US Treasuries

- Wednesday’s UST 10y range: 4.38% – 4.50%, closing at 4.50%

Bloomberg: Bond Traders Target Deeper 2025 Fed Rate Cuts Than Market Expectations

With inflation proving sticky, however, Wall Street banks have started to anticipate that the Fed will forecast perhaps one fewer cut next year, meaning three quarters of a point in total.

Upcoming US Treasury Supply

- $22 billion 5-Year TIPS auction (Reopening) tomorrow, Thursday, 12/18/2024

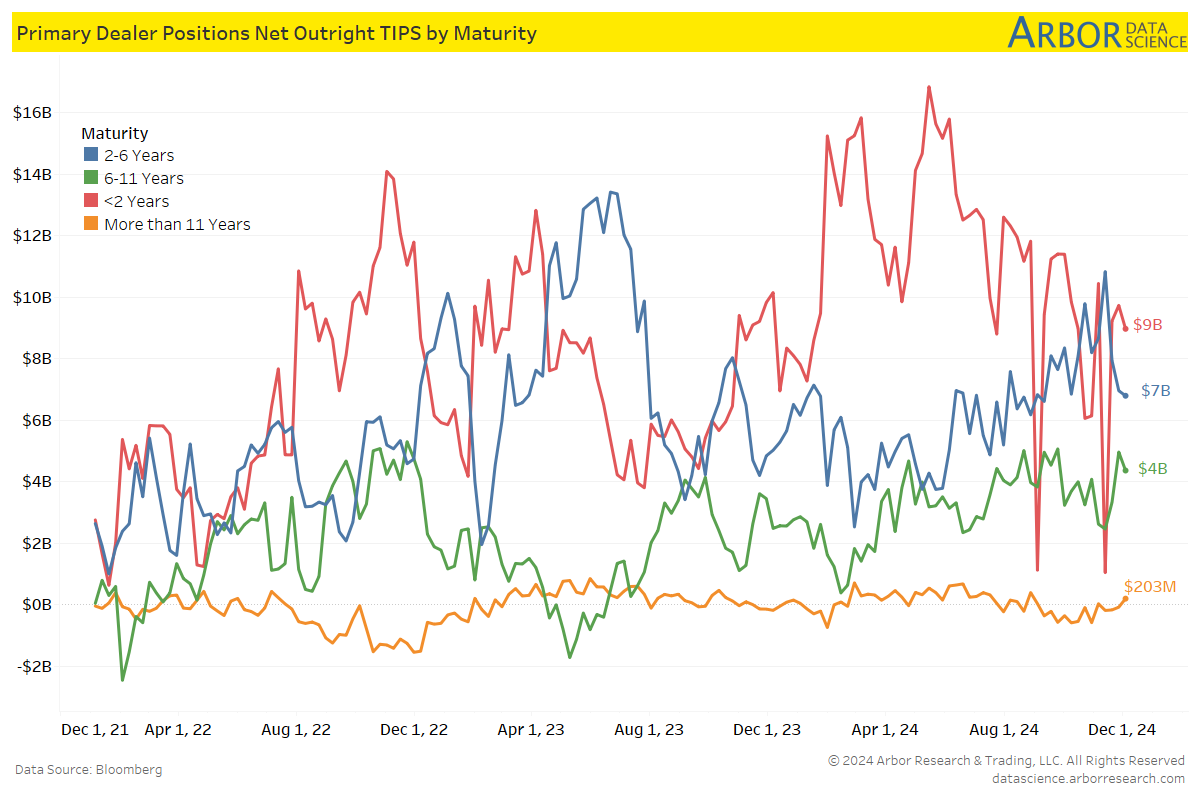

TIPS- Dealer Positions

For the week ended 12/04/2024

| <2 Year= $8.974 Million | 6-11 years= $ $4.368 Million |

| 2-6 years= $6.798 Million | >11 years= $203 Million |

Tentative Schedule of Treasury Buyback Operations

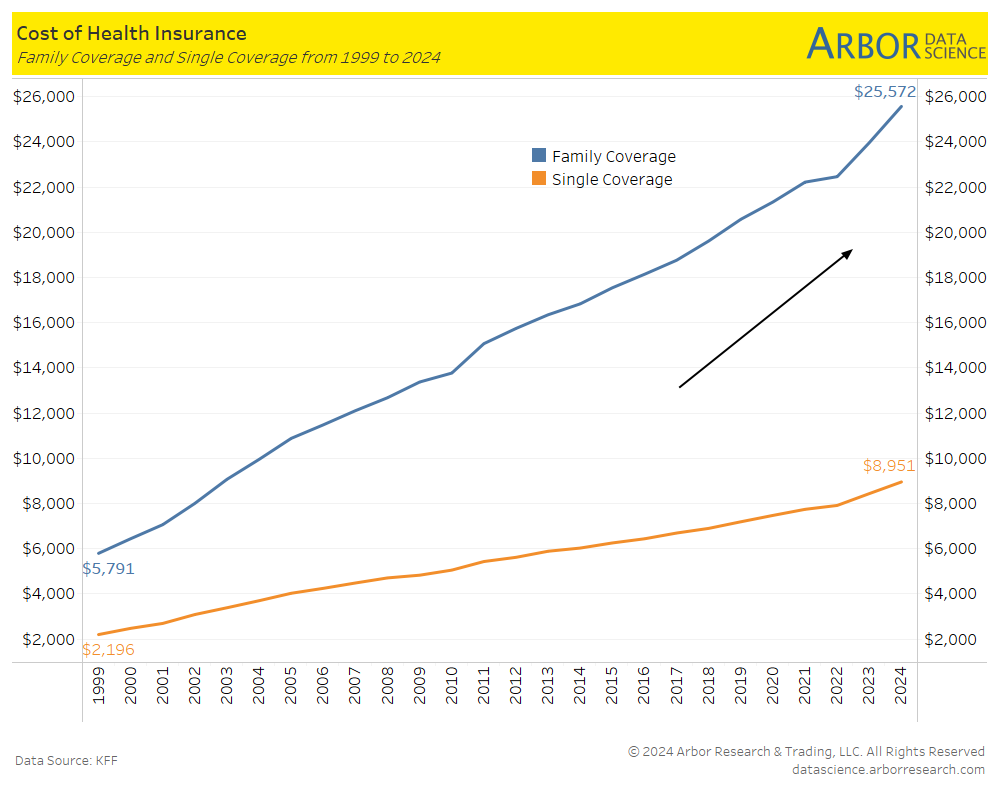

From our Arbor Data Science Desk: The Rising Cost of Healthcare in the U.S.

Health care experts are warning that costs for insurance will likely rise again in 2025. One trend that may be contributing to higher insurance costs is the growing market concentration among fewer insurance companies.

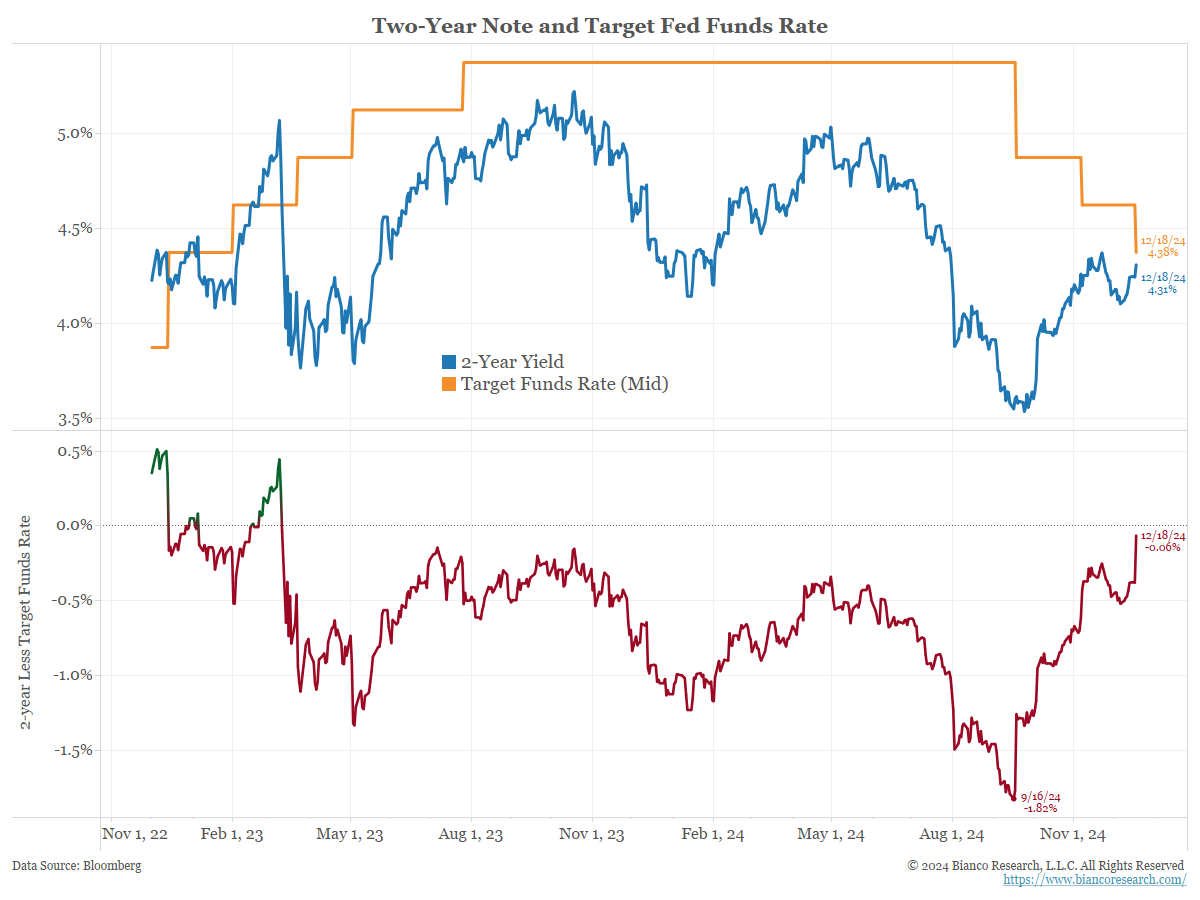

Intraday Commentary from Jim Bianco

The 2-year to funds curve is just below zero now. In normal times, this is a signal the Fed is done.

1-day tick chart of the 10-year yield.

The more the Fed tries to explain why they cut, the higher the 10-year.

In Other News…

OilPrice: China’s Car Exports Surge as Domestic Sales Slow

China has transformed itself from a minor player in the auto industry two decades ago to the world leader in car production and exports, particularly in electric vehicles (EVs), the New York Times reported late last month.

Read more on EVs from Arbor Data Science: Cruising with the EVs by Petr Pinkhasov

The Guardian: Amazon workers across US gear up to strike this week

Thousands of Amazon workers are gearing up to strike from Thursday, days before Christmas, over the tech giant’s refusal to begin negotiations over a contract. Union locals are preparing members for pickets and actions outside Amazon facilities around the US.

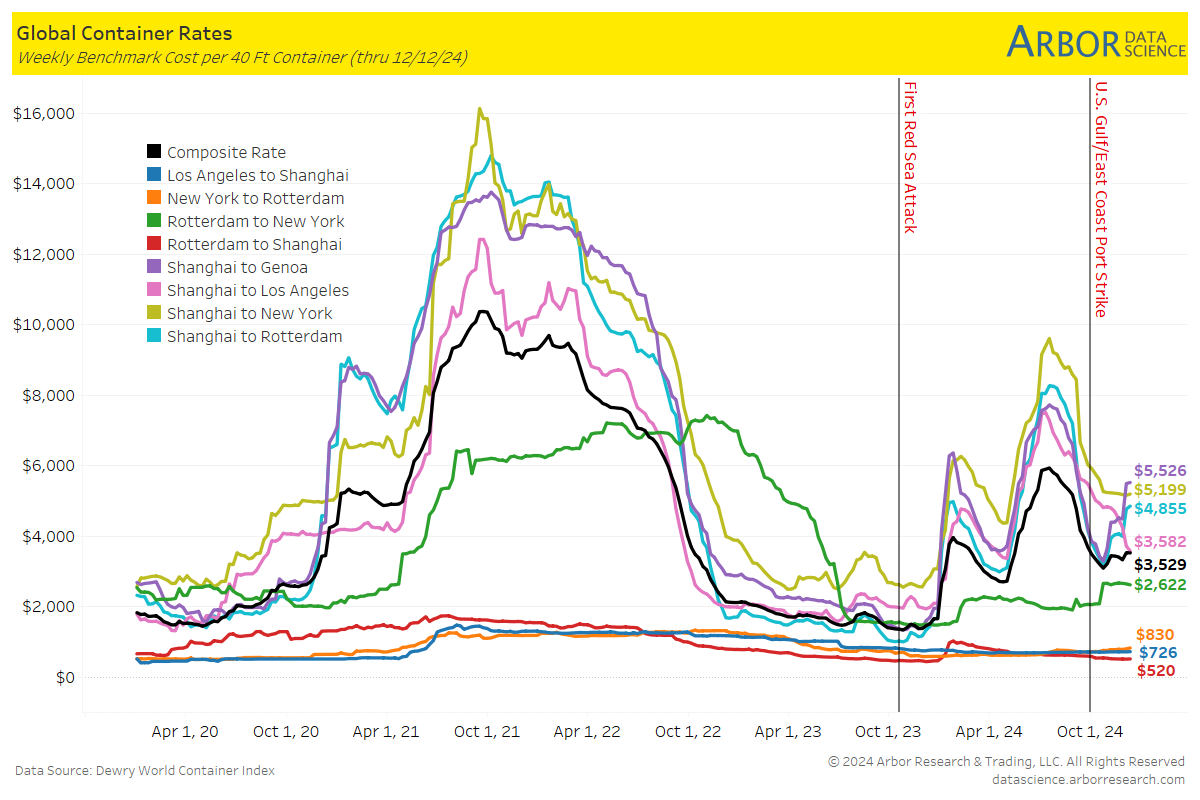

SupplyChainBrain: Busiest U.S. Container Ports Set to Close 2024 with Record Volumes

The two hubs — which together account for roughly a third of all U.S. container imports — have gotten more traffic as some businesses reroute goods via California, to avoid disruption from a still-unresolved labor dispute that shut down East and Gulf coast ports in October. There’s also a rush to bring in imports ahead of the tariffs promised by President-elect Donald Trump, which could slow traffic down in 2025.

Arbor Data Science: Global Supply Chain Update – 12/18/24

Brownfield Ag News: Number of U.S. Farms Continue to Decline

Data from the USDA shows the number of farms in the U.S. is declining and a farm real estate specialist says he expects the trend to continue.

Des Moines Register: Iowa’s average farmland values decline for first time in 5 years in new Iowa State study

Iowa’s average farmland values fell 3.1% this year after climbing to record highs over the past five years, a newly released Iowa State University survey shows.

Upcoming Economic Releases & Fed Speak

- 12/19/2024 at 8:30am EST: GDP Annualized QoQ & Personal Consumption

- 12/19/2024 at 8:30am EST: GDP Price Index & Core PCE Price Index QoQ & Philadelphia Fed Business Outlook

- 12/19/2024 at 8:30am EST: Initial Jobless Claims & Initial Jobless Claims

- 12/19/2024 at 10:00am EST: Leading Index & Existing Home Sales & Existing Home Sales MoM

- 12/19/2024 at 11:00am EST: Kansas City Fed Manf. Activity

- 12/19/2024 at 4:00pm EST: Total Net TIC Flows & Net Long-term TIC Flows

- 12/20/2024 at 7:30am EST: Fed’s Daly Appears on Bloomberg TV

- 12/20/2024 at 8:30am EST: Personal Income & Personal Spending & Real Personal Spending

- 12/20/2024 at 8:30am EST: PCE Price Index MoM & PCE Price Index YoY

- 12/20/2024 at 8:30am EST: Core PCE Price Index MoM & Core PCE Price Index YoY

- 12/20/2024 at 10:00am EST: U. of Mich. Sentiment & U. of Mich. Current Conditions & U. of Mich. Expectations

- 12/20/2024 at 10:00am EST: U. of Mich. 1-Yr Inflation & U. of Mich. 5-10 Inflation

- 12/20/2024 at 10:00am EST: Kansas City Fed Services Activity

- 12/23/2024 at 8:30am EST: Chicago Fed Nat Activity Index

- 12/23/2024 at 10:00am EST: Conf. Board Consumer Confidence/ Present Situation / Expectations

- 12/24/2024 at 8:00am EST: Building Permits & Building Permits MoM

- 12/24/2024 at 8:30am EST: Philadelphia Fed Non-Manufacturing & Durable Goods Orders & Durables ex Transportation

- 12/24/2024 at 8:30am EST: Cap Goods Orders Nondef Ex Air & Cap Goods Ship Nondef Ex Air

- 12/24/2024 at 10:00am EST: New Home Sales & New Home Sales MoM

- 12/24/2024 at 10:00am EST: Richmond Fed Manufact. Index & Richmond Fed Business Conditions