US Treasuries

- Tuesday’s UST 10y range: 4.505% – 4.595%, closing at 4.51%

Today’s Recap:

- Fed’s Daly (non-voter): Economy is in a good position. Fed has promised 2% inflation and will dedicate itself to achieving that.

Upcoming US Treasury Supply

Tentative Schedule of Treasury Buyback Operations

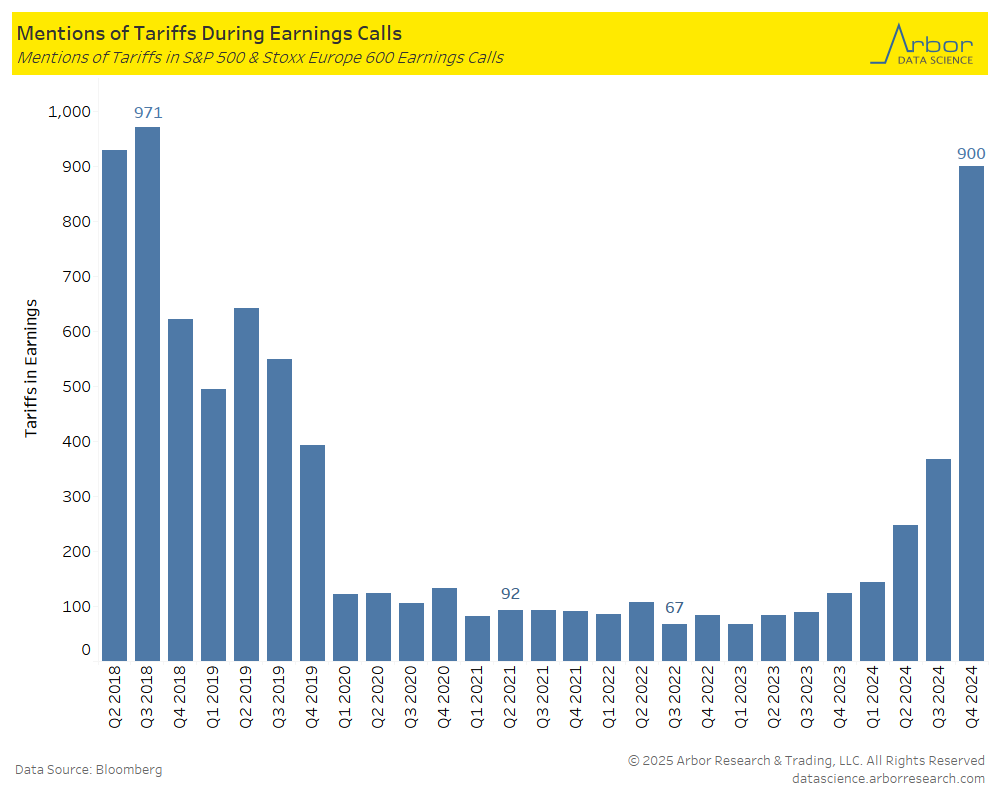

Arbor Data Science: Trading Tariffs by Sam Rines

Oilprice: The U.S. Has No Viable Alternative to Canadian Crude

The United States has no alternative crude oil supplier that could replace Canada, energy investor Eric Nuttall told Bloomberg this week, arguing this fact would put a quick end to the tariff war.

Intraday Commentary from Jim Bianco

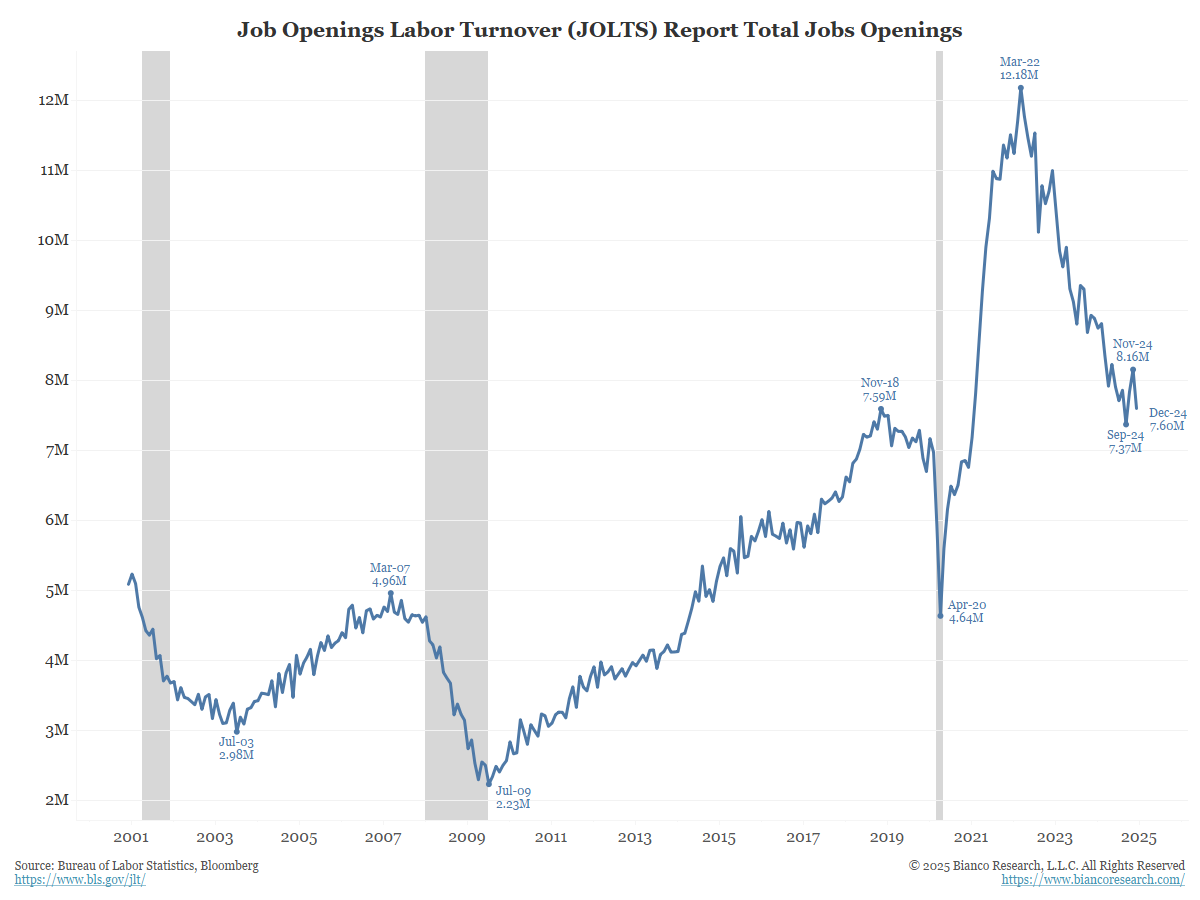

Nearly five years after the COVID shutdown and the JOLTS report STILL shows more open jobs now than anytime before COVID.

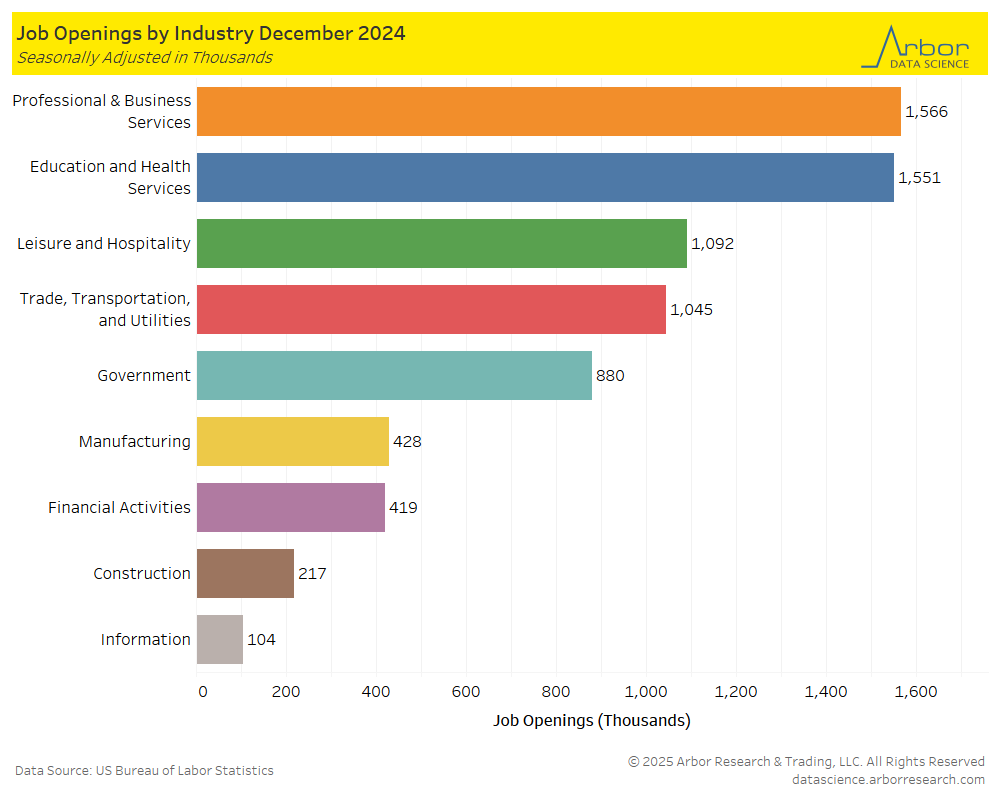

Arbor Data Science:

In Other News…

Crain’s Chicago Business: Allstate going all in on auto, home businesses despite challenges from natural disasters

Allstate’s $1.25 billion sale of its group health insurance shows the insurance giant is confident it can make money in its core home and auto businesses despite the increasing frequency of natural disasters and rising costs.

Insurify: Insurify Projects Car Insurance Costs Will Increase Another 5% in 2025, After Soaring 42% Since 2022

Rising vehicle repair costs, linked to high-tech and electric vehicles (EVs), fueled rate hikes in 2024. Auto insurance companies are also increasingly factoring climate risk into their rates as insurers can incur significant losses from severe weather events.

Read more from Arbor Data Science: Auto Repair Costs – In the Zone by Petr Pinkhasov

An Update to our post last week:

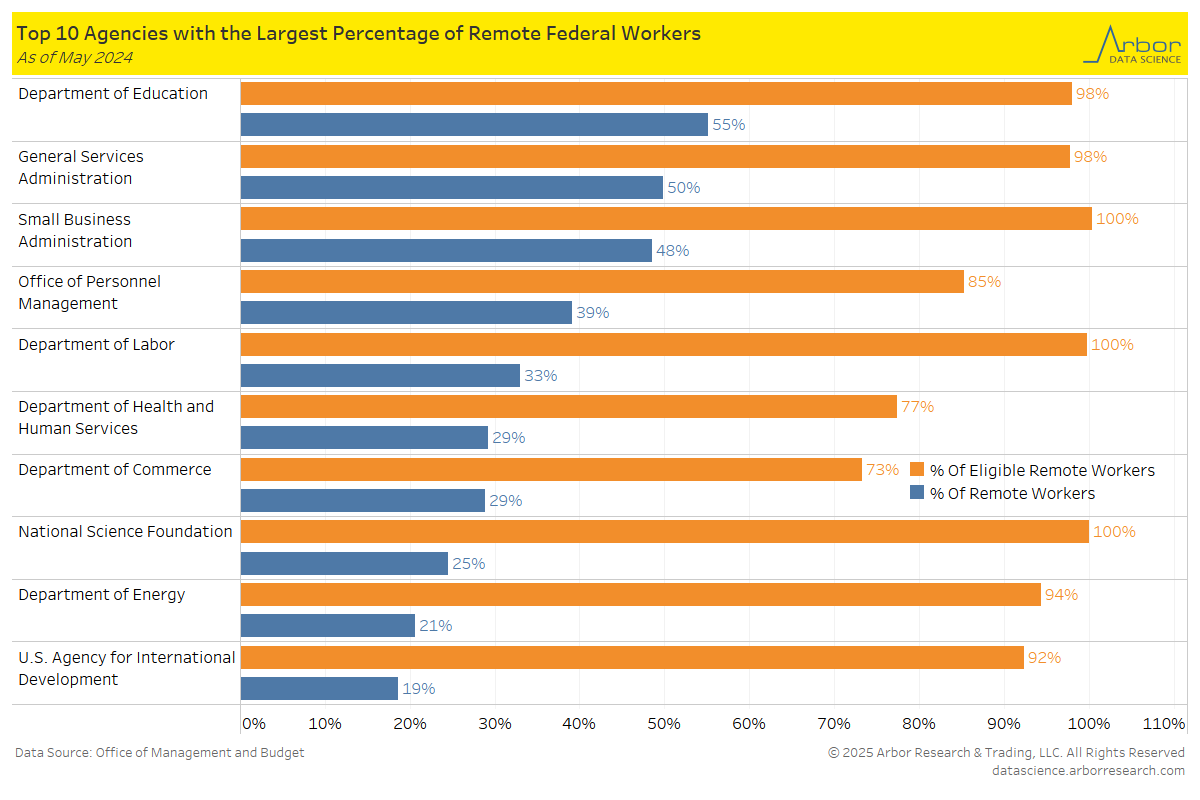

Axios: Scoop: 20,000 federal workers take “buyout” so far, official says

About 20,000 federal workers have accepted the “buyout” offer put forward by the Trump administration last week, a senior administration official tells Axios. t’s a significant number of people — about 1% of the federal workforce — but still substantially less than the White House’s target of 5% to 10%.

Arbor Data Science: Federal Employees Back to the Office – By the Numbers

Upcoming Economic Releases & Fed Speak

- 2/05/2025 at 07:00am EST: MBA Mortgage Applications

- 2/05/2025 at 07:30am EST: Barkin Appears on BTV

- 2/05/2025 at 08:15am EST: ADP Employment Change

- 2/05/2025 at 08:30am EST: Trade Balance

- 2/05/2025 at 09:00am EST: Barkin Speaks at Fireside Chat

- 2/05/2025 at 09:45am EST: S&P Global US Services PMI & S&P Global US Composite PMI

- 2/05/2025 at 10:00am EST: ISM Services Index & ISM Services New Orders

- 2/05/2025 at 10:00am EST: ISM Services Employment & ISM Services Prices Paid

- 2/05/2025 at 01:00pm EST: Goolsbee Gives Remarks at Auto Conference

- 2/05/2025 at 04:00pm EST: Bowman Gives Update on Economy, Bank Regulation

- 2/05/2025 at 07:30pm EST: Jefferson Gives Lecture

- 2/06/2025 at 07:30am EST: Challenger Job Cuts YoY

- 2/06/2025 at 08:30am EST: Nonfarm Productivity & Unit Labor Costs

- 2/06/2025 at 08:30am EST: Initial Jobless Claims & Continuing Claims

- 2/06/2025 at 02:30pm EST: Waller Gives Remarks on the Future of Payments

- 2/06/2025 at 07:10pm EST: Logan Speaks on Future Challenges for Monetary Policy

- 2/07/2025 at 08:30am EST: Annual Revisions: Establishment Survey Data

- 2/07/2025 at 08:30am EST: Change in Nonfarm Payrolls & Two-Month Payroll Net Revision

- 2/07/2025 at 08:30am EST: Change in Private Payrolls & Change in Manufacturing Payrolls

- 2/07/2025 at 08:30am EST: Unemployment Rate

- 2/07/2025 at 08:30am EST: Average Hourly Earnings MoM & Average Hourly Earnings YoY

- 2/07/2025 at 08:30am EST: Average Weekly Hours All Employees& Labor Force Participation rate

- 2/07/2025 at 08:30am EST: Underemployment Rate

- 2/07/2025 at 09:45am EST: Bowman Gives Update on Economy, Bank Regulation

- 2/07/2025 at 10:00am EST: U. of Mich. Sentiment

- 2/07/2025 at 10:00am EST: Wholesale Inventories MoM & Wholesale Trade Sales MoM

- 2/07/2025 at 10:00am EST: U. of Mich. Current Conditions & U. of Mich. Expectations

- 2/07/2025 at 10:00am EST: U. of Mich. 1 Yr Inflation & U. of Mich. 5-10 Yr Inflation

- 2/07/2025 at 12:00pm EST: Kugler Speaks in Entrepreneurship, Productivity

- 2/07/2025 at 03:00pm EST: Consumer Credit

- 2/10/2025 at 11:00am EST: NY Fed 1-Yr Inflation Expectations

- 2/11/2025 at 06:00am EST: NFIB Small Business Optimism

- 2/11/2025 at 08:50am EST: Hammack Speaks on Economic Outlook

- 2/11/2025 at 10:00am EST: Powell to Testify on Senate Committee

- 2/11/2025 at 07:30pm EST: Williams Gives keynote Remarks