US Treasuries

Today’s Recap:

- Bonds traded in a very tight range today: 4.42%/4.46%, closing at 4.44%

- Sellers appeared on any strength

- Hedge funds, dealers and those setting up for the refunding were involved

- Several clients sold USTs to set up for the torrent of IG supply

- Fed’s Goolsbee:

- I would be most concerned if long-term rates were rising in lockstep with inflation expectations; so far that is not what is happening.

- Long-term rates are set by complex market forces, not the Federal Reserve.

- The appearance that inflation has stalled is largely due to base effects.

- I feel the neutral rate is well below the current Fed policy, but it is appropriate to slow the pace of cuts to find a stopping point.

[Jim Bianco weighs in on these comments below]

Intraday Commentary from Jim Bianco

Goolsbee should look again…

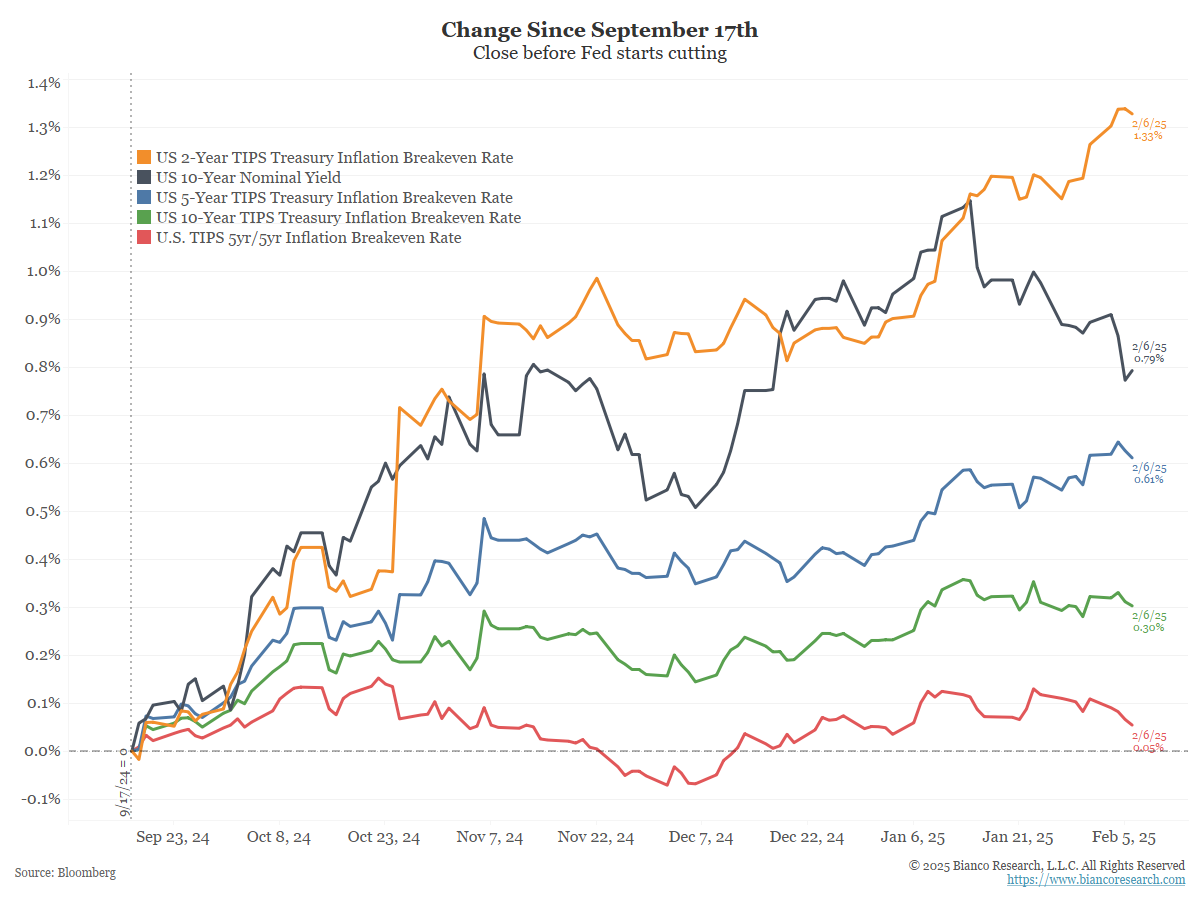

The black line is the change in the 10-year yield since the Fed started cutting on September 18.

The orange (2-year Inflation breakeven) and blue (5-year Inflation breakeven) lines say the majority of the 10-year rise has been accompanied by higher inflation expectations.

The green (10-year Inflation breakeven) and red (5-year/5-year Inflation breakeven) lines suggest this has not been the case further out the curve.

In other words, the market is saying it sees an inflation problem out to 2030 (the next five years). If this comes to pass, it would put inflation as a problem nine years after the Fed declared it was transitory. A decade is about the average inflation cycle.

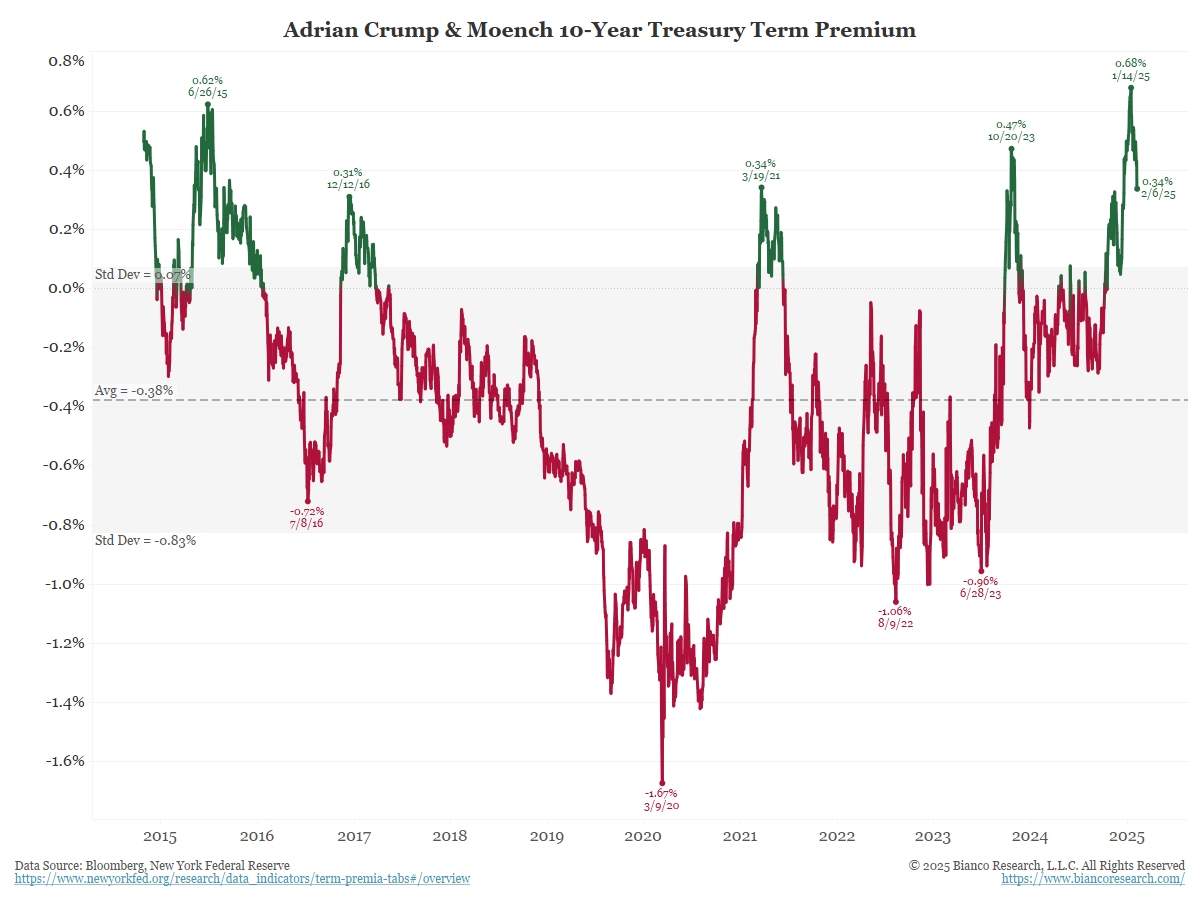

- LONG-TERM RATES ARE SET BY COMPLEX MARKET FORCES, NOT THE FEDERAL RESERVE.

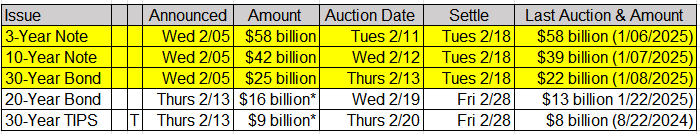

Upcoming US Treasury Supply

Tentative Schedule of Treasury Buyback Operations

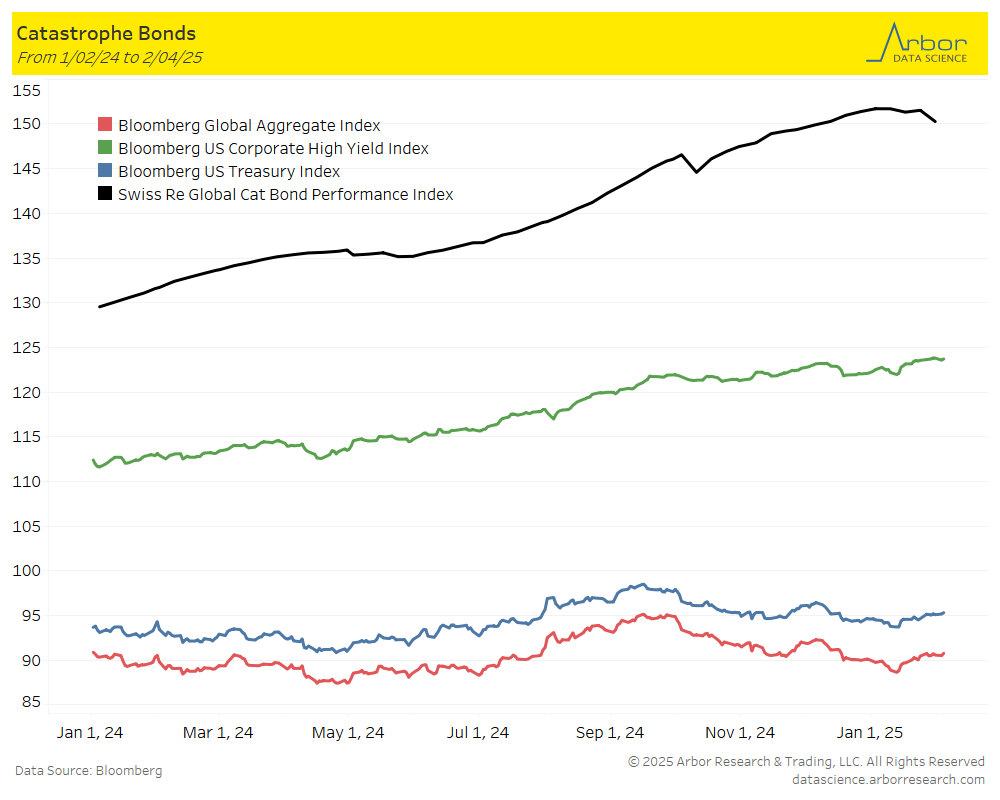

Arbor Data Science: It’s (Not) an Insurance Disaster Yet by Sam Rines

In Other News…

CME Group: U.S. farmers retain optimistic outlook for 2025 despite ag trade uncertainty

Agricultural trade remains a top concern for U.S. farmers. In January, 42% of producers identified “trade policy” as the most important policy for their farm over the next five years, more than double the 17% who selected “crop insurance program.”

American Veterinary Medical Association: New avian influenza genotype found in dairy cattle

A genotype of avian influenza type A H5N1 mostly found in wild birds and poultry has now been discovered in dairy cattle.

Read more from Arbor Data Science: Bird Flu Contagion

OilPrice: There’s No Magic Solution To The Slowdown In U.S. Output Growth

U.S. oil production growth is expected to continue slowing, with non-OPEC supply growth staying below 1 mb/d over the next few years.

The Latest on Housing…

Fast Company: Where the housing market shift is happening the fastest right now

National active listings are on the rise (up 24.6% between January 2024 and January 2025). This indicates that homebuyers have gained some leverage in many parts of the country over the past year, with some markets even feeling like balanced or buyers’ markets on the ground.

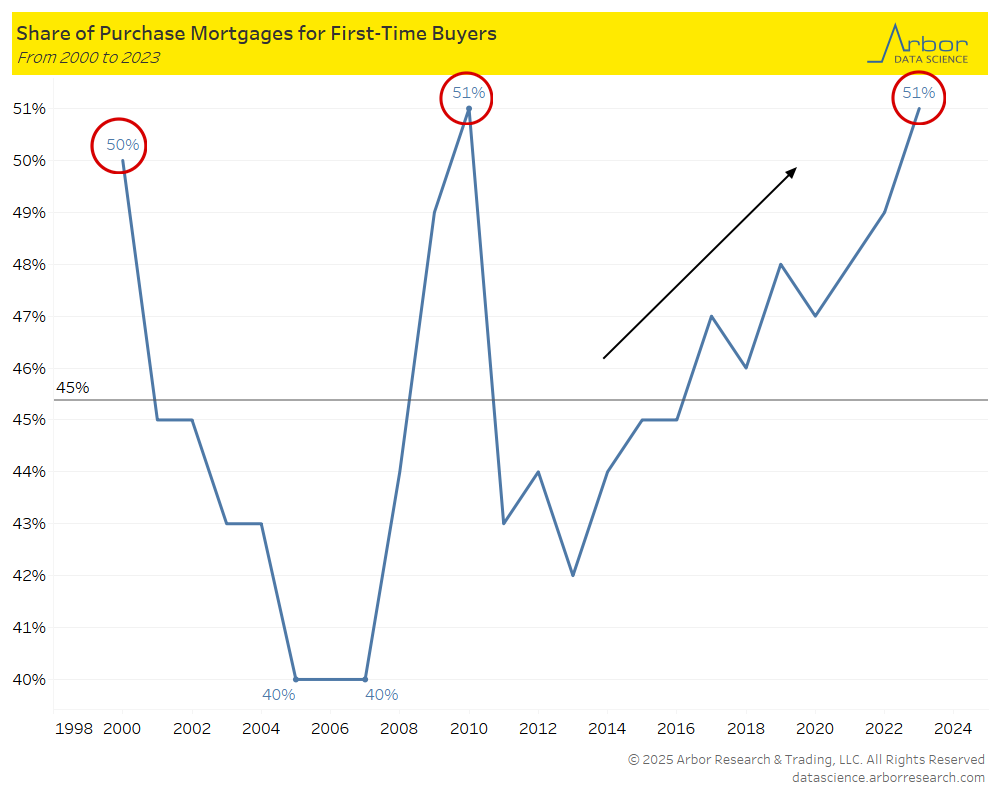

Arbor Data Science: Examining First-Time Home Buyer Activity

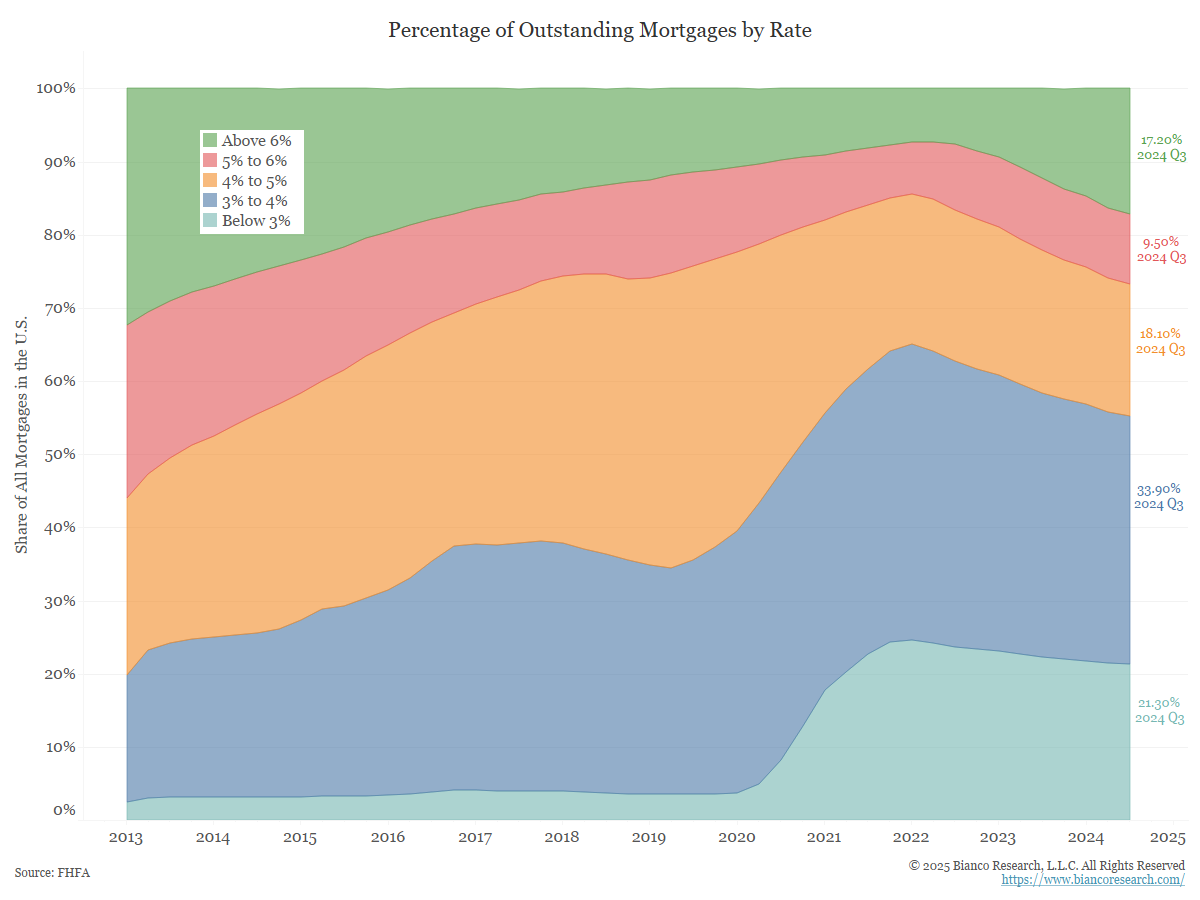

More on the housing market from Bianco Research, featured in Newsclips today:

Upcoming Economic Releases & Fed Speak

- 2/07/2025 at 08:30am EST: Annual Revisions: Establishment Survey Data

- 2/07/2025 at 08:30am EST: Change in Nonfarm Payrolls & Two-Month Payroll Net Revision

- 2/07/2025 at 08:30am EST: Change in Private Payrolls & Change in Manufacturing Payrolls

- 2/07/2025 at 08:30am EST: Unemployment Rate

- 2/07/2025 at 08:30am EST: Average Hourly Earnings MoM & Average Hourly Earnings YoY

- 2/07/2025 at 08:30am EST: Average Weekly Hours All Employees& Labor Force Participation rate

- 2/07/2025 at 08:30am EST: Underemployment Rate

- 2/07/2025 at 09:45am EST: Bowman Gives Update on Economy, Bank Regulation

- 2/07/2025 at 10:00am EST: U. of Mich. Sentiment

- 2/07/2025 at 10:00am EST: Wholesale Inventories MoM & Wholesale Trade Sales MoM

- 2/07/2025 at 10:00am EST: U. of Mich. Current Conditions & U. of Mich. Expectations

- 2/07/2025 at 10:00am EST: U. of Mich. 1 Yr Inflation & U. of Mich. 5-10 Yr Inflation

- 2/07/2025 at 12:00pm EST: Kugler Speaks in Entrepreneurship, Productivity

- 2/07/2025 at 03:00pm EST: Consumer Credit

- 2/10/2025 at 11:00am EST: NY Fed 1-Yr Inflation Expectations

- 2/11/2025 at 06:00am EST: NFIB Small Business Optimism

- 2/11/2025 at 08:50am EST: Hammack Speaks on Economic Outlook

- 2/11/2025 at 10:00am EST: Powell to Testify on Senate Committee

- 2/11/2025 at 07:30pm EST: Williams Gives keynote Remarks

- 2/12/2025 at 07:00am EST: MBA Mortgage Applications

- 2/12/2025 at 08:30am EST: CPI MoM & CPI Ex Food and Energy MoM

- 2/12/2025 at 08:30am EST: CPI YoY & CPI Ex Food and Energy YoY

- 2/12/2025 at 08:30am EST: CPI Index NSA & CPI Core Index SA

- 2/12/2025 at 08:30am EST: Real Average Weekly Earnings YoY & Real Average Hourly Earning YoY

- 2/12/2025 at 12:00pm EST: Bostic Speaks on Economic Outlook

- 2/12/2025 at 02:00pm EST: Federal Budget Balance

- 2/13/2025 at 08:30am EST: PPI Final Demand MoM & PPI Ex Food and Energy MoM

- 2/13/2025 at 08:30am EST: PPI Ex Food, Energy, and Trade MoM & PPI Final Demand YoY

- 2/13/2025 at 08:30am EST: PPI Ex Food and Energy YoY & PPI Ex Food, Energy, Trade YoY

- 2/13/2025 at 08:30am EST: Initial Jobless Claims & Continuing Claims