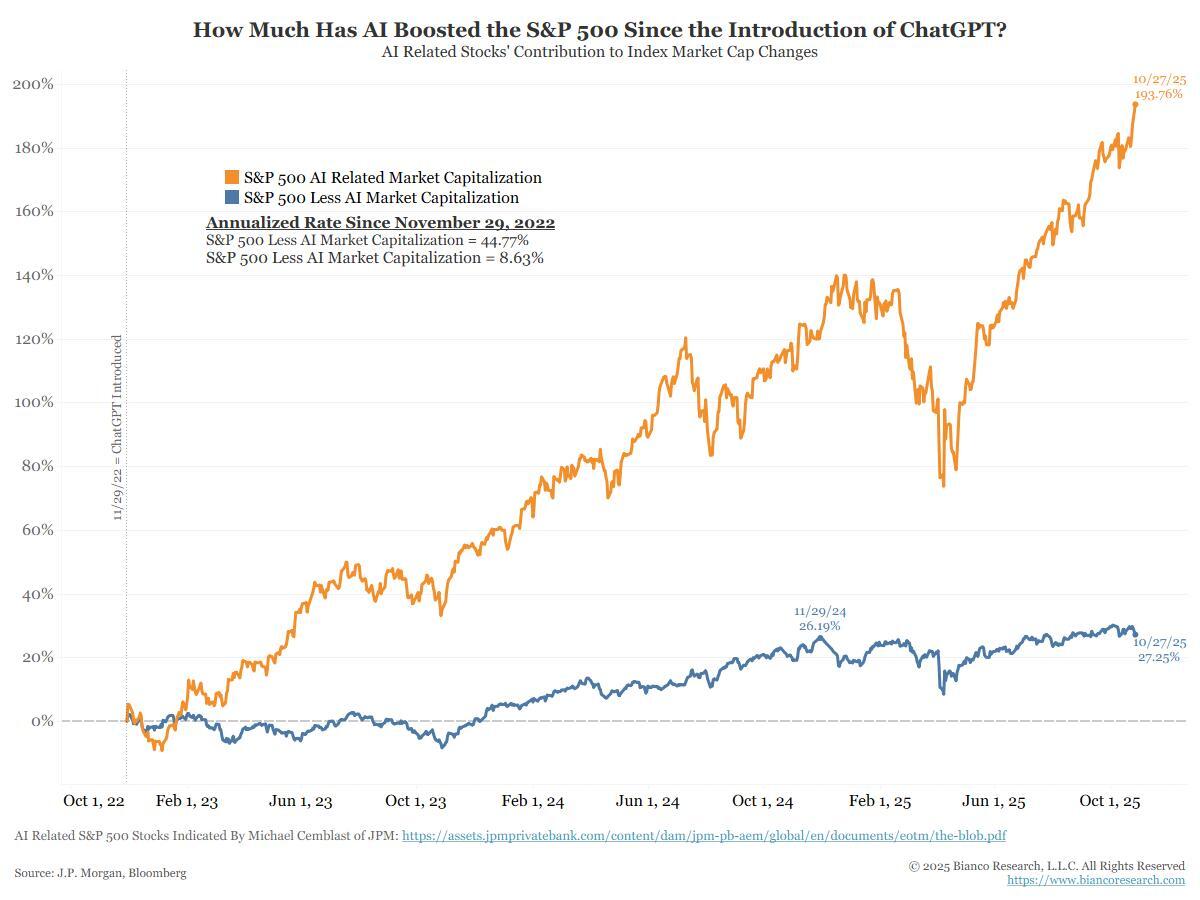

In raw terms, since November 29, 2022 (ChatGPT start):* 41 AI-related stocks (orange) = 193.76% (44.77% ann.)

* 459 non-AI-related stocks (blue) = 27.25% (8.63% ann.)

Note the “459” is up less than 1% since last November (11 Months).

The top 41 stocks in the S&P 500 will always account for around 50% (or more) of the S&P 500’s market capitalization. Nothing new here. What is different now, however, is that 47% of the Index’s capitalization is based on a single theme: AI. This is unique and represents the most significant concentration around a single theme ever. Take out the AI-related stocks, and the rest of the stock market has rather pedestrian results.

For comparison, since November 29, 2022:

* 3-Month Bill Total Return = 15.22% (4.98% ann.)

* 459 non-AI-related stocks = 27.25% (8.63% ann.)

Roughly two-thirds of the stock market’s non-AI gains could be had by sitting in a money market fund, while taking zero market risk.

Anyone who owns a broad-based equity index ETF now has roughly half their investment exposed to AI. And nearly 75% of their gains since late 2022 have come from AI. Is this truly understood?

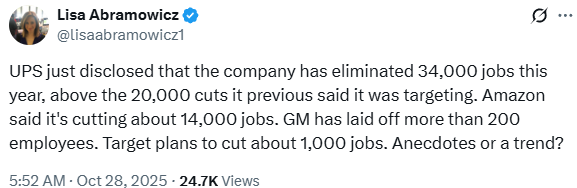

In the News

Bloomberg: The Fed’s $6 Trillion Balance Sheet Is About Right

New York Post: Toyota pledges $10B toward new auto plants in U.S: “Go out and buy a Toyota,” Trump says

ZeroHedge: The 3 Stages of Gold Miners

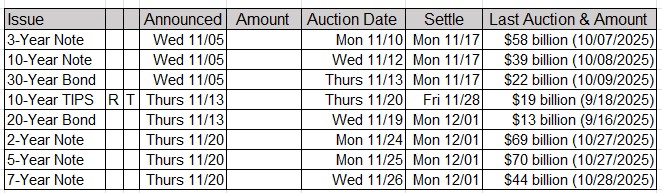

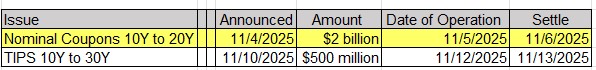

Upcoming US Treasury Supply