US Treasuries

- Wednesday’s UST 10y range: 4.40% – 4.51%, closing at 4.42%

- UST yields decline to lowest levels in 2025 after release of softer ISM services data

Today’s Recap:

- Fed’s Barkin: Need clarity on Policies; Current rates still moderately restrictive; Strengthening expectations for rates to remain on hold. In second speech today: Case for hiking would require evidence of overheating

- Fed’s Goolsbee: Trump’s tariffs will put central bank in ‘difficult position’; Impact on supply chains could be long-lasting

- Fed’s Bowman: Regulators could boost Treasury liquidity; Credit decisions shouldn’t be dictated by bank supervisors

MarketWatch: Pay attention to what junk bonds are saying about the value of Treasury Bonds

Junk-bond investors are giving zero odds to a global trade war. They are almost certainly wrong, since even if a trade war is avoided, the odds are not zero.

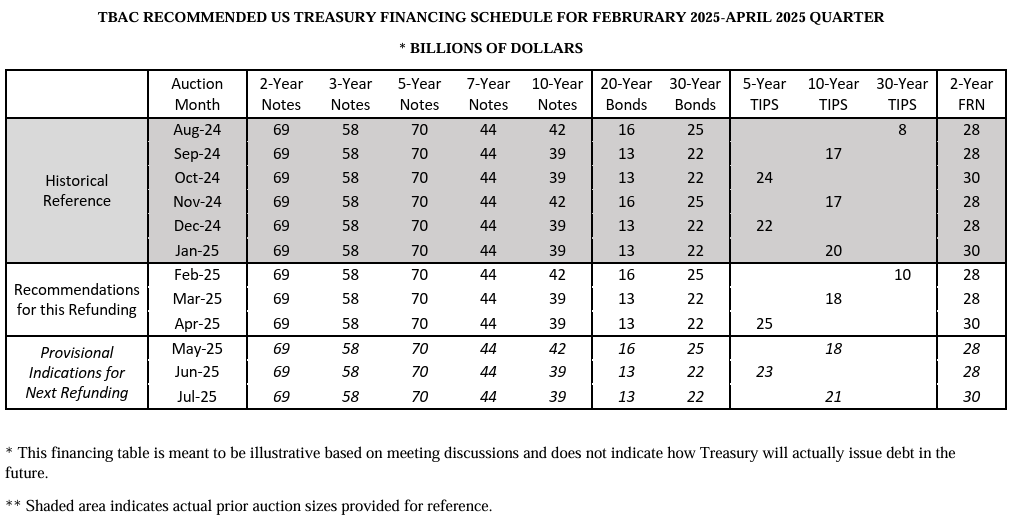

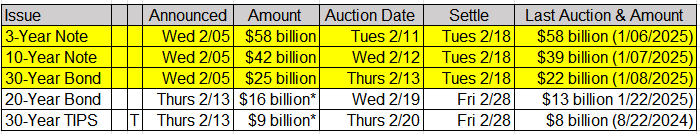

Upcoming US Treasury Supply

The February Refunding Announcement confirmed unchanged coupon auction sizes for the upcoming quarter; in-line with the consensus and consistent with the Treasury Department’s prior messaging.

Tentative Schedule of Treasury Buyback Operations

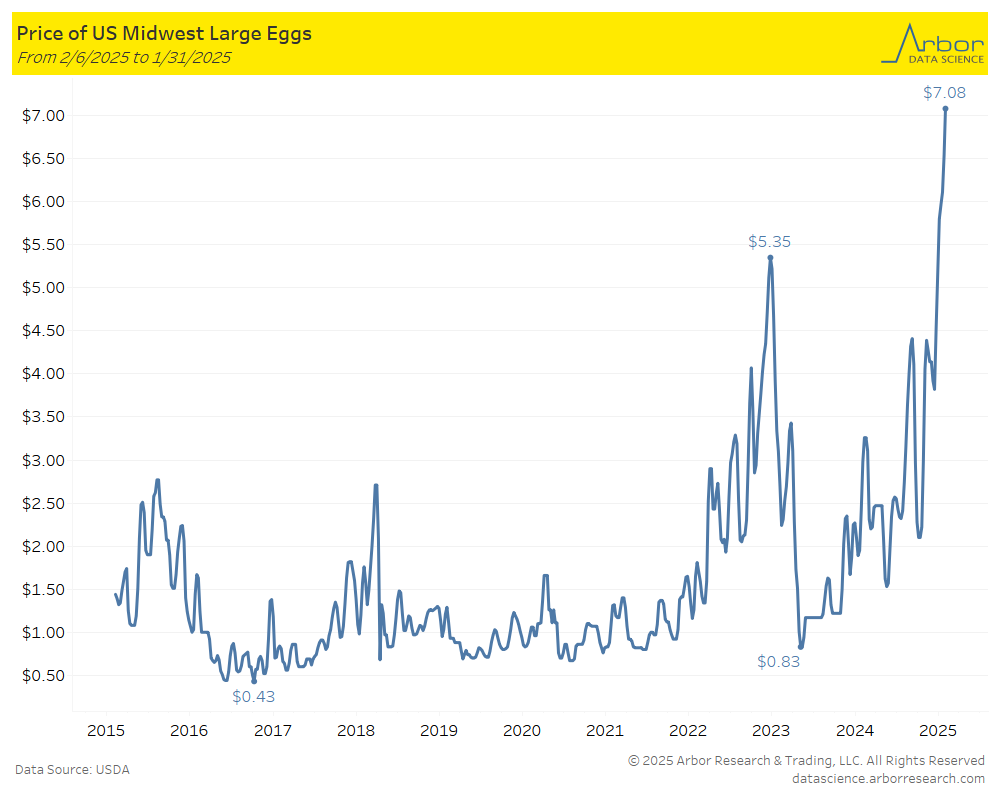

Arbor Data Science: Bird Flu Contagion

Bloomberg: Waffle House 50-Cent Egg Markup Shows Strain on US Restaurants

Intraday Commentary from Jim Bianco

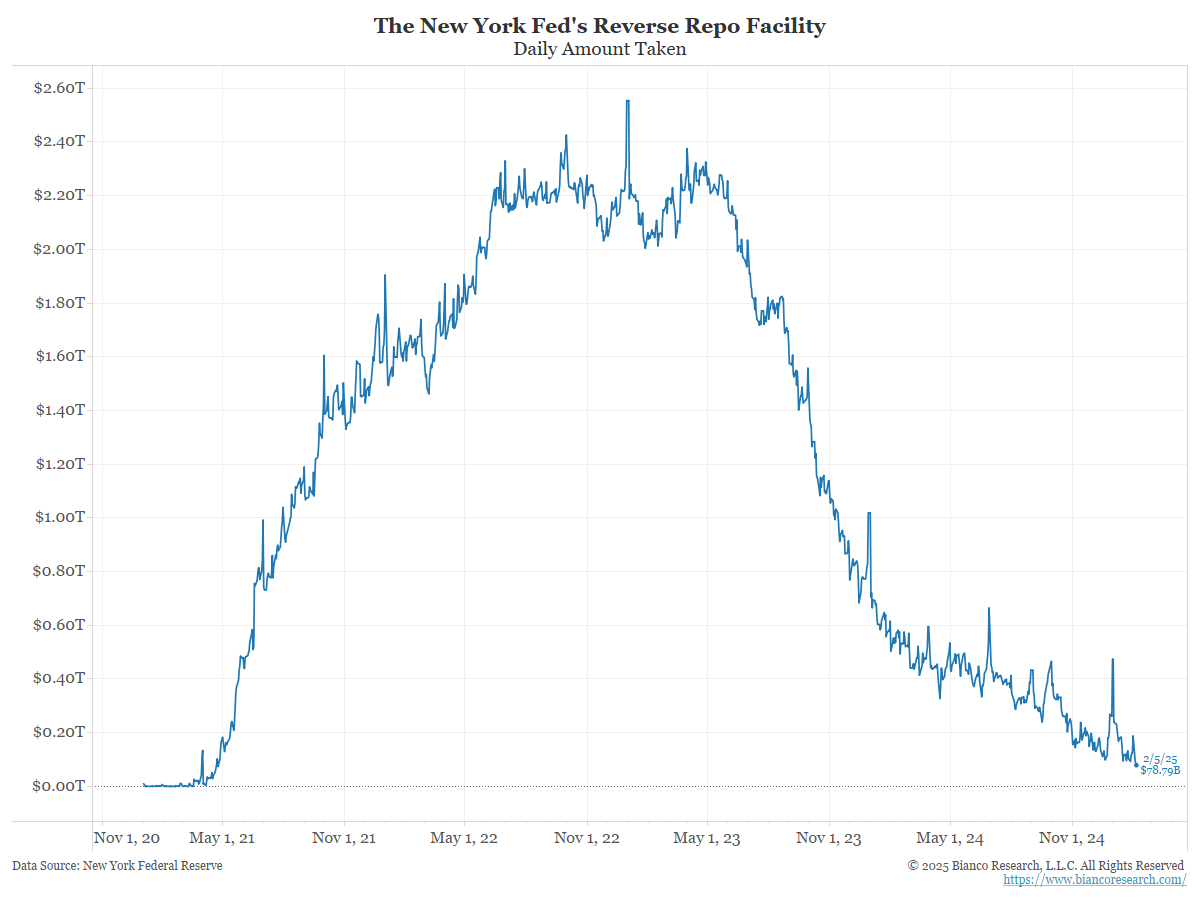

The Fed’s RRP facility is at $78.8B. A nice round trip to 2021 levels:

Remember that 90% to 95% of all RRP is done by Money Market Funds. The other 5% to 10% is GSEs.

Banks and dealers do not play in this sandbox. And also remember that money market funds are BRUTALLY competitive based on their yield. Even a one basis point difference between you and your competitors matters! This because the price of a Money Market is $1.00 every day so the only thing you can go off of is yield.

——

Too many overly complicate. It is straightforward.

Money in RRP is money held at the New York Fed. So, it is OUTSIDE the financial system. When RRP falls this money is being “pushed” back into the financial system, So it is adding liquidity. The opposite is true (rising RRP is “pulling” liquidity out of the financial system).

——

RRP really started down after the Fed started cutting in September.

If you’re a Money Market Fund and think the Fed is on hold, RRP or 6 to 12 month bills are effectively the same thing.

But if you think the Fed will be cutting in the future, then grab 6 to 12 month bills now and lock in those yields to advertise.

Money market managers believe the consensus (because they are the consensus) that more cuts are coming later this year, so they are moving out to 6, 9 and 12 month bills to lock in yields above 4% so they can keep advertising >4% yields for most of 2025, even if the Fed cuts.

In Other News…

Newsweek: Walmart to Cut Hundreds of Jobs: What to Know

Walmart is planning to cut hundreds of jobs and close a North Carolina office as the company continues to focus efforts on its main hubs in California and Arkansas.

Fast Company: Chipotle adds hundreds of new restaurants in record-breaking year

While other fast casual chains struggle with closures and bankruptcies, the company reports growing revenue and margins.

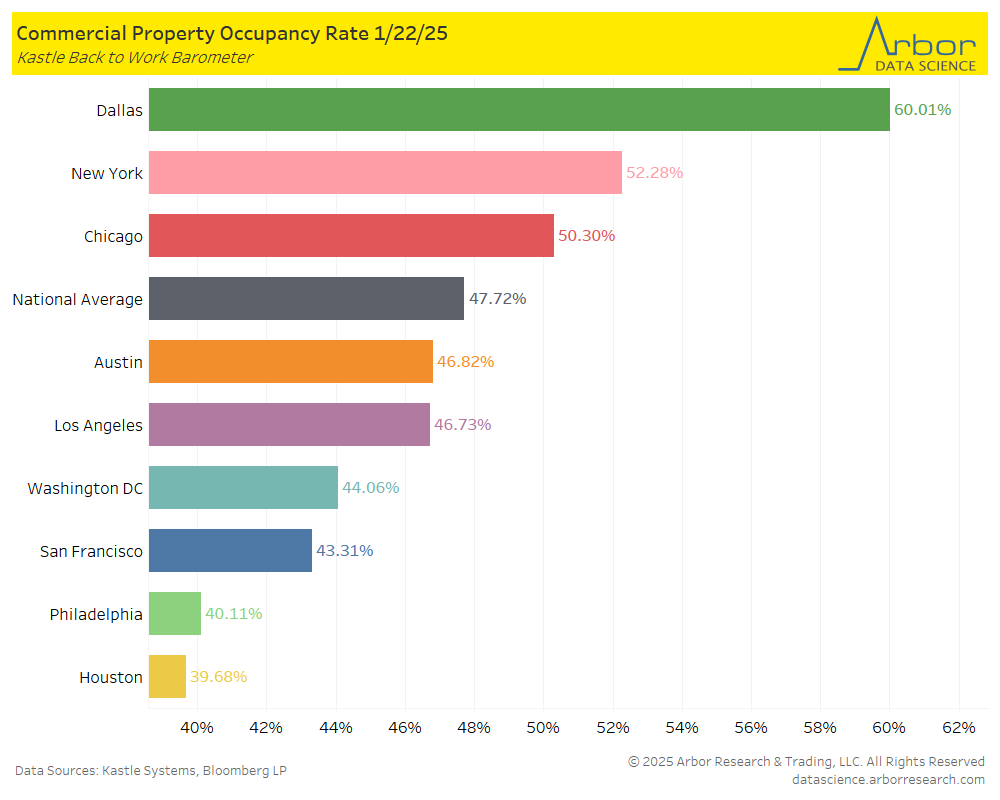

Axios: First look: America’s biggest office leases are growing again

Companies have been shrinking their office footprints, with many people still working from home.That’s starting to change, per the report from CBRE, a commercial real estate firm.

Yet…

The Guardian: Citigroup commits to hybrid working, bucking Wall Street trend

Managers told letting most staff continue to work up to two days a week at home will give bank competitive advantage

Arbor Data Science: Commercial Real Estate Occupancy

Upcoming Economic Releases & Fed Speak

- 2/06/2025 at 07:30am EST: Challenger Job Cuts YoY

- 2/06/2025 at 08:30am EST: Nonfarm Productivity & Unit Labor Costs

- 2/06/2025 at 08:30am EST: Initial Jobless Claims & Continuing Claims

- 2/06/2025 at 02:30pm EST: Waller Gives Remarks on the Future of Payments

- 2/06/2025 at 07:10pm EST: Logan Speaks on Future Challenges for Monetary Policy

- 2/07/2025 at 08:30am EST: Annual Revisions: Establishment Survey Data

- 2/07/2025 at 08:30am EST: Change in Nonfarm Payrolls & Two-Month Payroll Net Revision

- 2/07/2025 at 08:30am EST: Change in Private Payrolls & Change in Manufacturing Payrolls

- 2/07/2025 at 08:30am EST: Unemployment Rate

- 2/07/2025 at 08:30am EST: Average Hourly Earnings MoM & Average Hourly Earnings YoY

- 2/07/2025 at 08:30am EST: Average Weekly Hours All Employees& Labor Force Participation rate

- 2/07/2025 at 08:30am EST: Underemployment Rate

- 2/07/2025 at 09:45am EST: Bowman Gives Update on Economy, Bank Regulation

- 2/07/2025 at 10:00am EST: U. of Mich. Sentiment

- 2/07/2025 at 10:00am EST: Wholesale Inventories MoM & Wholesale Trade Sales MoM

- 2/07/2025 at 10:00am EST: U. of Mich. Current Conditions & U. of Mich. Expectations

- 2/07/2025 at 10:00am EST: U. of Mich. 1 Yr Inflation & U. of Mich. 5-10 Yr Inflation

- 2/07/2025 at 12:00pm EST: Kugler Speaks in Entrepreneurship, Productivity

- 2/07/2025 at 03:00pm EST: Consumer Credit

- 2/10/2025 at 11:00am EST: NY Fed 1-Yr Inflation Expectations

- 2/11/2025 at 06:00am EST: NFIB Small Business Optimism

- 2/11/2025 at 08:50am EST: Hammack Speaks on Economic Outlook

- 2/11/2025 at 10:00am EST: Powell to Testify on Senate Committee

- 2/11/2025 at 07:30pm EST: Williams Gives keynote Remarks

- 2/12/2025 at 07:00am EST: MBA Mortgage Applications

- 2/12/2025 at 08:30am EST: CPI MoM & CPI Ex Food and Energy MoM

- 2/12/2025 at 08:30am EST: CPI YoY & CPI Ex Food and Energy YoY

- 2/12/2025 at 08:30am EST: CPI Index NSA & CPI Core Index SA

- 2/12/2025 at 08:30am EST: Real Average Weekly Earnings YoY & Real Average Hourly Earning YoY

- 2/12/2025 at 12:00pm EST: Bostic Speaks on Economic Outlook

- 2/12/2025 at 02:00pm EST: Federal Budget Balance