US Treasuries

- Thursday’s UST 10y range: 4.37% – 4.435%, closing at 4.43%

Upcoming US Treasury Supply

From our Arbor Data Science Desk:

In Other News…

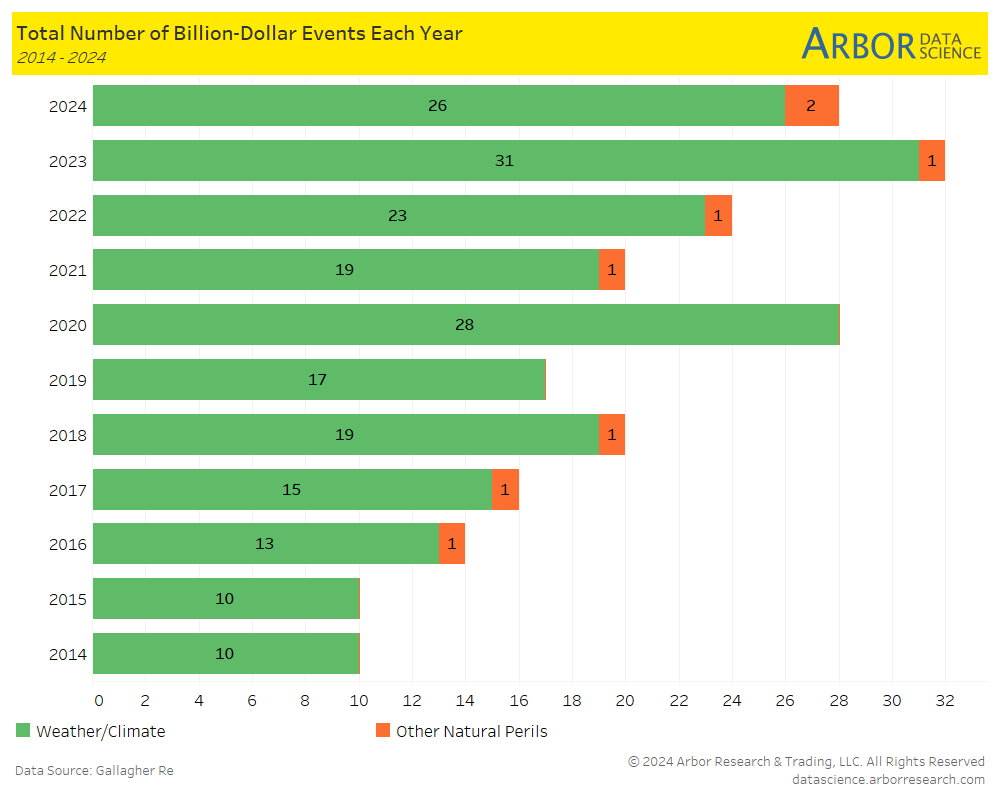

Insurance Business Mag: Natural disasters drive premium hikes for 2025 renewals – Faris Re

The 2025 reinsurance renewal season is approaching, with several factors influencing the market landscape. Economic fluctuations, natural catastrophe trends, regulatory changes, and evolving risk profiles are key elements shaping discussions between insurers and reinsurers.

CBS12: Home sales in West Palm Beach drop 13.8% as natural disasters impact Florida cities

Pending home sales in West Palm Beach dropped by 13.8% year over year during the four weeks ending November 10. This decline is part of a broader trend affecting several major cities in Florida, including Fort Lauderdale, Miami, Jacksonville, and Tampa.

Arbor Data Science:

gCaptain: Container Shipping Industry Sees Exponential Profit Surge Driven by Red Sea Situation

The container shipping industry has experienced a remarkable turnaround in the third quarter of 2024, with total net income soaring to $26.8 billion, marking a staggering 164% increase from the previous quarter, according to renowned industry analyst John McCown.

Freightwaves: Port of LA whittles dwell time despite record container volumes

“We are seeing a resilient consumer and an overall strong economy,” said Seroka, adding that some shippers in October chose Los Angeles for discretionary cargo to avoid labor disruptions at East Coast ports. He also said volumes benefited from more direct trans-Pacific services by ocean carriers.

Upcoming Economic Releases & Fed Speak

- 11/22/2024 at 9:00am EST: Bloomberg Nov. United States Economic Survey

- 11/22/2024 at 9:45am EST: S&P Global US Manufacturing PMI & S&P Global US Services PMI & S&P Global US Composite PMI

- 11/22/2024 at 10:00am EST: U. of Mich. Sentiment & U. of Mich. Current Conditions & U. of Mich. Expectations

- 11/22/2024 at 10:00am EST: U. of Mich. 1 Yr Inflation & U. of Mich. 5-10 Yr Inflation

- 11/22/2024 at 11:00am EST: Kansas City Fed Services Activity

- 11/22/2024 at 6:15pm EST: Bowman Speaks on AI

- 11/25/2024 at 8:30am EST: Chicago Fed Nat Activity Index

- 11/25/2024 at 10:30am EST: Dallas Fed Manf. Activity

- 11/26/2024 at 8:30am EST: Philadelphia Fed Non-Manufacturing Activity

- 11/26/2024 at 9:00am EST: FHFA House Price Index MoM & House Price Purchase Index QoQ

- 11/26/2024 at 9:00am EST: S&P CoreLogic CS 20-City MoM SA & S&P CoreLogic CS 20-City YoY NSA & S&P CoreLogic CS US HPI YoY NSA

- 11/26/2024 at 10:00am EST: New Home Sales & New Home Sales MoM

- 11/26/2024 at 10:00am EST: Conf. Board Consumer Confidence & Conf. Board Present Situation & Conf. Board Expectations

- 11/26/2024 at 10:00am EST: Richmond Fed Manufact. Index & Richmond Fed Business Conditions

- 11/26/2024 at 10:30am EST: Dallas Fed Services Activity

- 11/26/2024 at 2:00pm EST: FOMC Meeting Minutes

- 11/27/2024 at 7:00am EST: MBA Mortgage Application

- 11/27/2024 at 8:30am EST: GDP Annualized QoQ & Personal Consumption

- 11/27/2024 at 8:30am EST: GDP Price Index & Core PCE Price Index QoQ

- 11/27/2024 at 8:30am EST: Advance Goods Trade Balance & Wholesale Inventories MoM & Retail Inventories MoM

- 11/27/2024 at 8:30am EST: Durable Goods Orders & Durables ex Transportation

- 11/27/2024 at 8:30am EST: Cap Goods Orders Nondef Ex Air & Cap Goods Ship Nondef Ex Air

- 11/27/2024 at 8:30am EST: Initial Jobless Claims & Continuing Claims

- 11/27/2024 at 10:00am EST: Personal Income & Personal Spending & Real Personal Spending

- 11/27/2024 at 10:00am EST: PCE Price Index MoM & PCE Price Index YoY

- 11/27/2024 at 10:00am EST: Core PCE Price Index MoM & Core PCE Price Index YoY

- 11/27/2024 at 10:00am EST: Pending Home Sales MoM & Pending Home Sales NSA YoY

- 11/29/2024 at 9:45am EST: MNI Chicago PMI

Dealer Positions ($’s in millions of dollars)

- Dealer positions in T-Bills (as of 11/06) were down 2.71ln @33.90bln

- Dealer positions <2yrs TIPS (as of 11/06) were up 4.30mln @10.44bln.

- Dealer positions in 2-6yrs TIPS (as of 11/06) were down 468mln @8.66bln.

- Dealer positions in 6-11yrs TIPS (as of 11/06) were down 1.45bln @2.62bln.

- Dealer positions > 11yrs TIPS (as of 11/06) were up 615mln @37mln.

- Dealer positions in < 2yrs Coupons (as of 11/06) were up 4.72bln @28.28bln.

- Dealer positions > 2yrs and < 3yrs Coupons (as of 11/06) were up 571mln @18.36bln.

- Dealer positions in > 3 years and< 6yrs Coupons (as of 11/06) were down 7.73bln @55.43bln.

- Dealer positions > 6yrs and < 7yrs Coupons (as of 11/06) were down 955mln @16.29bln.

- Dealer positions in > 7 years and< 11yrs Coupons (as of 11/06) were up1.15bln @26.81bln.

- Dealer positions > 11yrs and < 21yrs Coupons (as of 11/06) were up 369mln @21.91bln.

- Dealer positions in > 21 years Coupons (as of 11/06) were up 1.55bln @28.65bln.