US Treasuries

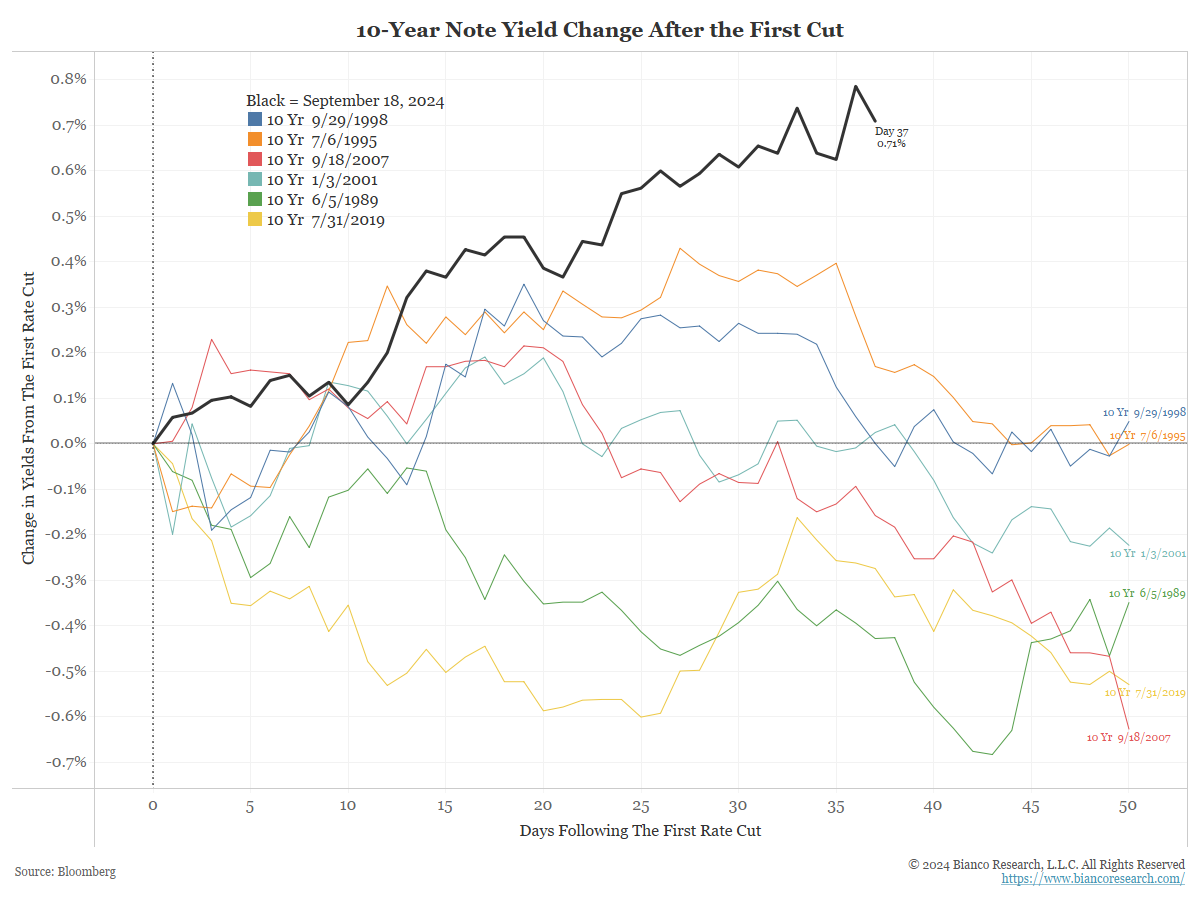

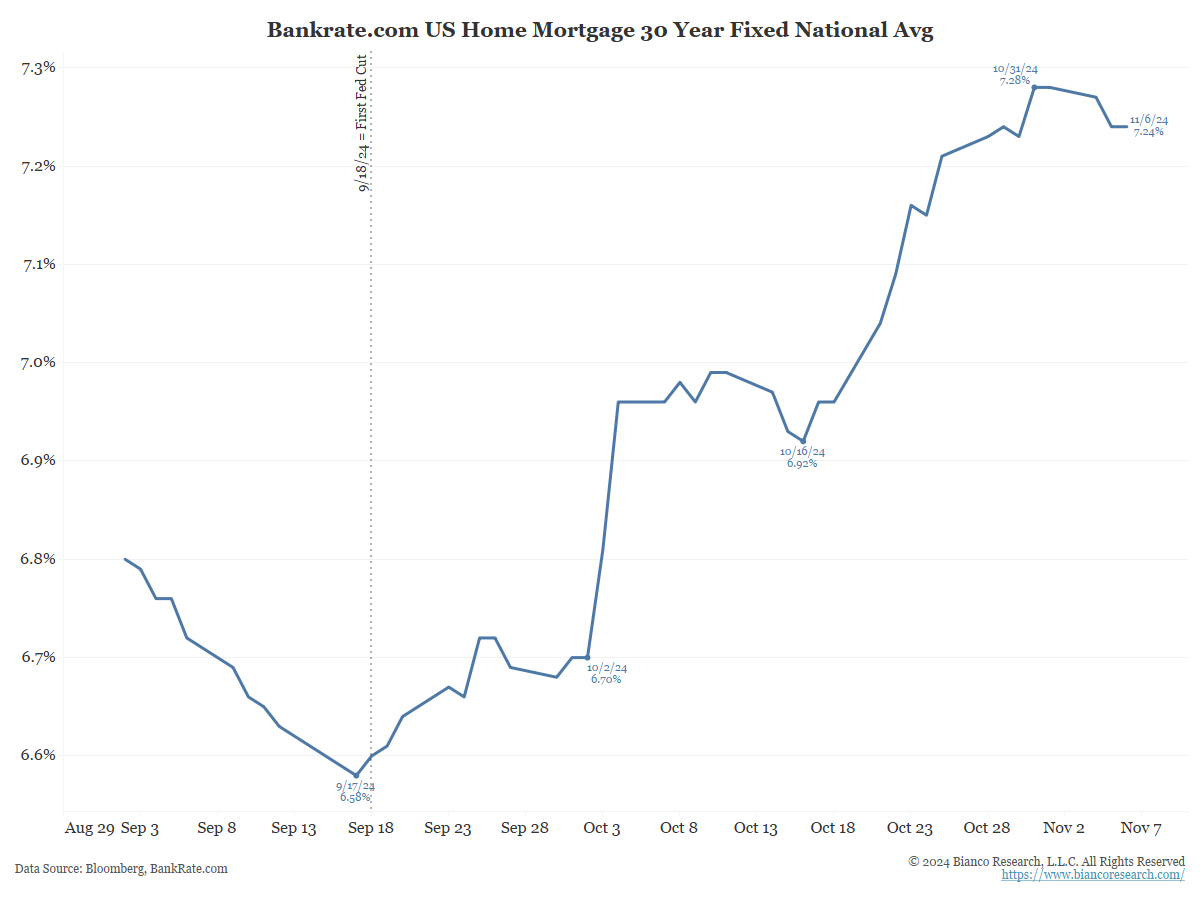

- Thursday’s UST 10y range: 4.31% – 4.45%, closing at 4.32%

Bloomberg: US Bond Yield Spike Sends Warning to ‘King of Debt’ Trump

As traders sent assets from stocks to the dollar rocketing on optimism that a second Trump administration would be good for business and stoke an already strong economy, investors in the $28 trillion US Treasury market sold bonds, driving yields to the highest in months.

Upcoming US Treasury Supply

Conference Call tomorrow, Friday, November 8th, featuring Jim Bianco

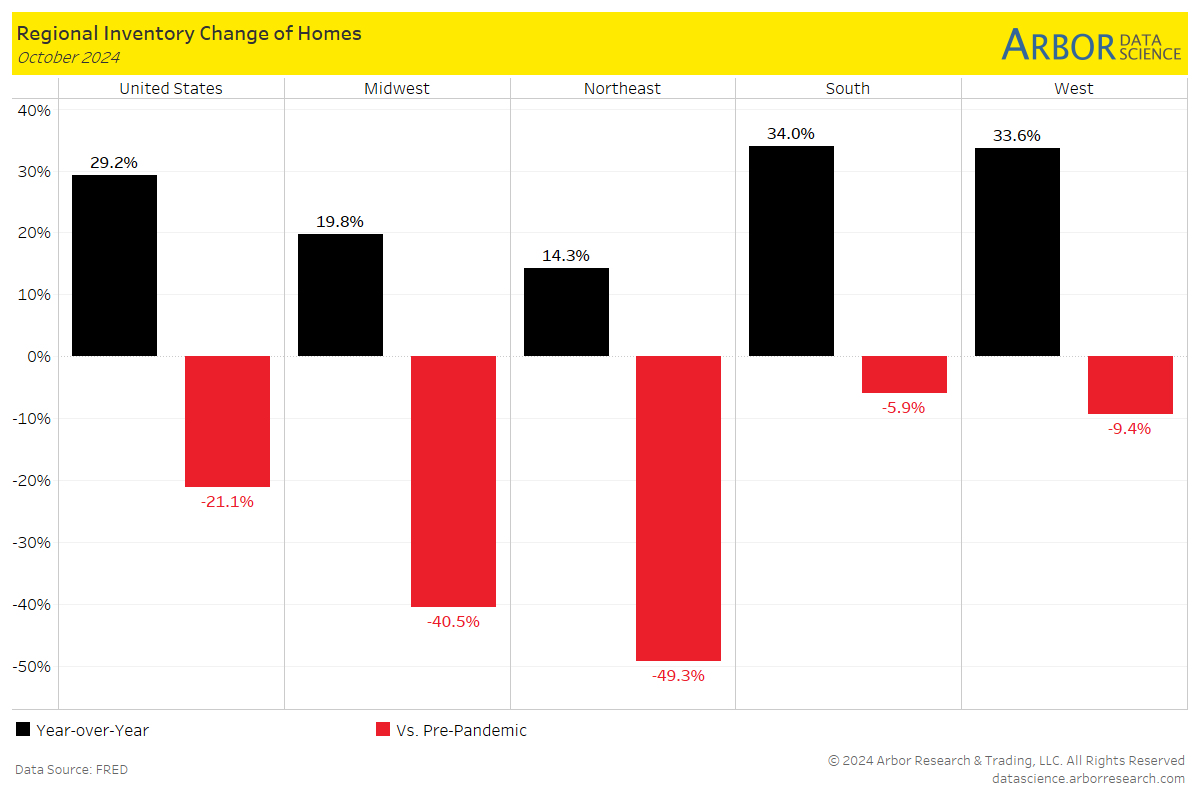

Arbor Data Science: U.S. Housing Inventory is On the Rise

The Mortgage Reports: October Housing Inventory Surged to 5-Year High

The double-edged sword of low affordability and low inventory has made house hunting a daunting task in recent times.

Intraday Commentary from Jim Bianco

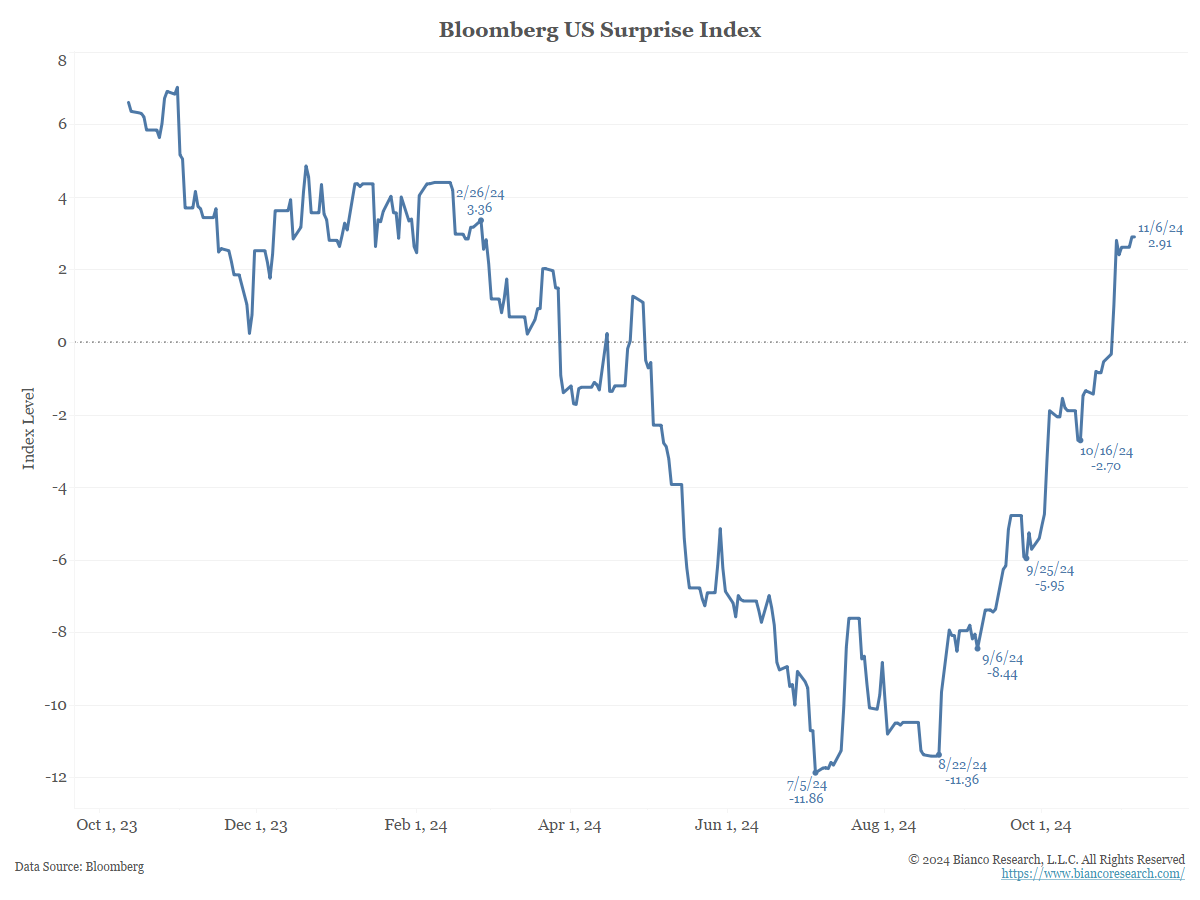

- Why did this happen?

2. Question 1 caused this. How is this helping?

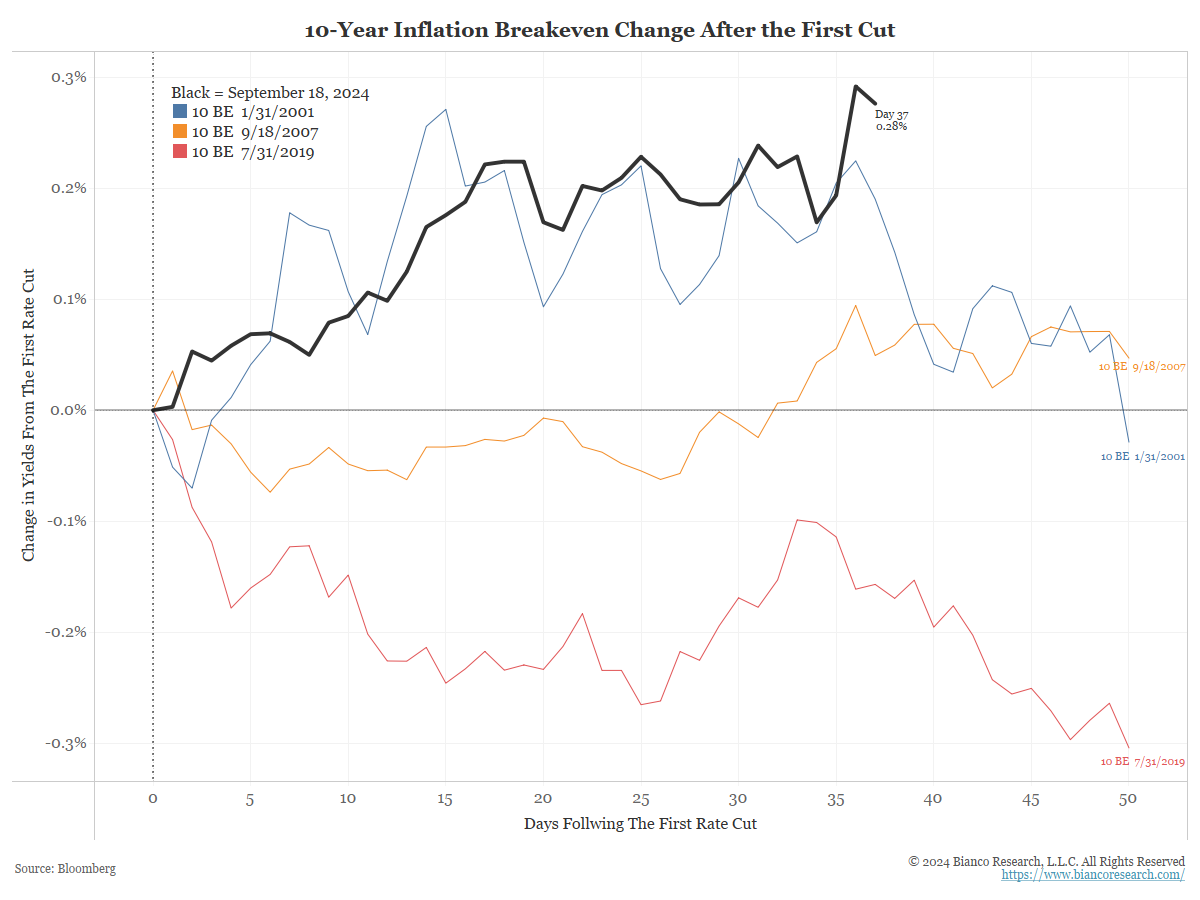

3. I know you think inflation has either been defeated or is about to be defeated. So, why did the market react this way after you cut in September?

4. You cut rates on concern the economy was slowing. Then this happened. So why keep cutting?

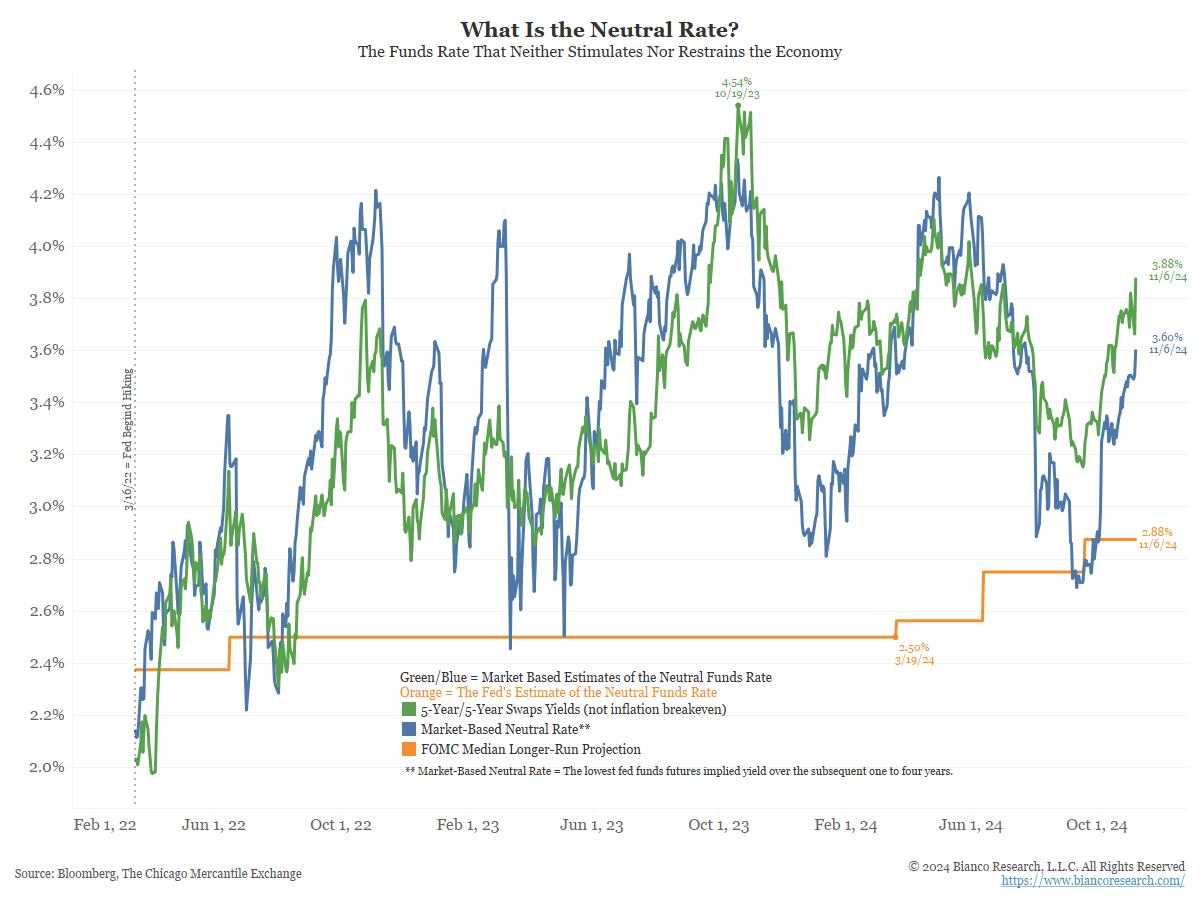

5. If you insist on cutting more. Where will you stop? Market measures of neutral (green and blue) think you are getting close to neutral. But the Fed’s neutral measure (orange) is hundreds of basis points away. So, where is neutral?

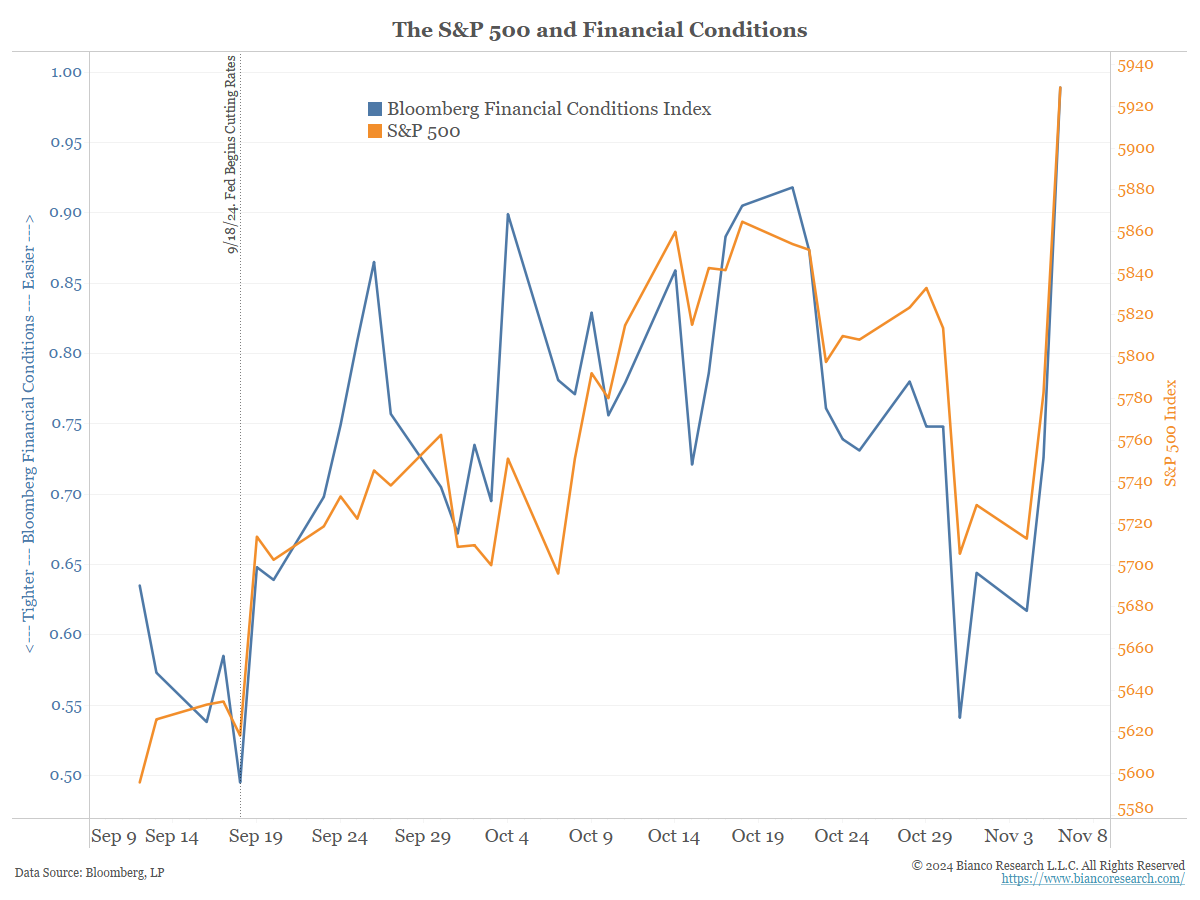

6. Since you cut rates in September, both financial conditions (blue) and the stock market (orange) have soared. Do you think this is enough? Why do we need more cuts to encourage even easier financial conditions?

In Other News…

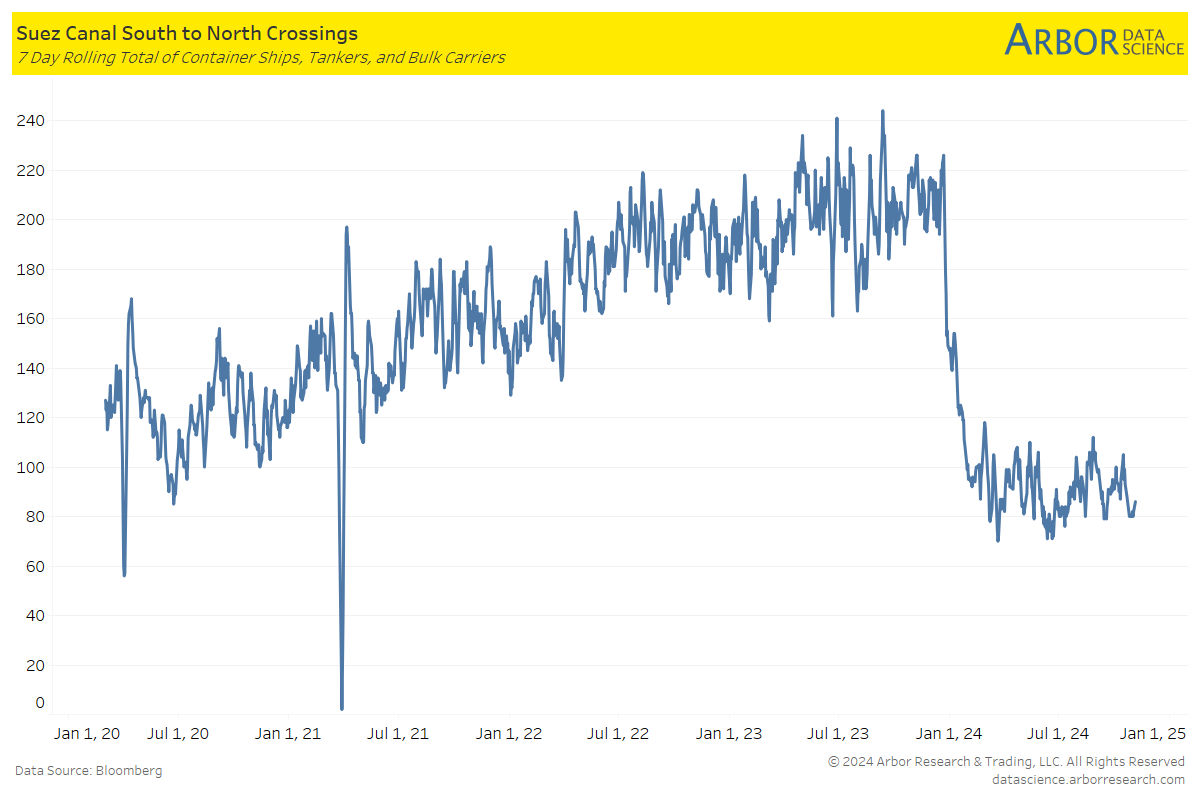

Sourcing Journal: A Year Later, Houthis Show No Sign of Curbing Red Sea Attacks

Any forthcoming return of container shipping to the Suez Canal seems even more unlikely.

Arbor Data Science: Global Supply Chain Update

Freightwaves: Reports claim Houthis make Red Sea vessel attacks a $2B business

Houthi rebels are extorting as much as $2 billion a year from shipping lines in exchange for not attacking their vessels in the Red Sea and Gulf of Aden, according to a new study.

TheLoadStar: Supply chain disruption costly for shippers, but helps build resilience, says Maersk

According to the maritime consultant, the Red Sea crisis has had a bigger impact on ship employment than Covid, “even more striking given the huge growth in the cellular fleet over the past four years”, it said.

Upcoming Economic Releases & Fed Speak

- 11/08/2024 at 10:00am EST: U. of Mich. Sentiment/Current Conditions/Expectations

- 11/08/2024 at 10:00am EST: U. of Mich. 1 Yr Inflation & U. of Mich. 5-10 Yr Inflation

- 11/08/2024 at 11:00am EST: Bowman Speaks on Banking Topics

- 11/08/2024 at 2:30pm EST: Musalem Gives Pre-Recorded Welcome Remarks

- 11/12/2024 at 6:00am EST: NFIB Small Business Optimism

- 11/12/2024 at 10:00am EST: Waller Speaks at Banking Conference

- 11/12/2024 at 10:15am EST: Barkin Speaks in Baltimore

- 11/12/2024 at 11:00am EST: NY Fed 1-Yr Inflation Expectations

- 11/12/2024 at 2:00pm EST: Senior Loan Officer opinion Survey on Bank Lending Practices

- 11/12/2024 at 5:00pm EST: Harker Speaks on Fintech, AI

- 11/12/2024 at 5:30pm EST: Barkin Repeats Speech, followed by Q&A

- 11/13/2024 at 7:00am EST: MBA Mortgage Applications

- 11/13/2024 at 8:30am EST: Real Avg. Hourly Earnings YoY & Real Avg. Weekly Earnings YoY

- 11/13/2024 at 8:30am EST: CPI MoM & CPI Ex Food and Energy MoM

- 11/13/2024 at 8:30am EST: CPI YoY & CPI Ex Food and Energy YoY

- 11/13/2024 at 8:30am EST: CPI Index NSA & CPI Core Index SA

- 11/13/2024 at 9:45am EST: Logan Gives Opening Remarks at Energy Conference

- 11/13/2024 at 1:00pm EST: Musalem Speaks on Economy, Monetary Policy

- 11/13/2024 at 1:30pm EST: Schmid Gives Keynote Remarks at Energy Conference

- 11/13/2024 at 2:00pm EST: Monthly Budget Statement

- 11/14/2024 at 8:30am EST: PPI Final Demand MoM & PPI Ex Food and Energy MoM

- 11/14/2024 at 8:30am EST: PPI Ex Food, Energy, Trade MoM & PPI Final Demand YOY

- 11/14/2024 at 8:30am EST: PPI Ex Food and Energy YoY & PPI Ex Food, Energy, Trade YoY

- 11/14/2024 at 8:30am EST: Initial Jobless Claims & Continuing Claims

- 11/14/2024 at 9:15am EST: Barkin Discusses Economy in Fireside Chat

- 11/14/2024 at 3:00pm EST: Powell Speaks at Event in Dallas

- 11/14/2024 at 4:15pm EST: Williams Speaks at NYFed Event