US Treasuries

- Monday’s UST 10y range: 4.455% – 4.505%, closing at 4.495%

Action packed week ahead:

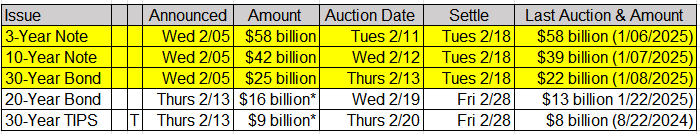

- $125 billion in coupon supply:

- $58 bln UST 3y Note auction Tuesday (2/11/25)

- $42 bln UST 10y Note auction on Wednesday (2/12/25)

- $25 bln UST 30y Bond auction on Thursday (2/13/25)

- $4 bln Treasury buyback on Wednesday (2/12/25):

- Nominal Coupon 1 Month to 2y

- Powell testifies before the US Senate Banking Committee on Banking, Housing and Urban Affairs on Tuesday, 2/11/25 at 10:00am EST

- Powell testifies before the Federal Reserve’s Semi-Annual Monetary Policy Report to the US House Committee on Financial Services on Wednesday, 2/12/2025 at 10:00am EST

- CPI released on Wednesday (2/12/25) at 8:30am EST and PPI released on Thursday (2/13/25) at 8:30am EST

Today’s Recap:

Federal Reserve Bank of New York: Survey of Consumer Expectations

Median inflation expectations were unchanged at 3.0% at both the one-and three-year ahead horizons in January.

Bloomberg: NY Fed Survey Sees Inflation Expectations Edge Up Before Tariffs

US consumers’ long-term inflation expectations edged higher in January ahead of tariff announcements by the Trump administration, a monthly Federal Reserve Bank of New York survey showed.

Jim Bianco: Is Inflation Becoming Unanchored? – An Update

There are no measures of inflation expectations that are “well anchored.” In fact, as a group, they are worse than in June 2022, when inflation was 9%.

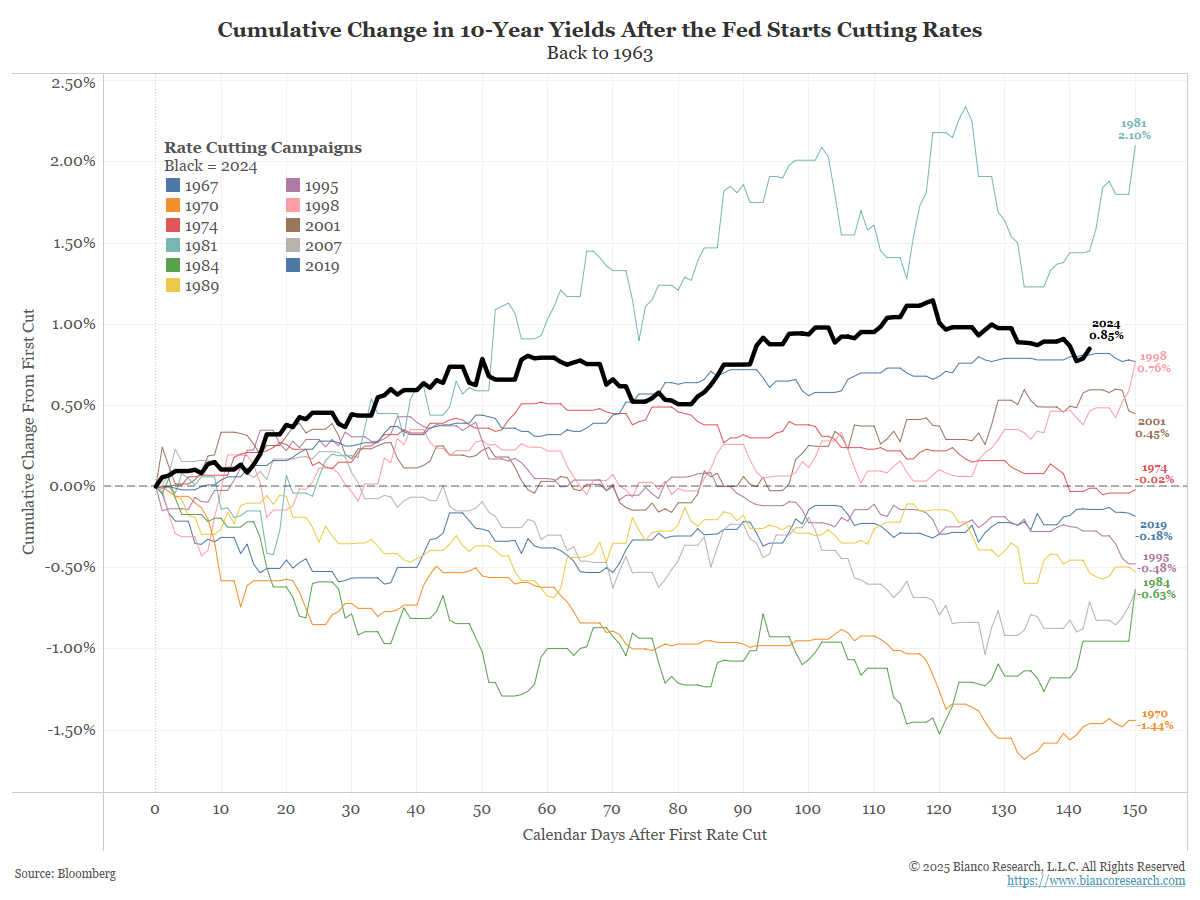

The following chart shows the rise in long-term yields in 20204 (black) has been larger than other rate-cutting cycles, save 1981(blue). Restated, this is the second biggest rise in yields during a rate cutting cycle outside the May 1981 rate cuts that started at 20%!

Upcoming US Treasury Supply

Tentative Schedule of Treasury Buyback Operations

In Other News…

ZeroHedge: First LNG-Laden Tankers Transits Red Sea In About One Year

According to Anas Alhajji, managing partner at Energy Outlook Advisors, Salalah LNG has become the first liquefied natural gas (LNG) laden carrier to transit the Bab el-Mandeb Strait at the southern end of the Red Sea in nearly a year.

Freightwaves: Waiting for a plunge in Red Sea freight rates? ‘Hold my containers’, say carriers

The head of the Suez Canal said he expects vessel traffic through the Middle East waterway to gradually return to normal by late March and fully recover by the middle of this year.

FastCompany: A water crisis at the U.S.-Mexico border is getting worse

A growing water crisis along the U.S.–Mexico border that affects tens of millions of people on both sides, and it can only be managed if the two governments work together.

NPR: New bird flu variant in cattle adds to converns about federal response under Trump

A variant of H5N1 bird flu that has circulated widely in wild birds — and in several instances led to severe illness in humans — has turned up in dairy cattle for the first time.

CNN: Why tariffs on Mexico and Canada could drive up grocery costs

From fresh avocados to dairy products, Americans rely heavily on their bordering countries for everyday grocery items.

Upcoming Economic Releases & Fed Speak

- 2/11/2025 at 06:00am EST: NFIB Small Business Optimism

- 2/11/2025 at 08:50am EST: Hammack Speaks on Economic Outlook

- 2/11/2025 at 10:00am EST: Powell to Testify on Senate Committee

- 2/11/2025 at 07:30pm EST: Williams Gives keynote Remarks

- 2/12/2025 at 07:00am EST: MBA Mortgage Applications

- 2/12/2025 at 08:30am EST: CPI MoM & CPI Ex Food and Energy MoM

- 2/12/2025 at 08:30am EST: CPI YoY & CPI Ex Food and Energy YoY

- 2/12/2025 at 08:30am EST: CPI Index NSA & CPI Core Index SA

- 2/12/2025 at 08:30am EST: Real Average Weekly Earnings YoY & Real Average Hourly Earning YoY

- 2/12/2025 at 12:00pm EST: Bostic Speaks on Economic Outlook

- 2/12/2025 at 02:00pm EST: Federal Budget Balance

- 2/12/2025 at 05:05pm EST: Waller Speaks on Stablecoins

- 2/13/2025 at 08:30am EST: PPI Final Demand MoM & PPI Ex Food and Energy MoM

- 2/13/2025 at 08:30am EST: PPI Ex Food, Energy, and Trade MoM & PPI Final Demand YoY

- 2/13/2025 at 08:30am EST: PPI Ex Food and Energy YoY & PPI Ex Food, Energy, Trade YoY

- 2/13/2025 at 08:30am EST: Initial Jobless Claims & Continuing Claims

- 2/14/2025 at 08:30am EST: Retail Sales Advance MoM & Retail Sales Ex Auto MoM

- 2/14/2025 at 08:30am EST: Retail Sales Ex Auto and Gas & Retail Sales Control Group

- 2/14/2025 at 08:30am EST: Import Price Index MoM & Import Price Index ex Petroleum MoM

- 2/14/2025 at 08:30am EST: Import Price Index YoY & Export Price Index MoM & Export Price Index YoY

- 2/14/2025 at 09:15am EST: Industrial Production MoM & Capacity Utilization & Manufacturing (SIC) Production

- 2/14/2025 at 10:00am EST: Business Inventories

- 2/14/2025 at 03:00pm EST: Logan Speaks in Moderated Q&A

- 2/19/2025 at 09:30am EST: Harker Speaks on the Economy Outloook