US Treasuries

- Thursday’s range for UST 10y: 4.075% – 4.15%, closing at 4.09%

- Thursday’s range for UST 30y: 4.67% – 4.73%, closing at 4.69%

- Fed’s Goolsbee: Says He is More Uneasy About Rate Cuts Absent Data

- Fed’s Williams: Natural Rate of Interest Is Hard to Pin Down

- Fed’s Barr: Sees Work to Do on Inflation, Cautions on Job Market

- Fed’s Hammack: Says Inflation a Bigger Concern than Labor Market

Intraday Commentary From Bianco Research

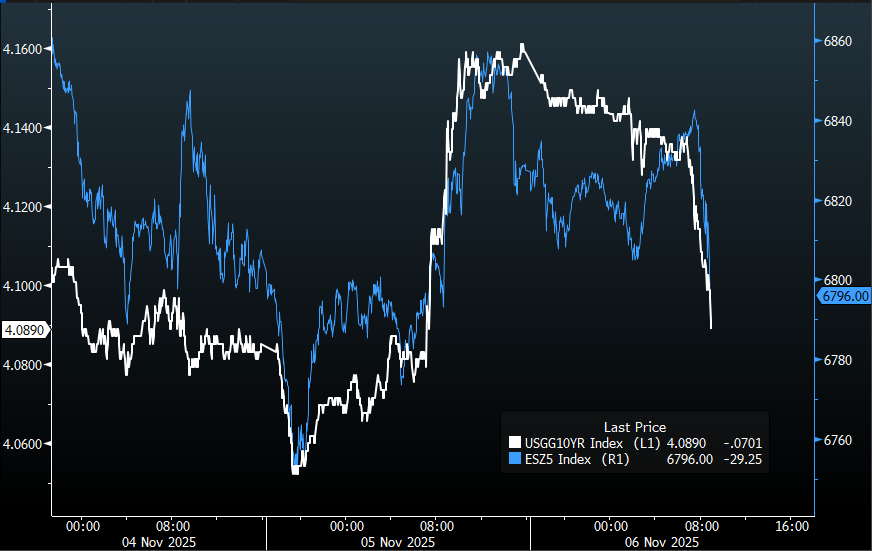

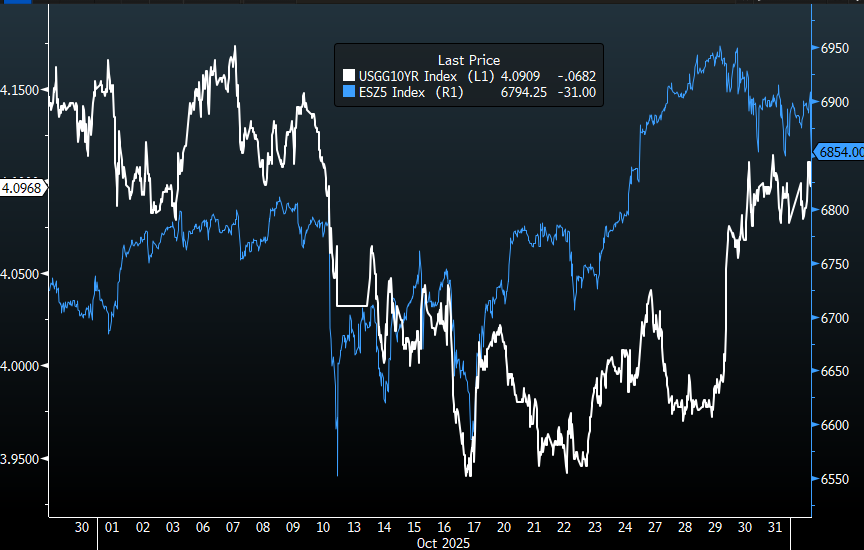

A short-term observation …The last few days stocks (blue, right x-axis) and 10-year yields (white, left axis) have been trading in a classic Pre-COVID “Risk-on, Risk-off” patten.

Risk-on Stocks up, yields up

Risk-off: Stocks down, yields down

This was largely NOT the case in the weeks before the last few days.

Not sure if I’m looking at random noise that happens to align, or maybe the market is changing its outlook. It has only been a few days.

In the News

ai-cio: Approximately 88% of Asset Allocators Plan to Increase Investments in AI, Data Centers

InsuranceBusinessMag: Gen AI becomes the new cyber battleground – are insurers falling behind?

ZeroHedge: CarMax Shares Crater As Board Ousts CEO Amid Deepening Used-Car Market Cracks

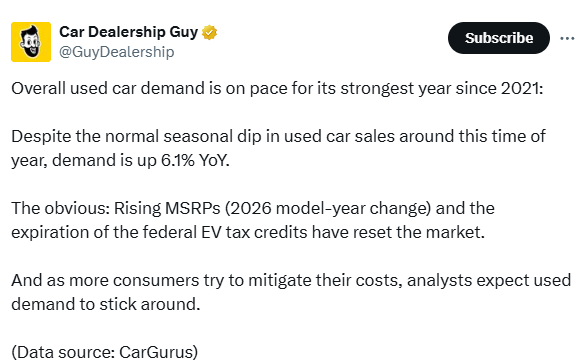

Car Dealership Guy on X:

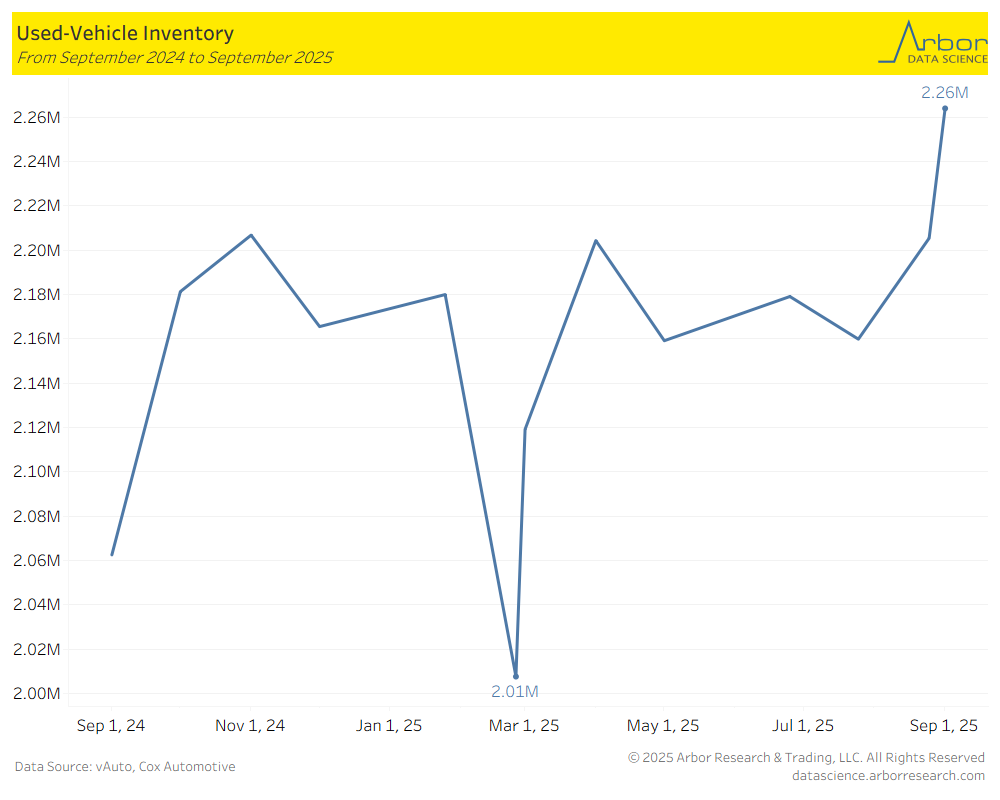

Arbor Data Science: The Financial Burden of an Automobile

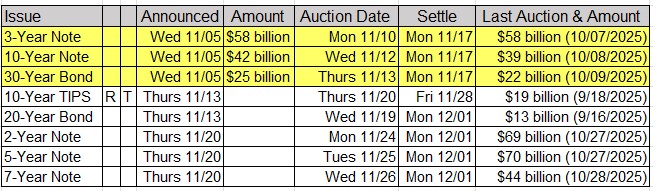

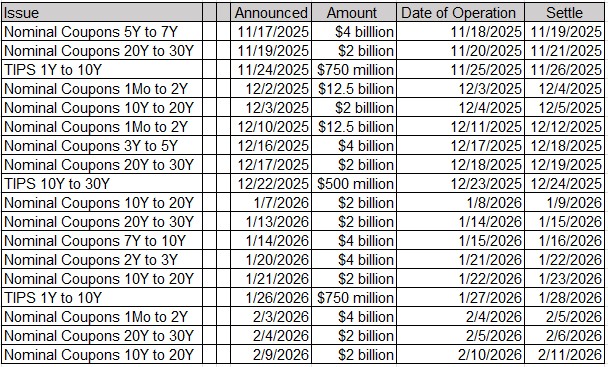

Upcoming US Treasury Supply