US Treasuries

- Monday’s UST 10y range: 4.26% – 4.325%, closing at 4.30%

Upcoming US Treasury Supply

- $42 billion 10yr Note auction tomorrow: Tuesday, 11/05/2024

Conference Call Friday, November 8th, featuring Jim Bianco

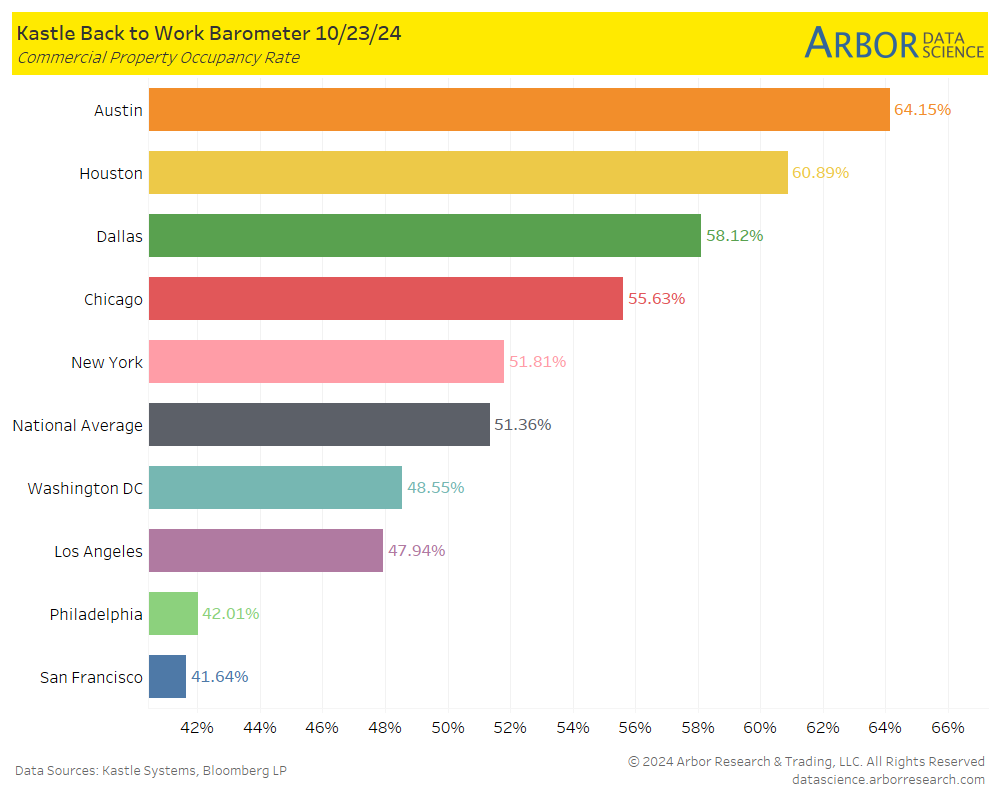

Arbor Data Science: Commercial Real Estate Occupancy

Globest: MetLife Sees ‘Positive Rebound’ in CRE Investments

Commercial real estate has been on a “positive rebound” for MetLife, said executive VP, chief financial officer, and head of investment management John McCallion on an earnings call.

Hubble: The Official List of Every Company’s Back-to-Office Strategy

In this article, Hubble explores how over 40 of the world’s most well-known companies, from Amazon to Apple, have shaped, adapted, and navigated their workplace strategies.

Intraday Commentary from Jim Bianco

Regarding my comment about the Fed making a mistake, to be clear, the mistake is not cutting 50. The mistake is what Austan Goolsbee (Chicago Fed President) said after the cut …

—

From Bloomberg: https://www.bloomberg.com/news/articles/2024-09-23/fed-s-goolsbee-sees-many-more-rate-cuts-over-the-next-year

Goolsbee noted borrowing costs are “hundreds” of basis points above neutral — a level of rates that neither stimulates nor restrains economic activity.

“Over the next 12 months, we have a long way to come down to get the interest rate to something like neutral to try to hold the conditions where they are,” Goolsbee said during the moderated discussion.

—

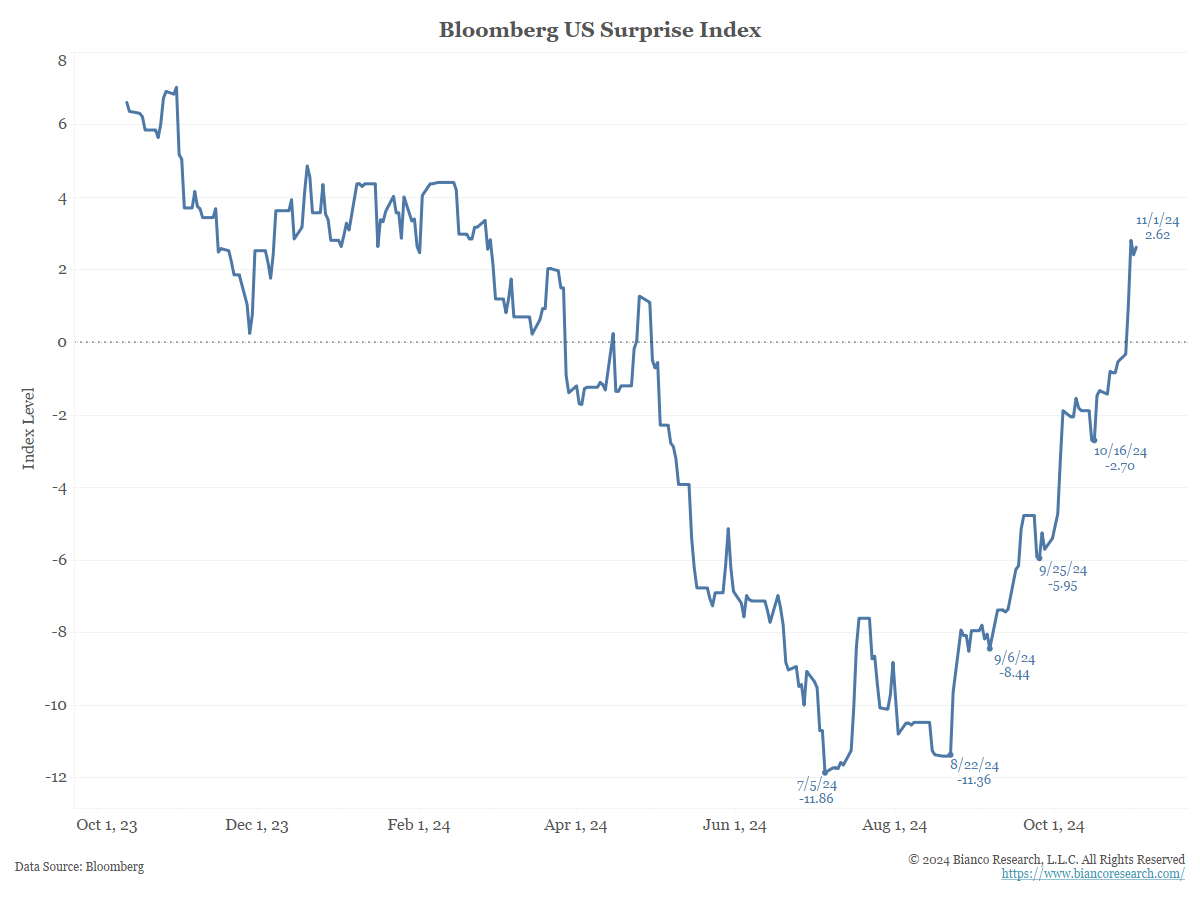

The chart below shows the Bloomberg Surprise Index. It is screaming higher, meaning the economy is beating expectations left and right.

Add to this the real possibility of a Trump victory, and with it more fiscal stimulus via tax cuts and deregulation, and inflation via tariffs, and monetary stimulus via rate cuts looks unnecessary.

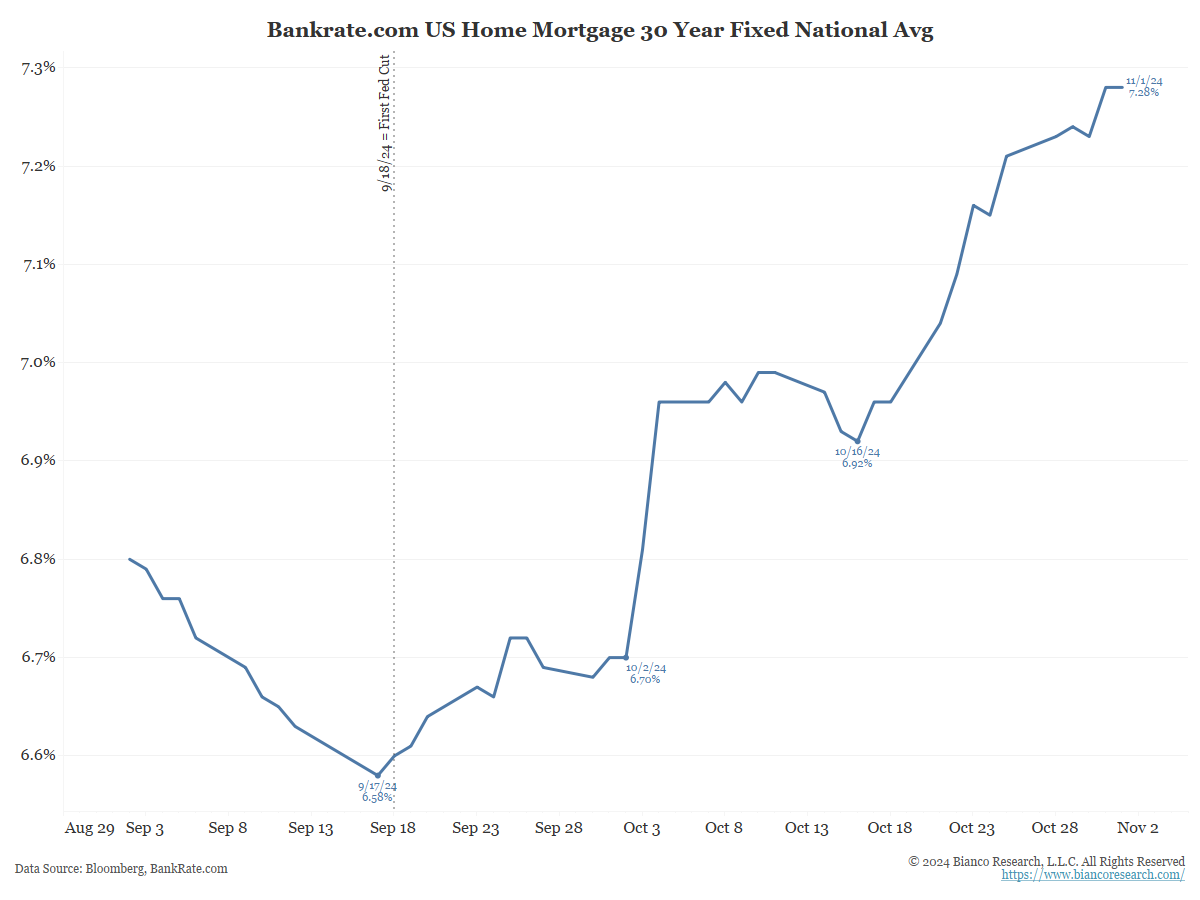

There is no way they thought this was what 30-year mortgage rates would do after they cut on September 18.

To me, this is more about stimulating an economy with rate cuts that does not need it, and the market rejecting the policy as potentially inflationary and pricing is more risk for long-term rates.

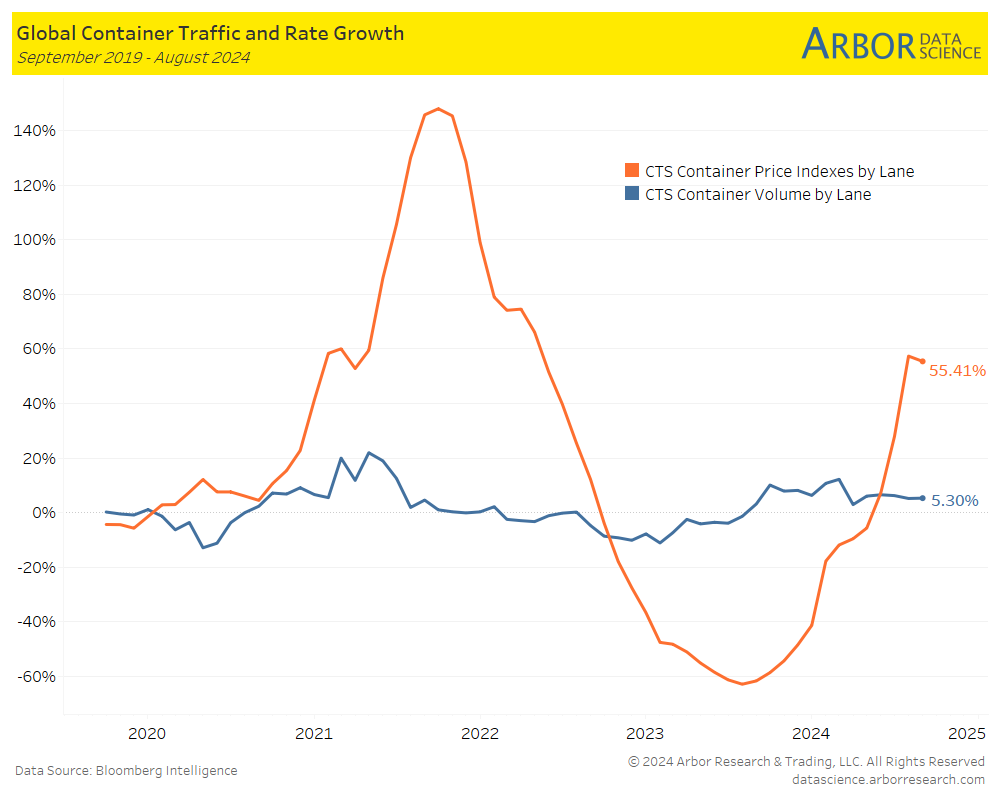

In Other News… Potential Supply Chain Issue

SupplyChainBrain: Canada Port Disruption Sparks Fear of Wider Trade Snarls

Two of Canada’s three biggest ports are expected to be closed November 4 after maritime employers responded to a longshore union’s strike notice by locking them out. A leading business group called for government intervention to prevent costly economic damage.

Arbor Data Science:

Upcoming Economic Releases & Fed Speak

- 11/05/2024 at 8:30am EST: Trade Balance

- 11/05/2024 at 10:00am EST: ISM Services Index & ISM Services Prices Paid

- 11/05/2024 at 10:00am EST: ISM Services Employment & ISM Services New Orders

- 11/06/2024 at 7:00am EST: MBA Mortgage Applications

- 11/06/2024 at 9:45am EST: S&P Global US Services PMI & S&P Global US Composite PMI

- 11/07/2024 at 8:30am EST: Nonfarm Productivity & Unit Labor Costs

- 11/07/2024 at 8:30am EST: Initial Jobless Claims & Continuing Claims

- 11/07/2024 at 10:00am EST: Wholesale Trade Sales MoM & Wholesale Inventories MoM

- 11/07/2024 at 2:00pm EST: FOMC Rate Decision

- 11/07/2024 at 2:00pm EST: Fed Interest on Reserve Balances Rate

- 11/07/2024 at 3:00pm EST: Consumer Credit

- 11/08/2024 at 10:00am EST: U. of Mich. Sentiment & U. of Mich. Current Conditions & U. of Mich. Expectations

- 11/08/2024 at 10:00am EST: U. of Mich. 1 Yr Inflation & U. of Mich. 5-10 Yr Inflation

- 11/08/2024 at 11:00am EST: Bowman Speaks on Banking Topics

- 11/08/2024 at 2:30pm EST: Musalem Gives Pre-Recorded Welcome Remarks