Download this Report to Print

US Treasuries

- UST10s closed today at 4.18%. Our 1st weekly support zone is 4.23% – 4.24% (75% to hold).

- We ended the day above our 1st monthly support zone of 4.13% – 4.16%, which has held for the past 11 months.

- We have a 1st weekly resistance zone of 4.12% – 4.14% (90% to hold).

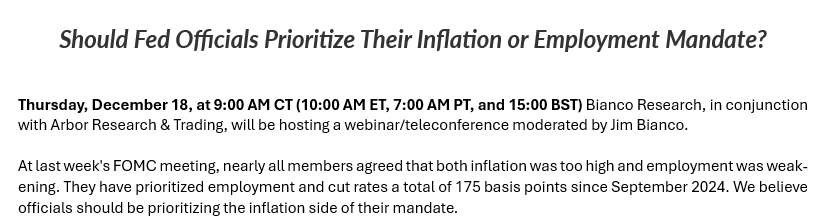

Join Us Thursday, December 18th, for our Next Conference Call Featuring Jim Bianco

Click Here to Register

Intraday Commentary from Jim Bianco

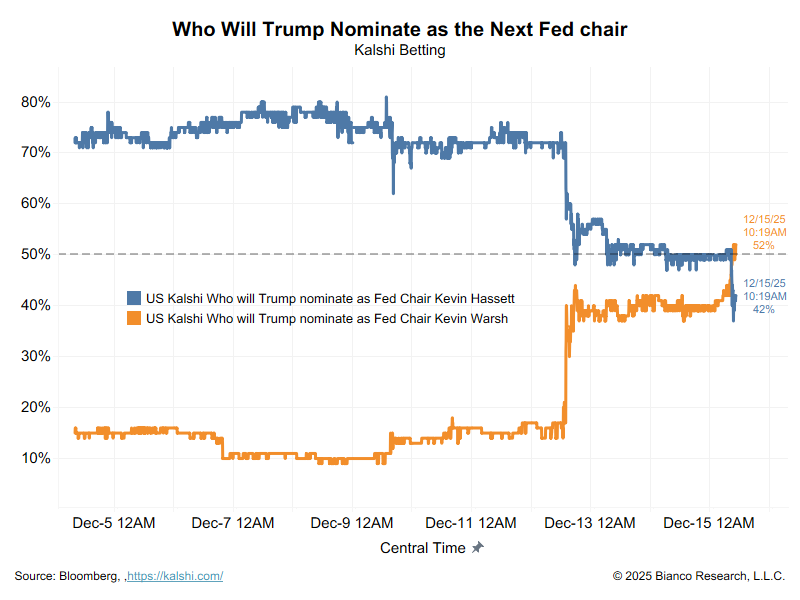

Warsh has now overtaken Hassett to lead for next Fed Chairman.

In the News

OilPrice: Copper Prices Surge Toward $12,000 on AI Demand and Supply Chaos

SupplyChainBrain: U.S.-Australia Mining Deal: One Small Step Toward Weakening China’s Chokehold on Critical Minerals

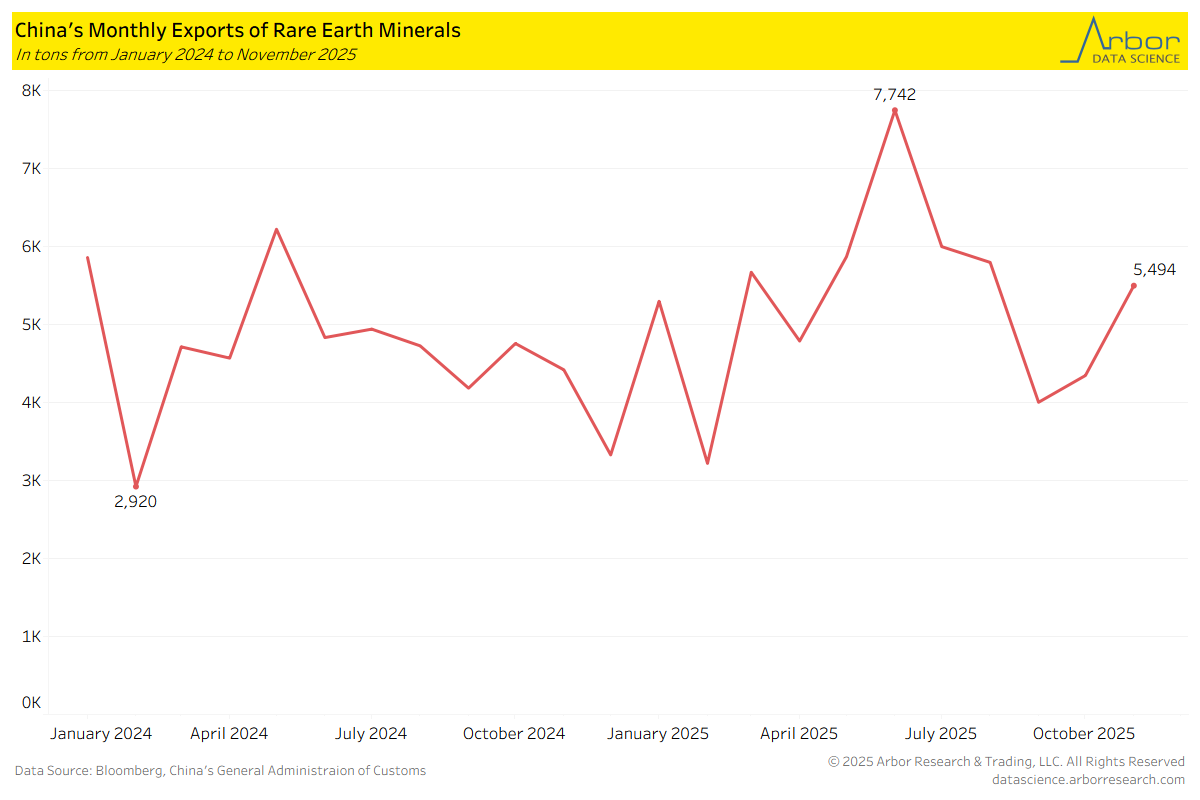

Arbor Data Science: Promising News on Rare Earth Minerals in the United States

Quartz: The white-collar layoffs have come to McKinsey

Quartz: The white-collar layoffs have come to McKinsey

CBT News: Global EV sales slow to 6% in November

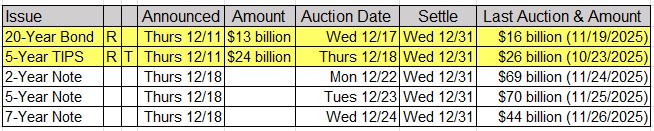

Upcoming US Treasury Supply

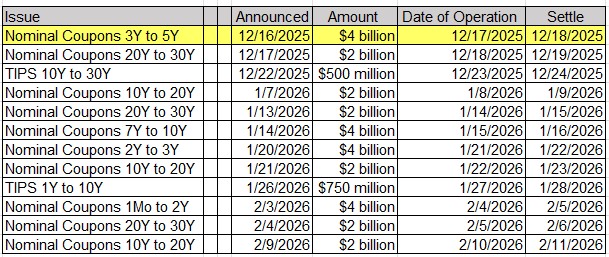

Tentative Schedule of Treasury Buyback Operations

Upcoming Economic Releases & Fed Speak

- 12/16/2025 at 08:15am EST: ADP Weekly Employment Preliminary Estimate

- 12/16/2025 at 08:30am EST: BLS to Release Nov. Employment with Partial Oct. Data

- 12/16/2025 at 08:30am EST: Change in Nonfarm Payrolls / Two-Month Payroll Net Revision

- 12/16/2025 at 08:30am EST: Change in Private Payrolls / Change in Manfact. Payrolls

- 12/16/2025 at 08:30am EST: Nonfarm Payrolls 3-Mo Avg Chg

- 12/16/2025 at 08:30am EST: Average Hourly Earnings MoM / Average Hourly Earnings YoY

- 12/16/2025 at 08:30am EST: Average Weekly Hours All Employees

- 12/16/2025 at 08:30am EST: Underemployment Rate / Underemployment Rate

- 12/16/2025 at 08:30am EST: Labor Force Participation Rate

- 12/16/2025 at 08:30am EST: Retail Sales Advance MoM / Retail Sales Ex Auto MoM

- 12/16/2025 at 08:30am EST: Retail Sales Ex Auto and Gas / Retail Sales Control Group

- 12/16/2025 at 08:30am EST: New York Fed Services Business Activity

- 12/16/2025 at 09:45am EST: S&P Global US Manufacturing PMI

- 12/16/2025 at 09:45am EST: S&P Global US Services PMI / Composite PMI

- 12/16/2025 at 10:00am EST: Business Inventories

- 12/17/2025 at 07:00am EST: MBA Mortgage Applications

- 12/17/2025 at 08:15am EST: Fed’s Waller Speaks on Economic Outlook

- 12/17/2025 at 09:05am EST: Fed’s Williams Delivers Opening Remarks

- 12/17/2025 at 12:30pm EST: Fed’s Bostic Participates in Moderated Discussion

- 12/18/2025 at 08:30am EST: Initial Jobless Claims / Initial Claims 4-Wk Moving Avg / Continuing Claims

- 12/18/2025 at 08:30am EST: BLS Will Not Publish Oct. All-Items and Core PCI

- 12/18/2025 at 08:30am EST: CPI YoY / Core CPI YoY / CPI Index SA

- 12/18/2025 at 08:30am EST: Real Avg Hourly Earnings YoY / Real Avg Weekly Earnings YoY

- 12/18/2025 at 08:30am EST: Philadelphia Fed Business Outlook

- 12/18/2025 at 11:00am EST: Kansas City Fed Manf. Activity

- 12/18/2025 at 04:00pm EST: Total Net TIC Flows / Net Long-term TIC Flows

- 12/19/2025 at 06:00am EST: Bloomberg Dec. United States Economic Survey

- 12/19/2025 at 10:00am EST: Existing Home Sales / MoM

- 12/19/2025 at 10:00am EST: U. of Mich. Sentiment / Current Conditions / Expectations

- 12/19/2025 at 10:00am EST: U. of Mich. 1 Yr Inflation / 5 -10 Yr Inflation

- 12/19/2025 at 11:00am EST: Kansas City Fed Services Activity

- 12/22/2025 at 08:30am EST: Chicago Fed Nat Activity Index

Quartz: The white-collar layoffs have come to McKinsey

Quartz: The white-collar layoffs have come to McKinsey