US Treasuries

- Friday’s range for UST 10y: 4.07% – 4.11%, closing at 4.095%

- Weekly range for UST 10y: 3.97% – 4.11%

- Friday’s range for UST 30y: 4.64% – 4.675%, closing at 4.665%

- Weekly range for UST 30y: 4.53% – 4.675%

- Fed’s Schmid: Cites Inflation Risks in Dissent Against Rate Cut

- Fed’s Logan: Says She Didn’t Want Rate cut with Inflation Still High

- Fed’s Hammack: Says She’d Have Preferred No Rate Cut This Week

- Fed’s Bostic: Eventually Got Behind This Week’s Rate Cut

Intraday Commentary From Bianco Research

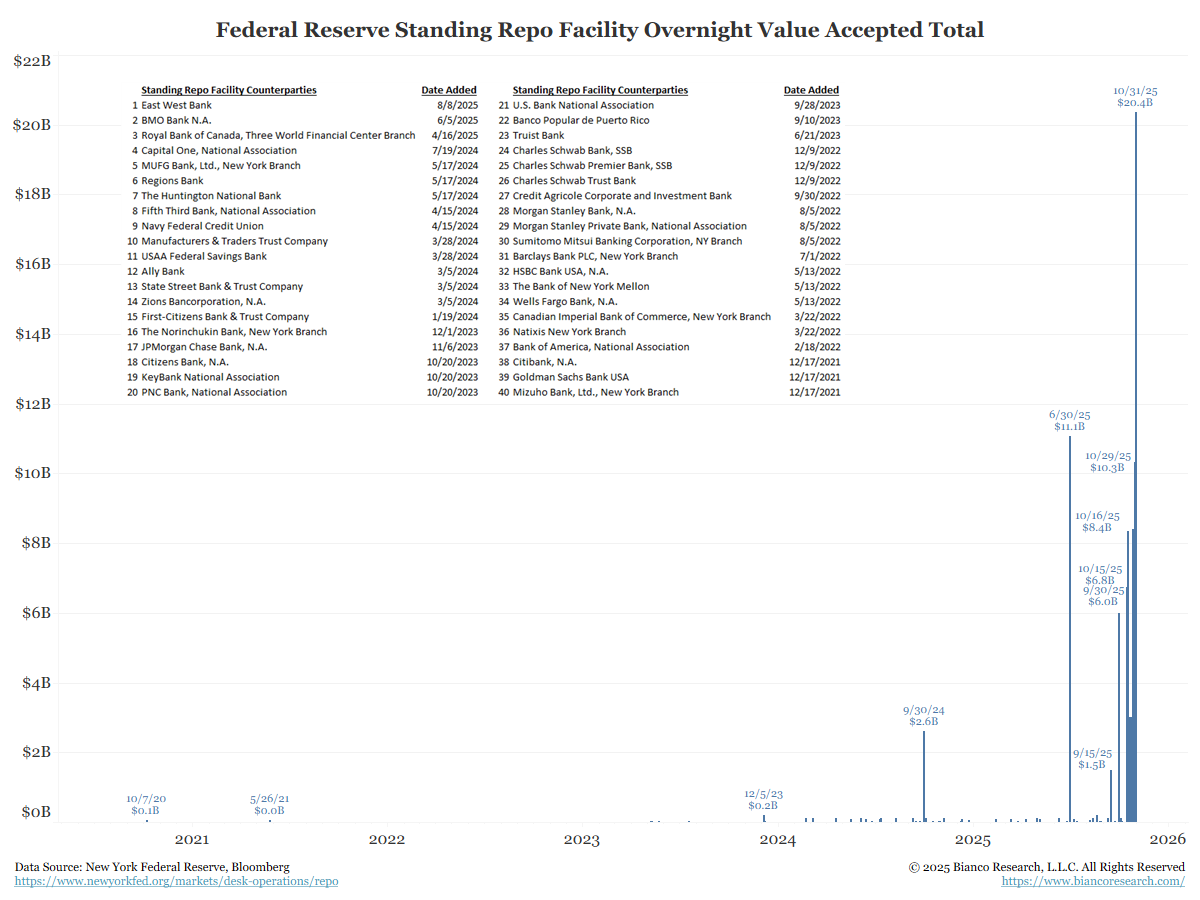

Greg Blaha: Over $20B in repo taken in this morning’s SRF operation.

Plenty of reasons to explain away this spike…month-end, we just had a rate cut which can make these markets act a bit odd for a few days, today is settlement for 2-, 5-, and 7-yr Tsys. All that being said, these numbers keep going higher.

Jim Bianco: $20 billion is a new record

Greg Blaha: Highest since June 2020 (although I don’t think it was technically called the SRF back.

Jim Bianco: To be technical, that was a “temporary” standing repo facility in 2020. They closed that facility and opened a “permanent” standing repo facility in 2021. This is a record for the permanent facility.

Temporary … this repo was opened on an emergency basis to address the September 2019 repo crisis. The Fed had intended to close it.

In 2021, they closed it, but opened a new “permanent” Standing Repo Facility (meaning it will live forever at the Fed). That is why the list of counterparty banks on the chart above goes back to 2021.

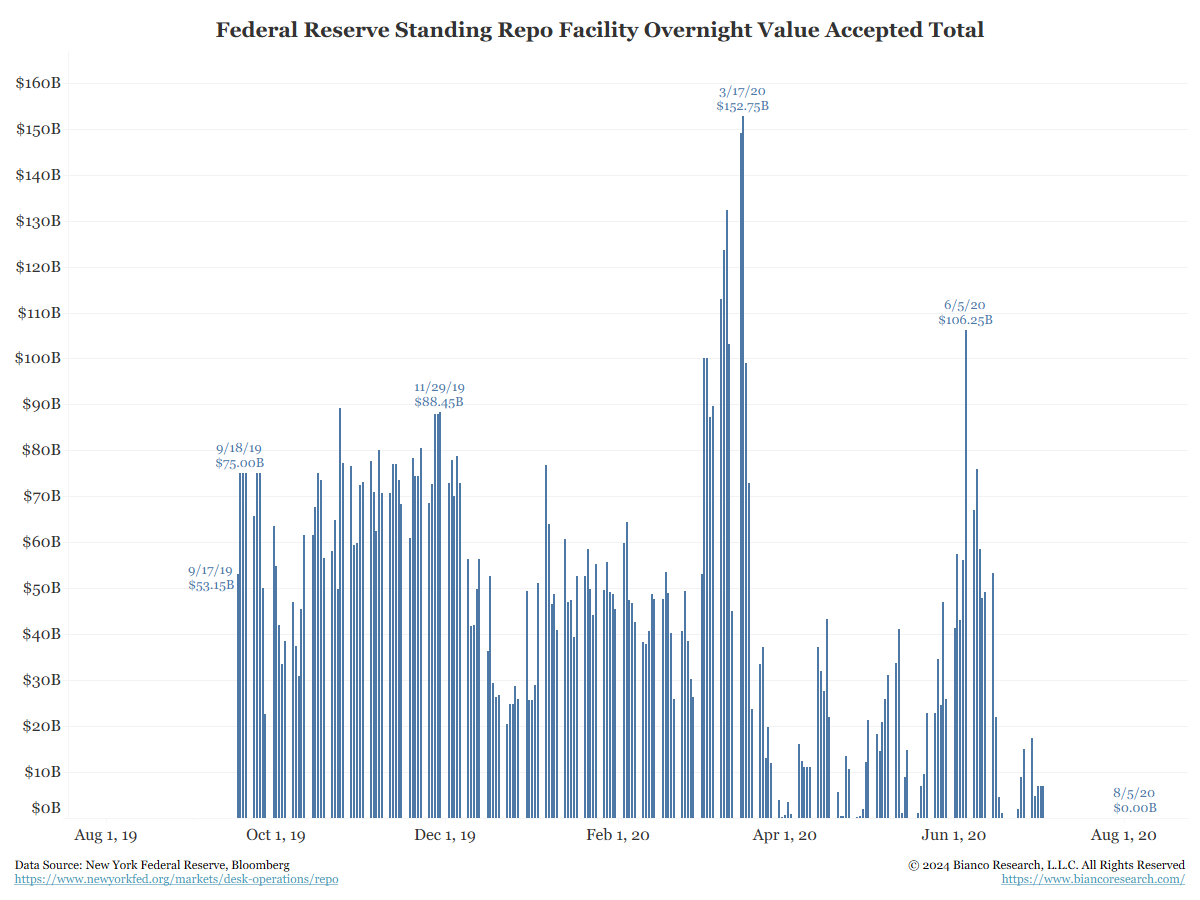

To complete the thought, here is the “temporary” standing repo facility usage starting with the Sept 2019 repo crisis through the 2020 shutdown crisis. It eventually hit zero in August 2020 and closed in 2021. It was replaced by the permanent standing repo facility in 2021 (the chart above).

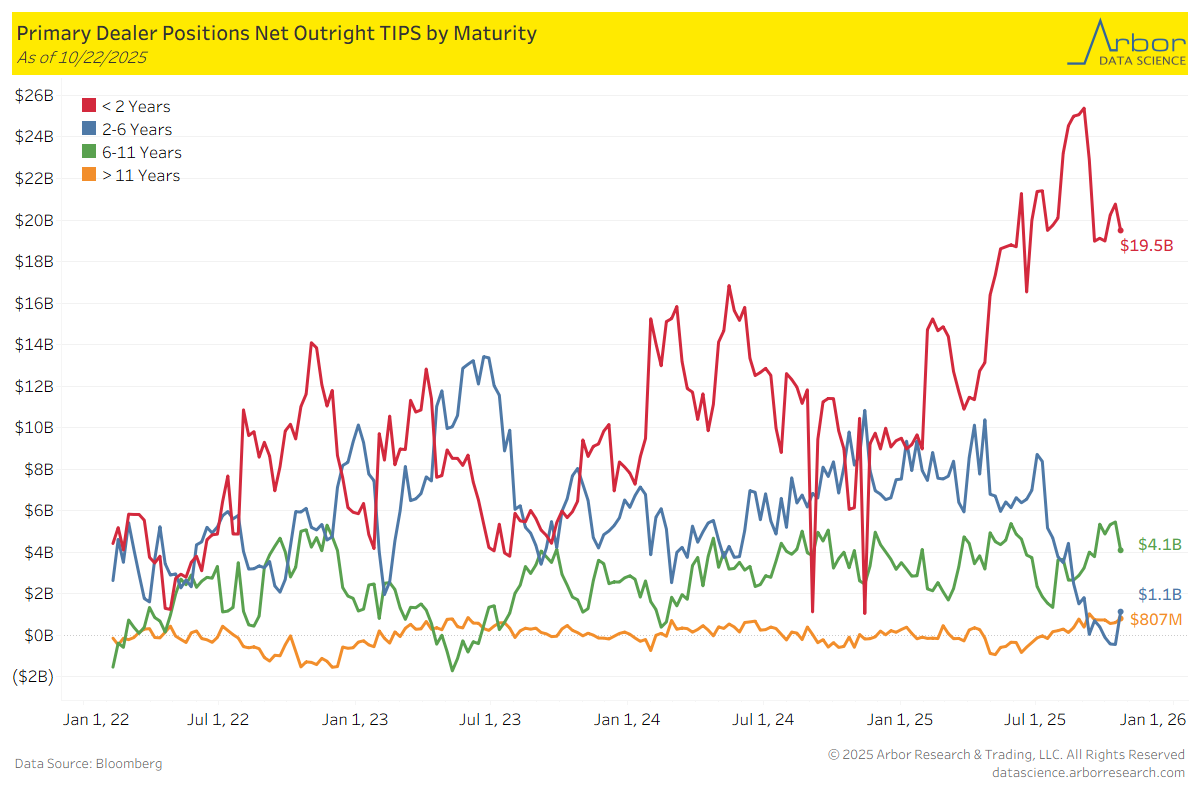

TIPS by Maturity (data through 10/22/25)

Week over Week Changes by Maturity

- < 2 years: $20.8 Bn on 10/15/25 to $19.5 Bn on 10/22/25 = ($1.3 Bn)

- 2 – 6 years: ($443 Mn) on 10/15/25 to $1.1 Bn on 10/22/25 = $1.6 Mn

- 6 – 11 years: $5.5 Bn on 10/15/25 to $4.1 Bn on 10/22/25 = ($1.4 Bn)

- > 11 years: $609 Mn on 10/15/25 to $807 Mn on 10/22/25 = $198 Mn

In the News

OilPrice: Oil Prices Fall for a third Straight Month as OPEC+ Considers Boosting Output

SupplyChainBrain: Can the U.S. Ever Stop Relying on China for Critical Minerals?

eia: U.S. coal exports declined 11% in the first half of 2025 due to reduced exports to China

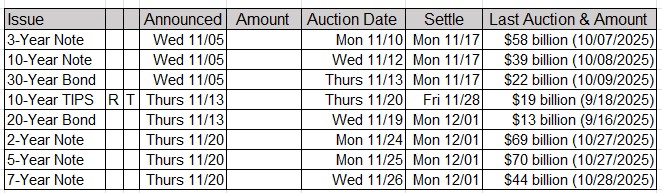

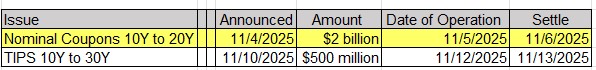

Upcoming US Treasury Supply