US Treasuries

- Wednesday’s UST 10y range: 4.36% – 4.475%, closing at 4.42%

Bloomberg: US Bonds Slide Most Since Pandemic as Trump Renews Inflation Bet

US Treasuries slid, with the 30-year bond falling the most since the pandemic struck, as investors piled back into bets that Donald Trump’s return to the White House will boost inflation.

Upcoming US Treasury Supply

Conference Call Friday, November 8th, featuring Jim Bianco

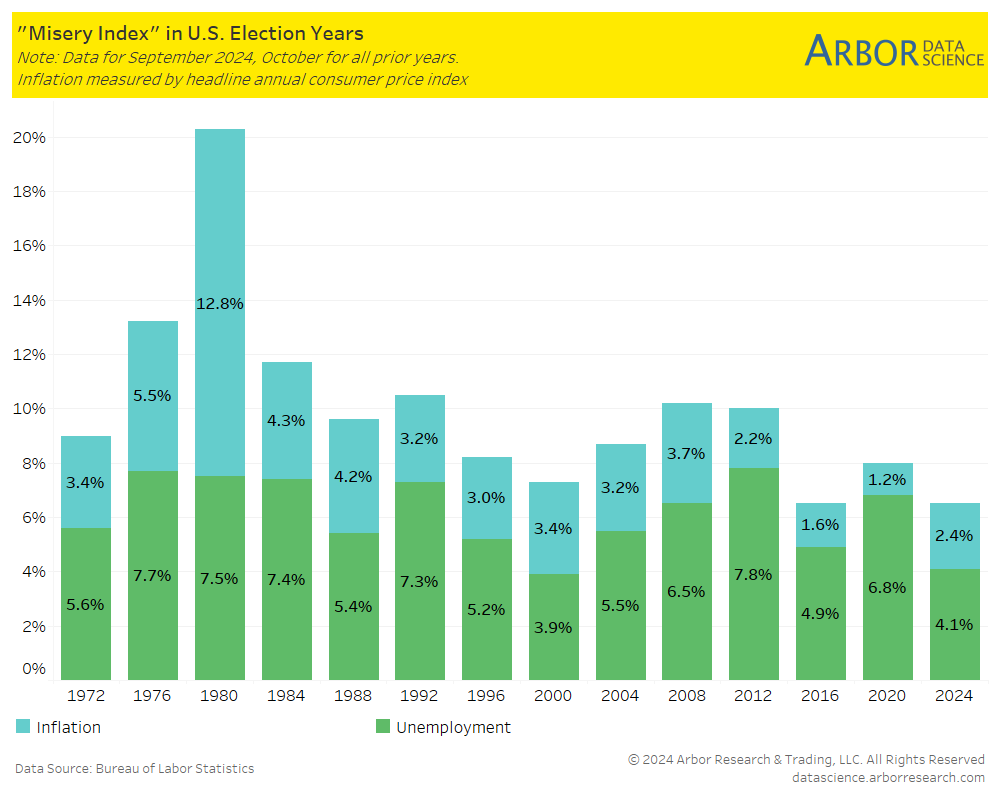

Arbor Data Science: The Misery Index in U.S. Election Years

Intraday Commentary from Jim Bianco

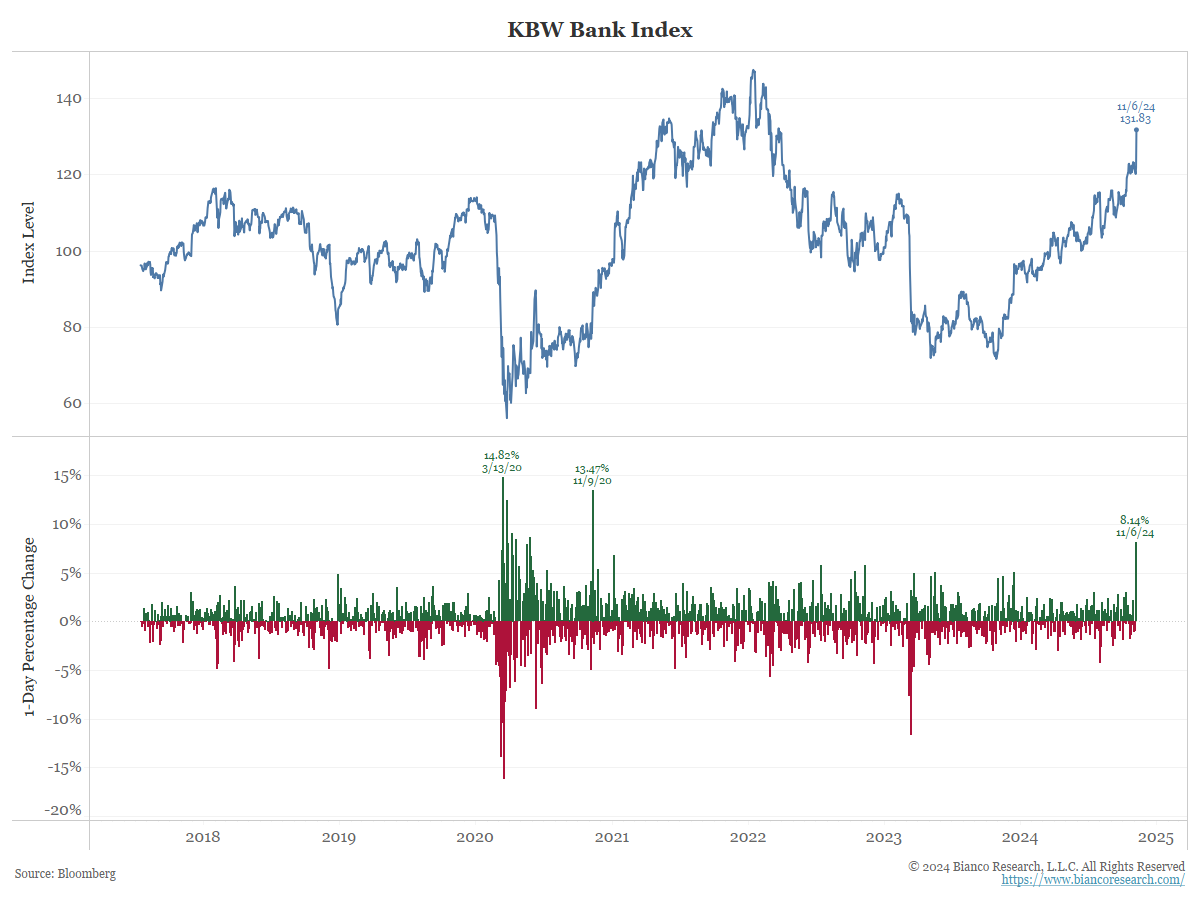

*KBW BANK INDEX JUMPS 8.5% IN BIGGEST GAIN SINCE NOVEMBER 2020

This is the biggest one-day rise for Banks since November 9, 2020—the Monday after the election and the next trading day after AP called the election (for Biden).

Today is the next trading day after AP called the election (this morning at 5:30 AM ET). The bank surge in 2020 continued in 2021 and then eventually burned itself out and then slumped badly.

Will this time be different?

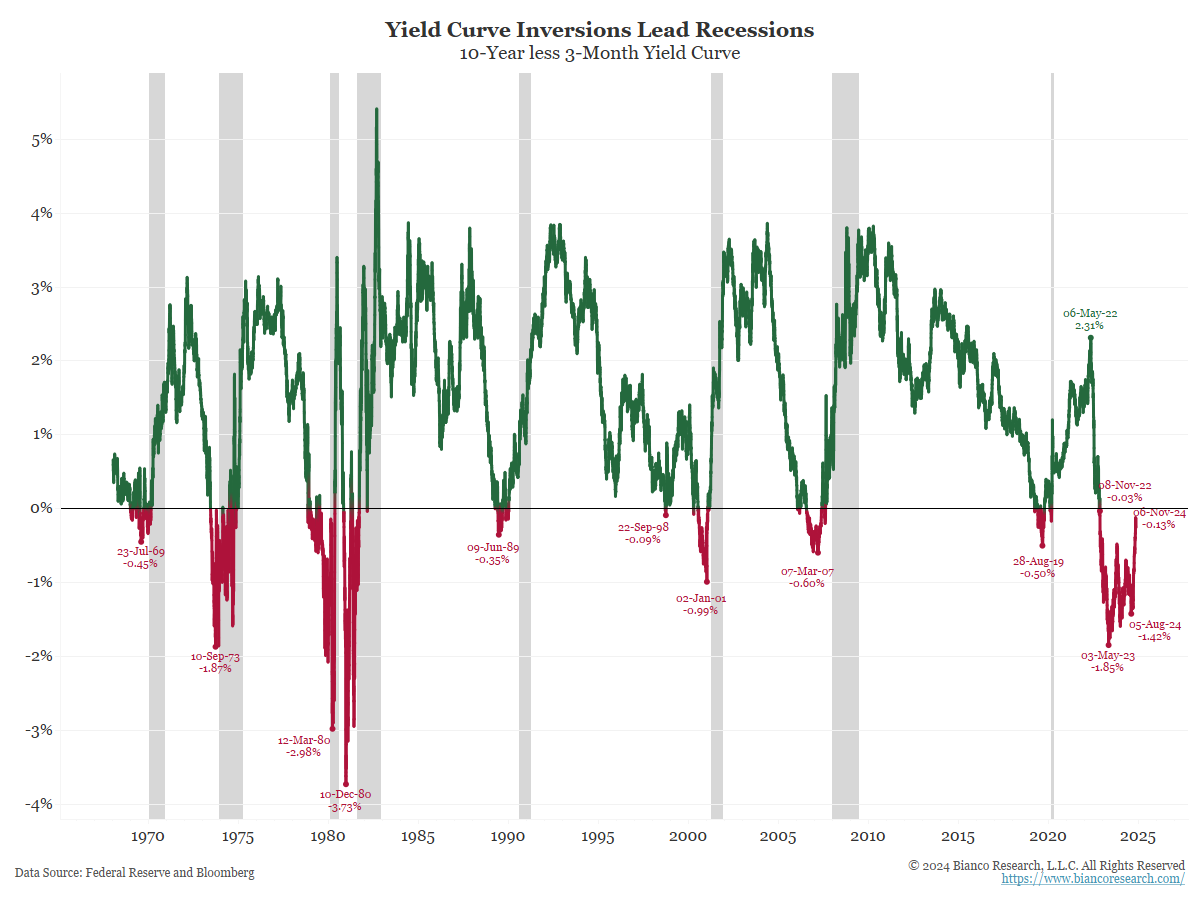

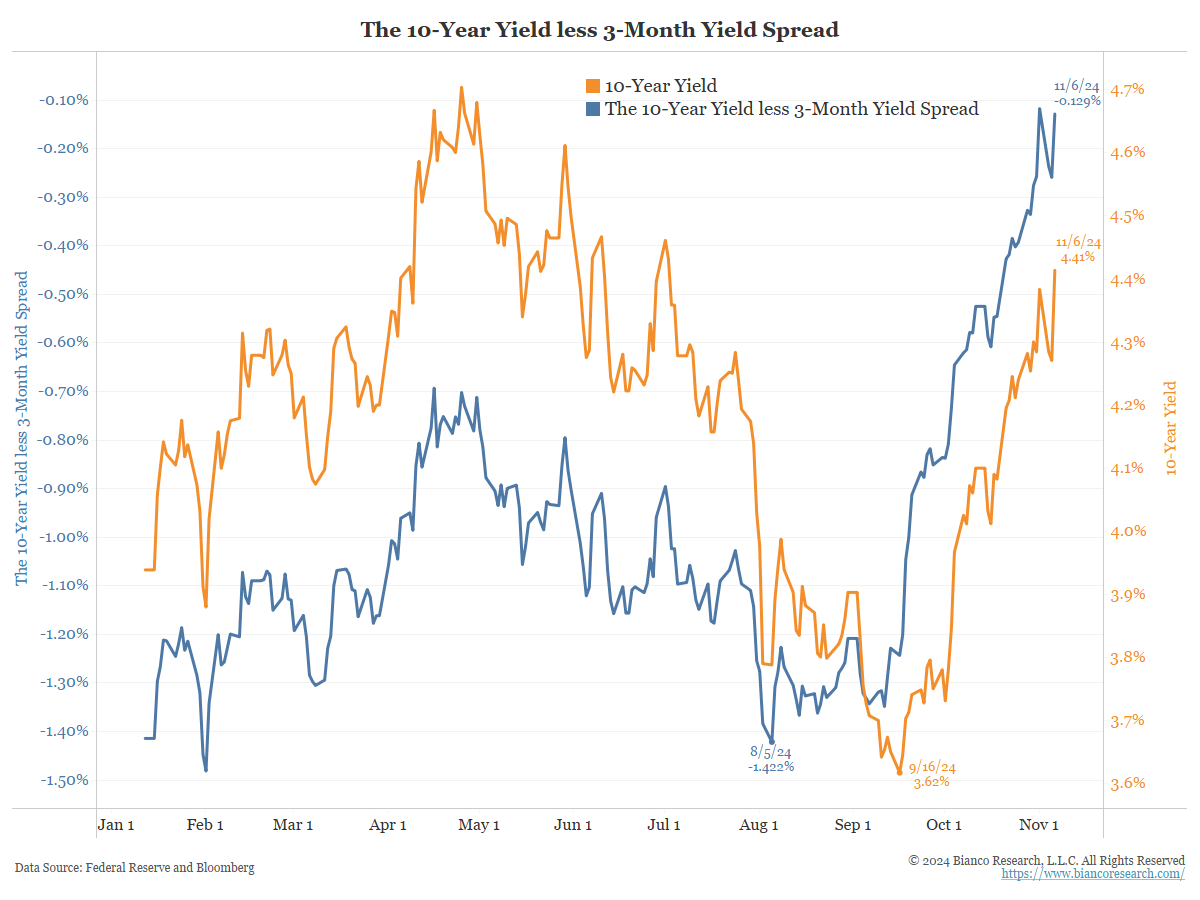

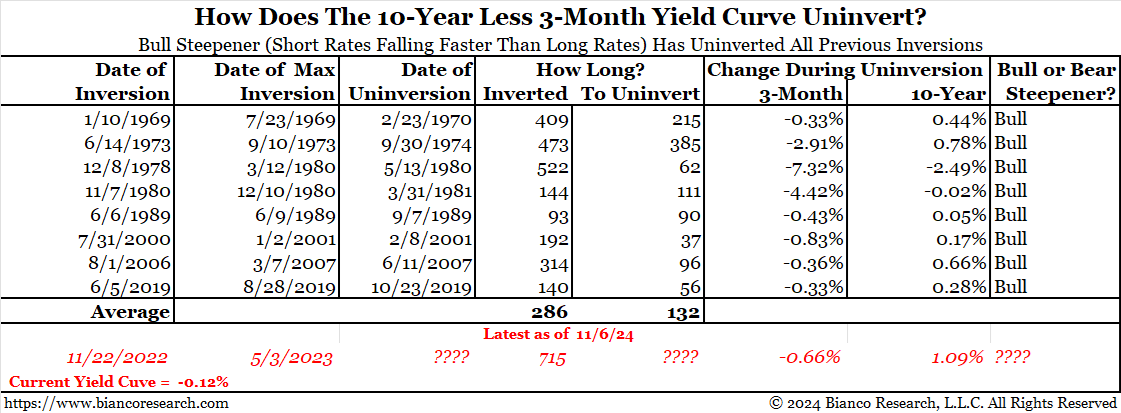

The 10-year-less 3-month yield curve continues to go vertical. “un-inverting” is now only 21 bps away.

This un-inversion of the 10-year-less 3-month yield curve is coming at lightning speed.

This curve (blue) was -142 bps three months ago (August 5); it was still -135 bps on September 11, the week before the Fed cut. It is now -13 bps.

Overlaid on this chart is the 10-year yield (orange). It is also going straight up too. So, the curve is un-inverting via a bear steepener. That is steepening (or getting less inverted) with rates rising (bear).

As this table illustrates, every other un-inversion or the 10-year-less 3-month yield curve has been a bull steepener. That is, short rates plummeted faster than long rates to return the yield curve to positive.

This time, however, the coming un-inversion (I’m assuming it will happen) is coming from a bear steepener. So, this un-inversion is unique.

So, what does it mean that the un-inversion is via the bear steepening?

Since we have no historical precedent, we can only guess. My guess is a fear of inflation returning.

Why? The economy is outperforming. Fiscal stimulus is coming via the Trump victory (tax cuts and deregulation), as well as inflation vis tariffs. Monetary stimulus via rate cuts is unnecessary, and Powell is set to plow ahead with more of them tomorrow.

So, the un-inversion is the market screaming to Powell to stop! Inflation is the problem, not a weak economy that needs help.

In Other News…

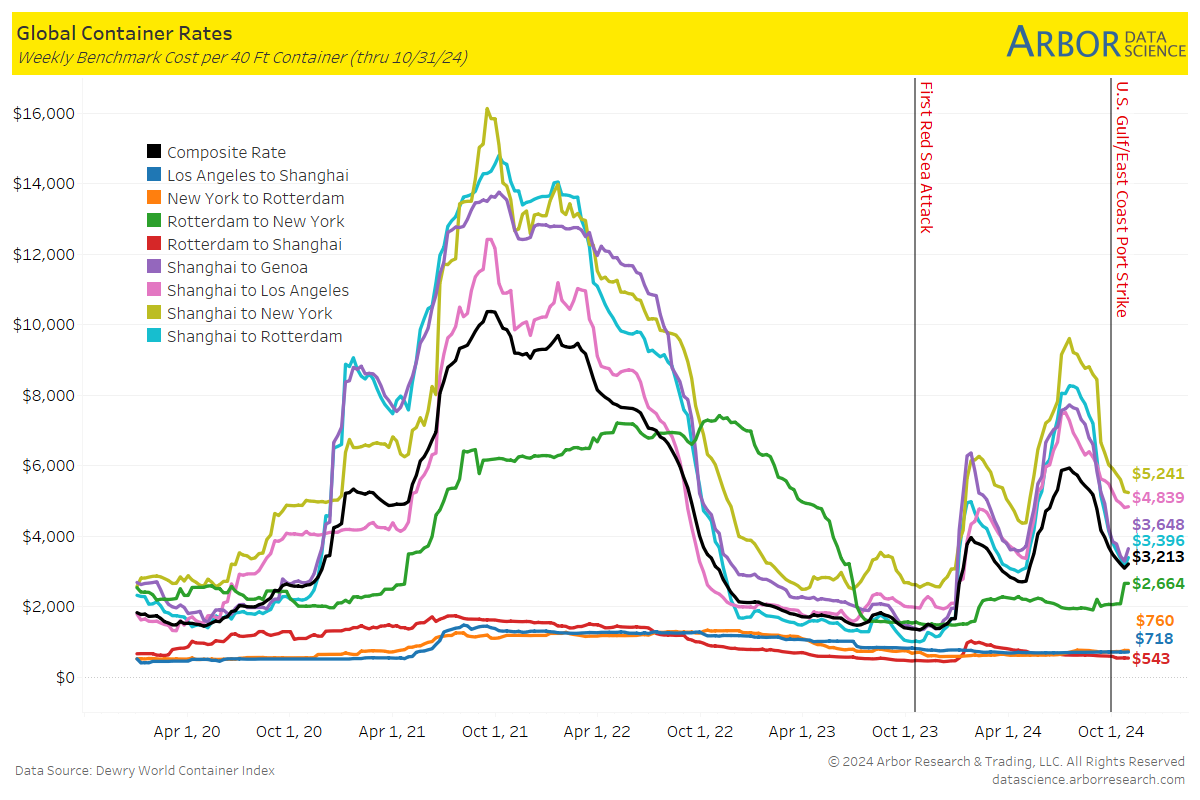

Supply Chain… Is an end in sight for the Red Sea attacks?

ZeroHedge: Iran-Backed Houthis Reportedly Declare Ceasefire Shortly After Trump Victory

Reports on X indicate that the rebels have declared a ceasefire, halting a year of missile and drone strikes on Western-linked commercial and military vessels across the critical maritime chokepoint in the southern Red Sea.

Reuters: Canada west coast ports shutdown enters second day

The British Columbia ports labor dispute continued on Tuesday, impacting exports at Canada’s biggest port in Vancouver with no sign of negotiating progress.

Arbor Data Science:

Another Hurricane?

USA Today: Rafael upgraded to hurricane; could undergo ‘rapid intensification.’ Is US at risk?

NBC: Florida’s largest insurance company drops nearly 200K policies

The state’s largest insurance company has just dropped 200,000 policies, meaning hundreds of thousands of people will be left looking for a new company. Last month, Citizens had 1.2 million customers. Now, they’re just over a million.

Upcoming Economic Releases & Fed Speak

- 11/07/2024 at 8:30am EST: Nonfarm Productivity & Unit Labor Costs

- 11/07/2024 at 8:30am EST: Initial Jobless Claims & Continuing Claims

- 11/07/2024 at 10:00am EST: Wholesale Trade Sales MoM & Wholesale Inventories MoM

- 11/07/2024 at 2:00pm EST: FOMC Rate Decision

- 11/07/2024 at 2:00pm EST: Fed Interest on Reserve Balances Rate

- 11/07/2024 at 3:00pm EST: Consumer Credit

- 11/08/2024 at 10:00am EST: U. of Mich. Sentiment/Current Conditions/Expectations

- 11/08/2024 at 10:00am EST: U. of Mich. 1 Yr Inflation & U. of Mich. 5-10 Yr Inflation

- 11/08/2024 at 11:00am EST: Bowman Speaks on Banking Topics

- 11/08/2024 at 2:30pm EST: Musalem Gives Pre-Recorded Welcome Remarks

- 11/12/2024 at 6:00am EST: NFIB Small Business Optimism

- 11/12/2024 at 11:00am EST: NY Fed 1-Yr Inflation Expectations

- 11/12/2024 at 2:00pm EST: Senior Loan Officer opinion Survey on Bank Lending Practices

- 11/12/2024 at 5:00pm EST: Harker Speaks on Fintech, AI

- 11/13/2024 at 7:00am EST: MBA Mortgage Applications

- 11/13/2024 at 8:30am EST: Real Avg. Hourly Earnings YoY & Real Avg. Weekly Earnings YoY

- 11/13/2024 at 8:30am EST: CPI MoM & CPI Ex Food and Energy MoM

- 11/13/2024 at 8:30am EST: CPI YoY & CPI Ex Food and Energy YoY

- 11/13/2024 at 8:30am EST: CPI Index NSA & CPI Core Index SA

- 11/13/2024 at 9:45am EST: Logan Gives Opening Remarks at Energy Conference

- 11/13/2024 at 1:00pm EST: Musalem Speaks on Economy, Monetary Policy

- 11/13/2024 at 1:30pm EST: Schmid Gives Keynote Remarks at Energy Conference

- 11/13/2024 at 2:00pm EST: Monthly Budget Statement

Dealer Positions ($’s in millions of dollars)

- Dealer positions in T-Bills (as of 10/23) were down 22.68ln @46.76bln

- Dealer positions <2yrs TIPS (as of 10/23) were down 2.91bln @6.06bln.

- Dealer positions in 2-6yrs TIPS (as of 10/23) were up 1.69bln @9.79bln.

- Dealer positions in 6-11yrs TIPS (as of 10/23) were down 749mln @3.25bln.

- Dealer positions > 11yrs TIPS (as of 10/23) were down 451mln @-87mln.

- Dealer positions in < 2yrs Coupons (as of 10/23) were down 899bln @13.16bln.

- Dealer positions > 2yrs and < 3yrs Coupons (as of 10/23) were up 3,27bln @12.44bln.

- Dealer positions in > 3 years and< 6yrs Coupons (as of 10/23) were up 1.87bln @62.76bln.

- Dealer positions > 6yrs and < 7yrs Coupons (as of 10/23) were down 3.42mln @16.66bln.

- Dealer positions in > 7 years and< 11yrs Coupons (as of 10/23) were up 884bln @26.96bln.

- Dealer positions > 11yrs and < 21yrs Coupons (as of 10/23) were up 689bln @22.15bln.

- Dealer positions in > 21 years Coupons (as of 10/23) were down 74.73bln @27.03bln.