US Treasuries

- Friday’s UST 10y range: 4.26% – 4.34%, closing at 4.305%

Upcoming US Treasury Supply

Conference Call Replay – Markets and the Economy Post-Election/Fed

- Given the Fed’s 25 basis point cut in November, further rate cuts could result in the potential for overstimulation leading to inflation, especially given current fiscal and monetary policies.

- Inflation is not as anchored as the Fed suggests shown by the dispersion between mean and median inflation expectations. The mean suggests stability while the median suggests volatility.

- A significant upward revision in job numbers due to low response rates in surveys and the resolution of strikes is possible and could challenge the necessity of further rate cuts by the Fed.

- The bond market, not political action, will ultimately address the deficit issue, requiring significantly higher interest rates to force a change in spending behavior.

- The bond market now presents a competitive investment alternative to stocks due to higher yields, meaning bonds could offer returns comparable to stocks with less risk, which could shift investor prefer.

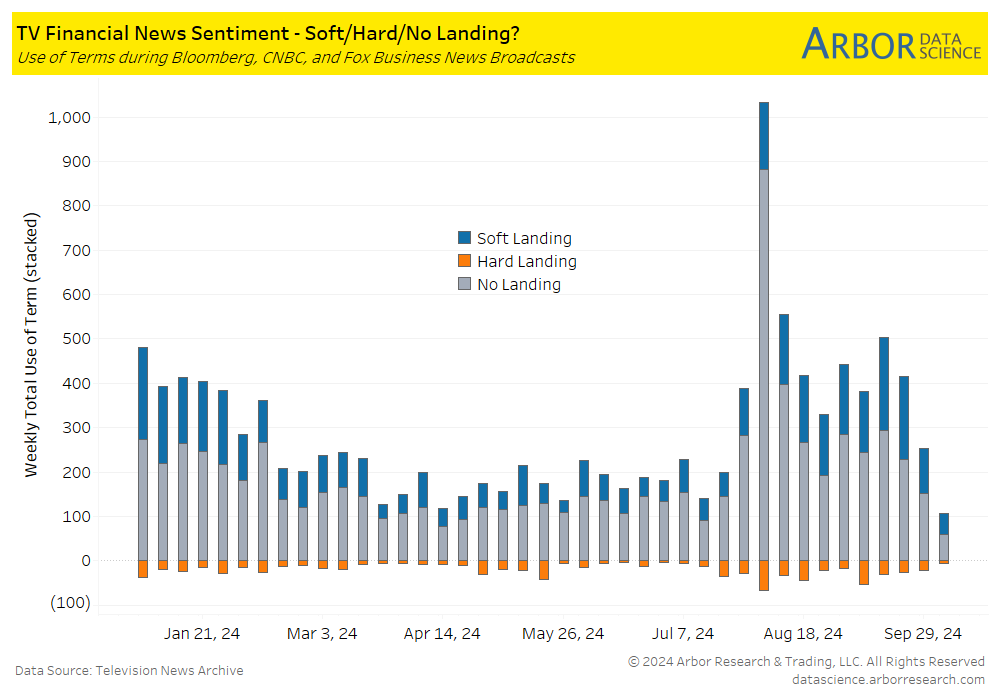

Arbor Data Science: Soft/Hard/No Landing or Balanced Language?

Bianco Research: The No-Landing Scenario Gains Steam

Intraday Commentary from Jim Bianco

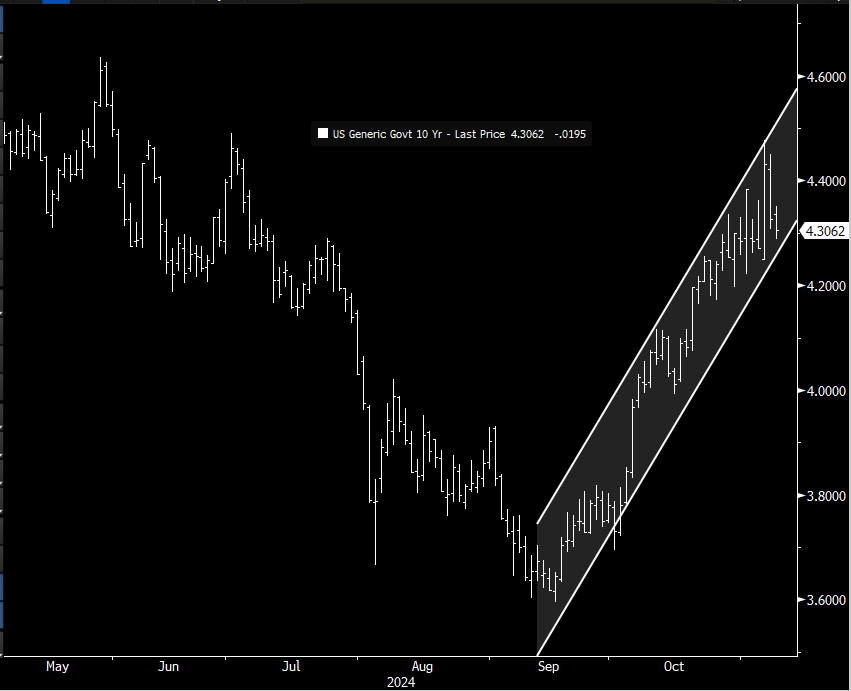

10-year yields with a trend channel drawn on it.

Yes, we have been having excitement this week. The 136 MOVE on Monday (a 13-month high) was a warning of volatility.

But stepping back from the excitement, the channel toward higher rates remains.

In Other News…

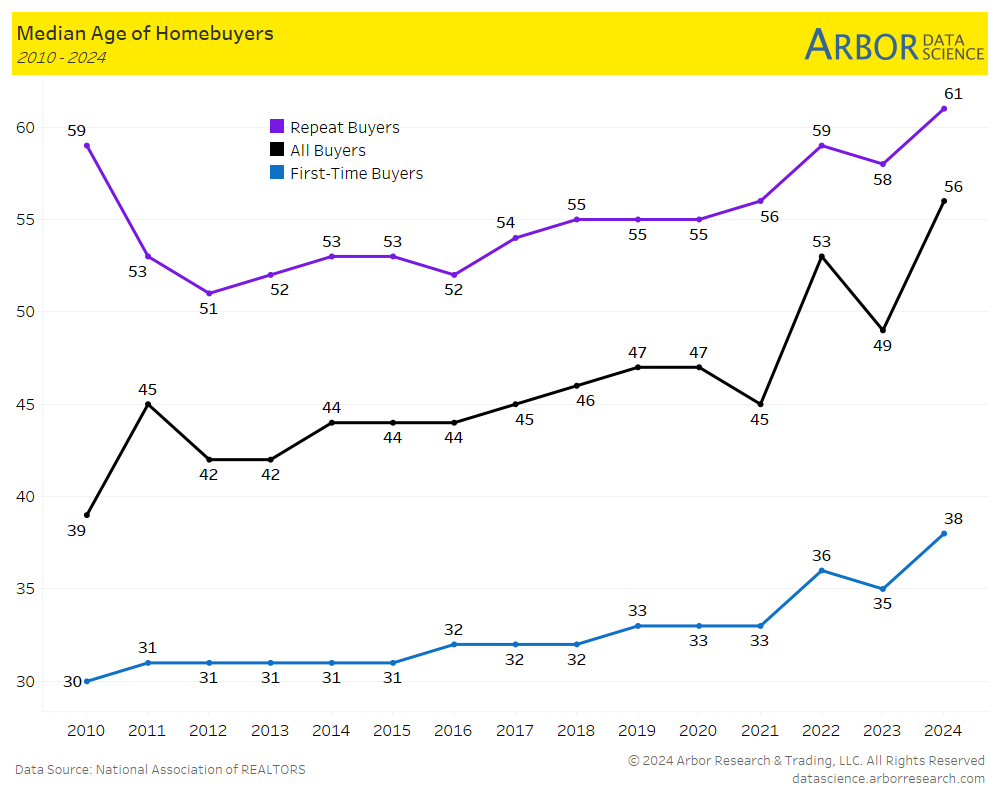

MPA: NAR: Worst of housing affordability crisis appears to be over

As mortgage rates slightly declined in the third quarter, monthly mortgage payments on a typical single-family home became a bit more affordable.

Arbor Data Science: Demographics of U.S. Homebuyers

Upcoming Economic Releases & Fed Speak

- 11/12/2024 at 6:00am EST: NFIB Small Business Optimism

- 11/12/2024 at 10:00am EST: Waller Speaks at Banking Conference

- 11/12/2024 at 10:15am EST: Barkin Speaks in Baltimore

- 11/12/2024 at 11:00am EST: NY Fed 1-Yr Inflation Expectations

- 11/12/2024 at 2:00pm EST: Senior Loan Officer opinion Survey on Bank Lending Practices

- 11/12/2024 at 2:00pm EST: Kashkari Speaks with Yahoo Finance

- 11/12/2024 at 5:00pm EST: Harker Speaks on Fintech, AI

- 11/12/2024 at 5:30pm EST: Barkin Repeats Speech, followed by Q&A

- 11/13/2024 at 7:00am EST: MBA Mortgage Applications

- 11/13/2024 at 8:30am EST: Real Avg. Hourly Earnings YoY & Real Avg. Weekly Earnings YoY

- 11/13/2024 at 8:30am EST: CPI MoM & CPI Ex Food and Energy MoM

- 11/13/2024 at 8:30am EST: CPI YoY & CPI Ex Food and Energy YoY

- 11/13/2024 at 8:30am EST: CPI Index NSA & CPI Core Index SA

- 11/13/2024 at 9:45am EST: Logan Gives Opening Remarks at Energy Conference

- 11/13/2024 at 1:00pm EST: Musalem Speaks on Economy, Monetary Policy

- 11/13/2024 at 1:30pm EST: Schmid Gives Keynote Remarks at Energy Conference

- 11/13/2024 at 2:00pm EST: Monthly Budget Statement

- 11/14/2024 at 8:30am EST: PPI Final Demand MoM & PPI Ex Food and Energy MoM

- 11/14/2024 at 8:30am EST: PPI Ex Food, Energy, Trade MoM & PPI Final Demand YOY

- 11/14/2024 at 8:30am EST: PPI Ex Food and Energy YoY & PPI Ex Food, Energy, Trade YoY

- 11/14/2024 at 8:30am EST: Initial Jobless Claims & Continuing Claims

- 11/14/2024 at 9:15am EST: Barkin Discusses Economy in Fireside Chat

- 11/14/2024 at 3:00pm EST: Powell Speaks at Event in Dallas

- 11/14/2024 at 4:15pm EST: Williams Speaks at NYFed Event

- 11/15/2024 at 8:30am EST: Empire Manufacturing & Retail Sales Advance MoM

- 11/15/2024 at 8:30am EST: Retail Sales Ex Auto MoM & Retail Sales Ex Auto and Gas

- 11/15/2024 at 8:30am EST: Retail Sales Control Group & Import Price Index MoM

- 11/15/2024 at 8:30am EST: Import Price Index ex Petroleum MoM & Import Price Index YoY

- 11/15/2024 at 8:30am EST: Export Price Index MoM & Export Price Index YoY

- 11/15/2024 at 9:15am EST: Industrial Production MoM & Capacity Utilization

- 11/15/2024 at 9:15am EST: Manufacturing (SIC) Production

- 11/15/2024 at 10:00am EST: Business Inventories