US Treasuries

- Friday’s range for UST 10y: 4.06% – 4.145%, closing at 4.14%

- Friday’s range for UST 30y: 4.665% – 4.75%, closing at 4.74%

- Fed’s Schmidt: Says More Cuts Could Drive Inflation Pressures

- Fed’s Logan: Says Modestly Restrictive Policy Still Appropriate

- Bloomberg: Economic Data Storm to Hit Treasury Market

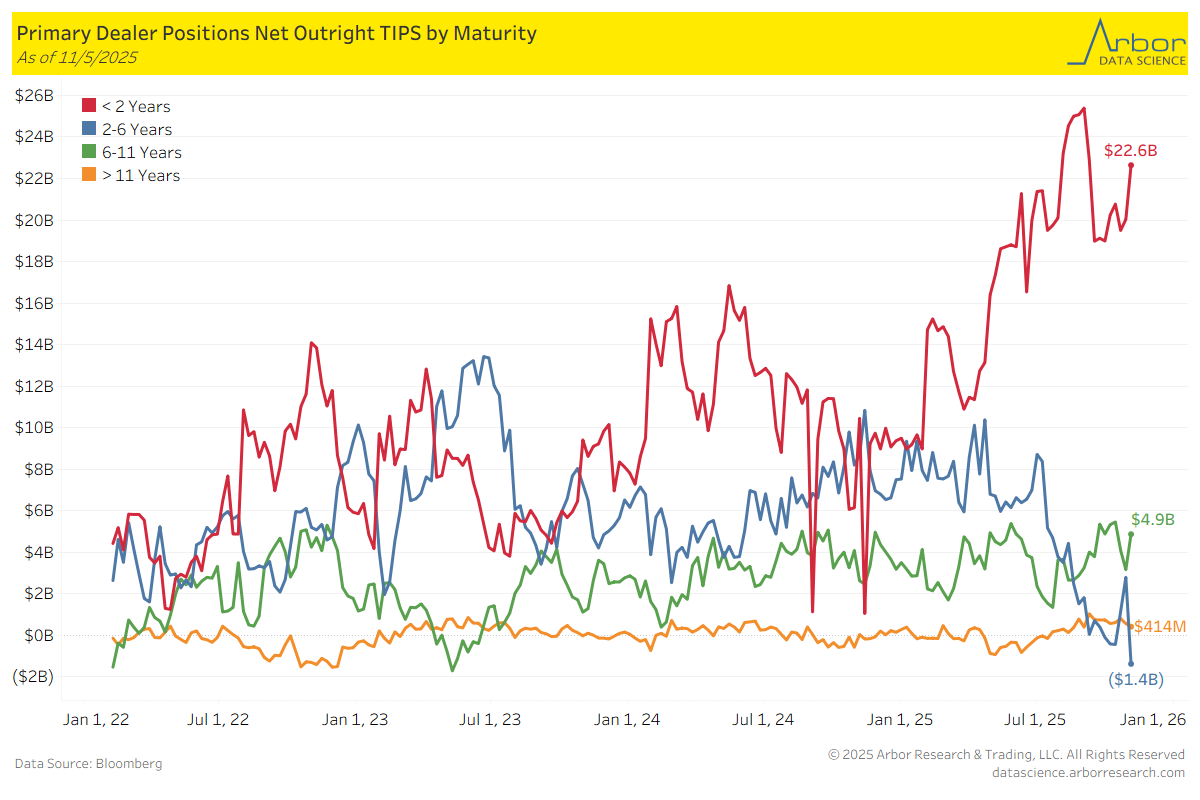

TIPS Returns by Maturity (data through 11/5/25)

Week over Week Changes by Maturity

- < 2 years: $20.0 Bn on 10/29/25 to $22.6 Bn on 11/5/2025 = $2.6 Bn

- 2 – 6 years: $2.8 Bn on 10/29/25 to ($1.4 Bn) on 11/5/2025 = ($4.2) Bn

- 6 – 11 years: $3.2 Bn on 10/29/25 to $4.9 Bn on 11/5/2025 = $1.7 Bn

- > 11 years: $561 Mn on 10/29/25 to $414 Mn on 11/5/2025 = ($147) Mn

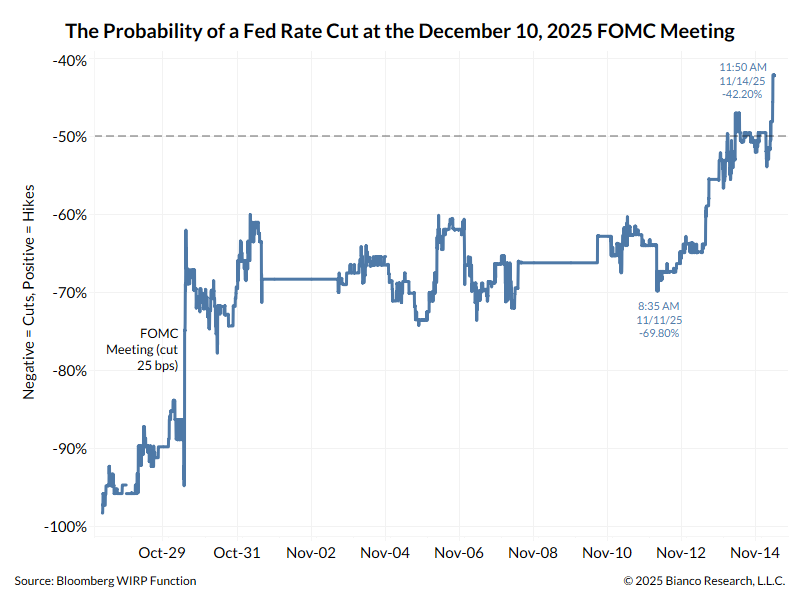

Intraday Commentary From Bianco Research

The market is concluding that “affordability” or inflation is a bigger problem than jobs. The probability that the Fed will cut rates at its December 10th meeting started the week at 70%. It is currently at 42% and still declining.

In the News

Bloomberg: JP Morgan Sees AI Boom Driving Record $1.8 Trillion Bond Sales in 2026

InsuranceBusiness: Amazon Insurance Store: Coming to a state near you?

ZeroHedge: Boeing Union Workers Approve New Contract, Ending 3-Month Strike

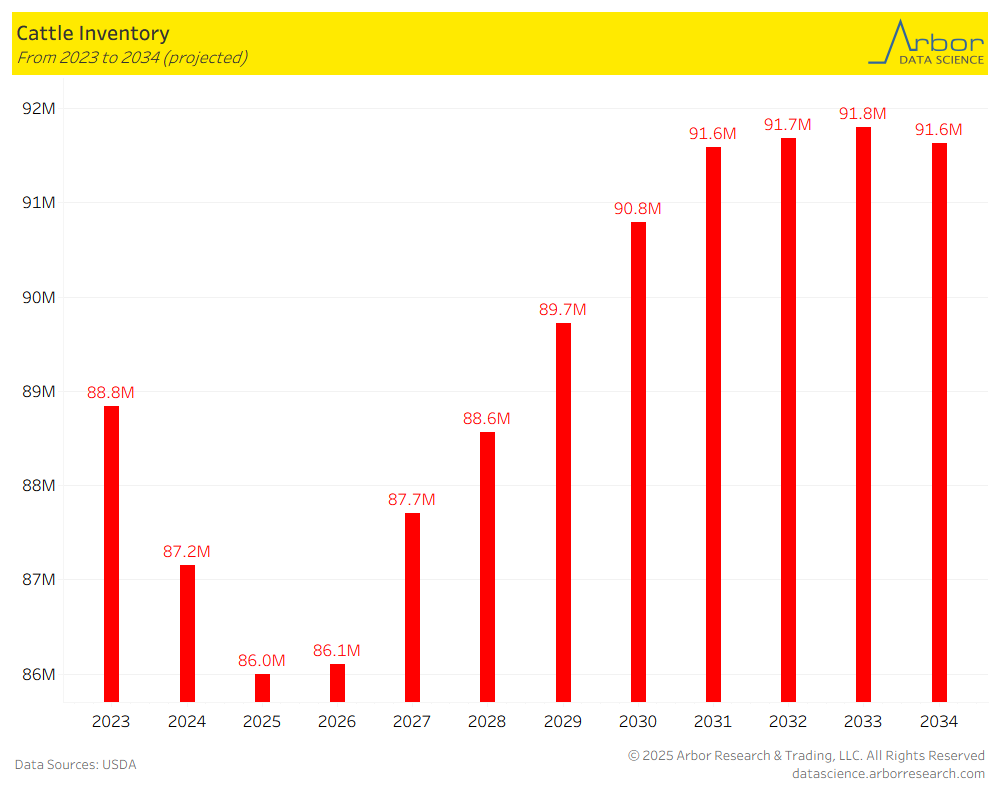

Bloomberg: Americans Just Can’t Get Enough Beef

Arbor Data Science: A Bump in Beef Prices

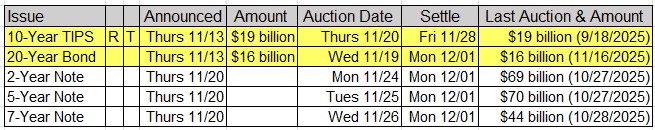

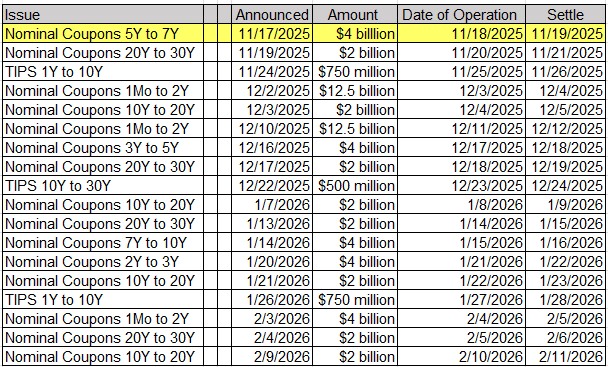

Upcoming US Treasury Supply