US Treasuries

- Friday’s range for UST 10y: 4.03% – 4.09%, closing at 4.06%

- UST 10y range for the week: 4.03% – 4.16%

- Friday’s range for UST 30y: 4.68% – 4.73%, closing at 4.71%

- UST 30y range for the week: 4.685% – 4.77%

- Fed’s Williams: Sees Rooms for an Interest-Rate Cut in “Near Term’

- Fed’s Collins: Signals Current Rates Are ‘Appropriate for Now’

- Fed’s Miran: Says He’d Vote for 25-Bp Cut If It Were the Marginal Vote

- Fed’s Jefferson: Sees Contrasts Between AI Rise and Dot-Com Boom

- Fed’s Logan: Repeats Call for Moving Slowly on Further Rate Cuts

Bloomberg: BLS Axes October CPI Report, Sets Dec. 18 for November Data

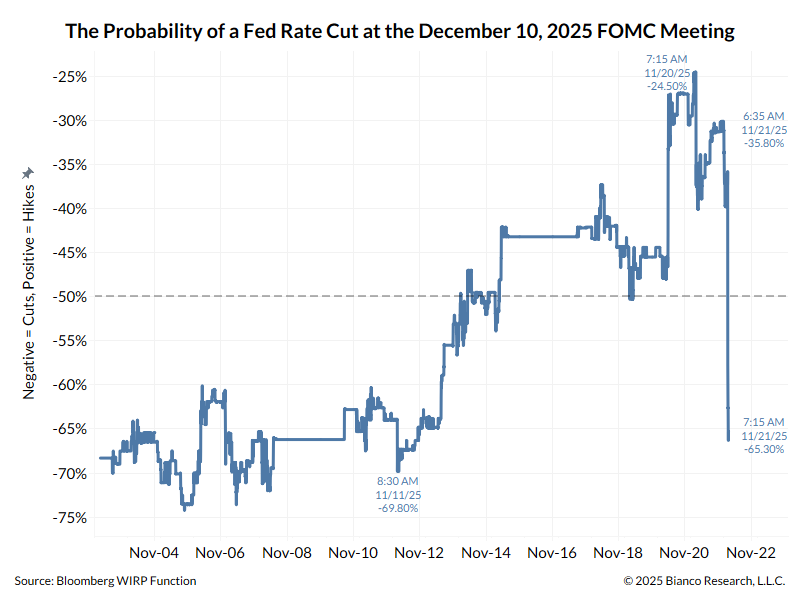

Intraday Commentary from Jim Bianco

Massive reversal in the last 30 minutes on this headline:

*FED’S WILLIAMS STILL SEES ROOM FOR A NEAR-TERM RATE CUT

Here are the headlines from the Fed Speak yesterday:

- Fed’s Goolsbee Says Uneasy ‘Front Loading’ Cuts Amid Inflation

- Fed Fractures Deepen as Barr Signals Inflation

- Fed’s Paulson Says She’s Cautious on December Rate Decision

Updating the Fed speak the last few weeks:

- 5 Voters have strongly signaled they do not want to cut rates (Barr, Musalem, Schmid, Goolsbee, Collins)

- 5 Voters signaled they want to cut rates (Miran, Waller, Bowman, Williams, Cook)

- 2 Voters are unknown (Powell and Jefferson)

If the Fed is truly becoming independent, then it should be a 7-5 vote … either way.

—

If they cave and vote 11-1 or 10-2 (without a stock market crash), the FOMC members who are not the Fed chairman will wreck their reputations. In this case, you can replace them with summer interns.

—

If they cave and vote 11-1 or 10-2 (without a stock market crash), the FOMC members who are not the Fed chairman will wreck their reputations. In this case, you can replace them with summer interns.

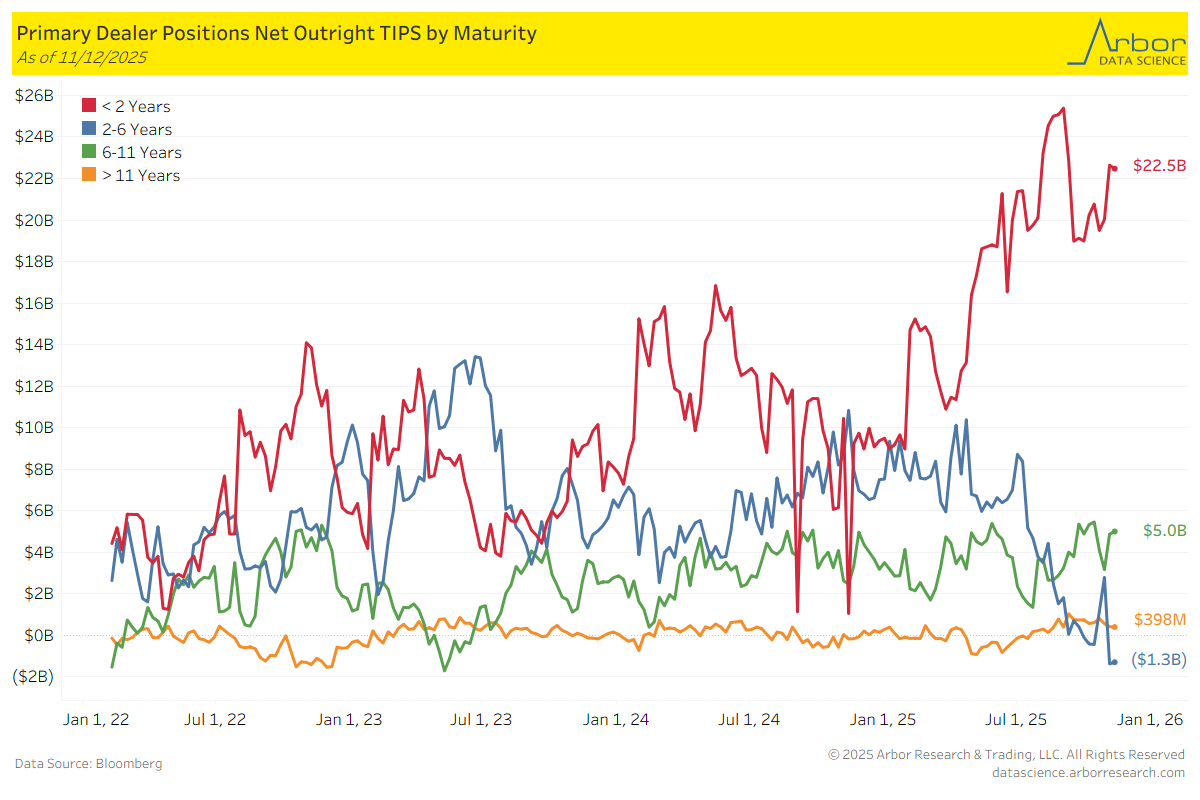

TIPS Returns by Maturity (data through 11/12/25)

Week over Week Changes by Maturity

- < 2 years: $22.6 Bn on 11/5/25 to $22.5 Bn on 11/12/2025 = ($0.1 Bn)

- 2 – 6 years: ($1.4 Bn) on 11/5/25 to ($1.3 Bn) on 11/12/2025 = $0.1 Bn

- 6 – 11 years: $4.9 Bn on 11/5/25 to $5.0 Bn on 11/12/2025 = $0.1 Bn

- > 11 years: $414 Mn on 11/5/25 to $398 Mn on 11/12/2025 = ($16) Mn

In the News

OilPrice: New U.S. Sanctions Could Leave 48 Million Barrels of Russian Oil Adrift at Sea

Redfin News: U.S. Luxury Home Prices Jump 5.5% in October, Triple the Pace of Non-Luxury Homes

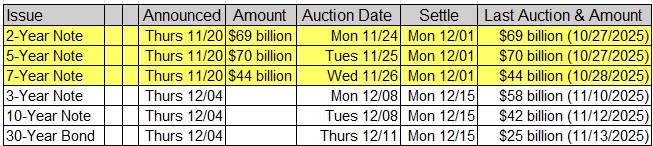

Upcoming US Treasury Supply

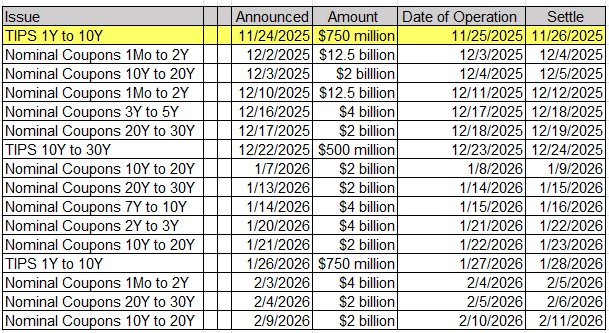

Tentative Schedule of Treasury Buyback Operations