US Treasuries

- UST 10s on Wednesday closed at 4.28%.

- Our 1st weekly support zone is 4.27% – 4.285% (54% shot to hold). Our 2nd weekly support zone is 4.325% – 4.33% (50% shot to hold).

- Our 1st monthly support zone is 4.32% – 4.345% (89% shot to hold).

- Our 1st weekly resistance zone is 4.195% – 4.205%, which has held for the last 10 weeks.

Bloomberg: US Sticks with T-Bills, No Note-Bond Hike for Several Quarters

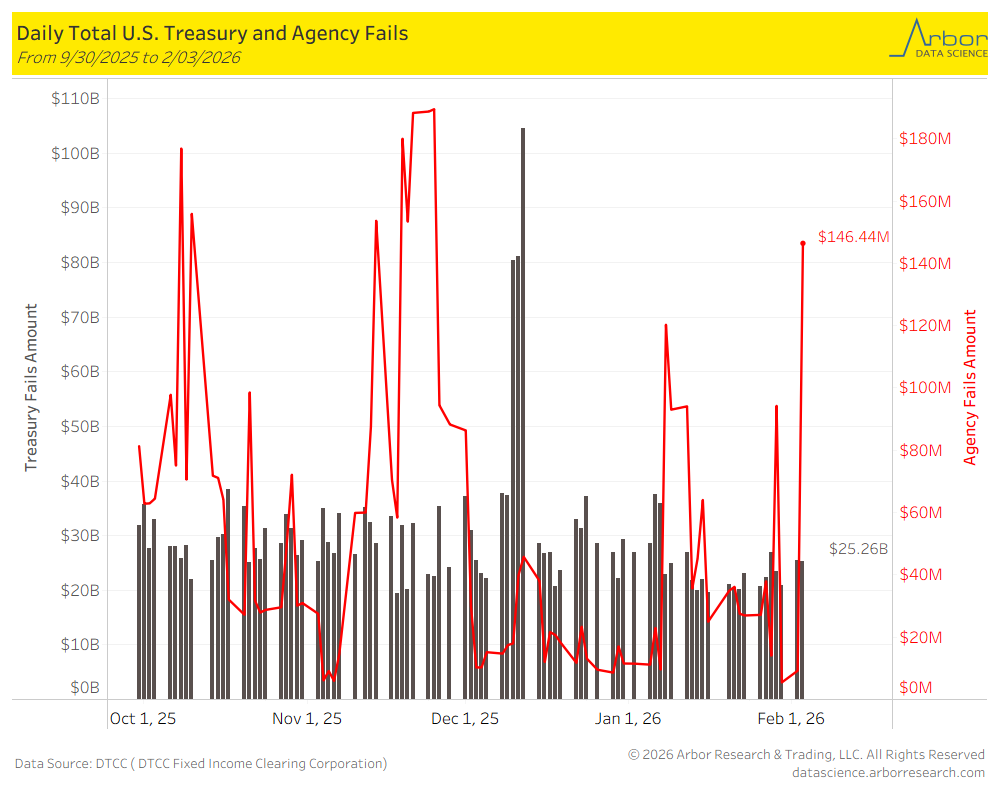

US Treasury Trade Fails

As of 2/03/2026, U.S. Treasury Fails were $25.26 billion and U.S. Agency Fails were $146.44 million.

Intraday Commentary From Jim Bianco

Client Question:

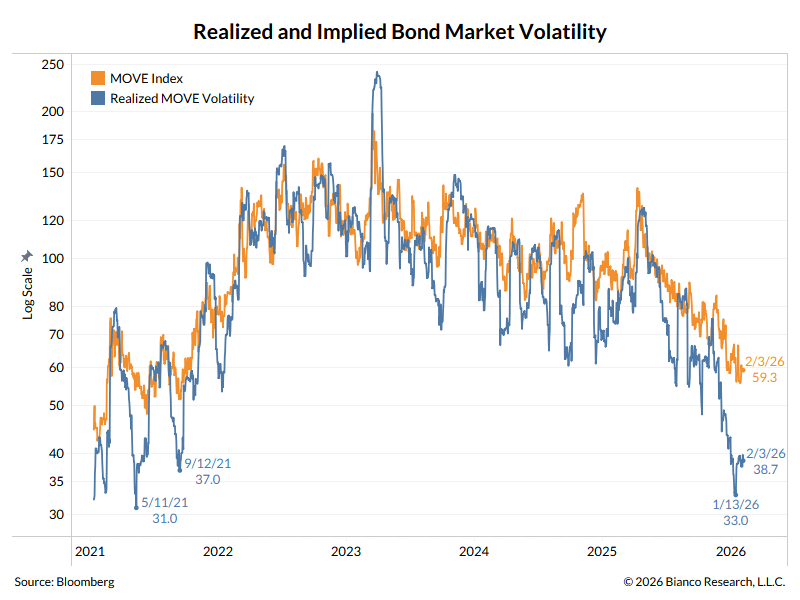

We have a new nominee for Fed chair, a falling dollar and GDP potentially growing by more than 5%. Through all this, bonds continue to trade sideways with volatility at multi-year lows. How much longer can this last?

In light of macro themes in the market, why do you think vol is depressed and the bond mkt trades sideways? Why isn’t the bond mkt reacting to these themes? We still have a 4.27 % 10 yr, like we did in August (although of course its up from 4% area.) It sure seems the market would have moved more in light of the macro world.

Jim Bianco:

The blue line shows realized volatility, or the volatility that has actually been observed over the PAST 30 days.

The orange line is implied volatility, or what volatility level is the market is pricing for the NEXT 30 days.

In the News

Bloomberg: US Regional Bank Shares Rally to Record High as Rotation Extends

OilPrice: Crude Oil Inventories Continue to Fall: EIA

SupplyChainBrain: China Warns Panama of ‘Heavy Price’ on Court Ruling on Ports

AgNewsWire: Former Industry Leaders Warn of Farm Crisis

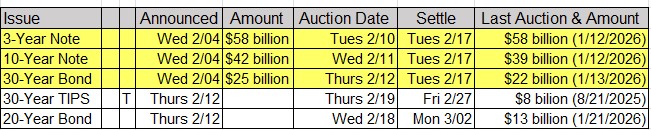

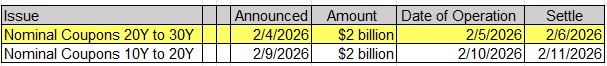

Upcoming US Treasury Supply