US Treasuries

- Tuesday’s UST 10y range: 4.27% – 4.32%, closing at 4.30%

Upcoming US Treasury Supply

- $44 Billion 7y Note Auction, Wednesday, 11/27/24

Tentative Schedule of Treasury Buyback Operations

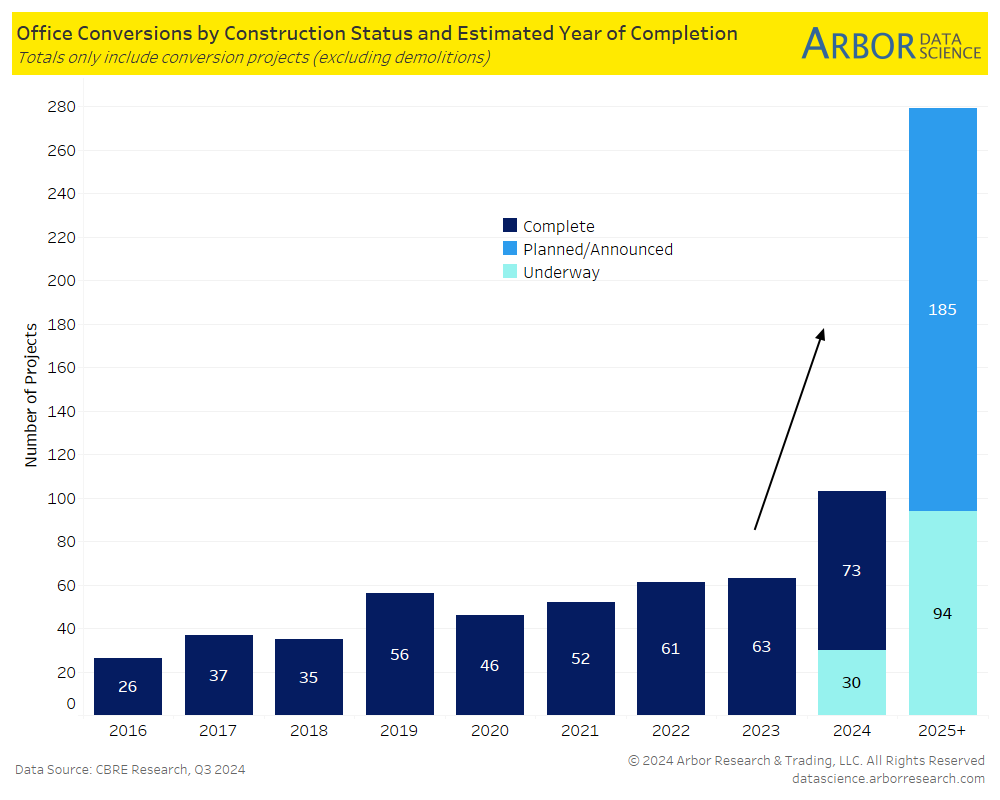

From our Arbor Data Science Desk: Office Conversion into Other Uses Trends Higher in 2025

WSJ: Office Conversions Find New Life After Property Values Plunge

Office conversions into residential buildings are gaining traction as office vacancy rates rise and property values plunge, making the economics of conversions more viable.

In Other News…

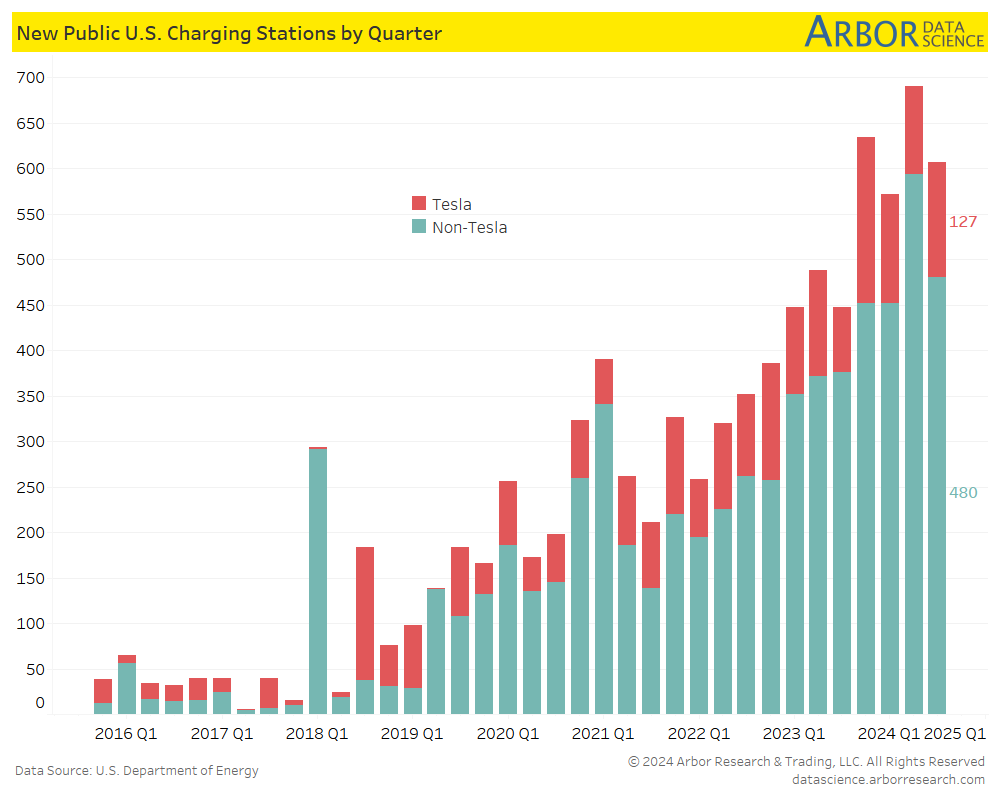

The Berkshire Eagle: Installing EV chargers are starting to pay off for retailers

“Companies are beginning to see charging as something that can potentially help the bottom line,” said Graham Evans, a director at S&P Global Mobility, an automotive market research firm. “It’s going to become more ubiquitous rather than a token gesture.”

Arbor Data Science: The Growth of EVs by Petr Pinkhasov

SupplyChainBrain: Amazon Workers to Strike or Protest Worldwide on Black Friday

Amazon is bracing for thousands of workers in more than 20 countries to protest or strike in more than 20 countries around Black Friday, the day after the Thanksgiving holiday in the U.S. that has become a big day for online retail sales promotions.

Fox Business: Service workers at Charlotte airport go on strike ahead of possible record Thanksgiving travel

Service workers at Charlotte Douglas International Airport (CLT) in Charlotte, North Carolina, went on strike Monday morning after an overnight vote in favor of the move, which comes as the Transportation Security Administration says there may be record Thanksgiving travel this year.

Data Center expansion continues….

GovTech: $2B+ in Data Center Projects Planned for Merrillville, Ind.

As people gobble up more and more data via scrolling, streaming and shopping online, developers plan to pour more than $2 billion into data centers in Merrillville.

Upcoming Economic Releases & Fed Speak

- 11/27/2024 at 7:00am EST: MBA Mortgage Application

- 11/27/2024 at 8:30am EST: GDP Annualized QoQ & Personal Consumption

- 11/27/2024 at 8:30am EST: GDP Price Index & Core PCE Price Index QoQ

- 11/27/2024 at 8:30am EST: Advance Goods Trade Balance & Wholesale Inventories MoM & Retail Inventories MoM

- 11/27/2024 at 8:30am EST: Durable Goods Orders & Durables ex Transportation

- 11/27/2024 at 8:30am EST: Cap Goods Orders Nondef Ex Air & Cap Goods Ship Nondef Ex Air

- 11/27/2024 at 8:30am EST: Initial Jobless Claims & Continuing Claims

- 11/27/2024 at 9:45am EST: MNI Chicago PMI

- 11/27/2024 at 10:00am EST: Personal Income & Personal Spending & Real Personal Spending

- 11/27/2024 at 10:00am EST: PCE Price Index MoM & PCE Price Index YoY

- 11/27/2024 at 10:00am EST: Core PCE Price Index MoM & Core PCE Price Index YoY

- 11/27/2024 at 10:00am EST: Pending Home Sales MoM & Pending Home Sales NSA YoY

- 12/02/2024 at 9:45am EST: S&P Global US Manufacturing PMI

- 12/02/2024 at 10:00am EST: Construction Spending MoM & ISM Manufacturing

- 12/02/2024 at 10:00am EST: ISM Prices Paid & ISM New Orders & ISM Employment

- 12/02/2024 at 3:15pm EST: Waller Gives Keynote at Fed Framework Conference

- 12/02/2024 at 4:30pm EST: Williams Gives Keynote Remarks

- 12/03/2024 at 10:00am EST: JOLTS Job Openings

- 12/03/2024 at 3:45pm EST: Goolsbee Gives Closing Remarks

- 12/03/2024: Wards Total Vehicle Sales

Dealer Positions ($’s in millions of dollars)

- Dealer positions in T-Bills (as of 11/13) were up 5.40bln @39.30bln

- Dealer positions <2yrs TIPS (as of 11/13) were up 33mln @10.48bln.

- Dealer positions in 2-6yrs TIPS (as of 11/06) were up 2.17bln @10.83bln.

- Dealer positions in 6-11yrs TIPS (as of 11/13) were down 158mln @2.46bln.

- Dealer positions > 11yrs TIPS (as of 11/13) were down 218mln @-181mln.

- Dealer positions in < 2yrs Coupons (as of 11/13) were down 11.24bln @17.03bln.

- Dealer positions > 2yrs and < 3yrs Coupons (as of 11/06) were up 4.35bln @22.72bln.

- Dealer positions in > 3 years and< 6yrs Coupons (as of 11/13) were up 1.52bln @56.95bln.

- Dealer positions > 6yrs and < 7yrs Coupons (as of 11/06) were down 1.98bn @14.30bln.

- Dealer positions in > 7 years and< 11yrs Coupons (as of 11/13) were up 3.75bln @30.56bln.

- Dealer positions > 11yrs and < 21yrs Coupons (as of 11/13) were down 1.90mln @20.37bln.

- Dealer positions in > 21 years Coupons (as of 11/13) were down 367mln @28.29bln.