US Treasuries

Our range today for UST10s was 4.135% – 4.19% . We closed at 4.14% . Our 1st weekly resistance zone is 4.12% – 4.14% (61% shot to hold).

Our 2nd weekly resistance zone is 4.085 % – 4.095 % ( 57% to hold).

Bloomberg : Fed’s Liquidity Tool Gets a Rebrand After ‘Crisis of Confidence’

Join Us Thursday, December 18th , for our Next Conference Call Featuring Jim Bianco

Click Here to Register

Intraday Commentary from Jim Bianco

In an indication that a 3-month average of 22K jobs is the world we now live in …

Out this morning …The retail sales control group, which goes into the GDP calculation, for October, the same month that saw -105k jobs, was 0.8%, beating the expectations of 0.4%. This is additive to GDP.

So while I’m sure social media will be losing its mind over people losing jobs, the public was too busy at the store buying stuff to notice. If this were a normal period of population growth, stocks would be diving, bonds would be surging, and retail sales would be collapsing. Instead they are all acting like this is normal … because it is.

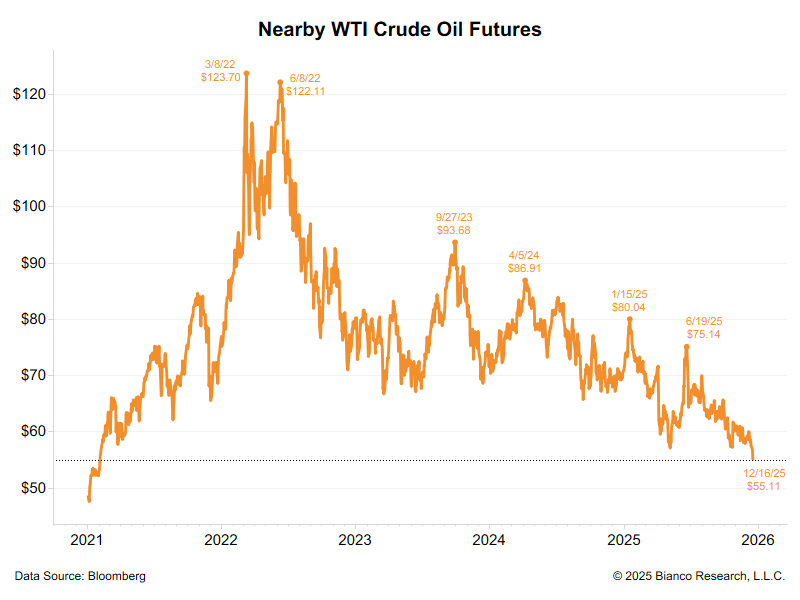

*US OIL FALLS BELOW $55 A BARREL FOR FIRST TIME SINCE FEB 2021

In the News

USNewsMoney : China Ups Demand to Controlling Stake in Panama Ports Deal, WSJ Reports

ZeroHedge : Pump-Prices Plummet As Ukraine Peace Deal Progress Sparks Oil Plunge

OilPrice : Global Coal Exports for First Annual Decline Since 2020

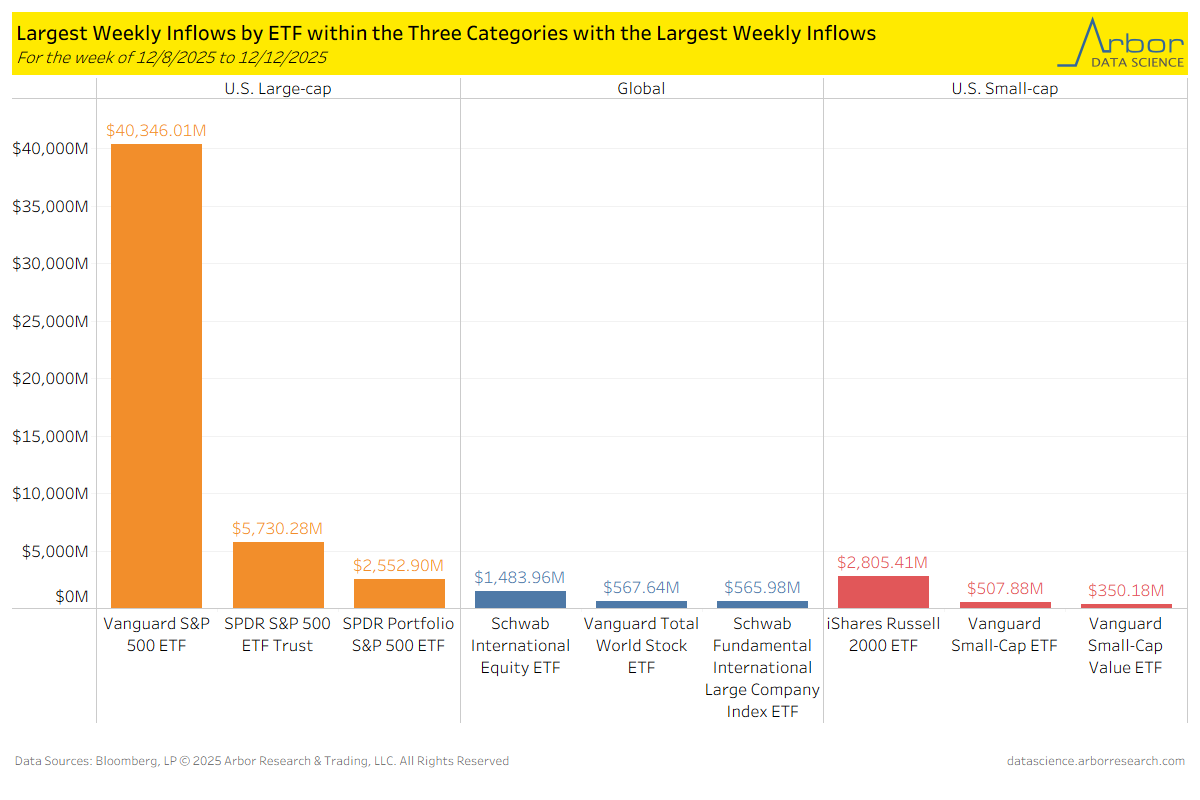

Arbor Data Science : Investor Flows – US Large Cap Rise to the Top

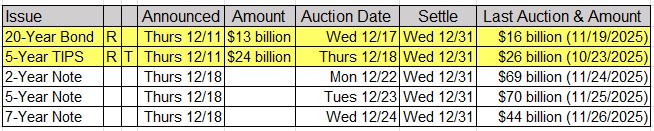

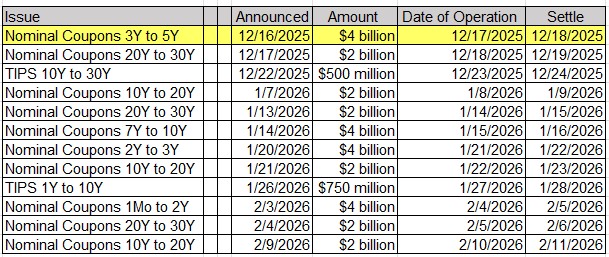

Upcoming US Treasury Supply

Tentative Schedule of Treasury Buyback Operations

Upcoming Economic Releases & Fed Speak

12/17/2025 at 07:00am EST: MBA Mortgage Applications 12/17/2025 at 08:15am EST: Fed’s Waller Speaks on Economic Outlook 12/17/2025 at 09:05am EST: Fed’s Williams Delivers Opening Remarks 12/17/2025 at 12:30pm EST: Fed’s Bostic Participates in Moderated Discussion 12/18/2025 at 08:30am EST: Initial Jobless Claims / Initial Claims 4-Wk Moving Avg / Continuing Claims 12/18/2025 at 08:30am EST: BLS Will Not Publish Oct. All-Items and Core PCI 12/18/2025 at 08:30am EST: CPI YoY / Core CPI YoY / CPI Index SA 12/18/2025 at 08:30am EST: Real Avg Hourly Earnings YoY / Real Avg Weekly Earnings YoY 12/18/2025 at 08:30am EST: Philadelphia Fed Business Outlook 12/18/2025 at 11:00am EST: Kansas City Fed Manf. Activity 12/18/2025 at 04:00pm EST: Total Net TIC Flows / Net Long-term TIC Flows 12/19/2025 at 06:00am EST: Bloomberg Dec. United States Economic Survey 12/19/2025 at 08:30am EST: Fed’s Williams Appears on CNBC 12/19/2025 at 10:00am EST: Existing Home Sales / MoM 12/19/2025 at 10:00am EST: U. of Mich. Sentiment / Current Conditions / Expectations 12/19/2025 at 10:00am EST: U. of Mich. 1 Yr Inflation / 5 -10 Yr Inflation 12/19/2025 at 11:00am EST: Kansas City Fed Services Activity 12/22/2025 at 08:30am EST: Chicago Fed Nat Activity Index 12/23/2025 at 08:15am EST: ADP Weekly Employment Preliminary Estimate 12/23/2025 at 08:30am EST: GDP Annualized QoQ / Personal Consumption / GDP Price Index 12/23/2025 at 08:30am EST: Core PCE Price Index QoQ / Philadelphia Fed Non-Manufacturing Activity 12/23/2025 at 08:30am EST: Durable Goods Orders / Durables Ex Transportation 12/23/2025 at 08:30am EST: Cap Goods Orders Nondef Ex Air 12/23/2025 at 09:15am EST: Fed to Release Oct. and Nov. Industrial Production on Dec. 23 12/23/2025 at 09:15am EST: Industrial Production MoM and Manufacturing (SIC) Production 12/23/2025 at 09:15am EST: Capacity Utilization 12/23/2025 at 10:00am EST: Richmond Fed Manufact. Index / Richmond Fed Business Conditions 12/23/2025 at 10:00am EST: Conf. Board Consumer Confidence / Present Situation / Expectations