US Treasuries

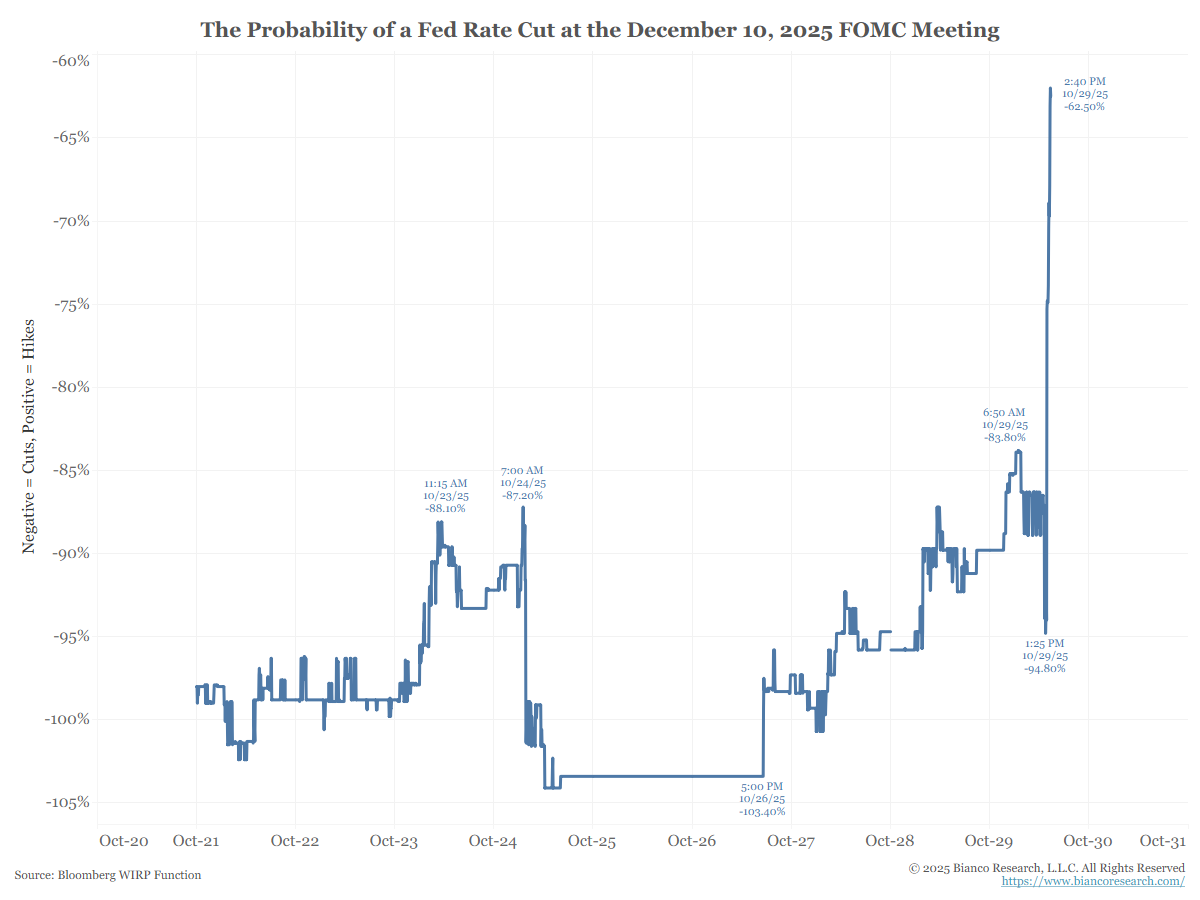

- Treasury yields climbed higher (led by the short-end) after Powell cast doubt on a December rate cut

- Wednesday’s range for UST 2y: 3.485% – 3.605%, closing at 3.57%

- Wednesday’s range for UST 10y: 3.97% – 4.07%, closing at 4.045%

- Wednesday’s range for UST 30y: 4.53% – 4.61%, closing at 4.59%

Bloomberg: Fed Cuts Rates Quarter Point, With Dissents on Both Sides

Intraday Commentary From Jim Bianco

2.5% for a rate cut in December. It was 95% yesterday. 2 year up 12 bps.

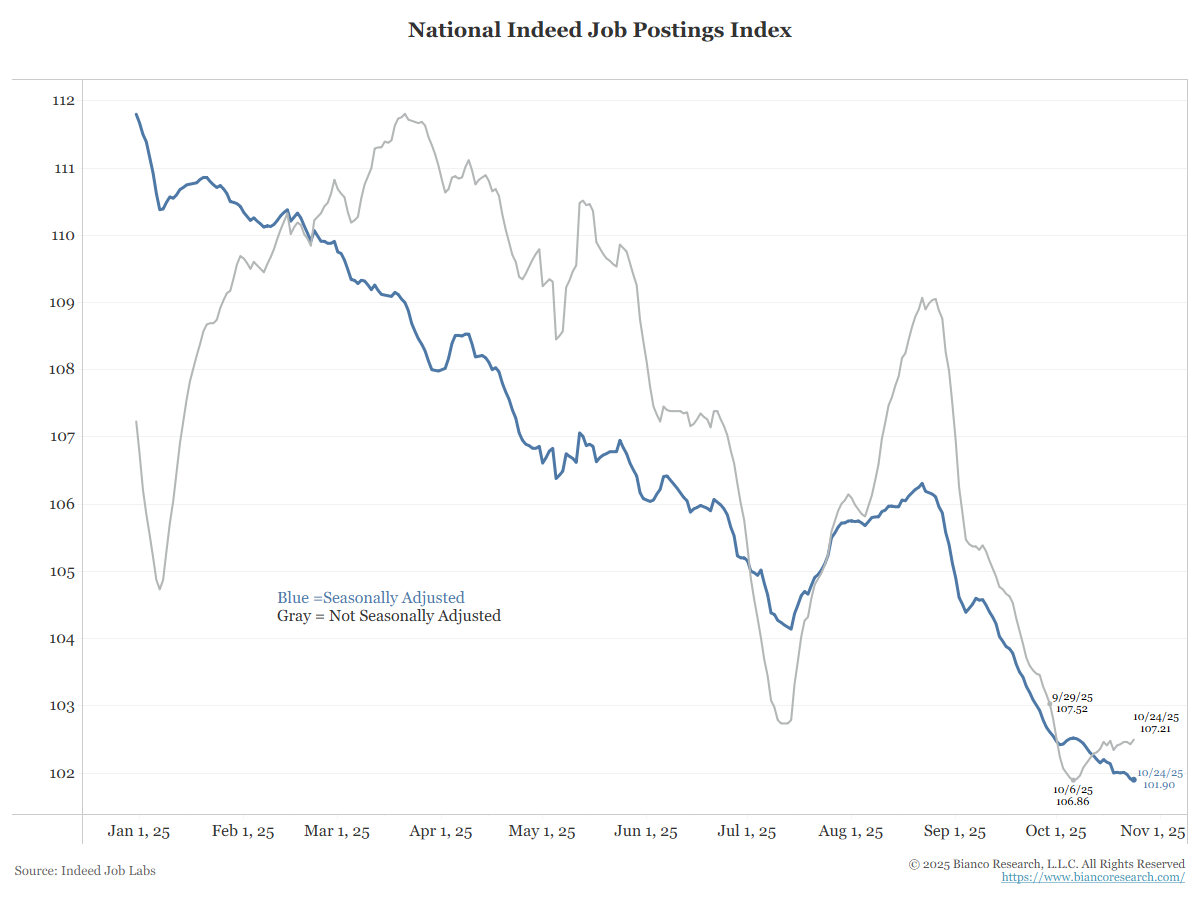

*POWELL: INDEED JOB OPENINGS SUGGEST MARKET STABLE LAST 4 WEEKS

The chart below shows the series. Powell must be looking at the “not seasonally adjusted” season as the seasonally adjusted series does not suggest “stable.”

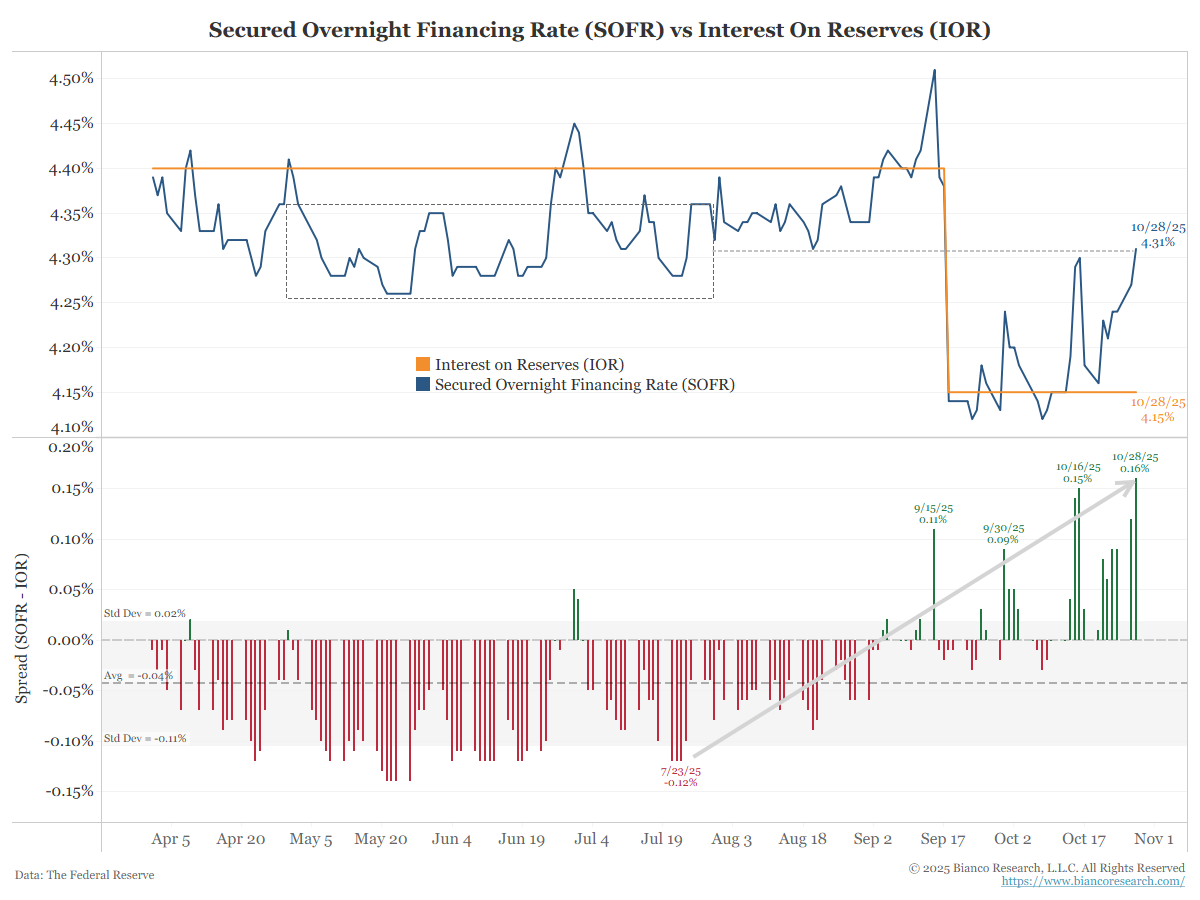

Yesterday, SOFR (blue) was 16 basis points above Interest on Reserves (orange).

As the dotted line and box show, SOFR has effectively “undone” the first rate cut in September. As this arrow in the bottom panel shows, funding market rates are tightening. And the Fed announced another month of QT, which will continue squeezing these markets.

Where will this spread be on November 30? Will today’s second cut get “undone” as well?

In the News

Bloomberg: Copper Hits a Record as Supply Snarls Set the Stage for Deficits

FarmPolicyNews: China Purchases First US Soybeans of the Season

InsuranceBusiness: Florida’s home insurance market is collapsing, research says

Car Dealership Guy:

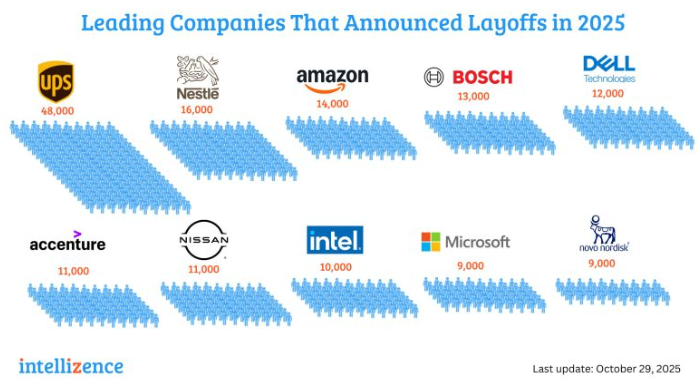

Intellizense Insights: Layoff Tracker 2025 – Recent Layoffs of the Week

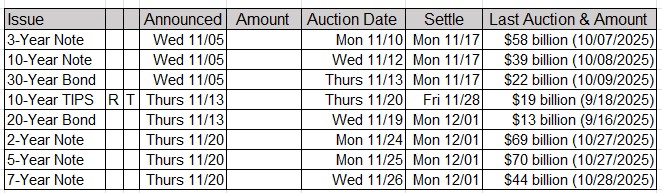

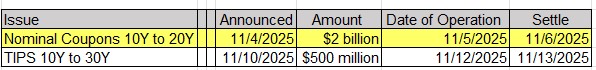

Upcoming US Treasury Supply