US Treasuries

- Treasury yields climbed higher (led by the long-end) after 30y Bond auction tailed by 1 bps

- Thursday’s range for UST 10y: 4.07% – 4.115%, closing at 4.11%

- Thursday’s range for UST 30y: 4.65% – 4.70%, closing at 4.70%

- Fed’s Daly: Approaches December Rate Call With ‘Open Mind’

- Fed’s Hammack: Says Interest Rates Should Still Weigh on Economy

- Fed’s Kashkari: Says Inflation Too High, Jobs Under Pressure

- Fed’s Musalem: Says Central Bank Must Lean Against Inflation

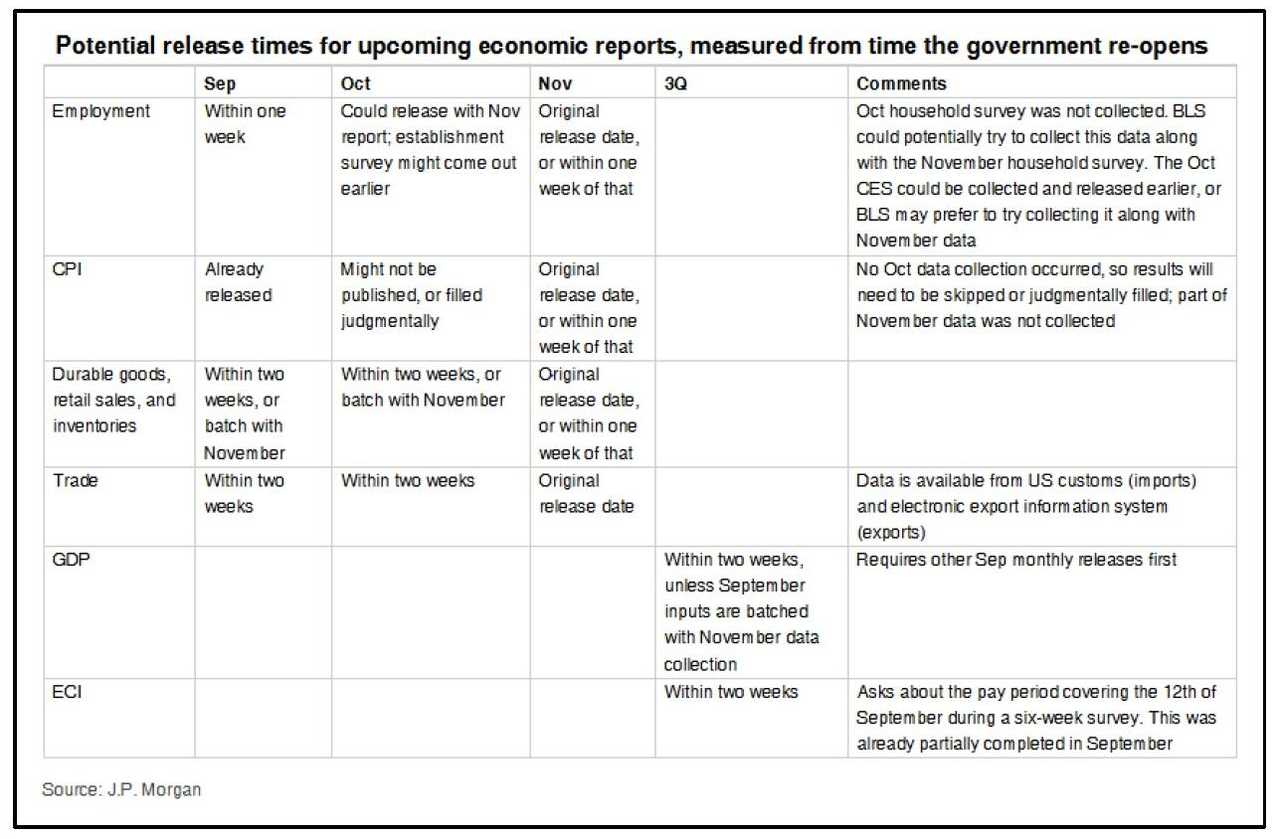

Bloomberg: October Jobs Report to Skip Unemployment Rate, Hassett Says

Conference Call Replay

Intraday Commentary From Jim Bianco

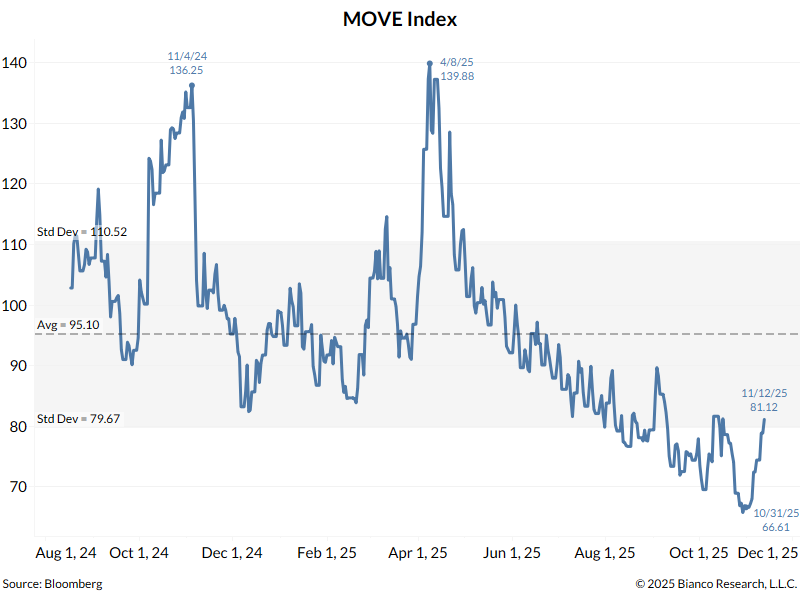

Is the bond market “waking up?” The MOVE was 66 on October 31, 81 yesterday.

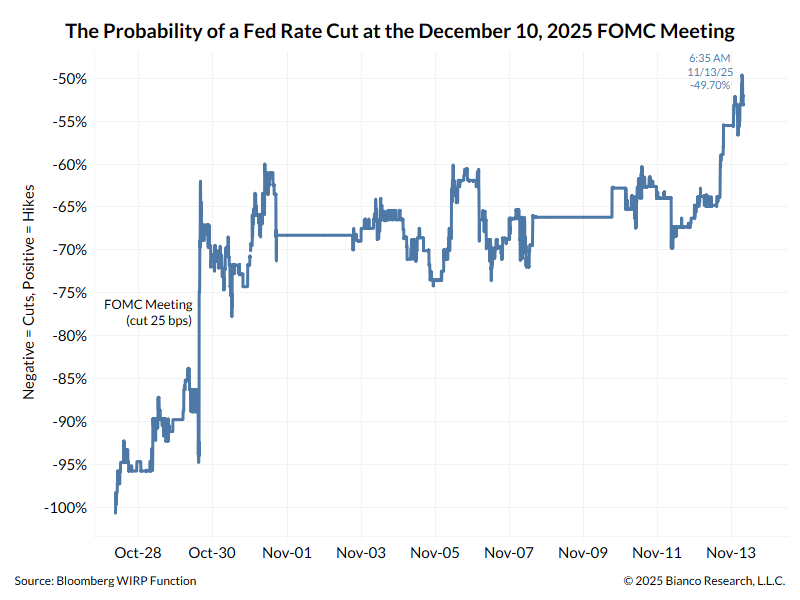

This might be helping raise bond volatility. Exactly 50/50 less than a month before the meeting. I’ll have to look, but seeing the probability of a Fed move exactly 50/50 less than a month before the meeting is unusual (rare). Usually, the issue is settled about what they are going to do this close the meeting.

In the News

OilPrice: IEA Warns Oil Glut Will Be Worse Than Expected

CNN Business: The Trump administration is ‘actively evaluating’ portable mortgages. What you need to know

Zillow: The Hidden Costs of Homeownership Top $16,000 a Year

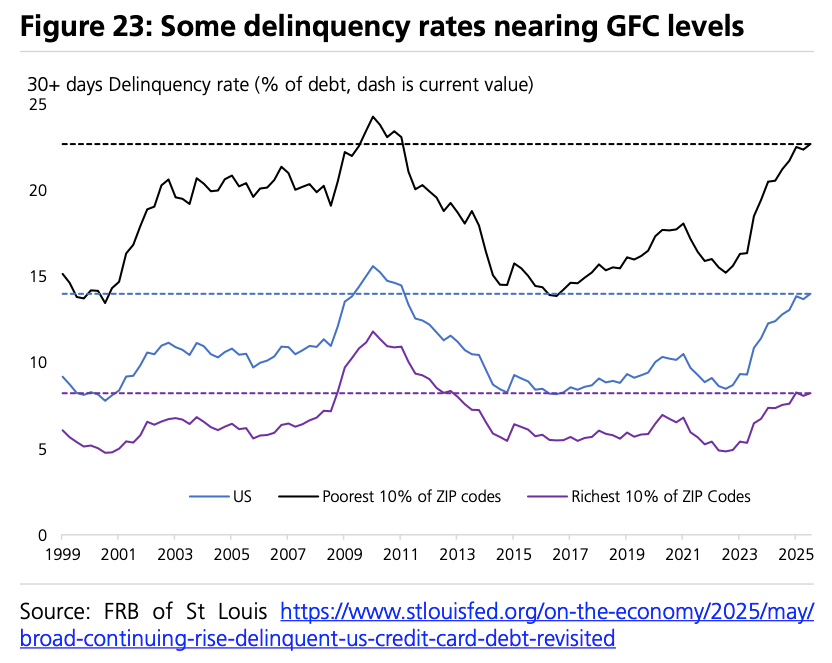

ZeroHedge: A Tale of Two Consumer Worlds – Captured In a Single Chart

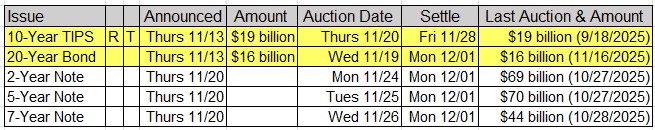

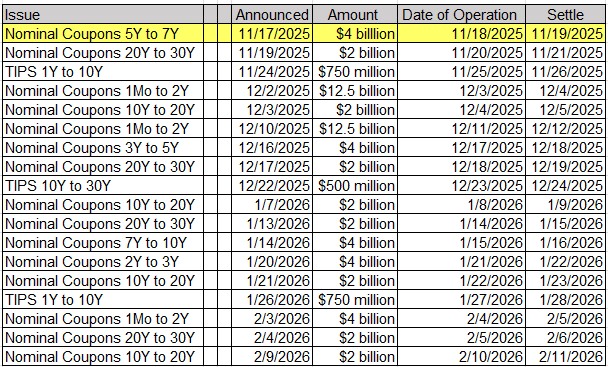

Upcoming US Treasury Supply