US Treasuries

- Wednesday’s UST 10y range: 4.22% – 4.295%, closing at 4.24%

Upcoming US Treasury Supply

Tentative Schedule of Treasury Buyback Operations

From our Arbor Data Science Desk:

Intraday Commentary from Jim Bianco

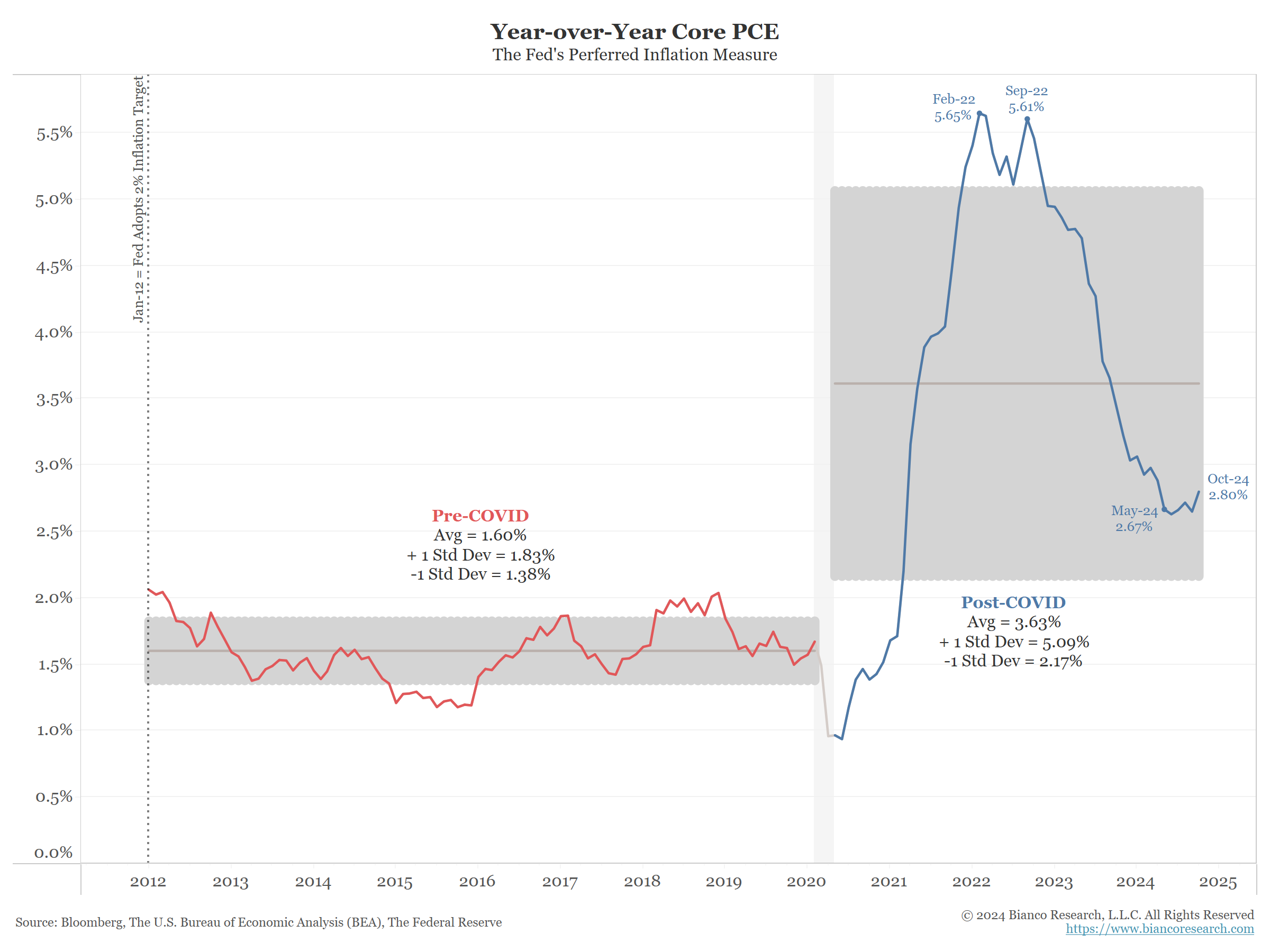

The Fed started targeting 2% in January 2012. Red is what Core PCE did from 2012 to the COVID recession. Blue is what Core PCE did post 2020.

The argument is inflation has been “fixed.” I do not see it.

Y/Y core PCE bottomed in May at 2.67%, not only higher than anything seen from 2012 to 2020, but if Core PCE ever got to 2.67% between 2012 and 2020, it would have been considerable completely unacceptable. Now this is consider “fixed.”

In October Core PCE was 2.80%. A reasonable argument can be made that Core PCE has already bottomed in May.

In Other News…

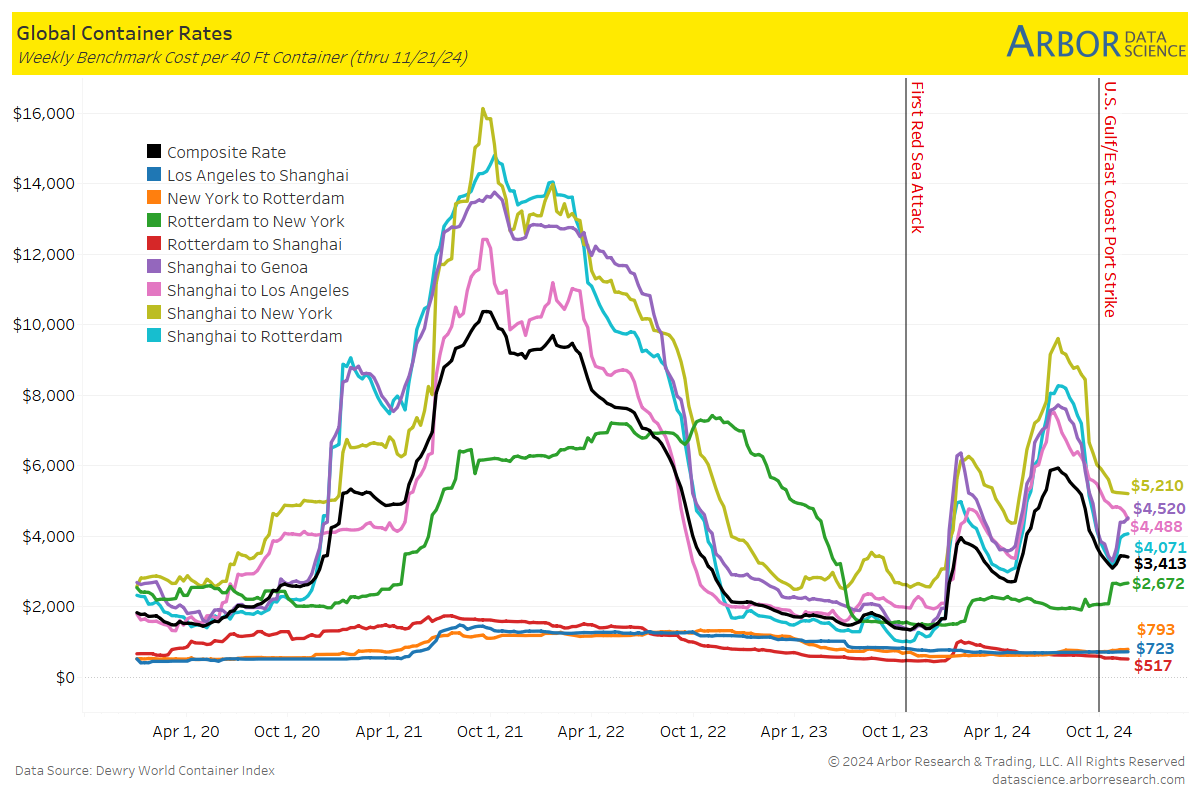

CNBC: The shipping industry is wrestling with one of its biggest challenges – seafarer shortages

The shipping industry is contending with a worldwide shortage of seafarers, and it’s fueling a troubling mix of fake resumes, accidents at sea, and elevated freight rates.

Ocean shipping is an integral part of the world’s supply chain — more than 80% of global trade volume is carried by sea, according to the U.N. Trade and Development organization.

Arbor Data Science: Global Supply Chain Update – November 27, 2024

SupplyChainBrain: Increased Consumer Confidence Will Boost Holiday Shopping

Seasonal spending from holiday shoppers in the U.S. is expected to grow by nearly 3% in 2024, driven by easing inflation rates, earlier promotions from retailers and other factors driving consumer confidence.

Redfin: Investor Home Purchases Plateau After a Pandemic-Era Rollercoaster Ride

U.S. investor home purchases fell 2% year over year in the third quarter, a much smaller change than the swings of the last several years. Purchases are now back near pre-pandemic levels.

KPMG: Global CEO Outlook Survey

This years’ findings reveal that CEOs are hardening their stance on returning to pre-pandemic ways of working, with 83 percent expecting a full return to the office within the next three years — a notable increase from 64 percent in 2023.

Upcoming Economic Releases & Fed Speak

- 12/02/2024 at 9:45am EST: S&P Global US Manufacturing PMI

- 12/02/2024 at 10:00am EST: Construction Spending MoM & ISM Manufacturing

- 12/02/2024 at 10:00am EST: ISM Prices Paid & ISM New Orders & ISM Employment

- 12/02/2024 at 3:15pm EST: Waller Gives Keynote at Fed Framework Conference

- 12/02/2024 at 4:30pm EST: Williams Gives Keynote Remarks

- 12/03/2024 at 10:00am EST: JOLTS Job Openings

- 12/03/2024 at 3:45pm EST: Goolsbee Gives Closing Remarks

- 12/03/2024: Wards Total Vehicle Sales

- 12/04/2024 at 7:00am EST: MBA Mortgage Applications

- 12/04/2024 at 8:15am EST: ADP Employment Change

- 12/04/2024 at 9:45am EST: S&P Global US Services PMI & S&P Global US Composite PMI

- 12/04/2024 at 10:00am EST: Factory Orders & Factory Orders Ex Trans

- 12/04/2024 at 10:00am EST: ISM Services Index & ISM Services Prices Paid

- 12/04/2024 at 10:00am EST: Durable Goods Orders & ISM Services Employment

- 12/04/2024 at 10:00am EST: Durables Ex Transportation & ISM Services New Orders

- 12/04/2024 at 10:00am EST: Cap Goods Orders Nondef ex Air & Cao Goods Ship Nondef Ex Air

- 12/04/2024 at 8:45am EST: Musalem Speaks on US Economy, Policy

- 12/04/2024 at 2:00pm EST: Federal Reserve Releases Beige Book