US Treasuries

- The range today for UST10s was 4.10% – 4.145%.

- We closed at 4.11%, which is below our 1st weekly resistance zone of 4.12% – 4.14% (25% shot to hold).

- Our 2nd weekly resistance zone is 4.085% – 4.095% (70% shot to get in and 71% shot to hold).

Bloomberg: Trump Praises Waller and Bowman, Says Fed Pick Coming in Weeks

Summary Points From Today’s Conference Call:

- The Federal Reserve should prioritize its inflation mandate over its employment mandate due to the current high inflation rates and public concern over affordability.

- Despite the Federal Reserve cutting rates seven times since September 2024, there is division within the Federal Reserve with a range of opinions on where the funds rate should be. The U.S. and the U.K. are the only two major economies where the market expects further rate cuts in 2026.

- A significant drop in gas prices and crude oil prices could potentially ease inflationary pressures. However, concern about the high level of personal debt, especially credit card debt, complicates this, and lowering interest rates will only make things worse by enabling more borrowing.

- The labor market is healthy despite a slowdown in job creation. This is attributable to low population growth and reduced immigration. In other words, the current state of the labor market is misunderstood due to a lack of real-time population data.

- Federal debt as a percent of GDP is running at around $1.8 trillion. The current level of deficit is usually associated with major crises or wars, and is not sustainable as a normal run rate for government spending. The responsibility for fixing the deficit lies with Congress and the President, not the Federal Reserve.

In the News

SupplyChainBrain: U.S. Logistics Companies Slash Jobs in Face of Weak Freight Demand

Bloomberg: China Has Bought More Than Half the Soybeans It Promised From US

InsuranceBusinessMag.com: US homeowners insurance shows early signs of stabilization amid rising costs

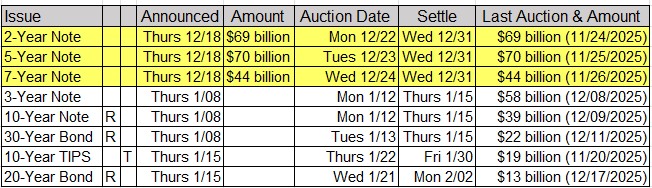

Upcoming US Treasury Supply

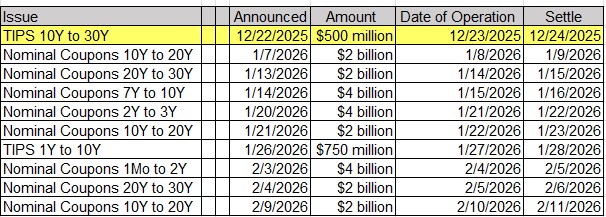

Tentative Schedule of Treasury Buyback Operations