US Treasuries

- Friday’s range for UST 10y: 4.09% – 4.14%, closing at 4.135%

- 10y Note Range for the Week: 4.03% – 4.14%

- Friday’s range for UST 30y: 4.75% – 4.80%, closing at 4.79%

- 30y Bond Range for the Week: 4.69% – 4.80%

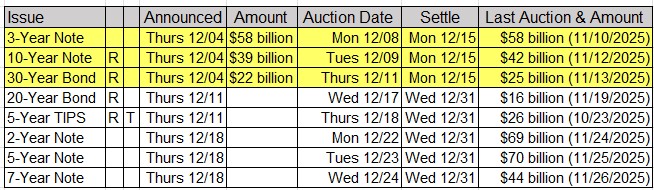

- Monday, 12/8/25: $58 Billion 3y Note Auction

Jim Bianco Joins Fox Business to discuss the Cost of Living, Lack of Wage Growth & Whether the Fed Should Cut or Not with Charles Payne

Intraday Commentary from Jim Bianco

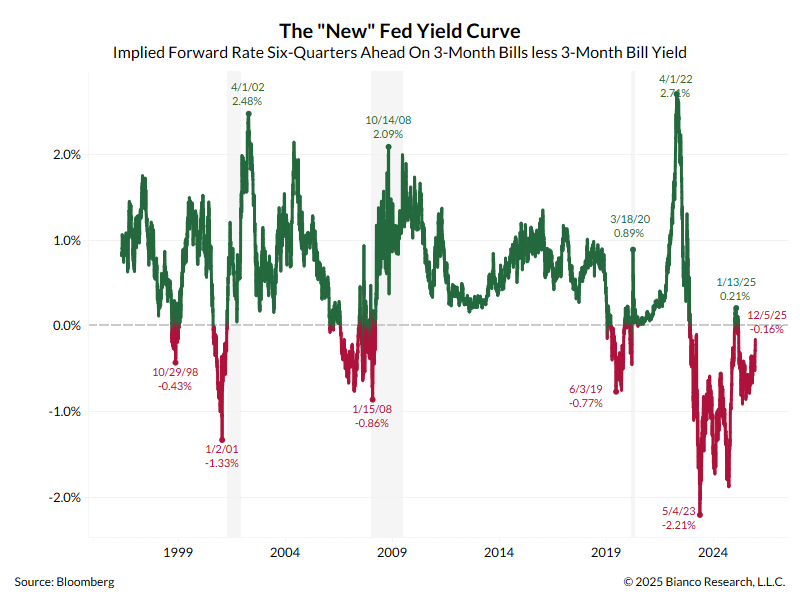

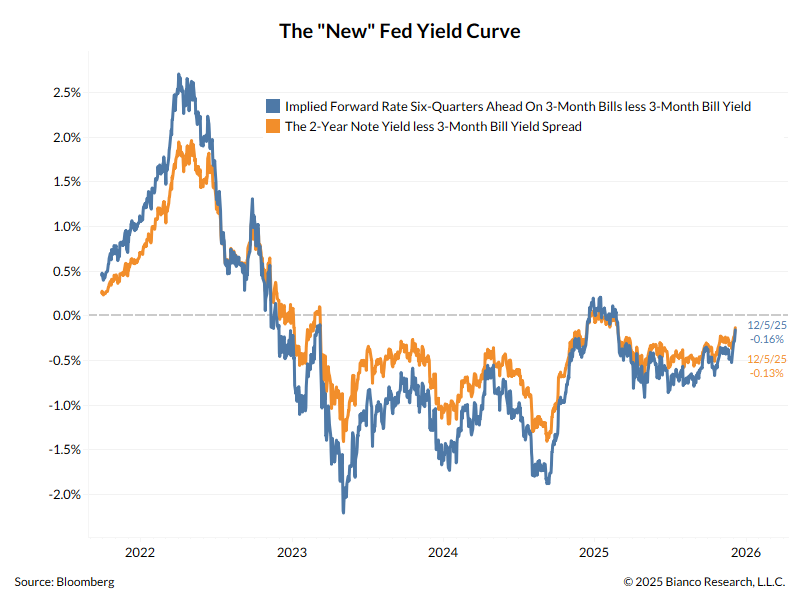

What is this curve (blue)? It is the 2-year/3-Month curve (orange).

The 10-year yield has been in an identifiable downtrend of lower highs and lower lows since May, highlighted below.

It made its first higher low at the end of November and now at 4.14% is on the verge of breaking through the top end of this channel. Will it? Or will it hold this channel again?

Long-bond yield, highest since September 8th (red line)

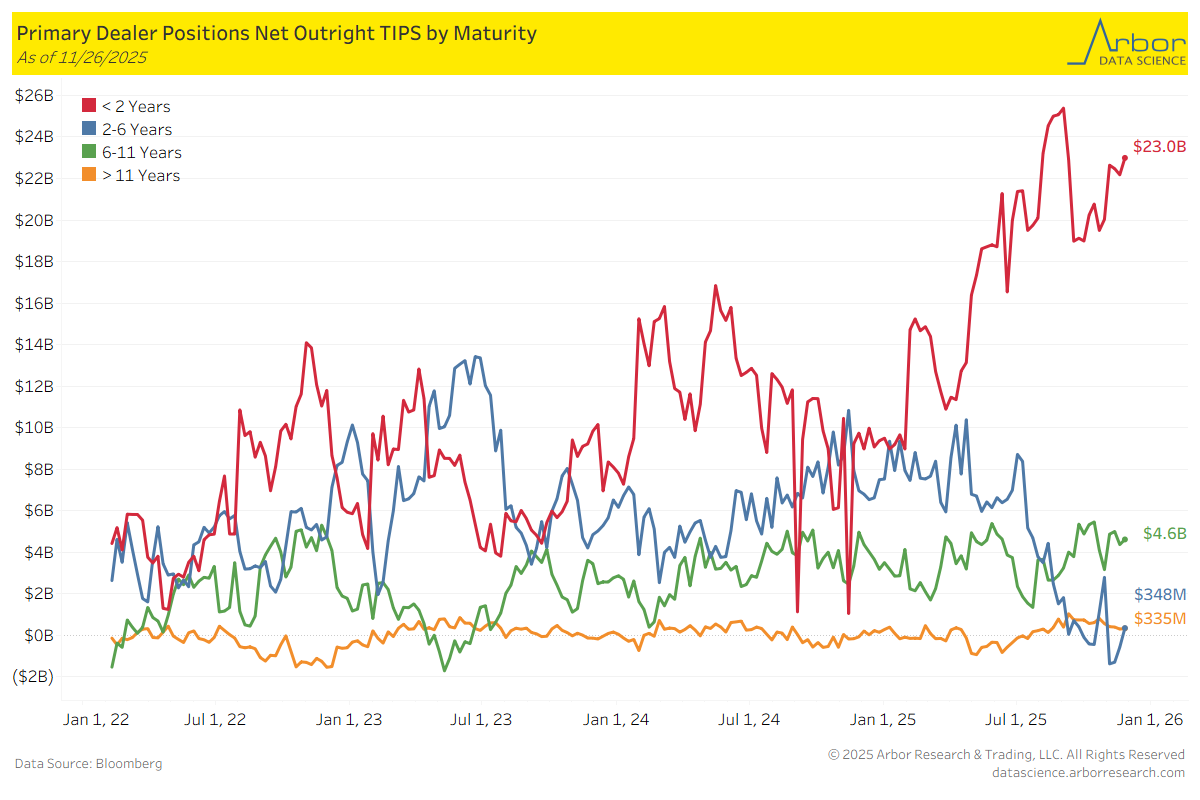

TIPS Returns by Maturity (data through 11/26/25)

Week over Week Changes by Maturity

- < 2 years: $22.2 Bn on 11/19/25 to $23.0 Bn on 11/26/2025 = $0.8 Bn

- 2 – 6 years: ($572 Mn) on 11/19/25 to $348 Mn on 11/26/2025 = $920 Mn

- 6 – 11 years: $4.4 Bn on 11/19/25 to $4.6 Bn on 11/26/2025 = $0.2 Bn

- > 11 years: $298 Mn on 11/19/25 to $335 Mn on 11/26/2025 = $37 Mn

In the News

datacenterdynamics: Shark Tank’s Kevin O’Leary: 50% of planned US data centers will not be built

OilPrice: How Digital Oilfields Could Unlock $320 Billion in Savings

FarmPolicyNews: China Soybean Deadline Now February, Bessent Says

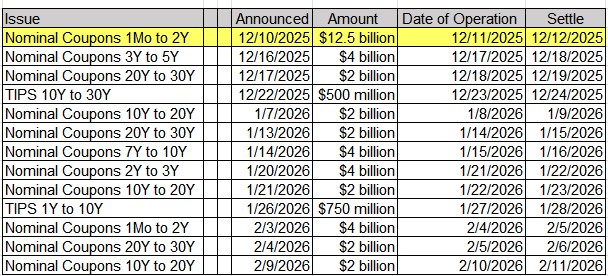

Upcoming US Treasury Supply

Tentative Schedule of Treasury Buyback Operations