US Treasuries

- Monday’s UST 10y range: 4.53% – 4.62%, closing at 4.54%

Upcoming US Treasury Supply

Tentative Schedule of Treasury Buyback Operations

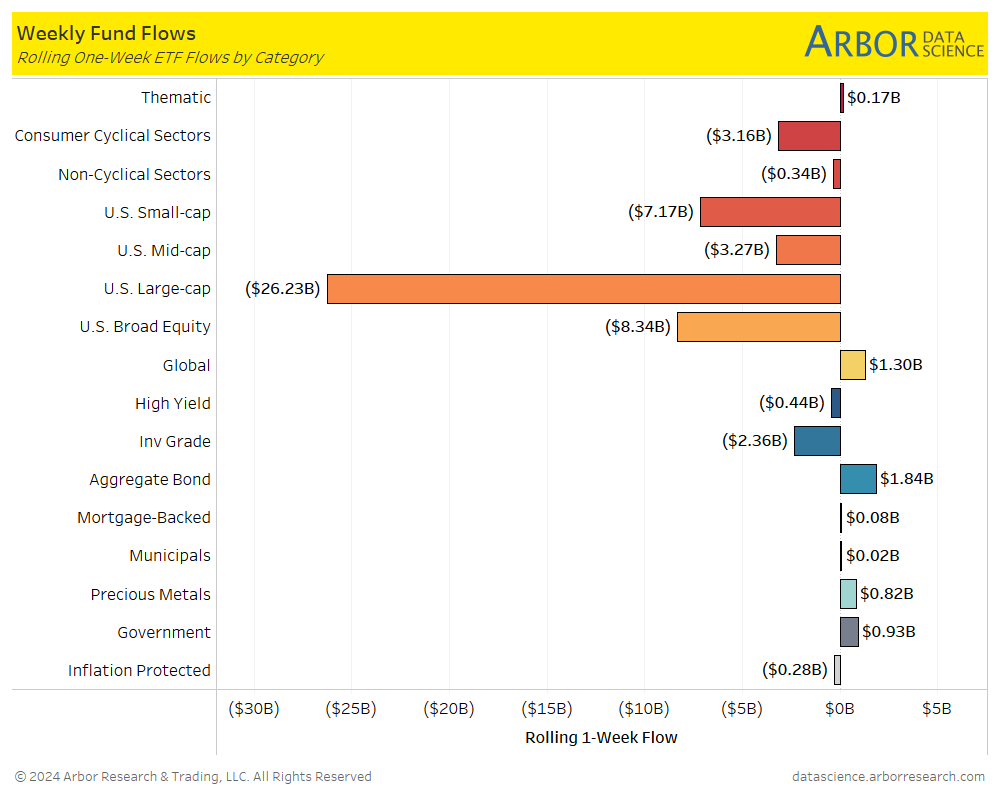

From our Arbor Data Science Desk: Investor Flows – U.S. Large Cap ETFs Outflows Surge

WSJ: A Record-Shattering $1 Trillion Poured Into ETFs This Year

Investors plowed more than $1 trillion into U.S.-based exchange-traded funds in 2024, shattering the previous record set three years ago and raising Wall Street hopes for an even bigger year ahead.

TRONWEEKY: Spot Bitcoin ETFs in the US Surpass $35 Billion in 2024 Net Inflows

Spot Bitcoin ETFs in the United States attracted $35.66 billion in net inflows in 2024. These figures exceeded initial industry forecasts, including Galaxy Digital’s $14 billion estimate. BlackRock’s iShares Bitcoin Trust ETF (IBIT) led with $37.31 billion, followed by Fidelity’s Wise Origin Bitcoin Fund with $11.84 billion.

In Other News:

Axios: Where the minimum wage will rise in 2025

Millions of workers are getting a raise on Jan. 1, when the minimum wage is set to rise across 21 states, and 48 cities and counties. The increases lift the pay of more than 9.2 million people, per the Economic Policy Institute’s tally.

TechCrunch: AI data centers could be ‘distorting’ the US power grid

The proliferation of data centers aiming to meet the computational needs of AI could be bad news for the US power grid, according to a new report in Bloomberg.

SupplyChainBrain: Climate Change, Increased Demand, Make Coffee Prices Soar

In December, coffee prices reached a nearly 50-year high, after years of droughts and flooding have strained the global coffee beans supply while global demand has kept rising, reports The New York Times. Futures prices for arabica beans rose in mid-December to more than $3.30 per pound, breaking a 47-year-old record.

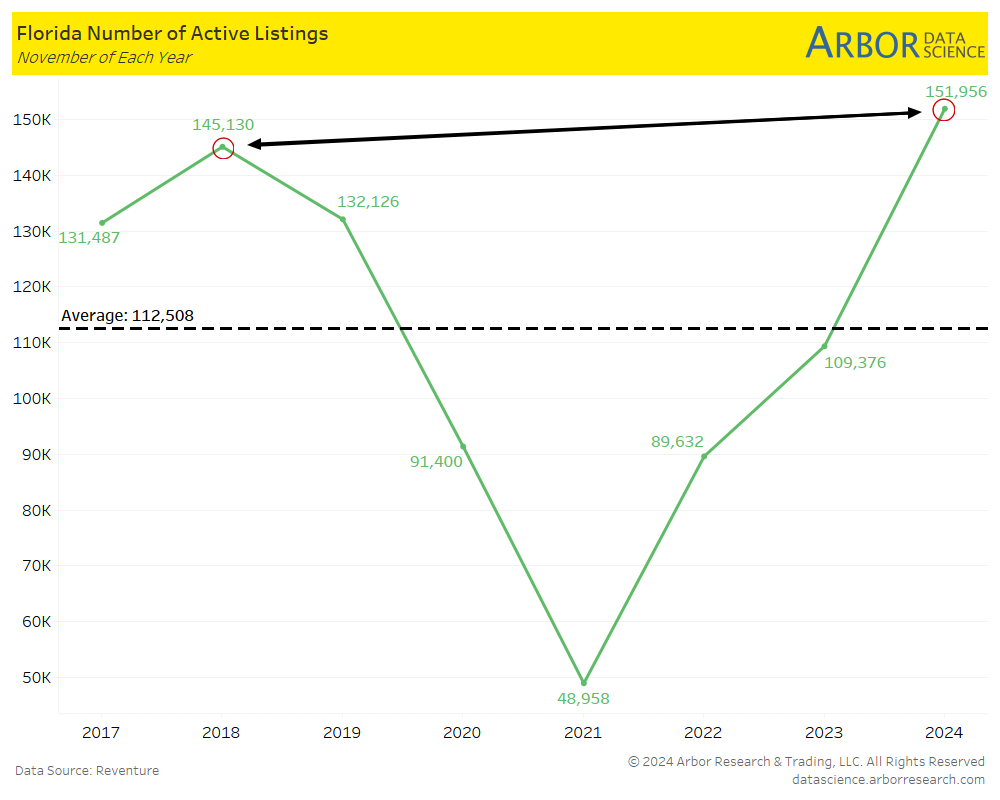

Fast Company: Builders are a ‘bit desperate’ to move Florida inventory, says housing market analyst

Florida is getting hit by three main headwinds entering 2025: a structural slowdown in inbound migration, excess supply hitting the market from home builders, and an affordability crisis for existing homeowners related to HOA and insurance costs.

Arbor Data Science: Examining the Housing Market in Florida

Upcoming Economic Releases & Fed Speak

- 12/31/2024 at 9:00am EST: FHFA House Price Index MoM & S&P CoreLogic CS 20-City MoM SA

- 12/31/2024 at 9:00am EST: S&P CoreLogic CS 20-City YoY NSA & S&P CoreLogic CS US HPI YoY NSA

- 12/31/2024 at 10:30am EST: Dallas Fed Services Activity

- 1/02/2025 at 7:00am EST: MBA Mortgage Applications & Initial/Continuing Jobless Claims

- 1/02/2025 at 9:45am EST: S&P Global US Manufacturing

- 1/03/2025 at 10:00am EST: ISM Manufacturing/Prices Paid/New Orders/Employment

- 1/03/2025: Wards Total Vehicle Sales

- 1/03/2025 at 11:00am EST: Barkin Gives Keynote Address

- 1/04/2025 at 5:30pm EST: Daly Speaks at AEA Monetary Policy Session

- 1/05/2025 at 1:15pm EST: Daly Gives Remarks on Panel Honoring Bernanke

- 1/06/2025 at 9:45am EST: S&P Global US Services PMI and S&P Global US Composite PMI

- 1/06/2025 at 10:00am EST: Factory Orders and Factory Orders Ex Trans

- 1/06/2025 at 10:00am EST: Durable Goods Orders and Durables Ex Transportation

- 1/06/2025 at 10:00am EST: Cap Goods Orders Nondef Ex Air and Cap Goods Ship Nondef Ex Air

- 1/06/2025 at 10:00am EST: Cap Goods Orders Nondef Ex Air and Cap Goods Ship Nondef Ex Air