US Treasuries

- Monday’s range for UST 10y: 4.08% – 4.12%, closing at 4.105%

- Monday’s range for UST 30y: 4.655% – 4.70%, closing at 4.685%

- US Treasury Expects To Borrow $569 Bln In Q4, $21 Bln Less Than July Estimate

- Fed’s Miran: Repeats View That Policy Remains Too Restrictive

- Fed’s Goolsbee: is More Worried About Inflation Than Job Market

- Fed’s Daly: says Fed Should “Keep an Open Mind’ About December Rate Cut

- Fed’s Cook: says Risk to Labor Market Outweighs Inflation Risk

Intraday Commentary From Bianco Research

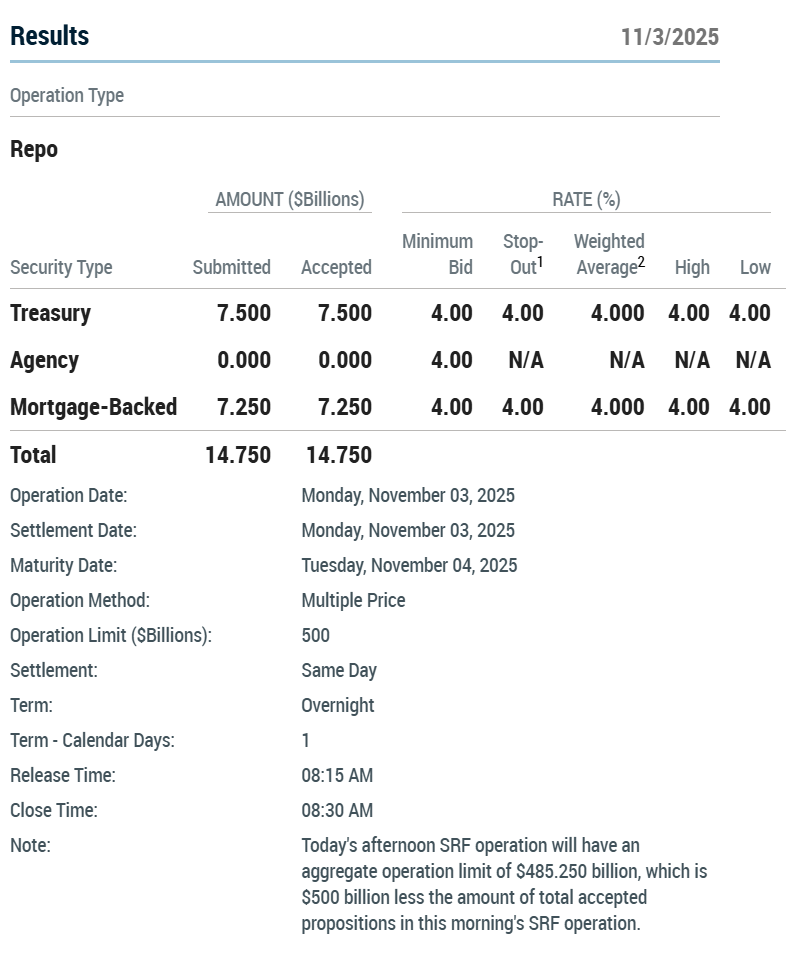

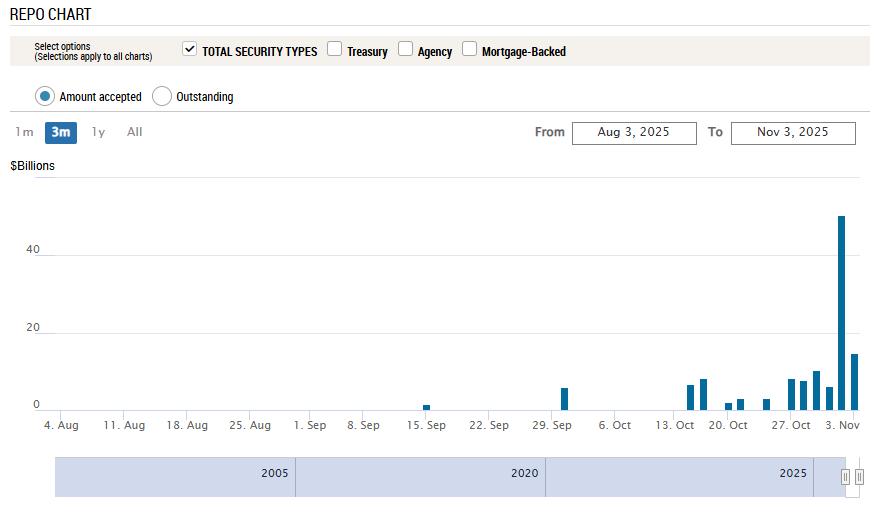

SRF hit up for almost $15B this morning.

(highest total outside of Friday)

In the News

CIO: Institutions Eye ETF Seeding, but There are Some Tradeoffs

Successful Farming: Chinese Buyers Purchase Brazilian Soybeans as Prices Ease Over U.S.-China Trade Thaw

CNBC: Auto giants rally as China says it will consider exemptions for Nexperia chip exports

artemis: No adverse ILS market reaction expected from Melissa cat bond payout: Fitch

Bloomberg: High-Risk Consumer Borrowers Rise to Most Since 2019

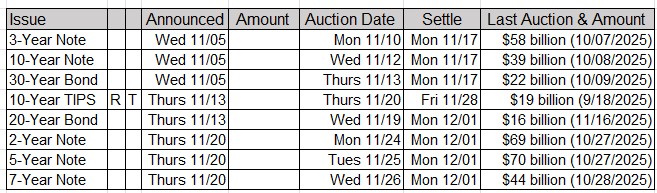

Upcoming US Treasury Supply

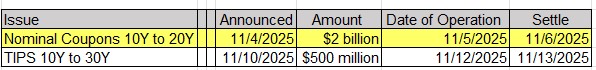

Tentative Schedule of Treasury Buyback Operations

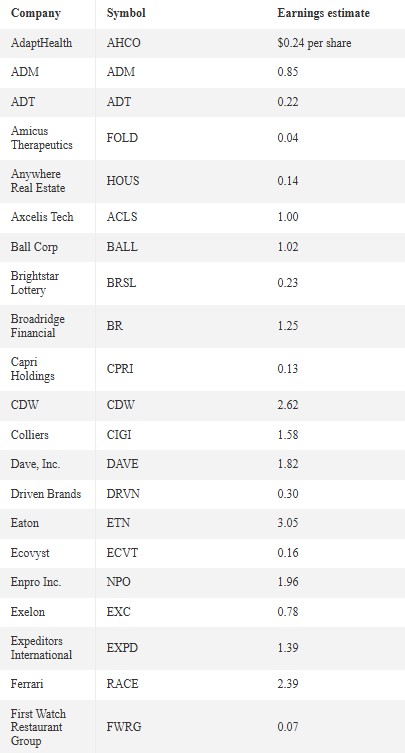

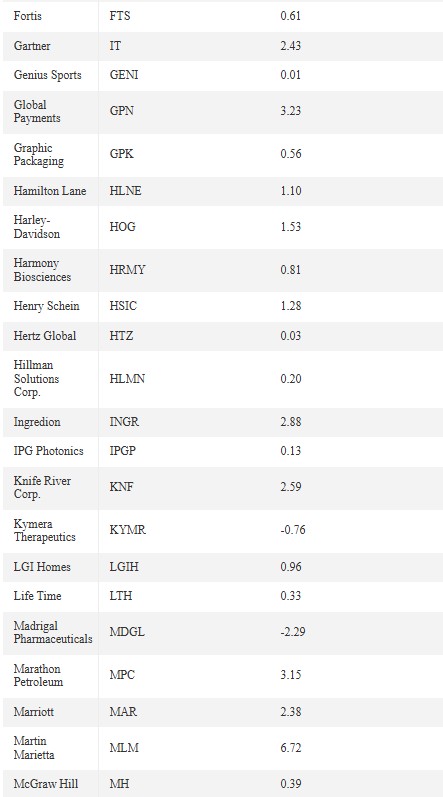

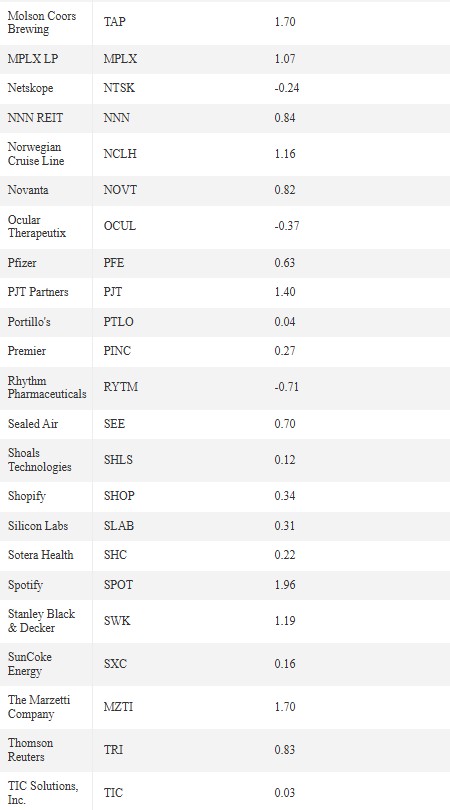

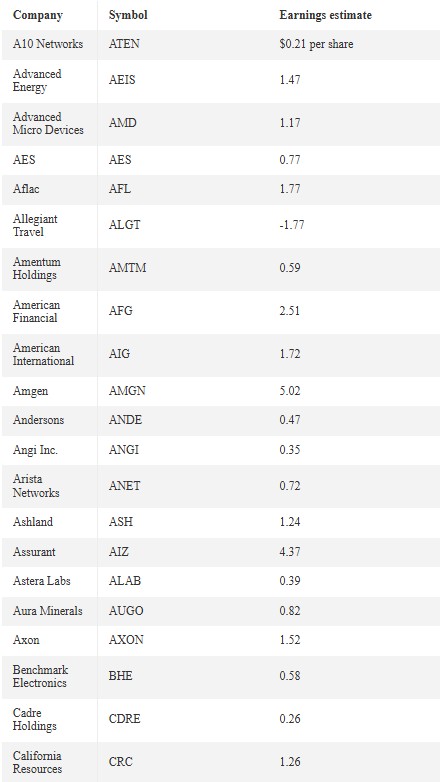

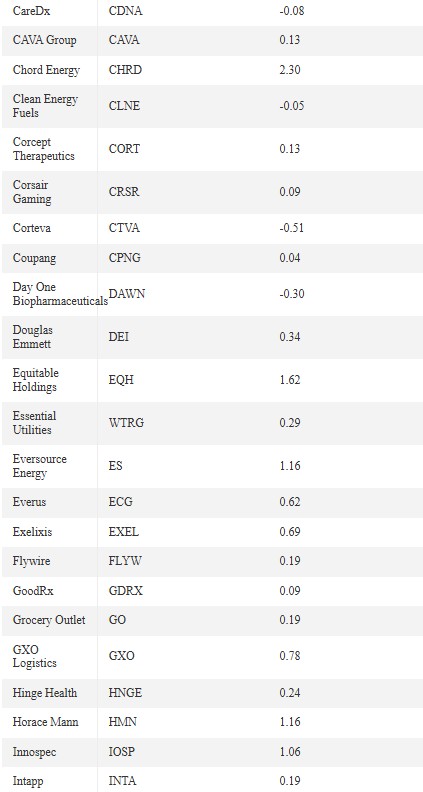

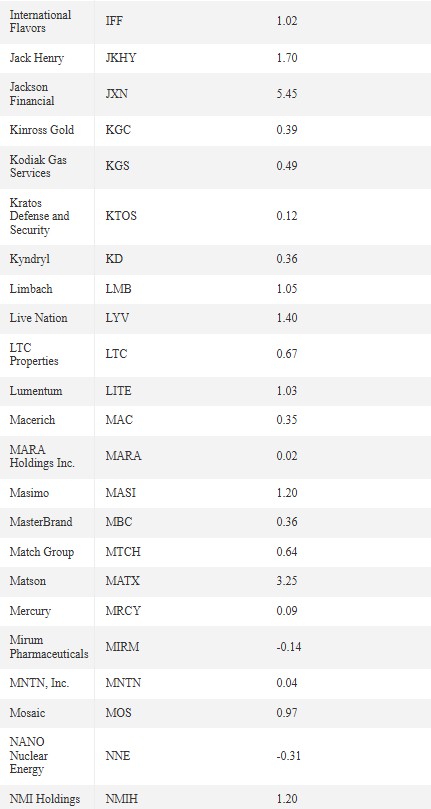

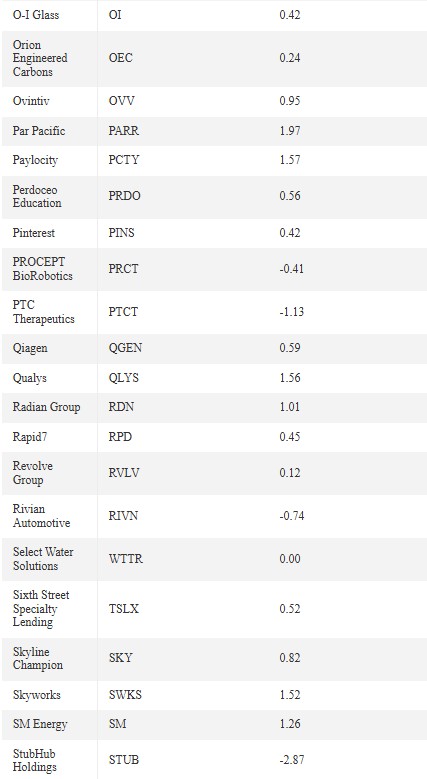

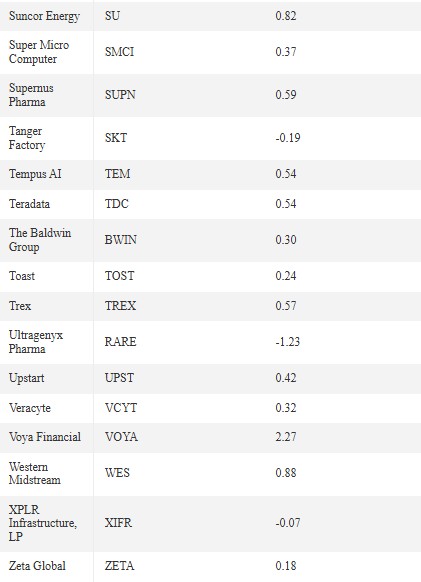

After the Close