Download this Report to Print

US Treasuries

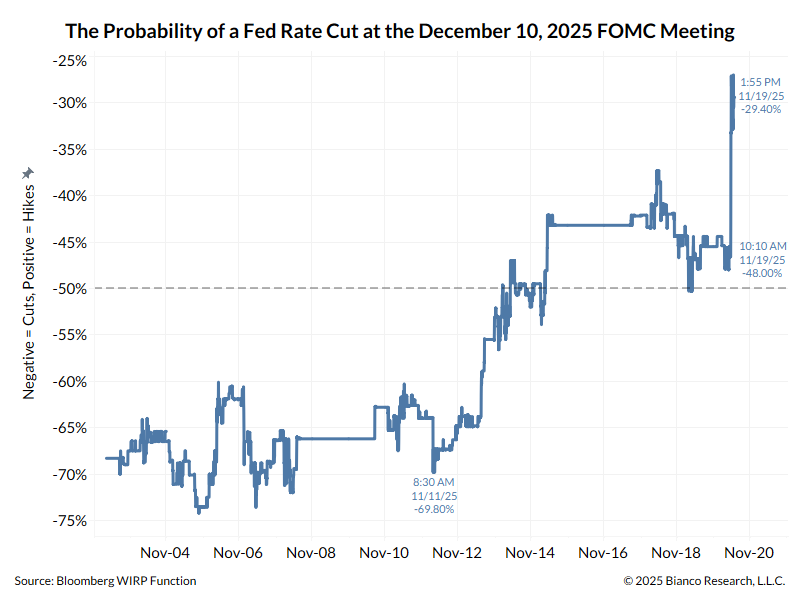

Treasury yields climbed higher after release of Hawkish FOMC minutes

Wednesday’s range for UST 10y: Wednesday’s range for UST 30y:

Tom orrow: Thursday, 11/20/25 at 08:30am EST: Nonfarm Payrolls Tom orrow: Thursday, 11/20/25 at 12:00pm EST: $19Bn 10y TIPS Auction (Reopening)

Jim Bianco : Reaction to the release of FOMC minutes:

Jim Bianco Joins Bloomberg Radio to discuss Sticky Inflation, Upcoming Data Releases & the K-Shaped Economy with Tom Keene & Paul Sweeney

Jim Bianco Joins MS Now to Discuss Trump Bets Big on AI

Intraday Commentary from Jim Bianco

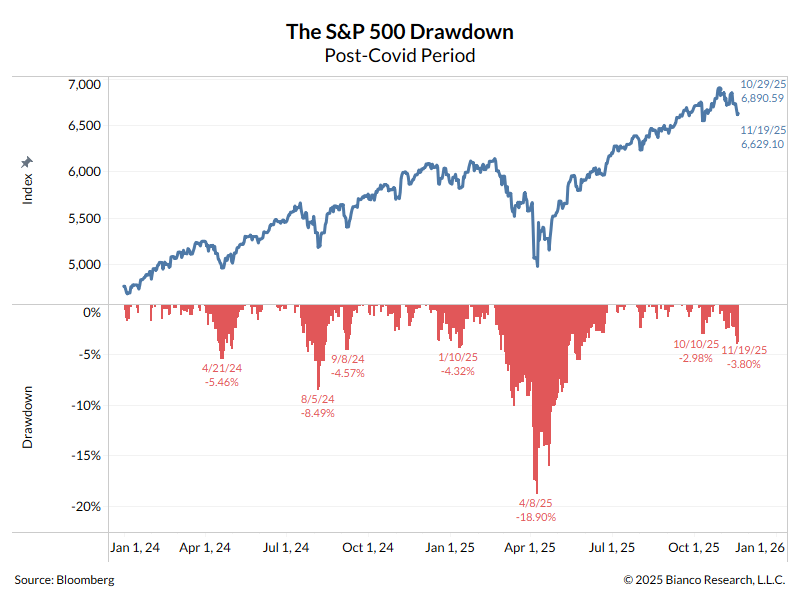

The correction in the stock market through yesterday’s close was 3.8% (bottom panel). Over the last two years there’s been five larger corrections.

Awful lot of bearishness for such a small pullback. It’s starting to feel like early April after the market got smashed post Liberation Day. But, that was a 19% correction and this one isn’t even 4%.

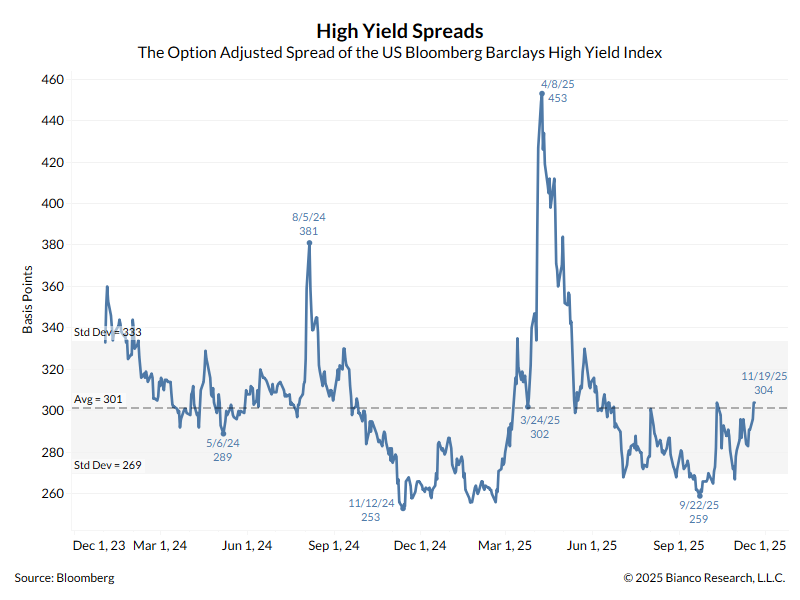

And here are High Yield spreads since Jan 1, 2024 (same period as above). I include it on the chart, the average for the period, and the shaded area is one standard deviation. Yes spreads have widened in the last couple weeks, but they are at their average of the last two years, and I don’t see them signaling stress in the credit markets.

Above is not to say that things can’t worsen from here forward, but this looks like a standard pullback… at least so far.

In the News

Bloomberg : Family Offices Hunt 2,900% Returns in Global Defense Tech Drive

OilPrice : Global Oil Demand Surged in September

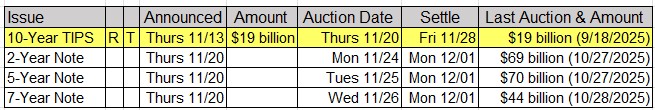

Upcoming US Treasury Supply

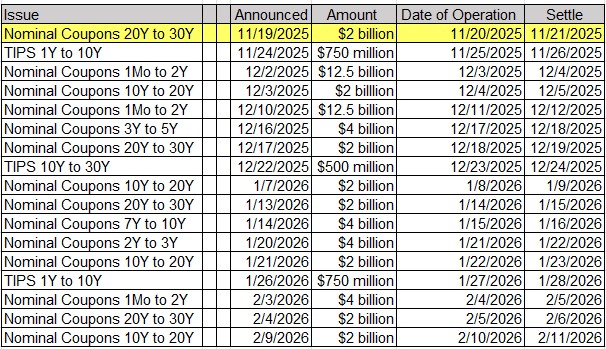

Tentative Schedule of Treasury Buyback Operations

Upcoming Economic Releases* & Fed Speak

*BLS SAYS IT WON’T PUBLISH OCT. JOBS REPORT *US NOV. JOBS REPORT RESCHEDULED FOR DEC. 16

11/20/2025 at 08:30am EST: Initial Jobless Claims / Continuing Claims / Change in Nonfarm Payrolls 11/20/2025 at 08:30am EST: Change in Private Payrolls / Change in Manufact. Payrolls 11/20/2025 at 08:30am EST: Nonfarm Payrolls 3-Mo Avg Change / Unemployment Rate 11/20/2025 at 08:30am EST: Labor Force Participation Rate / Average Hourly Earnings MoM & YoY 11/20/2025 at 08:30am EST: Underemployment Rate / Philadelphia Fed Business Outlook 11/20/2025 at 08:45am EST: Fed’s Hammack Delivers Opening Remarks 11/20/2025 at 09:30am EST: Fed’s Barr in Discussion on Artificial Intelligence 11/20/2025 at 10:00am EST: Existing Home Sales 11/20/2025 at 10:00am EST: Kansas City Fed Manf. Activity 11/20/2025 at 11:00am EST: Fed’s Cook Speaks on Financial Stability at Georgetown University 11/20/2025 at 01:40pm EST: Fed’s Goolsbee Speaks in Moderated Discussion in Indianapolis 11/20/2025 at 06:15pm EST: Fed’s Miran Speaks at American Investment Council 11/20/2025 at 06:45pm EST: Fed’s Paulson Speaks on Economic Outlook 11/21/2025 at 05:00am EST: Bloomberg Nov. United States Economic Survey 11/21/2025 at 07:30am EST: Fed’s Williams Delivers Keynote Speech 11/21/2025 at 08:30am EST: Real Avg Hourly Earnings YoY / Real Avg Weekly Earnings YoY 11/21/2025 at 08:30am EST: Fed’s Barr Gives Welcoming Remarks at the College Fed Challenge 11/21/2025 at 08:45am EST: Fed’s Jefferson Speaks on Financial Stability 11/21/2025 at 09:00am EST: Fed’s Logan Speaks at Conference in Switzerland 11/21/2025 at 09:45am EST: S&P Global US Manufacturing PMI / Services PMI/ Composite PMI 11/21/2025 at 10:00am EST: U of Mich Sentiment / Current Conditions / Expectations 11/21/2025 at 10:00am EST: U of Mich 1 Yr Inflation / 5 – 10 Yr Inflation 11/24/2025 at 08:30am EST: Chicago Fed Nat Activity Index 11/24/2025 at 10:30am EST: Dallas Fed Manf. Activity 11/24/2025 at 10:30am EST: Fed Releases Annual Revision to Industrial Production 11/25/2025: Retail Sales 11/25/2025 at 08:30am EST: Philadelphia Fed Non-Manufacturing Activity 11/25/2025 at 08:30am EST: PPI Final Demand MoM / POPI Ex Food and Energy MoM 11/25/2025 at 08:30am EST: PPI Ex Food, Energy, Trade MoM, PPI Final Demand YoY 11/25/2025 at 08:30am EST: PPI Ex Food and Energy YoY, PPI Ex Food, Energy, Trade YoY 11/25/2025 at 09:00am EST: FHFA House Price Index MoM 11/25/2025 at 09:00am EST: House Price Purchase Index QoQ 11/25/2025 at 09:00am EST: S&P Cotality CS 20-City MoM SA / YoY NSA / US HPI YoY HSA 11/25/2025 at 10:00am EST: Richmond Fed Manufact. Index / Business Conditions 11/25/2025 at 10:00am EST: Conf. Board Consumer Confidence / Present Situation / Expectations 11/25/2025 at 10:00am EST: Pending Home Sales MoM / NSA YoY 11/25/2025 at 10:30am EST: Dallas Fed Services Activity 11/26/2025 at 07:00am EST: MBA Mortgage Applications 11/26/2025 at 08:30am EST: Initial Jobless Claims / Initial Claims 4-Wk Moving Avg / Continuing Claims 11/26/2025 at 08:30am EST: GDP Annualized QoQ 11/26/2025 at 08:30am EST: Personal Consumption 11/26/2025 at 08:30am EST: GDP Price Index / Core PCE Price Index QoQ 11/26/2025 at 09:45am EST: MNI Chicago PMI 11/26/2025 at 02:00pm EST: Fed Releases Beige Book

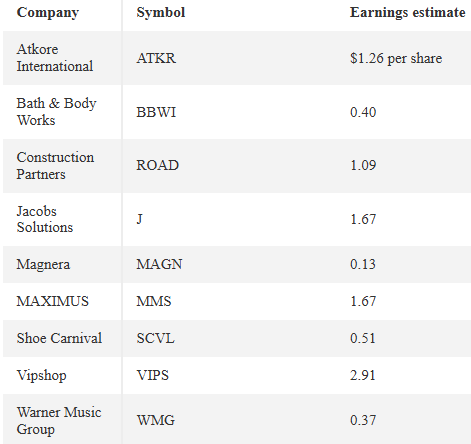

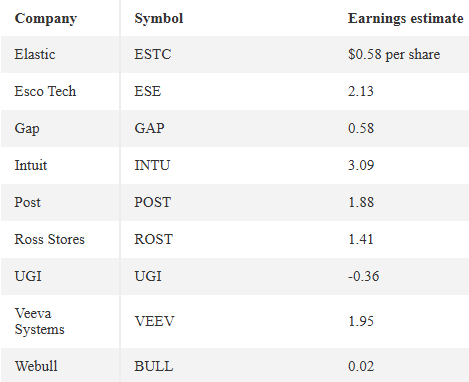

Upcoming Earnings Releases for Thursday, November 20, 2025

Before the Open

After the Close