US Treasuries

- Wednesday’s range for UST 10y: 3.995% – 4.04%, closing at 3.995%

- Wednesday’s range for UST 30y: 4.64% – 4.69%, closing at 4.64%

Jim Bianco joins Fox Business

Intraday Commentary from Jim Bianco

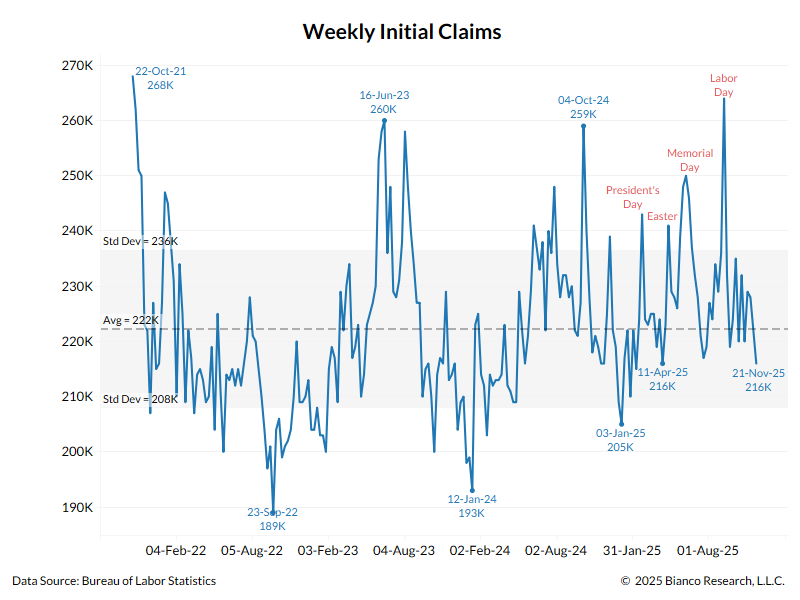

*US JOBLESS CLAIMS 216,000 IN NOV. 22 WEEK; EST. 225K

This is one of the lowest readings of the year.

I’m old enough to remember 2010 to 2021. This was considered a “desert-island indicator:” if you needed one measure to tell you the health of the economy, it was initial claims.

Now it doesn’t fit the narrative that the labor market is falling apart and the Fed must keep cutting rates, so it’s getting ignored.

Meanwhile, every financial television network has run at least 3 stories about affordability (i.e., inflation) this morning.

So let’s make money cheaper, stimulate the economy and pump the stock market higher, that will fix affordability!

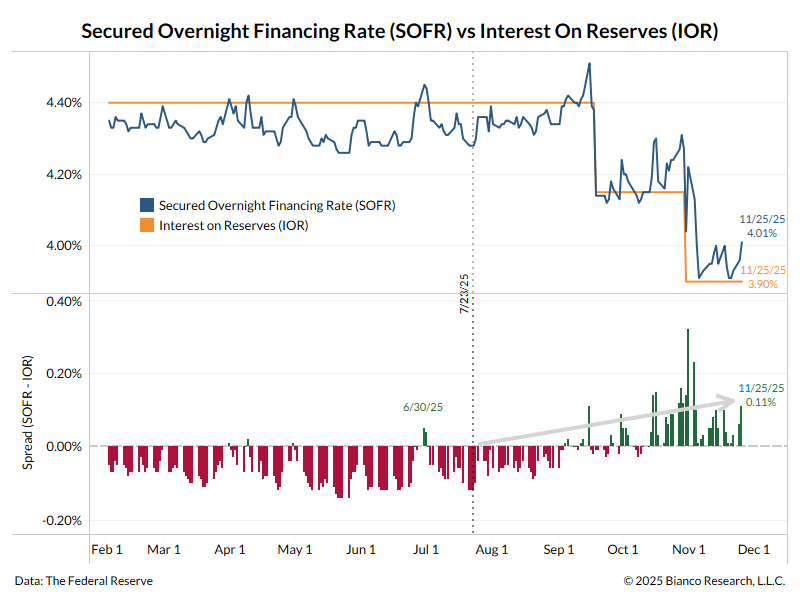

Don’t look now but the funding markets are getting squeezed again.

Yesterday, SOFR closed at a three-week high

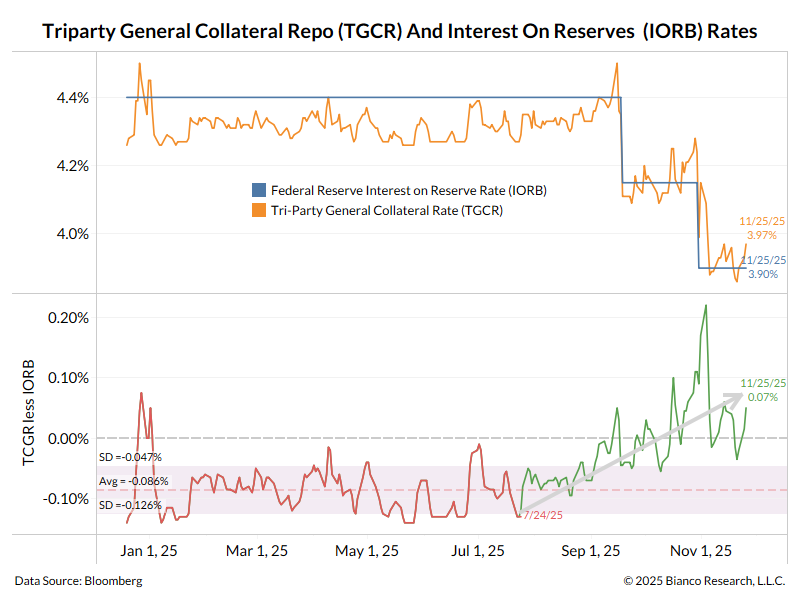

Dallas Fed President Lorie Logan (who previously ran the NY Fed Open Market Desk) has suggested that Tri-party repo (orange) is the most important funding rate.

As the red part of the bottom panel shows, it trades typically eight basis points below the interest on reserve rate (blue). Yesterday tri-party repo closed seven basis points above Interest on Reserves, also a three-week high.

Restated the Fed has cut the funds rate 50 basis points, and the Tri-party repo is trading 15 basis points higher than it usually would. So it’s like the Fed cut 35 basis points.

And as the gray arrows on both this chart and the one above it show, it’s not clear whether this trend towards tighter funding market rates has ended

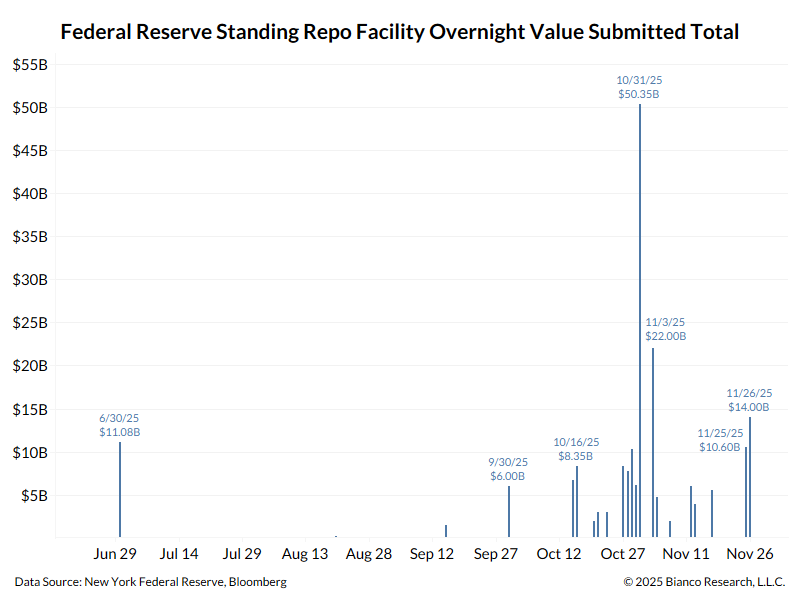

Finally, there has been a jump in the take from the Fed’s Standing Repo Facility. This morning, it was $14 billion, the third-highest ever (this facility started in 2021). Yesterday’s $10.6 billion was the fifth-highest ever.

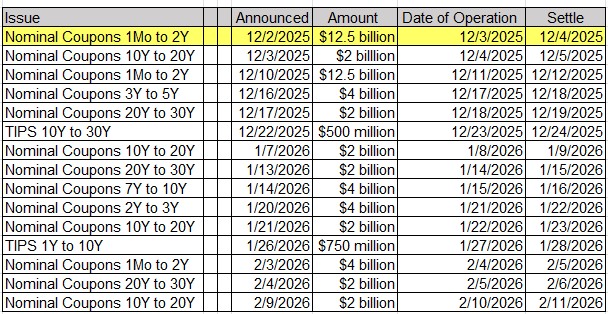

The 20-year, 2-year, 5-year, 7-year, and 2-year floater all settle next Monday, December 1st.

This will put enormous demand on the repo market, causing funding rates to spike.

In the News

CNN: Restaurant Reservations Spike for Thanksgiving as Grocery Store Prices Bite

MSN: From Silicon Valley to Hollywood, why California’s Job Market is Taking a Hit

CNBC: AI data center ‘frenzy’ is pushing up your electric bill- here’s why

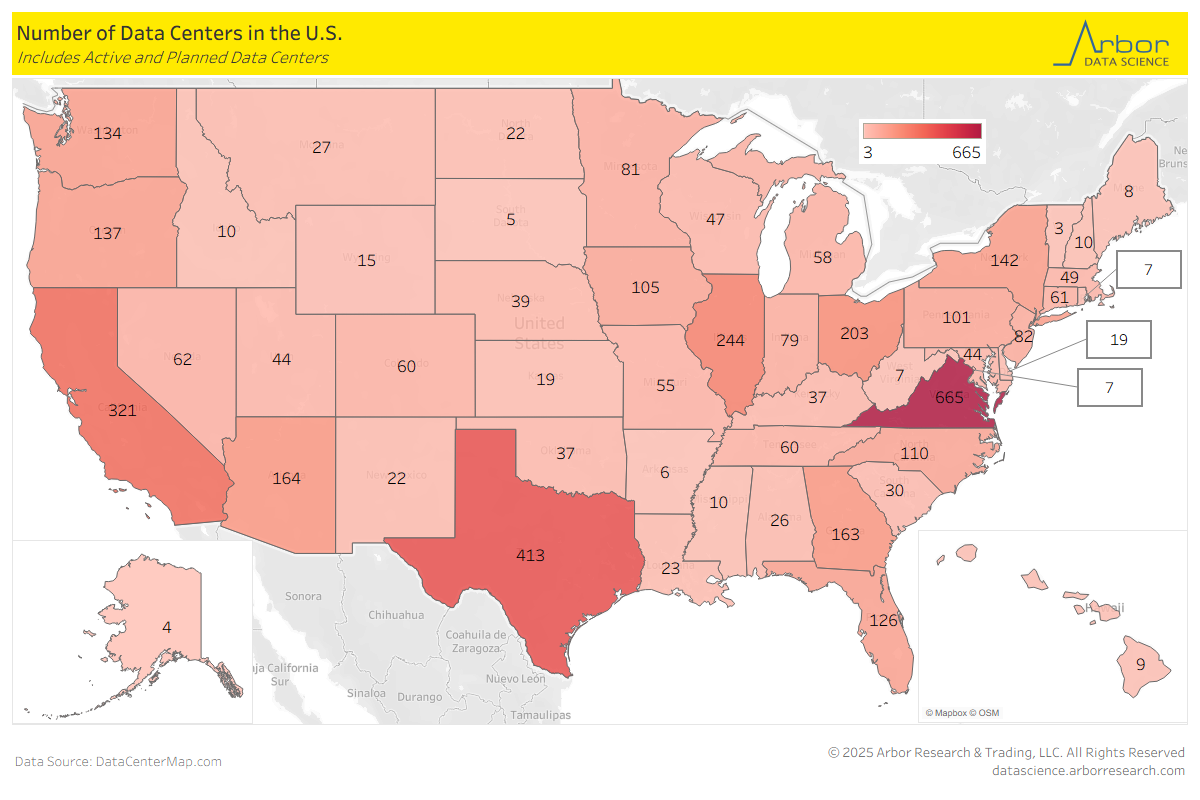

Arbor Data Science: Data Center Construction…Steady as She Goes

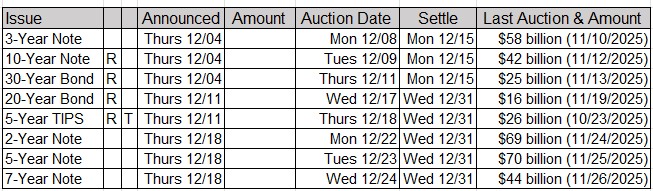

Upcoming US Treasury Supply