US Treasuries

- Monday’s UST 10y range: 4.46% – 4.56%, closing at 4.54%

Today’s Recap:

- UST yields traded in a 2 bps – 3 bps range after Trump confirmed delay of tariffs against Mexico for one month

- Boston Fed President Susan Collins: No urgency in making adjustments.

- Atlanta Fed President Raphael Bostic: Nominal Neutral rate at 3% – 3.5%; wants to wait to see impact of past cuts; prepared to wait before cutting again

- US Treasury estimates $815 billion in net borrowing for January – March (down from previous estimate of $823 billion). It expects to borrow a net $123 billion in April – June quarter (assuming $850 billion cash balance at end of period). [Note and Bond Sales to be announced on Wed, 2/5/25]

Bloomberg: Bond Dealers Lock Horns over Inflation-Protected Bond Supply

A small coterie of Wall Street dealers say it’s time for the US Treasury to resume increasing the size of its 30-year inflation-protected bond auctions.

Upcoming US Treasury Supply

Tentative Schedule of Treasury Buyback Operations

TIPS Volumes

- January 31, 2025 month-end TIPS extension: 0.28 years

- Large TIPS volume at month-end January 31, 2025: 87.5 billion

TIPS Index outperformed the Treasury Index in January 2025 by 77 bps

- Bloomberg US Treas index Total Return: MTD: 0.52% YTD: 0.52%

- Bloomberg Inflation index Total Return: MTD: 1.29% YTD: 1.29%

Jim Bianco joins Fox Business to discuss the Impacts on Tariffs, Bitcoin & No Landing

Intraday Commentary from Jim Bianco

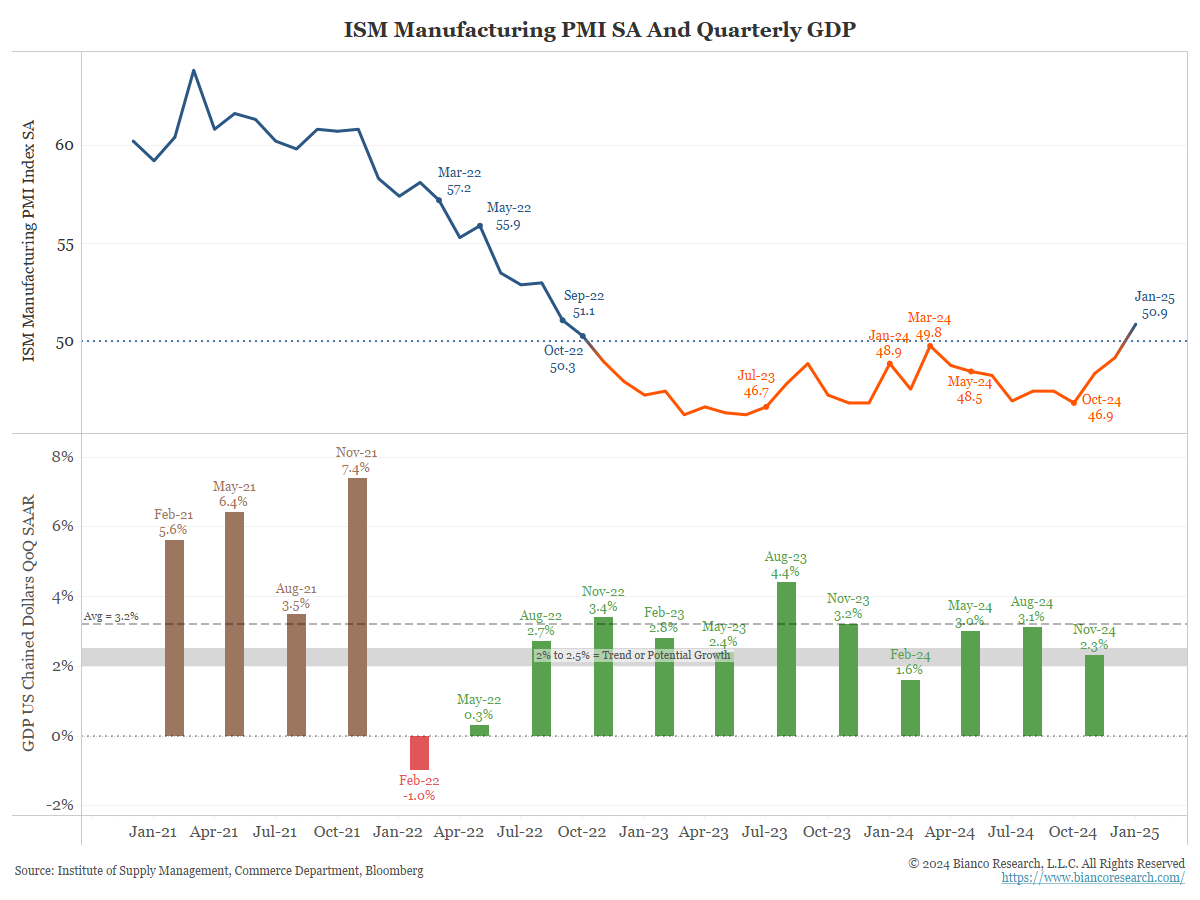

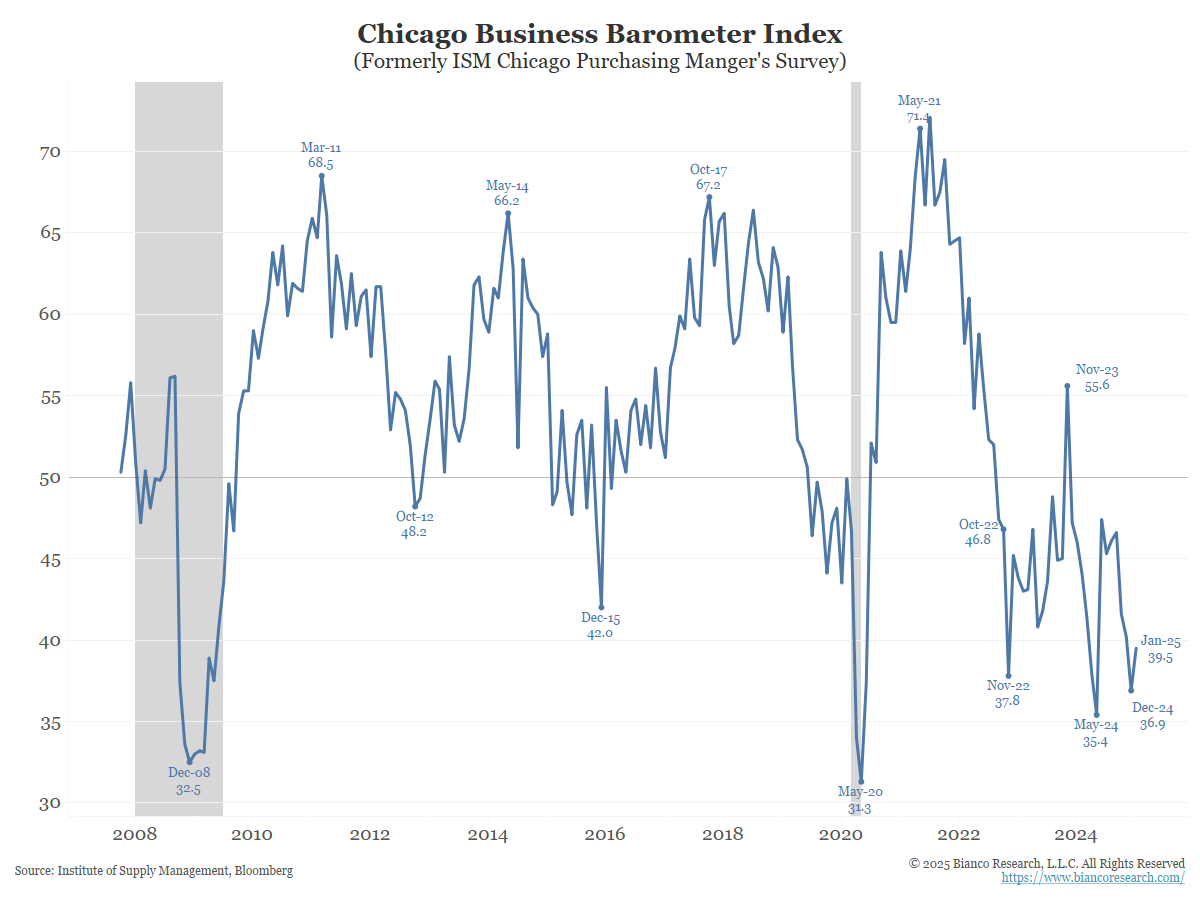

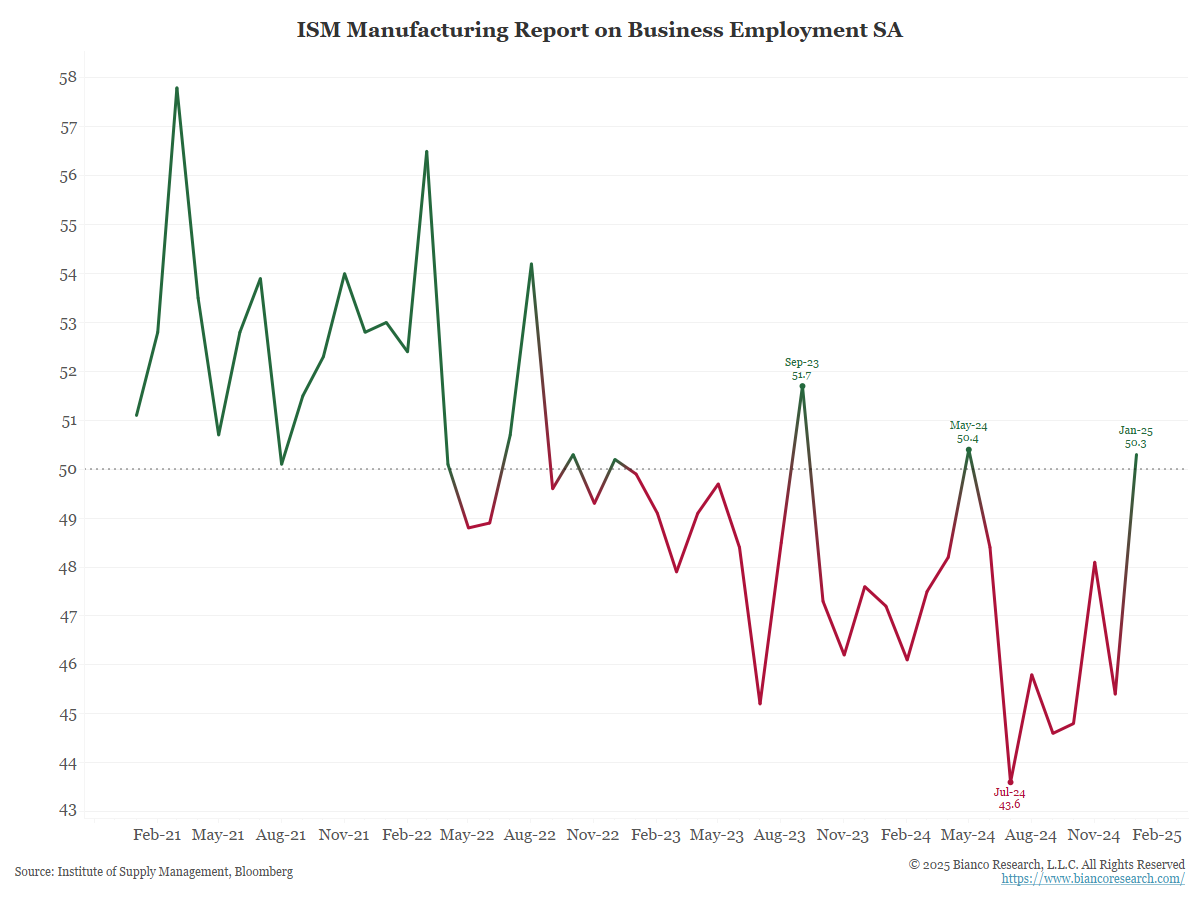

While the national ISM is back above 50, the Chicago ISM (known as the Chicago Business Barometer) is still below 40. Chicago ISM is not an economic indicator… it is a plea for help.

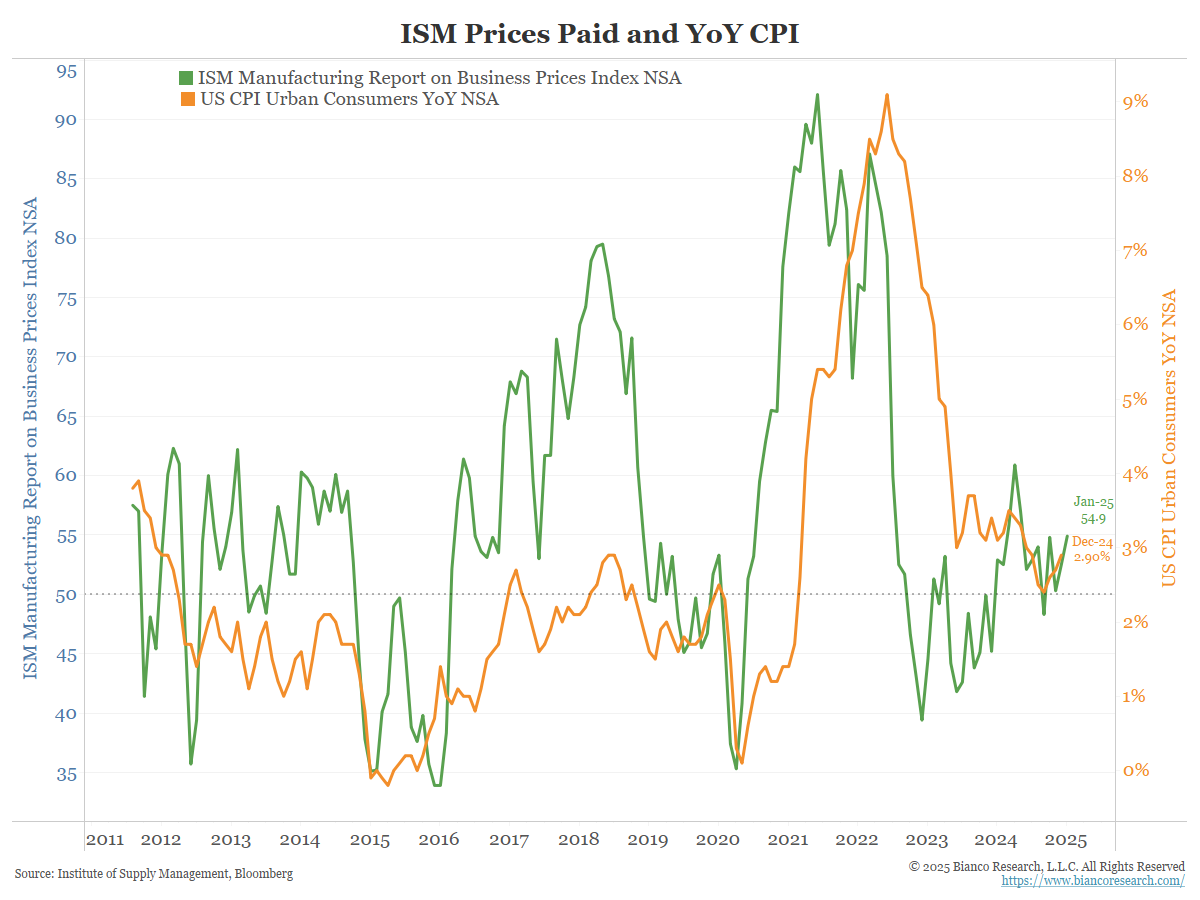

Prices paid beat expectations at 54.9 (green), suggesting upward pressure on inflation (orange).

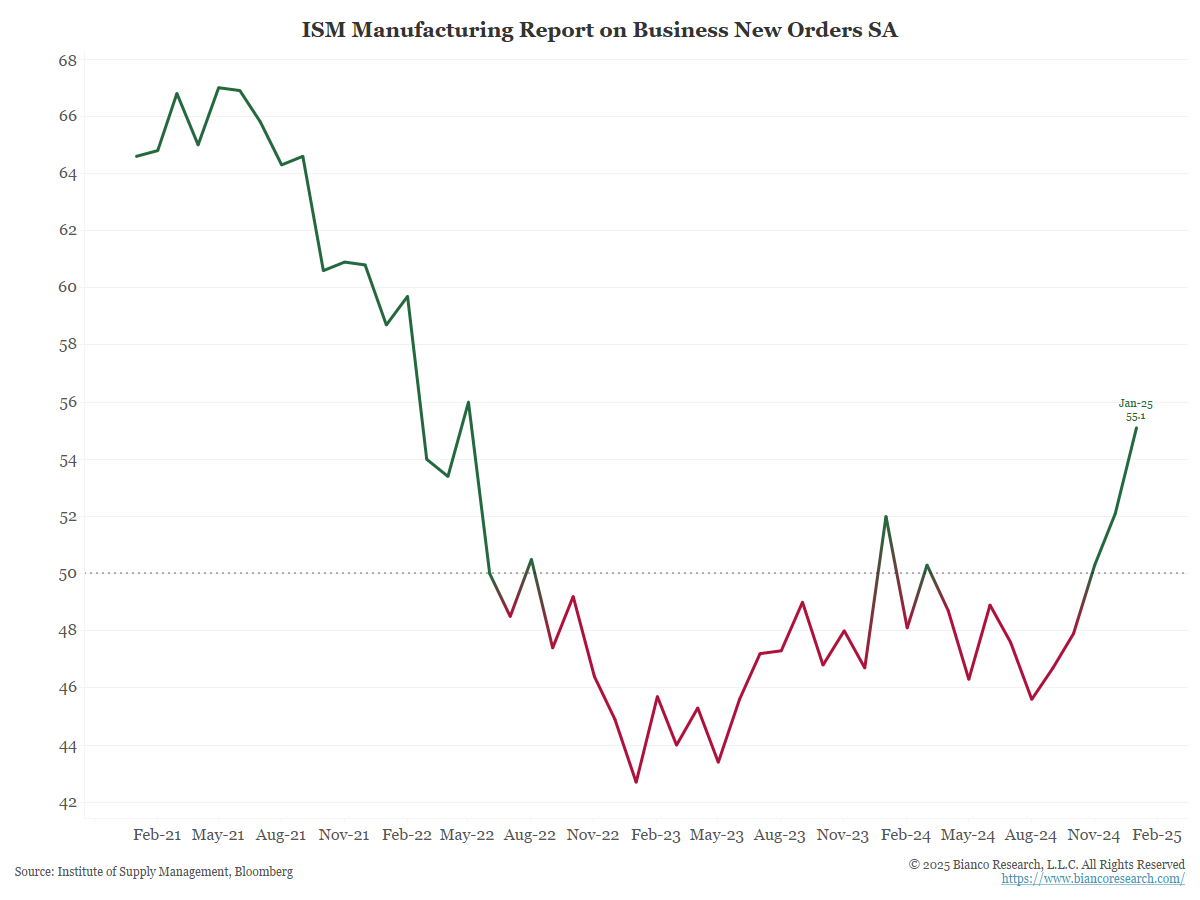

New Orders, considered a “leading indicator,” shot up. This is being dismissed as front-loading ahead of tariffs. So, a dip back down is expected in Feb/Mar.

Finally, employment topped 50 again.

All in all, the ISM report SHOULD HAVE BEEN bond-bearish. It was totally ignored because it was released about the same time as the Mexico headline (delaying tariffs for a month).

Speaking of bonds. The 10-year yield is still “hanging around” the .382 retracement (upper green line).

Despite closing below that level a few times, yields are not generating any downside momentum.

Every day that goes by without yields going lower is another day suggesting the trend is still higher.

In Other News…

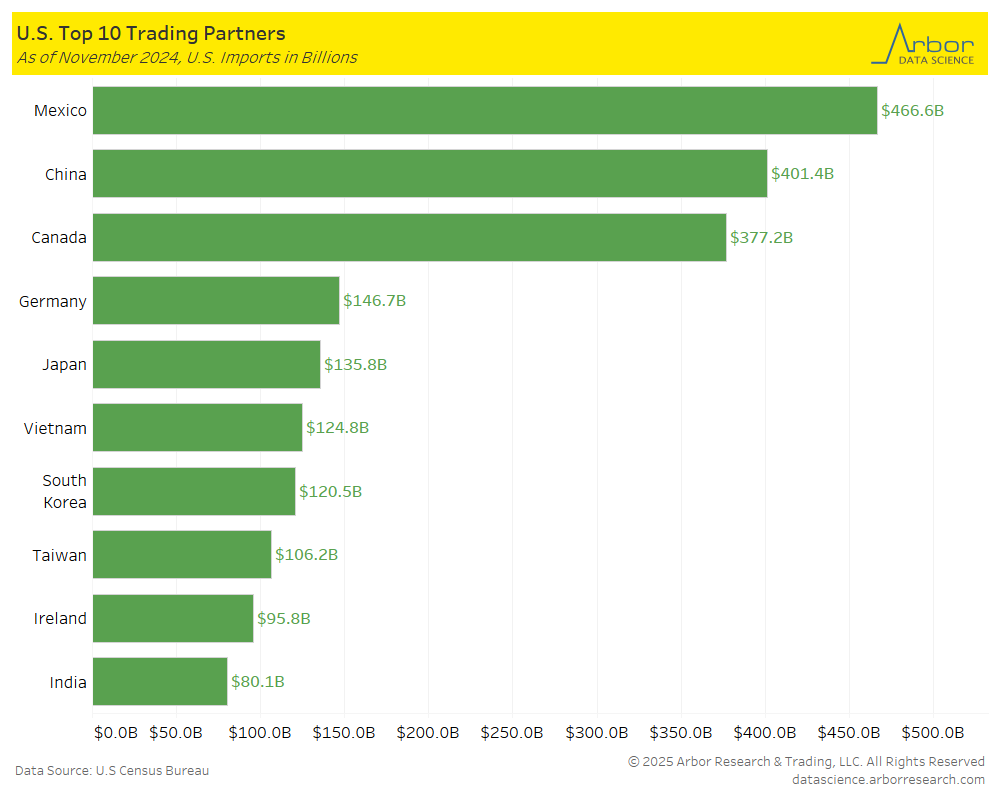

Arbor Data Science:

Bloomberg: Price Tag for Amazon’s Mississippi Data Centers Jump 60% to $16 Billion

Amazon.com Inc. is expected to spend 60% more than previously announced on a massive data center project in Mississippi, underscoring the escalating costs for artificial intelligence infrastructure.

PYMNTS: Consumers Change Spending Habits to East Monthly Money Squeeze

The latest PYMNTS Intelligence reveals that 65% of consumers are living paycheck to paycheck, with 24% struggling to pay their bills. That’s nearly a quarter of Americans playing an exhausting game of financial whack-a-mole, deciding which bills to pay in full, which to pay partially and which to outright ignore until the next paycheck arrives.

NPR: On the frontline against bird flu, egg farmers fear they’re losing the battle

Greg Herbruck knew 6.5 million of his birds needed to die, and fast.

But the CEO of Herbruck’s Poultry Ranch wasn’t sure how the third-generation family egg producer (one of the largest in the US) was going to get through this round of avian flu, financially or emotionally.

Upcoming Economic Releases & Fed Speak

- 2/04/2025 at 10:00am EST: JOLTS Job Opening & Factory Orders

- 2/04/2025 at 10:00am EST: Factory Orders Ex Trans & Durable Goods Orders

- 2/04/2025 at 10:00am EST: Durables Ex Transportation & Cap Goods Orders Nondef Ex Air & Cap Goods Ship Nondef Ex Air

- 2/04/2025 at 11:00am EST: Bostic Speaks in Moderated Conversation on Housing

- 2/04/2025 at 02:00pm EST: Daly Speaks in Moderated Panel

- 2/04/2025 at 07:30pm EST: Jefferson Speaks on Economic Outlook, Policy

- 2/05/2025 at 07:00am EST: MBA Mortgage Applications

- 2/05/2025 at 08:15am EST: ADP Employment Change

- 2/05/2025 at 08:30am EST: Trade Balance

- 2/05/2025 at 09:00am EST: Barkin Speaks at Fireside Chat

- 2/05/2025 at 09:45am EST: S&P Global US Services PMI & S&P Global US Composite PMI

- 2/05/2025 at 10:00am EST: ISM Services Index & ISM Services New Orders

- 2/05/2025 at 10:00am EST: ISM Services Employment & ISM Services Prices Paid

- 2/05/2025 at 01:00pm EST: Goolsbee Gives Remarks at Auto Conference

- 2/05/2025 at 04:00pm EST: Bowman Gives Update on Economy, Bank Regulation

- 2/05/2025 at 07:30pm EST: Jefferson Gives Lecture

- 2/06/2025 at 07:30am EST: Challenger Job Cuts YoY

- 2/06/2025 at 08:30am EST: Nonfarm Productivity & Unit Labor Costs

- 2/06/2025 at 08:30am EST: Initial Jobless Claims & Continuing Claims

- 2/06/2025 at 02:30pm EST: Waller Gives Remarks on the Future of Payments

- 2/06/2025 at 05:15pm EST: Jefferson Gives Lecture

- 2/07/2025 at 08:30am EST: Annual Revisions: Establishment Survey Data

- 2/07/2025 at 08:30am EST: Change in Nonfarm Payrolls & Two-Month Payroll Net Revision

- 2/07/2025 at 08:30am EST: Change in Private Payrolls & Change in Manufacturing Payrolls

- 2/07/2025 at 08:30am EST: Unemployment Rate

- 2/07/2025 at 08:30am EST: Average Hourly Earnings MoM & Average Hourly Earnings YoY

- 2/07/2025 at 08:30am EST: Average Weekly Hours All Employees& Labor Force Participation rate

- 2/07/2025 at 08:30am EST: Underemployment Rate

- 2/07/2025 at 09:45am EST: Bowman Gives Update on Economy, Bank Regulation

- 2/07/2025 at 10:00am EST: U. of Mich. Sentiment

- 2/07/2025 at 10:00am EST: Wholesale Inventories MoM & Wholesale Trade Sales MoM

- 2/07/2025 at 10:00am EST: U. of Mich. Current Conditions & U. of Mich. Expectations

- 2/07/2025 at 10:00am EST: U. of Mich. 1 Yr Inflation & U. of Mich. 5-10 Yr Inflation

- 2/07/2025 at 12:00pm EST: Kugler Speaks in Entrepreneurship, Productivity

- 2/07/2025 at 03:00pm EST: Consumer Credit