Download this Report to Print

US Treasuries

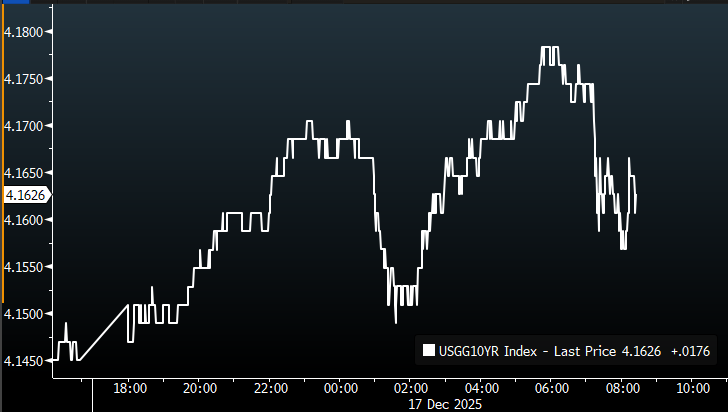

- The range today for UST10s was 4.14% – 4.18%. We closed at 4.15%.

- Our 1st weekly resistance zone is 4.12% – 4.14% (80% shot to hold).

- Our 2nd weekly resistance zone is 4.085% – 4.095% (90% shot to hold).

Join Us Tomorrow, December 18th, for our Next Conference Call Featuring Jim Bianco

Click Here to Register

Intraday Commentary from Jim Bianco

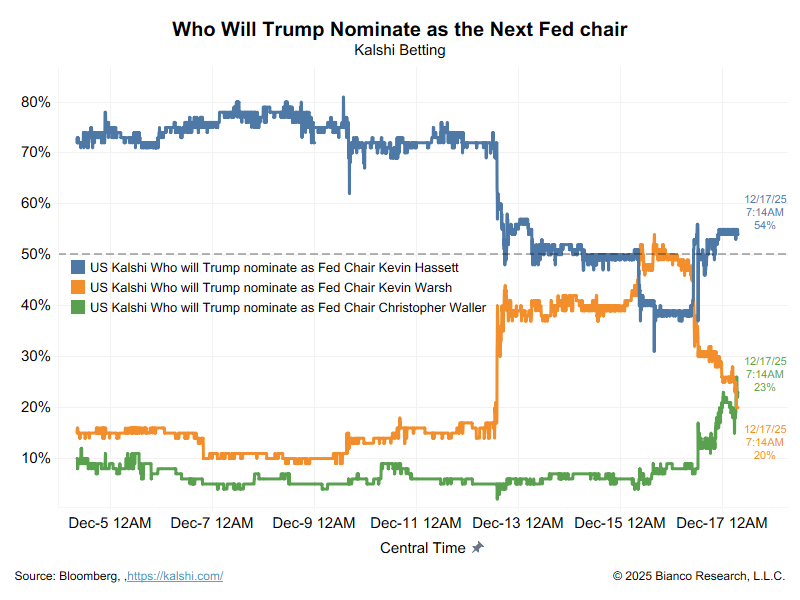

Monday, Warsh (orange) was leading the horse race.

Now he is third behind Waller (green).

Hassett (blue) is only at 54%, hardly a “done deal.”

Bonds Pare Drop as Fed’s Waller Nods to Lower Rate: Markets Live

The 10-year yield is up 2 bps from yesterday’s close. But down 1.5 bps after Waller started speaking.

In the News

OilPrice: Phillips 66 Sees Strong Support for Western Gateway Pipeline

InsuranceBusinessMag: ILS rebounds as cat bond issuance hits record highs

SupplyChainBrain: Louisiana to Get $850M to Build Rare Earth Refinery

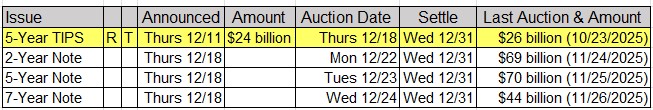

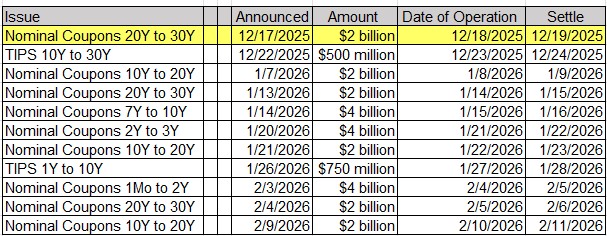

Upcoming US Treasury Supply

Tentative Schedule of Treasury Buyback Operations

Upcoming Economic Releases & Fed Speak

- 12/18/2025 at 08:30am EST: Initial Jobless Claims / Initial Claims 4-Wk Moving Avg / Continuing Claims

- 12/18/2025 at 08:30am EST: BLS Will Not Publish Oct. All-Items and Core PCI

- 12/18/2025 at 08:30am EST: CPI YoY / Core CPI YoY / CPI Index SA

- 12/18/2025 at 08:30am EST: Real Avg Hourly Earnings YoY / Real Avg Weekly Earnings YoY

- 12/18/2025 at 08:30am EST: Philadelphia Fed Business Outlook

- 12/18/2025 at 11:00am EST: Kansas City Fed Manf. Activity

- 12/18/2025 at 04:00pm EST: Total Net TIC Flows / Net Long-term TIC Flows

- 12/19/2025 at 06:00am EST: Bloomberg Dec. United States Economic Survey

- 12/19/2025 at 08:30am EST: Fed’s Williams Appears on CNBC

- 12/19/2025 at 10:00am EST: Existing Home Sales / MoM

- 12/19/2025 at 10:00am EST: U. of Mich. Sentiment / Current Conditions / Expectations

- 12/19/2025 at 10:00am EST: U. of Mich. 1 Yr Inflation / 5 -10 Yr Inflation

- 12/19/2025 at 11:00am EST: Kansas City Fed Services Activity

- 12/22/2025 at 08:30am EST: Chicago Fed Nat Activity Index

- 12/23/2025 at 08:15am EST: ADP Weekly Employment Preliminary Estimate

- 12/23/2025 at 08:30am EST: GDP Annualized QoQ / Personal Consumption / GDP Price Index

- 12/23/2025 at 08:30am EST: Core PCE Price Index QoQ / Philadelphia Fed Non-Manufacturing Activity

- 12/23/2025 at 08:30am EST: Durable Goods Orders / Durables Ex Transportation

- 12/23/2025 at 08:30am EST: Cap Goods Orders Nondef Ex Air

- 12/23/2025 at 09:15am EST: Fed to Release Oct. and Nov. Industrial Production on Dec. 23

- 12/23/2025 at 09:15am EST: Industrial Production MoM and Manufacturing (SIC) Production

- 12/23/2025 at 09:15am EST: Capacity Utilization

- 12/23/2025 at 10:00am EST: Richmond Fed Manufact. Index / Richmond Fed Business Conditions

- 12/23/2025 at 10:00am EST: Conf. Board Consumer Confidence / Present Situation / Expectations

- 12/24/2025 at 07:00am EST: MBA Mortgage Applications

- 12/24/2025 at 08:30am EST: Initial Jobless Claims / 4-Wk Moving Avg / Continuing Claims