Download this Report to Print

US Treasuries

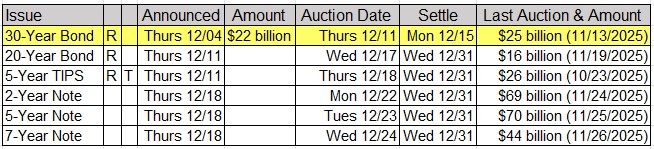

Tuesday’s range for UST 10y: Tuesday’s range for UST 30y: 4.77% – 4.81%, closing at 4.805% Wednesday, 12/10/2025: FOMC Rate Decision Thursday, 12/11/25: $22 Billion 30y Bond Auction

Intraday Commentary from Jim Bianco

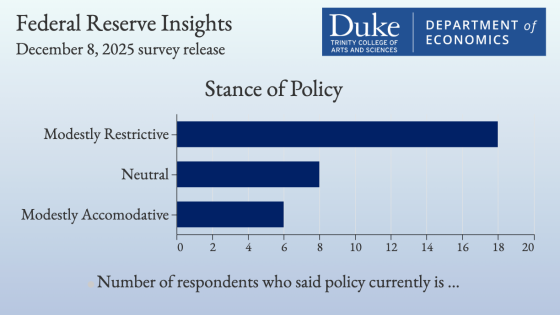

Nice graphic from Duke. The Fed thinks the neutral funds rate is 3%. So, the Fed calls the current rate of current policy 3.75%-4.00% (to be cut tomorrow) “moderately accommodative.”

This view is shared by only 6 of the 32 (19%) former Fed officials. 18 of 32 (56%) think the Fed is already restrictive (I do too) and 8 of 32 (25%) think they are neutral now.

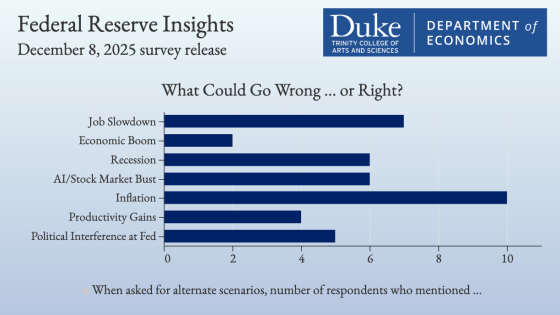

10 of 32 (31%) worry about inflation (I do too) 2 of 32 (6%) about an economic boom 6 of 32 (19%) about AI/Market Bust

A total of 18 of 32 (56%) are worried about things made WORSE by the Fed’s rate cuts.

*SPOT SILVER TOPS RECORD $60 AS TRADERS BET ON LOWER RATES

YTD (spot price change) Silver = 101% Gold = 60% Bitcoin = -4%

In the News

OilPrice : U.S. Army Looks to Build Small Refineries for Critical Minerals

ZeroHedge : Gas Prices Drop To Lowest Level in Nearly 5 Years Across US

Successful Farming : Trump Threatens Mexico With 5% Tariff Increase Over Water Dispute

Upcoming US Treasury Supply

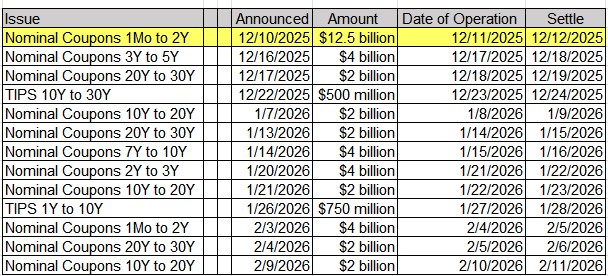

Tentative Schedule of Treasury Buyback Operations

Upcoming Economic Releases & Fed Speak

12/10/2025 at 07:00am EST: MBA Mortgage Applications 12/10/2025 at 08:30am EST: Employment Cost Index 12/10/2025 at 08:30am EST: FOMC Rate Decision 12/10/2025 at 08:30am EST: Fed Reverse Repo Rate 12/11/2025 at 08:30am EST: Initial Jobless Claims / Initial Claims 4-Wk Moving Avg 12/11/2025 at 08:30am EST: Continuing Claims / Trade Balance 12/11/2025 at 08:30am EST: Exports MoM / Imports MoM 12/11/2025 at 10:00am EST: Wholesale Inventories MoM /Wholesale Trade Sales MoM 12/11/2025 at 12:00pm EST: Household Change in Net Worth 12/12/2025 at 08:00am EST: Fed’s Paulson Speaks on Economic Outlook 12/12/2025 at 08:30am EST: Fed’s Hammack Speaks at Real Estate Roundtable Series 12/12/2025 at 08:30am EST: Empire Manufacturing 12/12/2025 at 08:30am EST: NAHB Housing Market Index 12/12/2025 at 10:35am EST: Fed’s Goolsbee Speaks at Economic Outlook Symposium 12/15/2025 at 10:30am EST: Fed’s Williams delivers Keynote Remarks 12/16/2025 at 08:30am EST: Change in Nonfarm Payrolls / Two-Month Payroll Net Revision 12/16/2025 at 08:30am EST: Change in Private Payrolls / Change in Manfact. Payrolls 12/16/2025 at 08:30am EST: Nonfarm Payrolls 3-Mo Avg Chg 12/16/2025 at 08:30am EST: Average Hourly Earnings MoM / Average Hourly Earnings YoY 12/16/2025 at 08:30am EST: Average Weekly Hours All Employees 12/16/2025 at 08:30am EST: Underemployment Rate / Underemployment Rate 12/16/2025 at 08:30am EST: Labor Force Participation Rate 12/16/2025 at 08:30am EST: Retail Sales Advance MoM / Retail Sales Ex Auto MoM 12/16/2025 at 08:30am EST: Retail Sales Ex Auto and Gas / Retail Sales Control Group 12/16/2025 at 08:30am EST: New York Fed Services Business Activity 12/16/2025 at 09:45am EST: S&P Global US Manufacturing PMI 12/16/2025 at 09:45am EST: S&P Global US Services PMI / Composite PMI 12/16/2025 at 10:00am EST: Business Inventories