US Treasuries

- Friday’s UST 10y range: 4.38% – 4.51%, closing at 4.48%

Today’s Recap:

The UMich expected change in prices report spooked bond this morning

- Fed’s Kashkari: The rise in the 10-year yield is not worrisome. Rates to decline ‘modestly’ in 2025

- Fed’s Kugler: Not at 2% inflation, makes sense to hold rates steady

Jim Bianco in the Media

Intraday Commentary from Jim Bianco

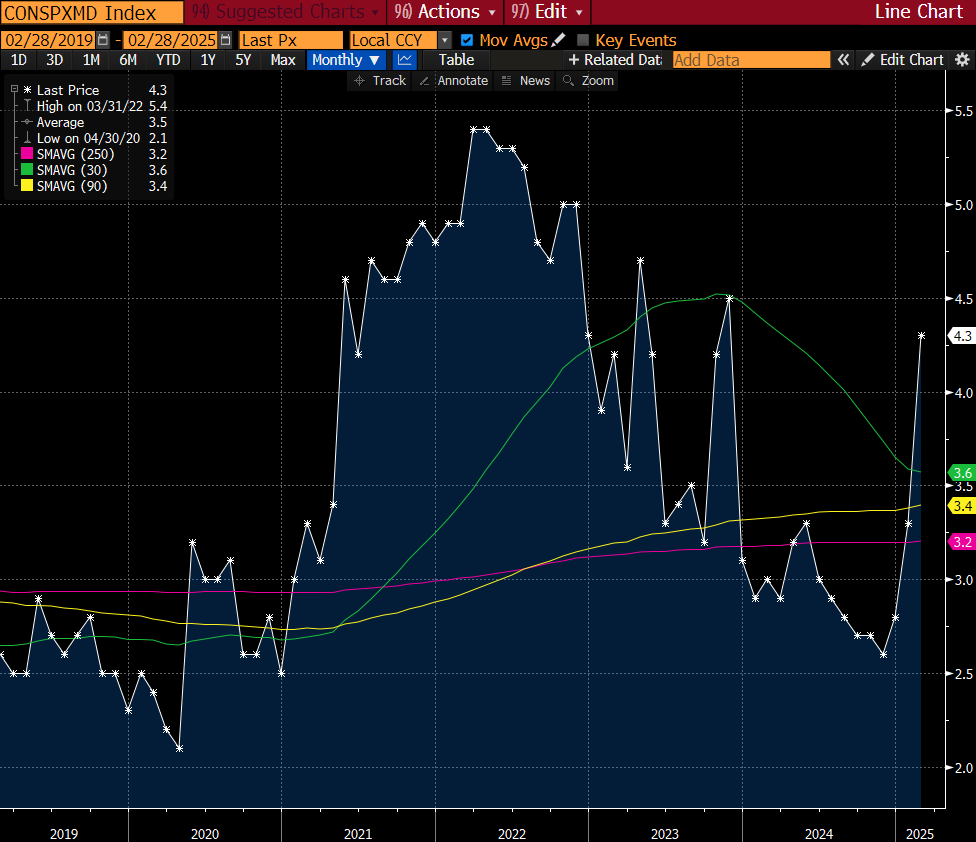

The difference above was one reason. Another is the Sham rule.

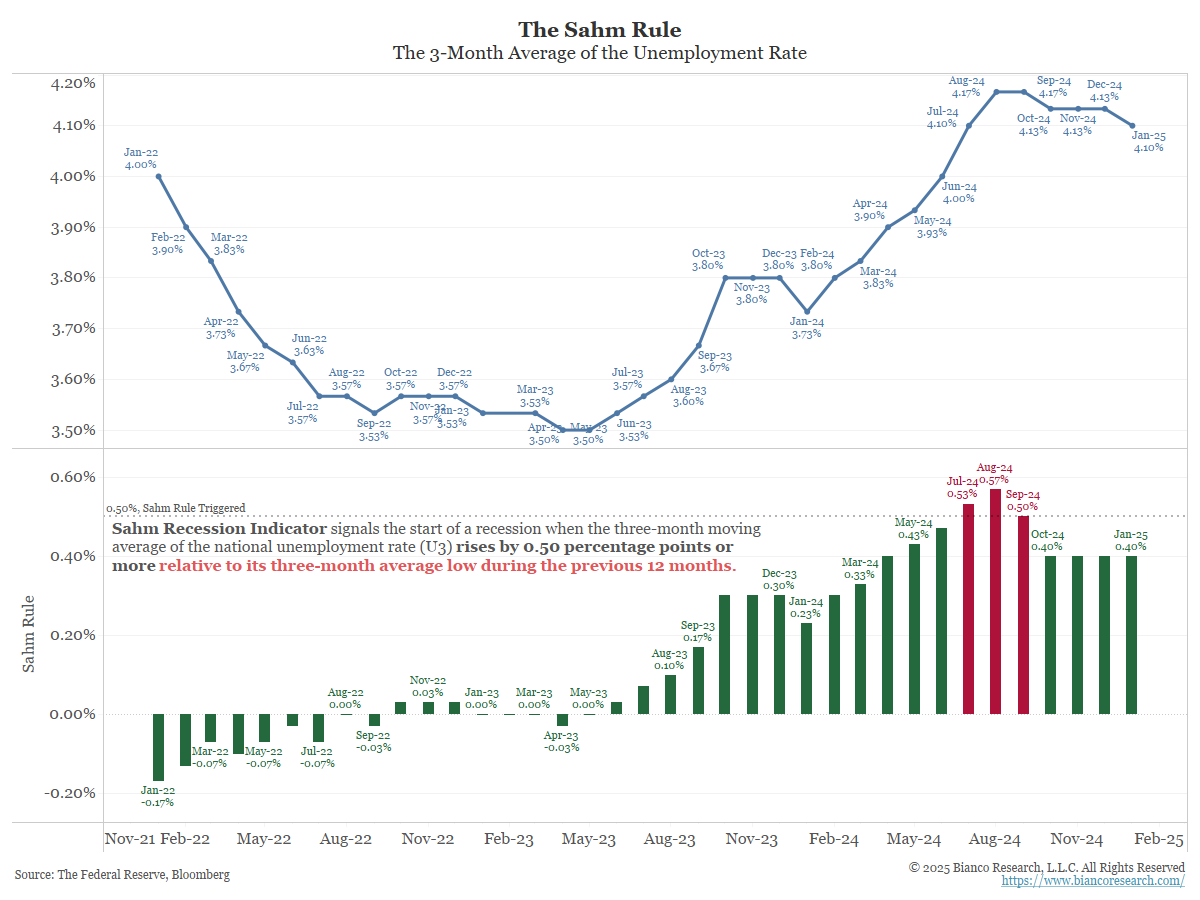

It triggered a Sham Recession warning in July (red bars). Even though Claudia Sham herself said it might not work, the Fed is always panicked by “what if” it’s right and we are “stuck” at 5.25% to 5.50% on the funds rate.

So they panicked and cut.

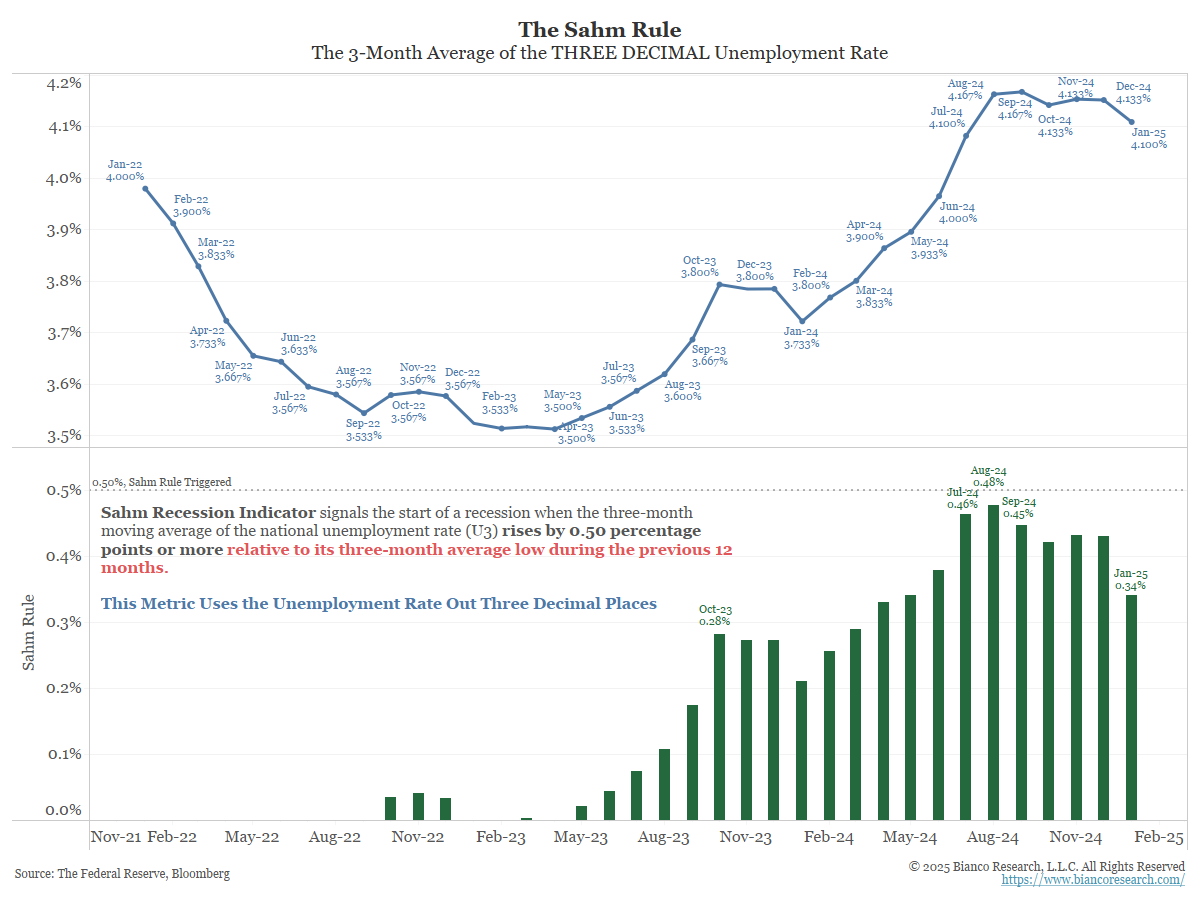

But the Sahm rule out to 3 decimal places never triggered a recession warning, and now it is falling again.

No recession warning.

In other words, they needlessly panicked about the labor market, and it is clear there was no problem in labor, requiring panic.

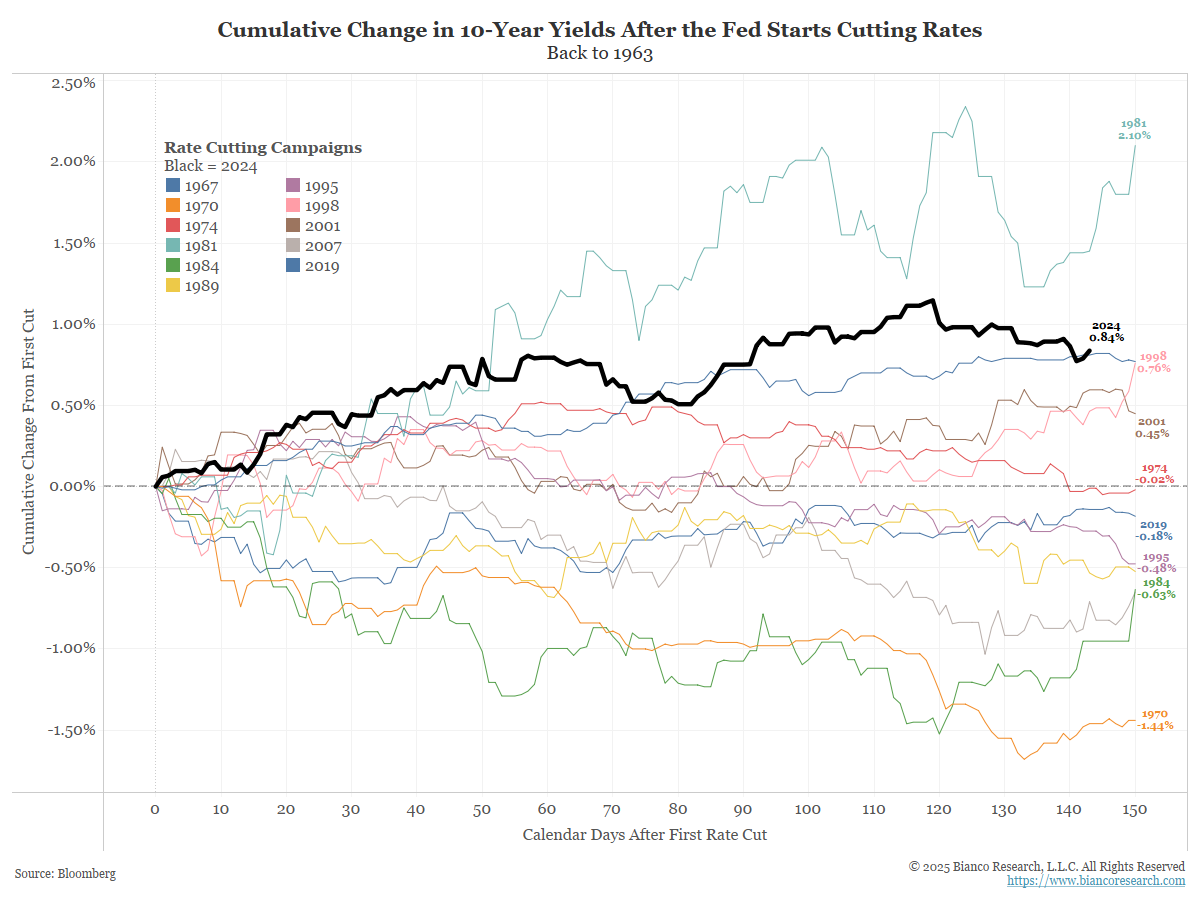

Add all the posts immediately above, and no matter how much Powell, Bullard (world salad earlier this week), and Goolsbee protest (read: Trump’s fault), long-term yields are higher since the Fed started cutting (black line) because the market signaling Fed policy was a mistake. We did not need rate cuts.

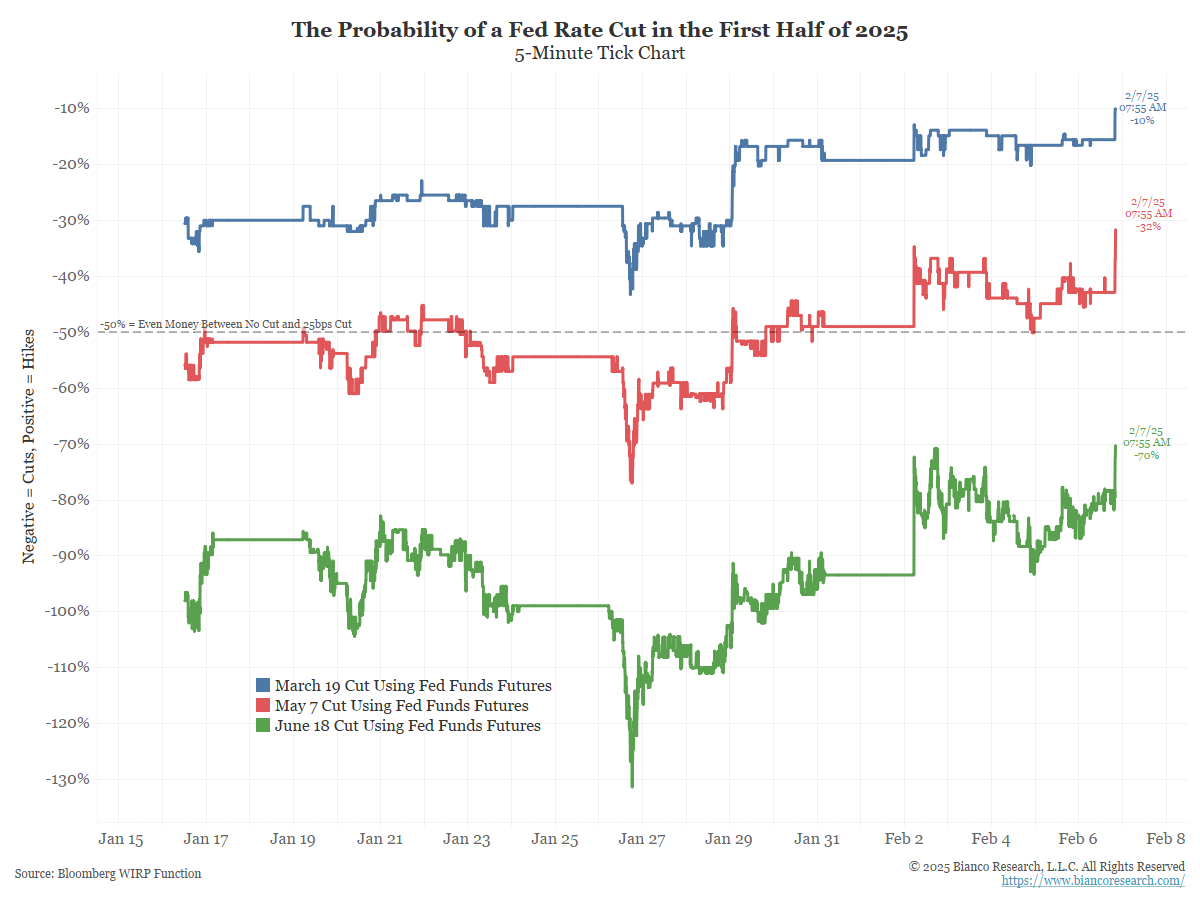

This chart is the probability of a rate cut. Blue is a rate cut at the March 19 FOMC meeting, 10% cut, 90% hold

Red is a rate cut at the May 7 FOMC meeting. 32% cut, 68% hold

Green is a rate cut at the June 18 FOMC meeting, 70% cut, 30% hold.

—-

I will continue to argue if the Fed makes it to June without cutting, the cutting cycle actually ended in December.

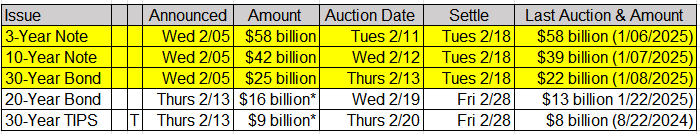

Upcoming US Treasury Supply

Tentative Schedule of Treasury Buyback Operations

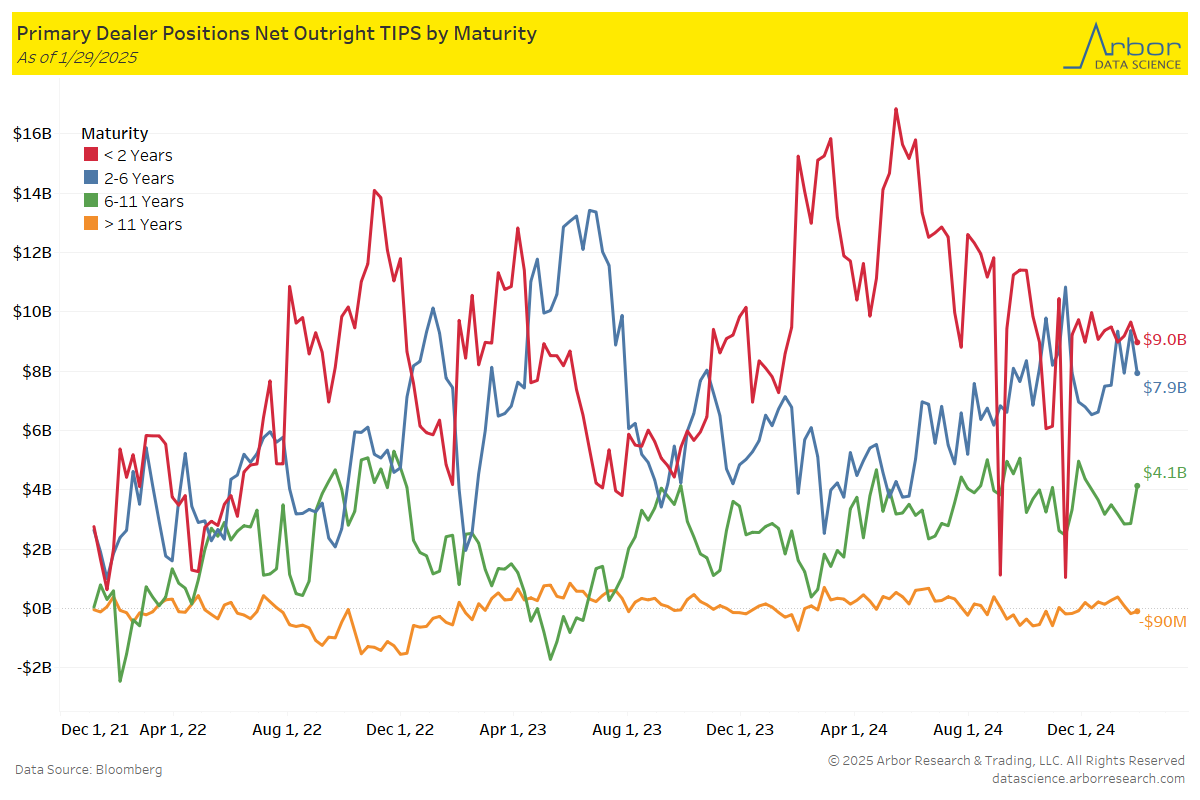

TIPS: Primary Dealer Positions by Maturity

Upcoming UST 30y TIPS Auction on Thursday, 2/13/25

In Other News…

Bloomberg: US Federal Workforce Hits Record as Musk ‘Buyout’ Offer Looms

The number of civilian federal workers reached a seasonally adjusted 2.42 million last month, excluding postal workers. That’s according to a Bureau of Labor Statistics jobs report that showed health care, retail trade and government employment leading the way as the unemployment rate fell to 4%.

Arbor Data Science: Federal Employees Back to the Office – By the Numbers

In Supply Chain News…

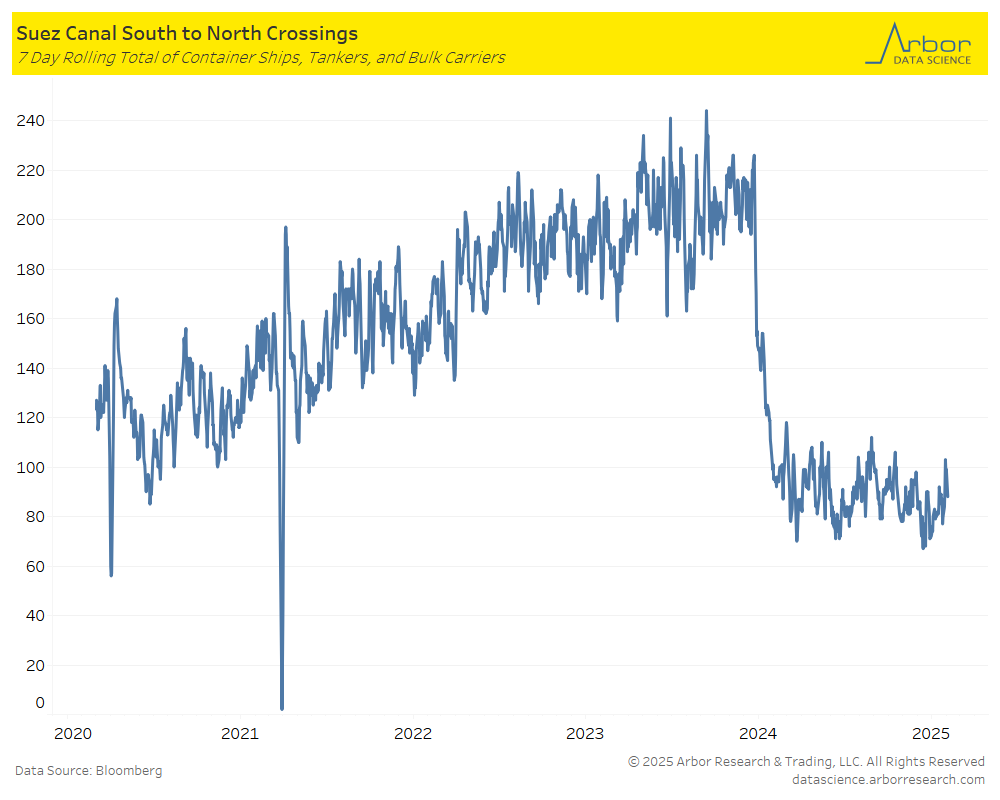

Offshore Energy: Ripe for return: As Red Sea tensions subside, Suez Canal prepares for ‘full-scale’ revival

With security in the Red Sea gradually improving, the Suez Canal is gearing up to handle global trade at full capacity, signaling the return of stability to this vital maritime corridor, the Suez Canal Authority (SCA) has revealed.

We monitor weekly Suez Canal crossing in our Weekly Supply Chain Update:

Arbor Data Science: Global Supply Chain Update – February 5, 2025

SupplyChainBrain: Transits Through the Panama Canal are Down 10%

Ship capacity transiting through the Panama Canal was 10% lower between September 2024 and January 2025 than the 2019-22 average, measured in deadweight tonnes, according to the Baltic and International Maritime Council (BIMCO).

Upcoming Economic Releases & Fed Speak

- 2/10/2025 at 11:00am EST: NY Fed 1-Yr Inflation Expectations

- 2/11/2025 at 06:00am EST: NFIB Small Business Optimism

- 2/11/2025 at 08:50am EST: Hammack Speaks on Economic Outlook

- 2/11/2025 at 10:00am EST: Powell to Testify on Senate Committee

- 2/11/2025 at 07:30pm EST: Williams Gives keynote Remarks

- 2/12/2025 at 07:00am EST: MBA Mortgage Applications

- 2/12/2025 at 08:30am EST: CPI MoM & CPI Ex Food and Energy MoM

- 2/12/2025 at 08:30am EST: CPI YoY & CPI Ex Food and Energy YoY

- 2/12/2025 at 08:30am EST: CPI Index NSA & CPI Core Index SA

- 2/12/2025 at 08:30am EST: Real Average Weekly Earnings YoY & Real Average Hourly Earning YoY

- 2/12/2025 at 12:00pm EST: Bostic Speaks on Economic Outlook

- 2/12/2025 at 02:00pm EST: Federal Budget Balance

- 2/13/2025 at 08:30am EST: PPI Final Demand MoM & PPI Ex Food and Energy MoM

- 2/13/2025 at 08:30am EST: PPI Ex Food, Energy, and Trade MoM & PPI Final Demand YoY

- 2/13/2025 at 08:30am EST: PPI Ex Food and Energy YoY & PPI Ex Food, Energy, Trade YoY

- 2/13/2025 at 08:30am EST: Initial Jobless Claims & Continuing Claims

- 2/14/2025 at 08:30am EST: Retail Sales Advance MoM & Retail Sales Ex Auto MoM

- 2/14/2025 at 08:30am EST: Retail Sales Ex Auto and Gas & Retail Sales Control Group

- 2/14/2025 at 08:30am EST: Import Price Index MoM & Import Price Index ex Petroleum MoM

- 2/14/2025 at 08:30am EST: Import Price Index YoY & Export Price Index MoM & Export Price Index YoY

- 2/14/2025 at 09:15am EST: Industrial Production MoM & Capacity Utilization & Manufacturing (SIC) Production

- 2/14/2025 at 10:00am EST: Business Inventories