Download this Report to Print

US Treasuries

- UST 10s on Thursday closed at 4.20%.

- Our 1st weekly resistance zone is 4.195% – 4.205% (80% shot to hold). Our 2nd weekly resistance zone is 4.165% – 4.17% (90% shot to hold).

- We have a 1st monthly resistance zone of 4.12% – 4.14% (60% shot to hold), which has held for the last 11 months.

- Our 1st weekly support zone is 4.27% – 4.285% (90% shot to hold).

Bloomberg: Crowded Hedge Fund Treasuries Trade Faces Risk of Rapid Unwind

ZeroHedge: Memory Shortage Fears Spread, Raising Alarm At Qualcomm And Arm

Reuters: China faces higher prices to further U.S. soybean buys to please Trump

Gulf Coast News: Florida Senate passes ‘Granny Flat’ housing bill

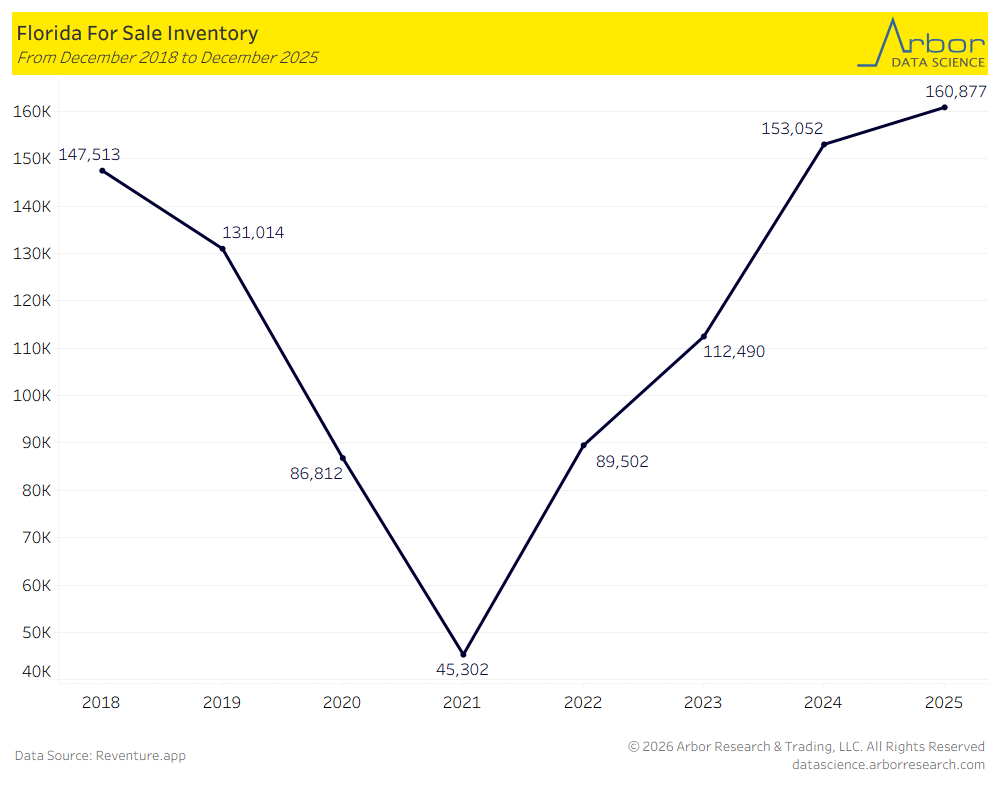

Arbor Data Science: Is Florida’s Housing Market Flashing Warning Signs?

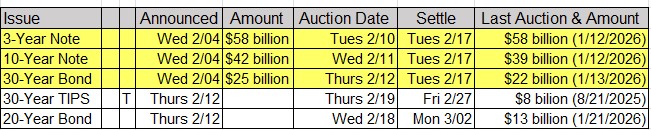

Upcoming US Treasury Supply

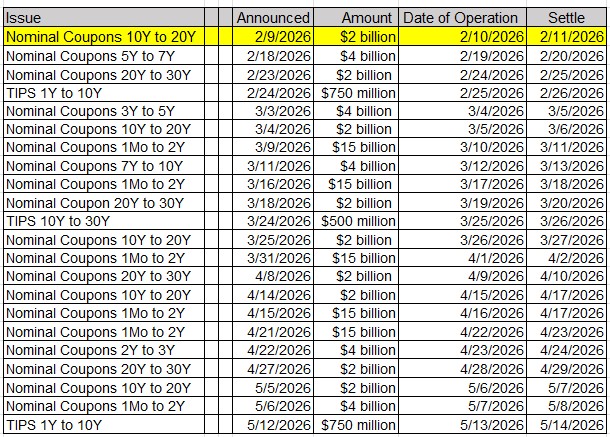

Tentative Schedule of Treasury Buyback Operations

Upcoming Economic Releases & Fed Speak

- 2/06/2026 at 10:00am EST: U. of Mich. Sentiment / Current Conditions/ Expectations

- 2/06/2026 at 10:00am EST: U. of Mich. 1 Yr Inflation / 5-10 Yr Inflation

- 2/06/2026 at 12:00pm EST: Fed’s Jefferson Speaks on the Economy

- 2/06/2026 at 03:00pm EST: Consumer Credit

- 2/09/2026 at 11:00am EST: NY Fed 1-Yr Inflation Expectations

- 2/09/2026 at 01:30pm EST: Fed’s Waller Speaks on Digital Assets

- 2/09/2026 at 03:15pm EST: Fed’s Bostic Speaks in Moderated Conversation

- 2/10/2026 at 06:00am EST: NFIB Small Business Optimism

- 2/10/2026 at 08:15am EST: ADP Weekly Employment Change

- 2/10/2026 at 08:30am EST: Import Price Index MoM / YoY / ex Petroleum MoM

- 2/10/2026 at 08:30am EST: Export Price Index YoY / MoM

- 2/10/2026 at 08:30am EST: Employment Cost Index

- 2/10/2026 at 08:30am EST: Retail Sales Advance MoM / Ex Auto MoM / Ex Auto and Gas / Control Group

- 2/10/2026 at 10:00am EST: Business Inventories

- 2/10/2026 at 12:00pm EST: Fed’s Hammack Speaks on Banking and Economic Outlook

- 2/10/2026 at 01:00pm EST: Fed’s Logan Speaks at Asset Management Derivatives Forum

- 2/11/2026 at 07:00am EST: MBA Mortgage Applications

- 2/11/2026 at 08:30am EST: Change in Nonfarm Payrolls / Two-Month Payroll Net Revision

- 2/11/2026 at 08:30am EST: Change in Private Payrolls / Change in Manufact. Payrolls

- 2/11/2026 at 08:30am EST: Nonfarm Payrolls 3-Mo Avg Change

- 2/11/2026 at 08:30am EST: Average Hourly Earnings MoM / YoY

- 2/11/2026 at 08:30am EST: Real Avg Hourly Earnings YoY / Average Weekly Hours All Employees

- 2/11/2026 at 08:30am EST: Real Avg Hourly & Weekly Earnings YoY

- 2/11/2026 at 08:30am EST: Unemployment Rate / Final Benchmark Payrolls Revision

- 2/11/2026 at 08:30am EST: Labor Force Participation Rate / Underemployment Rate

- 2/11/2026 at 02:00pm EST: Federal Budget Balance

- 2/12/2026 at 08:30am EST: Initial Jobless Claims / 4-Wk Moving Avg / Continuing Claims

- 2/12/2026 at 10:00am EST: Existing Home Sales / MoM

- 2/12/2026 at 07:00pm EST: Fed’s Logan Gives Opening Remarks

- 2/12/2026 at 07:00pm EST: Fed’s Miran Speaks in Moderated Discussion

- 2/13/2026 at 08:30am EST: CPI MoM / YoY; Core CPI MoM / YoY

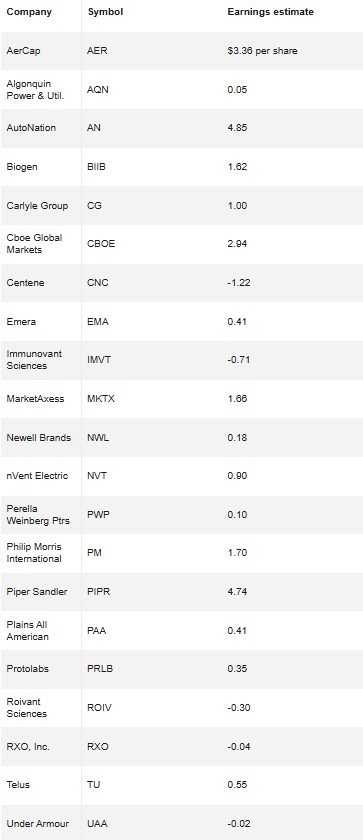

Upcoming Earnings Releases for Friday, February 6, 2026

Noteworthy Before-the-Open Earnings Releases